eBook

支払の ISO20022 移行の成功方程式

全世界で支払 (決済・送金) のメッセージが標準化されていないことは、ペイメントファクトリーやペイメントハブをモダナイズしていく上での大きな課題です。標準化されていないために、クロスボーダーでの支払にコストがかかり、充分な透明性がなく、支払における不正の増加やセキュリティリスクの高まりが見られます。多くの企業は、ローカルフォーマットの開発に膨大なリソースを費やしていますが、それでもなお、国内および国際送金の支払の検証やデータの照合を含む End-to-End (E2E: 始まりから終わりまで) のプロセスを調和させることができない複雑性に直面しています。

2009 年版の ISO20022 ベースの XML メッセージ標準規格の採用は、長年に渡り大きな進歩を遂げています。この規格は、グローバルに企業の支払に重要な成熟したフォーマットと考えられています。しかしながら、企業や銀行は、ローカルのレガシーフォーマット、あるいはさらに憂慮すべきことに独自フォーマットのサポートや保守に多くの時間とコストを費やしており、恒常的に保守を行うという課題を抱えているのが現状です。

幸い、SWIFT や欧州政策センター (EPC: European Policy Center) のほか、多くの銀行や企業の協業のもと、「2019 年版」の ISO 20022 ベースの XML メッセージ規格は暗闇に光を灯すものとなるかもしれません。

Table of Contents

新バージョンの ISO 20022 XML の新しい点

2004 年に初めて業界に導入された ISO 20022 は、世界中の金融データに共通のデジタル言語を確立するメッセージ標準です。SWIFT は ISO 20022 XML メッセージへの移行を開始していますが、この標準は SWIFT のサービスを超えて広く使用されています。現在、ほとんどのリアルタイム支払システムが ISO 20022 を使用しており、SEPA のクレジット送金やダイレクトデビットには 10 年以上この標準が使用されています。さらに、ISO 20022 はインボイス、投資信託注文、為替取引にも使用されています。

ISO 20022 には多くのメッセージが含まれており、毎年リリースされています。例えば、ISO 20022 の 2009 年リリースには、支払指図のために一般的に最も使用されるメッセージフォーマットである pain.001.001.03 メッセージが含まれています。最新バージョンの ISO 20022 の 2019 年リリースでは、同メッセージがバージョン 09、即ち pain.001.001.09 にアップグレードされています。

大多数の組織が採用すると、2019 年版の ISO 20022 ベースの XML メッセージ標準は、レガシーな支払コードの複雑なレイヤーを排除することで、迅速な支払取引を可能にします。

2025 年 11 月までに、SWIFT メッセージは、銀行間決済 (Interbank Settlement) において完全に XML へ移行されるでしょう。この移行のために、ほとんどの銀行はインフラを変更し、ドイツの DTAZV やフランスの AFB320 など、他の地域標準の支払よりも、2019 年版の ISO 20022 XML を採用するように法人顧客に促すでしょう。このプロセスは、スイスではすでに開始されており、SIX がこのフォーマットを新しいスイス標準として推進し、クレディ・スイスとスイス国立銀行がすでに顧客に提供しています。

ヨーロッパでは、EPC は新しいバージョンが 2023 年 11 月までに SEPA クレジット送金フォーマットになると発表しています。Common Global Implementation (CGI)、ISO 20022 XML の広範な受入を促進することで、さまざまな支払関連の法人 – 銀行間の実装を簡素化する取組みは、すでにその仕様を公開しています。

全世界的に、この新標準は、より構造化された方法で豊富なデータの伝送を可能にします。これにより、クロスボーダーの支払で常に問題となっていた支払の End-to-End の追跡と照合が可能となります。現在、中国、インド、日本を含む 70 カ国以上がすでに ISO 20022 の採用プロセスに取り組んでいます。

ISO20022 の ERP・銀行間接続と支払における重要性

ISO 20022 XML の 2019 年版の急速なグローバルでの適応に備え、組織は自社で運用する様々な支払のパターンにそれを追加する上での利点と制約を認識しておく必要があります。

財務と IT のリーダーにとって、この新標準は、先行するものと比較して多数のベネフィットを提供します。ISO 20022 の標準に適応することにより、不正の防止、システムエラーの回避、大小様々な支払取引の迅速化が可能となります。

ユースケースのハイライト:

- インスタントペイメント (即時支払) : この標準は、リアルタイムで円滑な支払を可能にし、誰でも任意のネットワークで実装可能なグローバルでオープンな標準を提供します。

- リッチデータ : 新しい標準によって可能になるリッチで一貫性があり、よく構造化されたデータは、取引を迅速にし、顧客のニーズに基づいた製品の開発を可能にし、イノベーションを促進します。

- 改善された規制報告 : 新しい標準は同一の形式とより高度な詳細レベルを要求するため、より安全な支払情報を生成し、より良く・より迅速な規制報告に寄与します。

- 不正防止 : 標準的な支払フォーマットは、マネーロンダリングを含む不正を特定する上で寄与します。新しい形式が構造化され完全な住所を要求することで、不正リスクも限定されます。

- コンプライアンス (セキュリティ強化) : 一貫性のある支払フォーマットは、政府の規制要件へのコンプライアンスを容易にします。

- 相互運用性: 標準は、国境を越えた支払における相互運用性を促進し、情報の容易な交換と利用を改善します。

- ペイメントハブのアップグレード: SWIFT の国境を越えた支払メッセージの移行など、グローバル・インダストリーにおける標準化との整合性を確保するために、支払システムの更新プログラムのニーズに応えます。ここでは、MT メッセージが段階的に XML に置き換えられていきます。

- より高速な照合: 標準化されたタグで一意な End-to-End トランザクション・リファレンス (UETR) をサポートし、この一意な ID を ERP システムの支払ファイルから銀行へ、そして支払通知 (ACK) と銀行入出金へと連携します。

- 追跡性と支払先へのアドバイス: 新しい標準は、End-to-End の追跡と最終受取人への支払アドバイス (情報通知) を通じて情報の伝達性を向上します。

加えて、新しい標準はシステム間メッセージの相互運用性の向上を約束するものですが、実際に得られる体験は、個々の銀行がメッセージ標準を内部でどのように設定するかに依存します。つまり、銀行は新しいメッセージ標準を異なる方法で展開し、シームレスな支払トランザクションには、いくつかのワークアラウンドが必要となるかもしれません。

銀行* は ISO 20022 移行に関する主な課題として、時間、リソース、技術的な制約を挙げています。

73% の銀行は、銀行内の技術的制約が ISO 20022 移行の推進を限定していることを認めています。

63% の銀行は、予算またはリソース上の制約が ISO 20022 移行の推進を限定していることを認めています。

Celent は、多くの銀行が期限に間に合う上で必要十分なことを行うことを予想しています

* ヨーロッパの 51 銀行を対象とした調査データ – 出典: CELENT (2022) 調査レポート: ISO 20022 へのレース

ユーザー企業にとっての意味

新しい標準が企業の支払にもたらす多くの具体的な利点を考慮すると、組織はバンキング・パートナーによる提供次第、採用すべきです。しかし、最近の Celent の調査によると、すべての銀行が ISO 20022 移行に等しく準備されているわけではありません。その結果、Celent は、多くの企業顧客がバンキング・パートナーから ISO 20022 の今後の変更について、そしてより重要なことに、変更に備えて企業が取るべき行動について十分に情報を得られていないことも特定しました。このコミュニケーション不足は不幸ではありますが、企業も新しい支払フォーマットを送受信するために自社のシステムを準備する必要があります。そうしないと、支払メッセージに含まれる豊富なデータからのメリットが失われることになります。なぜならば、システムの未準備やメッセージの非互換性により、最終受取人によって支払メッセージが切り捨てられる (トランケートされる) 可能性があるからです。

Kyriba は経験上、企業が新しいメッセージ形式に内部システムを準備するためには、ある程度の努力が必要となることを予測しています。簡易的なチェックリストには以下のようなものがあります:

ERP データのクリーンアップ – 支払先情報の構造化

クロスボーダー送金で構造化された住所のみが許可される国が増えるにつれて、支払先の完全な情報 (氏名、完全な住所、場合によっては識別番号まで) が必須になります。SWIFT の取組みである CBPR+ (クロスボーダー・ペイメント & レポーティング・プラス) は、MT メッセージで既に構造化された住所を提供することを目指しています。Kyriba は、少なくとも市、郵便番号、国 (一部の国では州/省も) の構造化された住所を完成させることから始めるよう、顧客にアドバイスしています。

支払の検証フローの最適化

ワークフロー設計の一環として、Kyriba はクライアントに対して不正検出システムの導入を検討することを推奨しています。ルールベースで AI を備えた不正およびコンプライアンス検出メカニズムは、支払の検証にかかる多くの手間とエラーを軽減、すべての関係者が処理される支払に対してより良いコントロールを獲得する上で寄与します。

ERP・TMS 間インテグレーションと E2E 照合プロセスの自動化

一意なインポート・インターフェースを使用し、各インポートファイルに対してユニークな ID を生成し、これらのユニークな ID を含むフォーマットで支払を開始することにより、照合プロセスのトランスフォーメーションが行われます。承認は特定のフォーマット (XML Pain.002.001.10) に統合され、支払がリジェクト (拒否) されたときに資金管理者らはほぼリアルタイムに警告を受けることができます。End-to-End の統合により、情報はリアルタイムでERP に返却され、迅速な対応が可能となります。

テクノロジーパートナーによる支援

多くの歳月をかけてプロプラエタリ・フォーマットの広範なライブラリの作成に専念してきた Kyriba の支払技術部門 (Payment Team) は、今後の変更を国際標準化に近づく機会と捉えています。しかし、ミッション・クリティカルなプロセスとして、支払プロセスにおけるどのような障害であっても、ビジネスの中断、サプライヤーの不満、原材料の納入遅延を引き起こす可能性があります。理解できることとして、主なフォーマットの変更や更新は、支払および IT 部門に不安を抱かせるものです。したがって、事前に対象を理解し、新しい標準を採用するための段階的なロードマップを計画し、必要であれば専門性を備えたベンダーと協力して変革の全体を管理することは、成果に繋がる取組みとなります。

Kyriba は常にフォーマットと支払のイノベーションの最先端にあり、市場で必要とされる最新のフォーマットを迅速にサポートしてきた実績があります。Kyriba のクライアントは、新しい標準を使用して Credit Suisse と支払トランザクション・データをシームレスに交換することができます。また、Kyriba は SEPA CT XML ISO 20022 バージョン 2019 をサポートし、CGI 標準バージョン XML ISO 20022 バージョン 2019 フォーマットを開発し、SWIFT の MT から MX メッセージへの移行を SWIFT Interact 経由でサポートする準備が整っています。

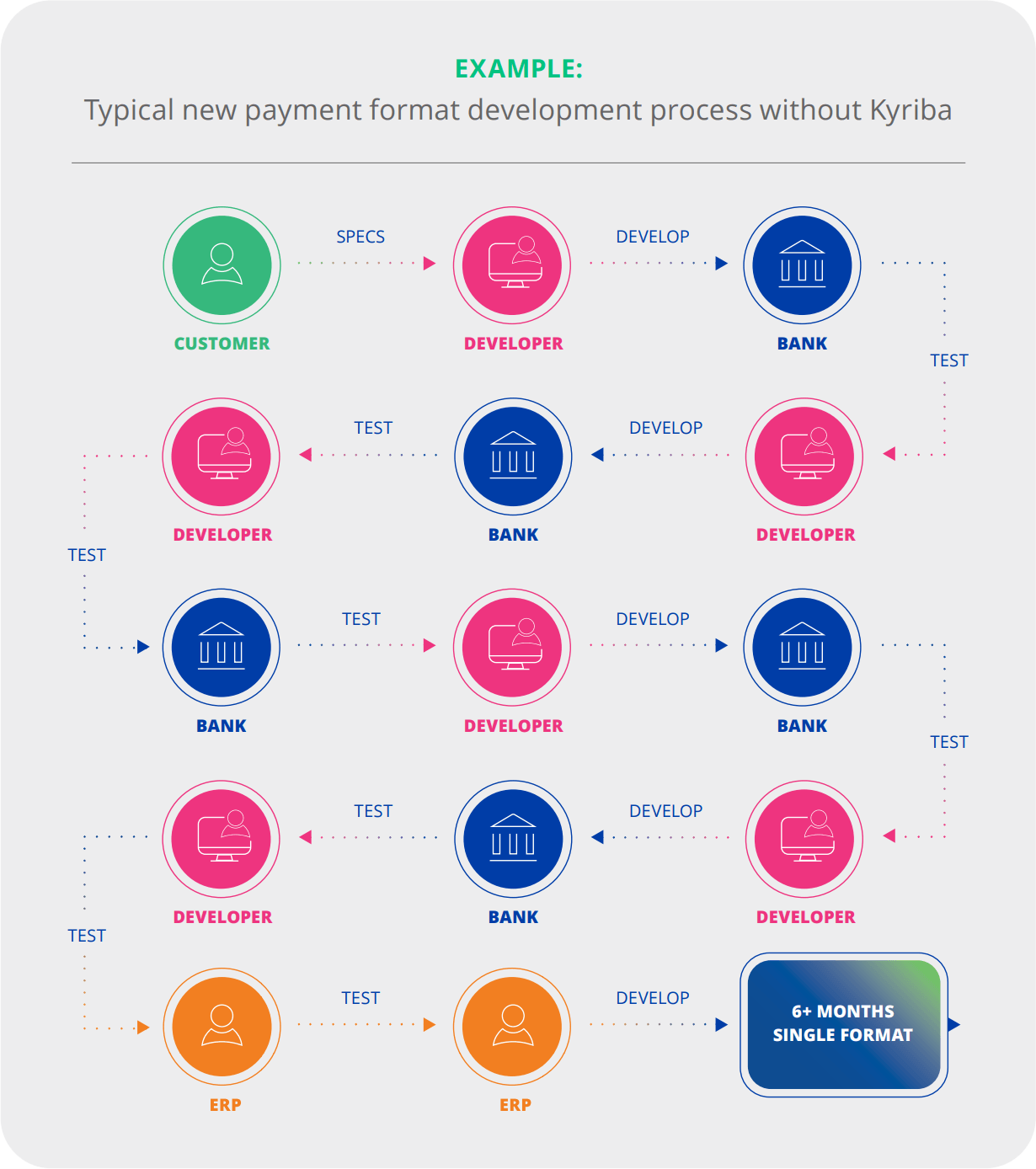

(CUSTOMER: ユーザー企業 / DEVELOPER: 開発ベンダー / BANK: 銀行)

支払テンプレートの開発に通常であれば要する労力を知るために、プロセスを掘り下げてみましょう:

- 全ての支払テンプレートは、それぞれの銀行で個別に開発され、テストを行う必要がある。

- 開発者は、各銀行の技術チームとテストを調整する必要がある。

- 最初のフォーマット・テストは失敗、各フォーマットに複数のテスト・ラウンドが必要となるのが典型的である。

- 企業は、各銀行のタイムラインとタイムゾーンで作業を進める必要がある。

- 開発から実稼働までの平均的なタイムラインは、単一の支払フォーマットについて 3 ~ 6ヶ月を要する。

Kyriba は、世界中の主要銀行をカバーし、使用可能な 50,000 以上の支払シナリオが準備された、予めビルドされテスト済の支払フォーマット・ライブラリをクライアントに提供しています。Kyriba のクライアントとのバリューエンジニアリング・プロジェクトによると、Kyriba のクライアントはこの時間と労力を要するプロセスから平均で 100,000 ドルの節約を見込んでいます。

XML 移行プロジェクトを推進中、または開始予定であれば、弊社の支払の専門家にご相談ください。私たちは、これからの貴社の支払のジャーニーをお手伝いすべく備えています。

参考資料

- Common Global Implementation (CGI) Initiative

- European Payments Council (2022): Guidance on the Migration to the 2019 Version of the ISO 20022-based XML Messaging Standard

- ISO (2020) Introduction to ISO 20022: Universal Financial Industry Message Scheme

- SWIFT (2022) UETR

- SWIFT (2022) What is ISO 20022?

情報ソース

- CELENT (2022) Survey & Report: The Race to ISO 20022

- The SWIFT Standards Team (2020): ISO 20022 for Dummies (5th) John Wiley & Sons, Ltd.

( 原文: The Winning Formula for Your ISO 20022 Payments Migration )