eBook

IDC MarketScape: Worldwide SaaS and Cloud-Enabled Enterprise Treasury and Risk Management Applications 2019–2020 Vendor Assessment

Please see the Appendix for detailed methodology, market definition, and scoring criteria.

Table of Contents

In This Excerpt

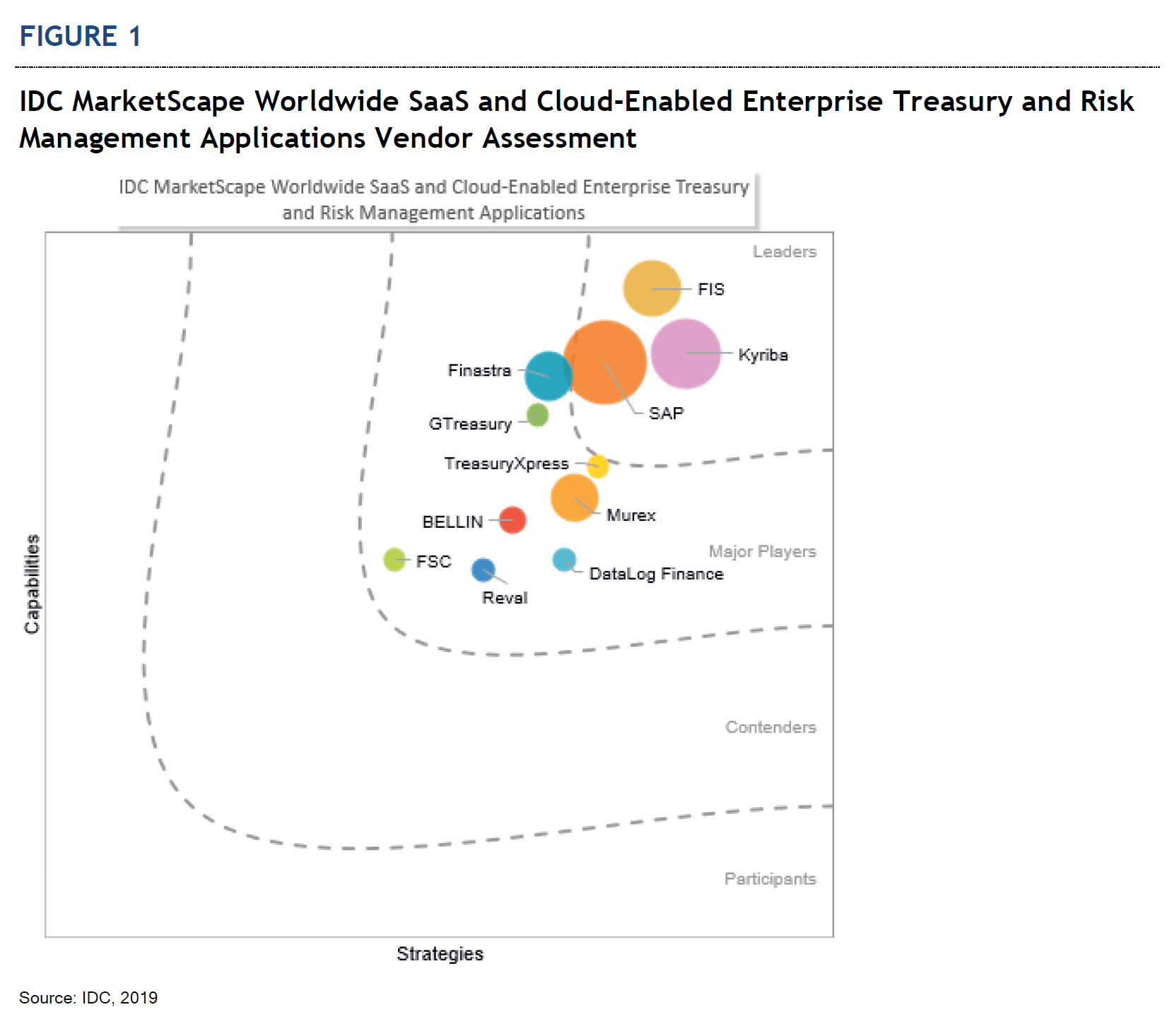

The content for this excerpt was taken directly from IDC MarketScape: Worldwide SaaS and Cloud-Enabled Enterprise Treasury and Risk Management Applications 2019–2020 Vendor Assessment (Doc # US45685819). All or parts of the following sections are included in this excerpt: IDC Opinion, IDC MarketScape Vendor Inclusion Criteria, Essential Guidance, Vendor Summary Profile, Appendix and Learn More. Also included is Figure 1.

IDC Opinion

The role of today’s treasury professional is rapidly changing and expanding. While cash management and cash forecasting continue to be strategic priorities, treasurers are also increasing their focus on supply chain finance, insurance, and commodities. However, many treasurers find themselves working with the same amount of resources. Today’s treasury professionals require more advanced and innovative technology to keep up with the challenge. This is driving the digital transformation that culminates in the intelligent treasury.

What Are Some of the Benefits to the Intelligent Treasury?

- Cash visibility: Treasurers are asked to cope with the expanding complexities related to increasingly global business environments. Dealing with globalization demands that treasurers can manage and track far-flung operations and fund flows.

- Scalability: Treasury professionals must be able to efficiently manage complex financial transactions at pace and at scale. Analytics are quickly moving from a nice to have to a must-have for today’s treasury professional. Treasury professionals are turning to advanced analytics and intelligence to assist in the process of remittance advice, cash forecasting, and monitoring cyberfraud-like account takeovers and check fraud.

- Streamlined financial controls: Organizations are reviewing procedures across business units and geographic boundaries and must work to find a way to streamline their regulatory compliance and mitigate compliance risks. Treasury departments must devote resources to understand the impact of these regulations and adjust their processes/systems to comply with them. Intelligence allows for tighter, real-time financial controls.

Digital Tools Supporting the Intelligent Treasury

As organizations move into the digital economy, focused on digital transformation initiatives, the functions of finance and treasury are turning to advanced technologies to enable the evolution. Fueled by the enormous amount of waste and inefficiency within the treasury workstreams, the CFO requires more advanced and innovative technology. Vendors are supporting digital transformation with new use cases that treasury applications can leverage with technologies such as big data and analytics and machine learning (ML) to perform efficiently.

- Software-as-a-service (SaaS) cloud: Treasury and risk management is one of the slower-moving application groups to the cloud. Customers making new purchase decisions for treasury solutions are overwhelmingly choosing public cloud offerings over on-premises/other software offerings. The ability to configure, upgrade, and add more functionality from the 3rd Platform and innovation accelerators is driving organizations to purchase cloud-based solutions.

- Artificial intelligence (AI)/machine learning: Machine learning has the potential to deeply transform the daily activities of treasury managers. The impact of this technology will be felt first in the areas of cash forecasting, cash positioning, and netting, where the technologies’ ability to analyze data and make recommendations will be essential.

- Rise of APIs: Treasurers interact with many different external entities (e.g., banks, suppliers, and agencies) to manage company treasury assets. The answer to this issue is to allow treasury application software to connect directly with banking systems, so that information flows seamlessly between end users and their banking partners. The potential of APIs within treasury is significant.

- Predictive analytics: Businesses are interested in analytics as part of their travel and expense applications. Business intelligence and analytics improve visibility into liquidity patterns.

The Enterprise Difference

IDC defines the enterprise treasury market as any customer with 1,000+ employees. Among the largest businesses, treasury becomes less about the basics of treasury accounting, bank relationship management, and cash management and much more about moving money efficiently into and out of the financial markets. Financial risks management becomes highlighted among treasury departments within very large businesses. As a result, data management becomes critically important among enterprise treasury departments. Further:

- Finding business insights: Treasury professionals must be able to accurately account for and provide detailed information on millions of transactions. Treasury professionals need to both verify and analyze these transactions for relevant reporting metrics, business insights, and compliance. This information may come in a variety of formats and sources, and the amount of this type of information is increasing daily, rapidly making finding relevant business insights an extremely daunting task.

- Preserving treasury data security: Security has become a multifaceted issue because of the rise of cybersecurity threats and cyberfraud. Treasury professionals must now be vigilant against cases of traditional fraud (e.g., suspicious accounting records or corporate account misuse) and more modern cyberthreats. Treasury resources are now devoted to monitoring potential weak points in banking structure, supplier management, treasury systems, and payment files.

- Enhancing foreign exchange (FX): Today’s treasurer is swimming in data and is finding FX with all its moving parts to be particularly difficult. Speed is another area of concern for treasurers, who desire the ability to move money around the clock and in real time into and out of the currency markets. However, with increased speed comes the need for more powerful real-time risk management capabilities.

- Complying and reporting: Treasury compliance is a rule-based process, often manual, that is handled on an exception basis from a historical transactional perspective. Without real-time treasury compliance, organizations are at risk for noncompliant employees and have an increased opportunity of fraud.

IDC Marketscape Vendor Inclusion Criteria

The vendor inclusion list for this document was selected to accurately depict the vendors that are representative of any given treasury management functional buyer’s selection list. Vendors were further investigated to ensure that their offerings qualified as “SaaS or cloud enabled” and the vendor had won recent deals. Also, the treasury software must be available for purchase and implementation separate from other associated financial/ERP software.

Advice for Technology Buyers

The process of transitioning treasury management from a manual model to an intelligent model can be a challenging one. It is important to structure your treasury department to be more efficient and agile to cope with the ever-changing compliance/regulatory/liquidity demands. Here are a few key steps in the journey toward optimizing your treasury management department through the addition of an advanced software package like the ones listed in this document:

- Begin by looking inward: Before you choose your treasury management software (TMS) vendor or even whether dedicated TMS is a good investment for your organization, first you should take the opportunity to do some self-reflection. Here are some key questions to ask regarding the internal resources and processes:

- What are some of the issues I would like to resolve with this new system?

- Are the issues technology related?

- What are my internal support resources and capabilities?

- How should we define success for this implementation?

- Which internal stakeholders should we include in the evaluations processes?

- Select the right partners (internal and external): The first step in the journey to TMS is developing a strategy and plan for the implementation. This includes doing the due diligence in finding the right TMS vendor. Here are a few key questions to ask regarding the TMS vendor:

- Does the vendor have experience with my type of product, service, and company size?

- Can the vendor show me a hands-on demo with our organization’s “live/real” data to show the benefit to the business?

- Does the vendor understand the regulations that will impact my business? How are these regulations reflected in my current product, and how will it change in the future?

- What is the vendor’s strategic investment outlook for the next three to five years? Why? How will that change and enhance my business?

- Take ownership of the implementation: For the best results, organizations must take a very active role in the actual implementation of the software. TMS touches upon a lot of other back-office systems (e.g., ERP, finance, accounts receivable, supply chain, and inventory). As a result, extreme attention must be given to how the TMS system is set up and how it interacts with other systems within your organization. Here are some key questions to ask regarding a TMS implementation:

- What levels of support are available, and are they geographically available for my business?

- How should I set up the service-level agreement (SLA) before signing any contracts?

- Can the TMS integrate with my company’s other IT systems and those of my partners?

- Which IT system needs to be integrated and to what degree?

- How are we set up to deal with frequent product updates?

- Realize that post-implementation is critical: In many ways, the success of any SaaS implementation hinges on what happens after the implementation is up and running. This is where change management takes center stage and the people side of treasury management becomes essential. Here are a few key questions to ask regarding the post-go-live phase of TMS implementations:

- Do we have a strategy to encourage rapid adoption among treasury employees?

- Do we have the right amount of training for employees to master the new features within the TMS system?

- Are we communicating the purpose and benefits of the system change to the treasury employees?

- Have we aligned existing policies and procedures to enable the adoption of the new workflows?

This IDC MarketScape assists in answering the aforementioned questions and others. The goal of this document is to provide potential software customers with a list of treasury software companies that have taken great strides to incorporate the previously listed capabilities. We have profiled and assessed their capabilities to support the complicated area of treasury management software.

Vendor Summary Profiles

This section briefly explains IDC’s key observations resulting in a vendor’s position in the IDC MarketScape. While every vendor is evaluated against each of the criteria outlined in the Appendix, the description here provides a summary of each vendor’s strengths and challenges.

Kyriba

After a thorough evaluation of Kyriba’s strategies and capabilities, IDC has positioned the company in the Leaders category in the 2019 IDC MarketScape for worldwide SaaS and cloud-enabled enterprise treasury and risk management applications.

Kyriba is a provider of cloud treasury and financial management solutions. Kyriba’s product portfolio includes solutions for treasury and finance management, payments, supply chain finance, and FX risk management. Kyriba provides secure connectivity, real-time payments fraud detection, and end-to-end currency risk management in one platform. Kyriba is headquartered in New York, with offices in San Diego, Paris, London, Dubai, and Tokyo.

Quick facts about Kyriba are:

- Employees: 750+

- Total number of clients: 2,000+

- Globalization: 12 global offices; supports 15 languages in 100+ countries

- Industry focus: Retail, telecom, consumer packaged goods, and manufacturing

- Ideal customer size: Upper midmarket and above

- SaaS: Multitenant SaaS platform

- Pricing model: Subscription based on number of active users

- Partner ecosystem: 100+ partners including Accenture, Deloitte, Infor, and Oracle NetSuite

Strengths

- Connectivity: Kyriba offers “connectivity as a service” featuring seven different connectivity options to financial institutions, including APIs, MT Concentrator, and multiple SWIFTNet options. Kyriba connects to an extensive set of banks.

- Focus on cash forecasting: Kyriba offers a large array of modeling capabilities to drive predictive forecasting, including complex extrapolation algorithms and more recently artificial intelligence to project transaction clear dates. Kyriba’s business intelligence forecast versioning enables more detailed forecast variance analysis and confidence in forecast performance

- Payments capabilities: Kyriba offers a complete payment hub to support complex treasury payments, ERP-to-bank connectivity, a library for 40,000 payment format scenarios, sanctions list screening, and real-time payment fraud detection. These are critical for customers seeking resilience and control against fraud and cybercrime.

- FX risk management capabilities: Kyriba offers an end-to-end FX risk management allowing users to identify, extract, and analyze balance sheet and cash flow exposures to understand the impact of currency volatility on earnings and mitigate FX risk through natural and intentional risk management.

Challenges

- Changing perception of SaaS: Kyriba targets midmarket and large enterprise companies. Although the SaaS model offers more price elasticity for less complex organizations, some CFOs are still opening their minds to SaaS for treasury and, as result, may still be reluctant to deploy SaaS treasury.

- Small, inexpensive niche providers: There are several providers that provide partial functionality (e.g., only cash management) but offer inexpensive offerings and the promise of interfacing with other best-of-breed providers to deliver a complete solution

Consider Kyriba When

If you are an upper midmarket or large enterprise company looking for a suite of treasury or FX risk management capabilities, consider Kyriba.

Appendix

Reading an IDC MarketScape Graph

For the purposes of this analysis, IDC divided potential key measures for success into two primary categories: capabilities and strategies.

Positioning on the y-axis reflects the vendor’s current capabilities and menu of services and how well aligned the vendor is to customer needs. The capabilities category focuses on the capabilities of the company and product today, here and now. Under this category, IDC analysts will look at how well a vendor is building/delivering capabilities that enable it to execute its chosen strategy in the market.

Positioning on the x-axis, or strategies axis, indicates how well the vendor’s future strategy aligns with what customers will require in three to five years. The strategies category focuses on high-level decisions and underlying assumptions about offerings, customer segments, and business and go-to-market plans for the next three to five years.

The size of the individual vendor markers in this IDC MarketScape represents the market share of each individual vendor within the specific market segment being assessed.

IDC MarketScape Methodology

IDC MarketScape criteria selection, weightings, and vendor scores represent well-researched IDC judgment about the market and specific vendors. IDC analysts tailor the range of standard characteristics by which vendors are measured through structured discussions, surveys, and interviews with market leaders, participants, and end users. Market weightings are based on user interviews, buyer surveys, and the input of IDC experts in each market. IDC analysts base individual vendor scores, and ultimately vendor positions on the IDC MarketScape, on detailed surveys and interviews with the vendors, publicly available information, and end-user experiences in an effort to provide an accurate and consistent assessment of each vendor’s characteristics, behavior, and capability.

Market Definition

Treasury and risk management applications support corporate treasury operations (including the treasuries of financial services enterprises) with the corresponding financial institution functionality and optimize related cash management, deal management, and risk management functions, as follows:

- Cash management automation includes several treasury processes involving electronic payment authorization, bank relationship management, and cash forecasting.

- Deal management automation includes processes for the implementation of trading controls, the creation of new instruments, and market data interface from manual or third-party sources.

- Risk management automation includes performance analysis, Financial Accounting Standards (FAS) 133 compliance, calculation of various metrics used in fixed-income portfolio analysis, and market-to-market valuations.

Learn More

Related Research

- Worldwide Treasury and Risk Management Applications Forecast, 2018-2022: Combating Fraud Through Advanced Technology (IDC #US43267118, June 2018)

- Worldwide Treasury and Risk Management Applications Market Shares, 2017: Treasury Manager Emerging as Trusted Advisor (IDC #US43267218, June 2018)

- IDC TechScape: Worldwide Intelligent Treasury and Cash Management, 2019 (IDC #US45024119, May 2019)

- IDC Market Glance: Treasury and Risk, 1Q19 (IDC #US44646619, March 2019)

Synopsis

This IDC study provides an assessment of the leading SaaS and cloud-enabled treasury and risk management applications and discusses the criteria that are most important for companies to consider when selecting a system.

“The world of treasury and risk management is rapidly evolving and becoming more and more complex. So, too, has the role of treasurer manager evolved from simply being a steward of cash to a trusted advisor to the executive board,” says Kevin M. Permenter, research manager, Enterprise Applications.