eBook

What is Payables Finance?

Payables finance, also known as accounts payable (AP) financing, is a form of working capital financing that enables businesses to access liquidity tied up in outstanding invoices.

Payables finance is a form of short-term borrowing for suppliers leveraging on their Buyer’s risk. It allows buyers to improve their working capital and suppliers to improve their cash flow by borrowing against unpaid invoices. It can also be used to strengthen supplier relationships by paying invoices early.

Table of Contents

- What Programs Are in Payables Finance Solutions?

- How Does Payables Finance Work?

- What are the Benefits of a Payables Finance Solution?

- What is Supply Chain Finance?

- How Does Supply Chain Finance Work?

- What are the Benefits of Supply Chain Finance?

- How Supply Chain Finance Helps Create a Sustainable Supply Chain

- What is Dynamic Discounting?

- How Does Dynamic Discounting Work?

- What are the Benefits of Dynamic Discounting?

- Kyriba’s Payables Finance Solutions

What Programs Are in Payables Finance Solutions?

Payables finance solutions help CFOs and senior strategic leaders generate free cash flow by extending payment terms and improve EBITDA by paying earlier their suppliers with their excess cash against a discount. There are typically two types of such programs:

- Supply chain finance is a system of financial tools used to manage the liquidity of a business’s supply chain. By providing access to capital, businesses can better manage their working capital and optimize the flow of goods and services.

- Dynamic discounting is a process that enables companies to take advantage of early payment discounts from suppliers. By taking these discounts, suppliers can improve their cash flow, reduce their cost of capital, and gain early visibility into their cash position while buyers can improve their EBITDA

Another form of payables finance is hybrid dynamic discounting.

- Hybrid dynamic discounting is a cash management solution allowing treasury teams to automate arbitration between supply chain finance or dynamic discounting, depending on cash availability at any given point in time. This flexible solution provides access to liquidity on a consistent basis, securing the supply chain while providing suppliers with consistent cash flow.

These payables finance programs create win-win scenarios for buyers and suppliers, while also enabling better working capital management to increase the health of organizational supply chains. Scroll down to find out more about Payables Finance, supply chain finance, and dynamic discounting.

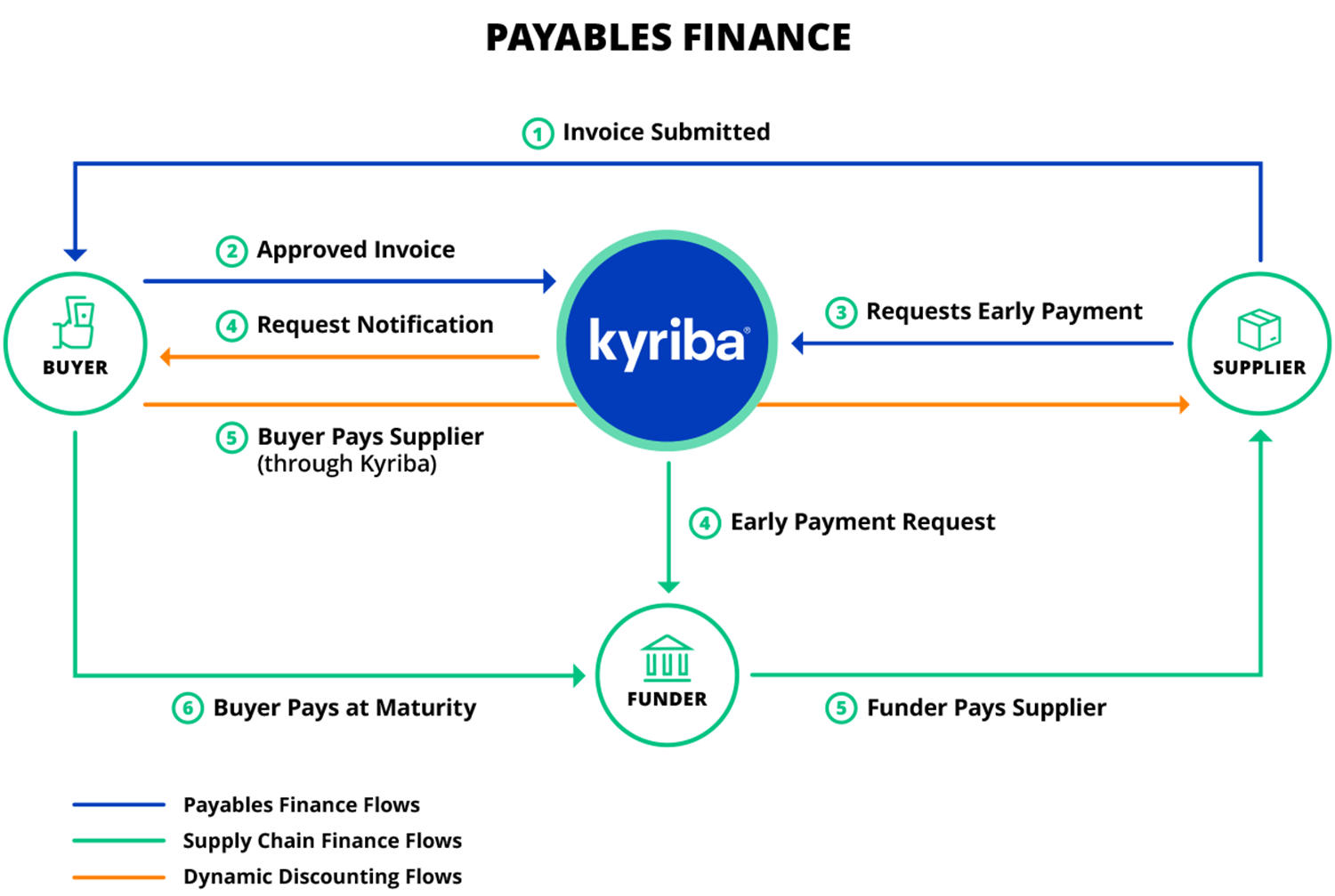

How Does Payables Finance Work?

Payables finance is an efficient way to access liquidity tied up in unpaid invoices. Suppliers can request early payments for their outstanding invoices to a payables finance provider assigned by the Buyer and leveraging on their risk.

What are the Benefits of a Payables Finance Solution?

Payables finance can provide businesses with access to working capital, allowing them to take advantage of new opportunities and investments. It can also help businesses build better relationships with suppliers by paying invoices early, and can provide greater control over cash flow management. Payables finance is a simple and cost-effective way to improve liquidity and increase operational efficiency. Payables finance solutions have many benefits for both buyers and sellers.

For buyers, using a payables finance solution provides:

- Enhanced cash visibility & predictability

- Reduced account payable inquiries

- Improved critical supplier relationships

- Financial incentive for sustainability and responsible sourcing

For suppliers, a payables finance solution delivers:

- Access cash faster

- Remittance information at no cost with reduced account receivable queries

- Financial incentives for sustainable and responsible sourcing

What is Supply Chain Finance?

Supply chain finance is a working capital credit facility giving suppliers the flexibility to “sell” approved invoices to financial institutions for a discount that is dependent on the credit risk of the buyers. Designed to reduce the costs of doing business, this system allows suppliers the ability to receive early payment of the receivable(s) owed and enables buyers to optimize their payment terms, all while strengthening their supply chain. These types of programs are funded by a financier and are ideal for organizations looking for term extensions on their payables to improve cash flow performance.

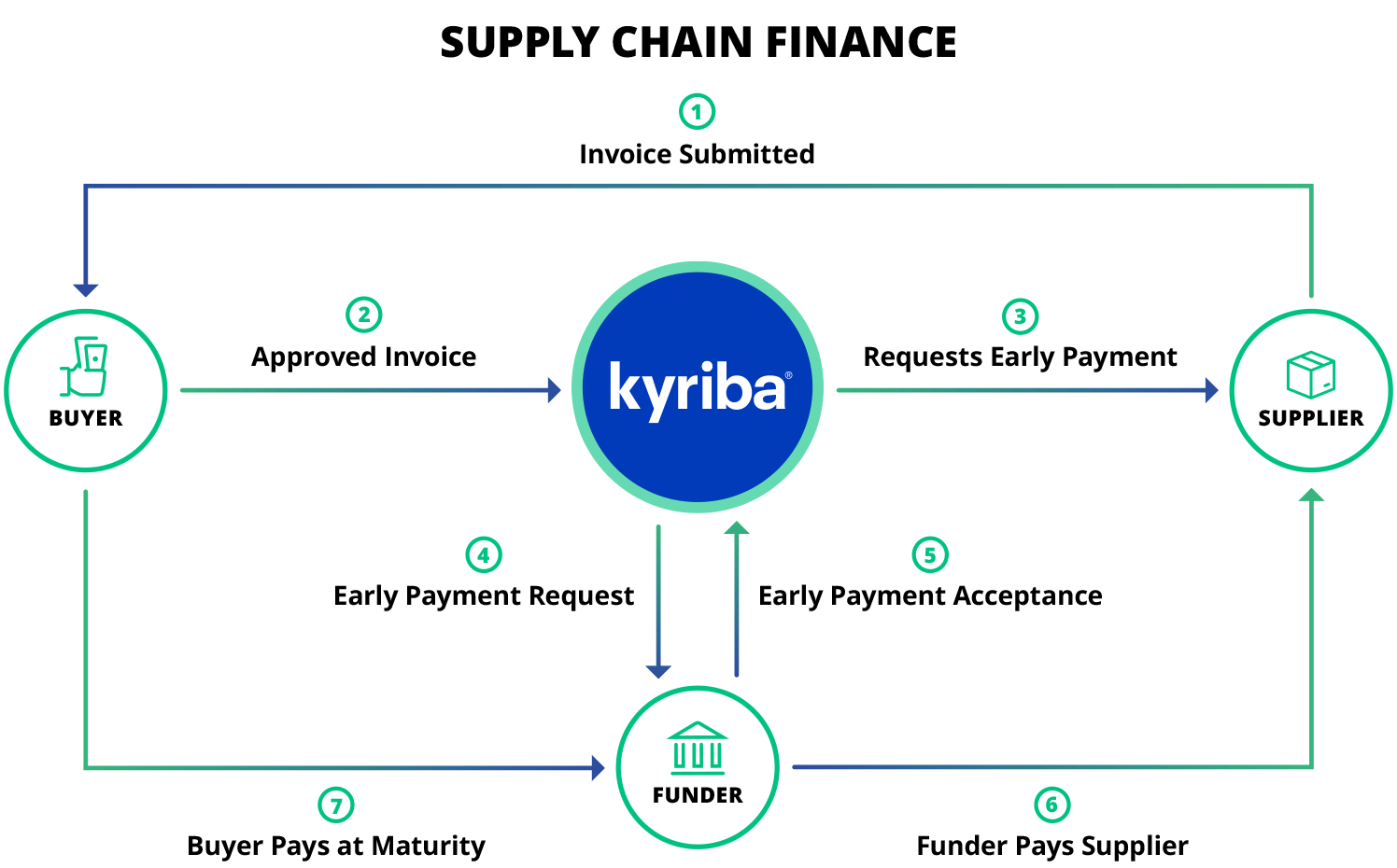

How Does Supply Chain Finance Work?

Supply chain finance works by connecting buyers, suppliers, and financiers in a mutually beneficial relationship. Buyers and suppliers access the platform to connect, manage, and automate payments, while financiers provide the funds for payment. SCF solutions provide buyers with extended payment terms, while suppliers can access early payment at a discount. This process helps buyers manage their cash flows, while suppliers can access working capital to meet their needs and grow their businesses. The result is improved liquidity, cash flow, and working capital for all participants in the supply chain.

What are the Benefits of Supply Chain Finance?

The key benefits of SCF include:

- improved liquidity and access to capital

- increased efficiency

- cost savings

- improved supplier relationships

- increased visibility into the supply chain

SCF also helps to reduce risk, providing companies with the ability to reduce their exposure to supplier risk, as well as reduce their working capital obligations. By leveraging the power of their supply chain, companies can gain access to low-cost financing and secure working capital for growth.

How Supply Chain Finance Helps Create a Sustainable Supply Chain

Organizations can use supply chain finance as an incentive for suppliers to integrate sustainability policies. The need for a code of ethics and responsible sourcing continues to grow as the global supply chain expands. In response to this growth, as well as consumer demands and investor preferences to do business with sustainable companies, an increasing number of companies are instating environment and social governance (ESG) or corporate social responsibility.

While many consumers and investors see sustainable businesses as being less risky, it can be difficult to implement and maintain these standards. In addition, there is a lack of incentives – both tangible and financial – for suppliers and as a result they may be non-compliant. In being non-compliant, the suppliers, who are the ones providing the resources to meet the standards, disrupt the standards set forth by the company. To remedy this, organizations can use supply chain finance as green finance through the association of the financing rate with ESG parameters.

What is Dynamic Discounting?

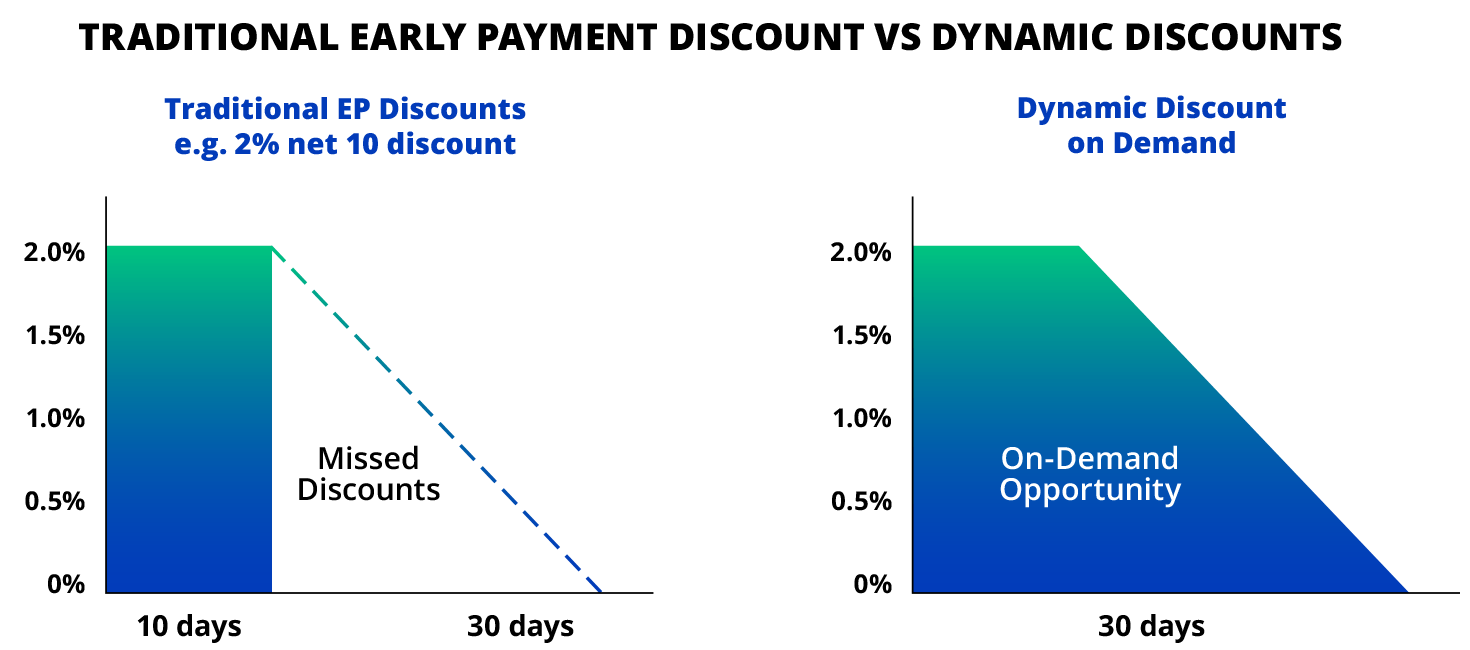

Dynamic discounting is an early payment method that allows buyers to offer suppliers the ability to receive early payment in exchange for a discount or financing fee at a lower cost of funding than they can achieve on their own.

Dynamic discounting programs are best suited for companies with excess cash and liquidity that are looking for an alternative to low-yield, short-term investments in order to earn risk-free returns on cash. With a dynamic discounting working capital solution, suppliers can:

- improve their own working capital

- increase production efficiencies

- drive growth

How Does Dynamic Discounting Work?

Dynamic discounting works by providing an incentive for buyers to pay a supplier’s invoices early. The buyer agrees to pay the supplier’s invoice before the agreed-upon due date in exchange for a discount on the total invoice amount. This discount is usually a percentage of the total invoice amount, and is set at the discretion of the buyer. It is also important to note that dynamic discounting is not a loan, as the buyer is not borrowing any money from the supplier.

What are the Benefits of Dynamic Discounting?

Dynamic discounting can help both buyers and sellers reduce the cost of their accounts payable and accounts receivable processes.

Dynamic discounting enables buyers to:

- generate high returns on available cash

- reduce cost of goods sold (COGS)

- grow profit and EBITDA margins

- reduce working capital costs

- improve control over their cash flow

Dynamic discounting can help sellers:

- accelerate their cash flow

- increase their bottom line profits.

Kyriba’s Payables Finance Solutions

Kyriba’s Payables Finance solutions help businesses streamline their accounts payable process and maximize working capital. Kyriba supports dynamic discounting and Supply Chain Finance solutions, as well as a special hybrid of both.