eBook

Strategic Treasurer: 2020 Treasury and Risk Management Systems Analyst Report

Welcome to the 2020 Treasury and Risk Management System (TMS/TRMS) Analyst Report, your definitive guide to smart financial stewardship in the digital age. Strategic Treasurer created this report as an aid to practitioners exploring how treasury technology meets treasury needs.

The Strategic Treasurer team created this publication with one overarching goal in mind—to equip readers with critical information as they seek answers to complex treasury management technology questions. Should my organization purchase a new TMS? If so, which system offers the functionality my firm requires? Will a major implementation be too difficult and disruptive? How do I streamline the process to achieve optimal results?

After months of market research and comprehensive data analysis, we have compiled this report

to help treasury practitioners make more contextually informed decisions regarding technology

solutions. We hope the coverage within, which revolves around current and projected challenges

across the industry, will help readers overcome obstacles, enhance treasury operations and improve

workflow. Let’s get started!

Table of Contents

What Is a TMS/TRMS?

One of the greatest levers for success in our day and age is that whenever a task becomes so complicated and time-consuming that it hinders our overall mission, we can find a way to have computers do it for us. As treasury professionals are often painfully aware, their industry is constantly and increasingly plagued by these types of tasks.

Treasury Management Systems (TMS) and Treasury and Risk Management Systems (TRMS) are programs designed to lift the burden of manual processes from treasury departments, enabling more efficient, effective and secure operations. They accomplish this by integrating and automating many of treasury’s primary functions.

The Types of TMS/TRMS and the Ecosystem

The needs of treasury departments differ depending on their organization’s industry, size, areas of intensity, global presence, and departmental breakouts. To meet these varied needs, vendors have developed a variety of solutions designed to suit different needs and situations. The available systems, then, can often be broken down, at least loosely, along certain differentiating factors. While we will not attempt to categorize specific solutions in this report, we will discuss a few of the different types and some of the distinguishing factors one may find among these systems.

TMS/TRMS:

The first distinction that needs to be discussed may be the most difficult to define clearly. Any difference that exists between a TMS and TRMS lies primarily in emphasis. One might call a TRMS a subtype of TMS with, as the name implies, more robust and specific risk management capabilities. In many cases, the terms “treasury management system” and “treasury and risk management system” have been used almost interchangeably in the industry, which is why we choose to acknowledge both in the title of this annual report. For the remainder of this report, we will refer primarily to TMS with the understanding that what applies to one will typically apply to both.

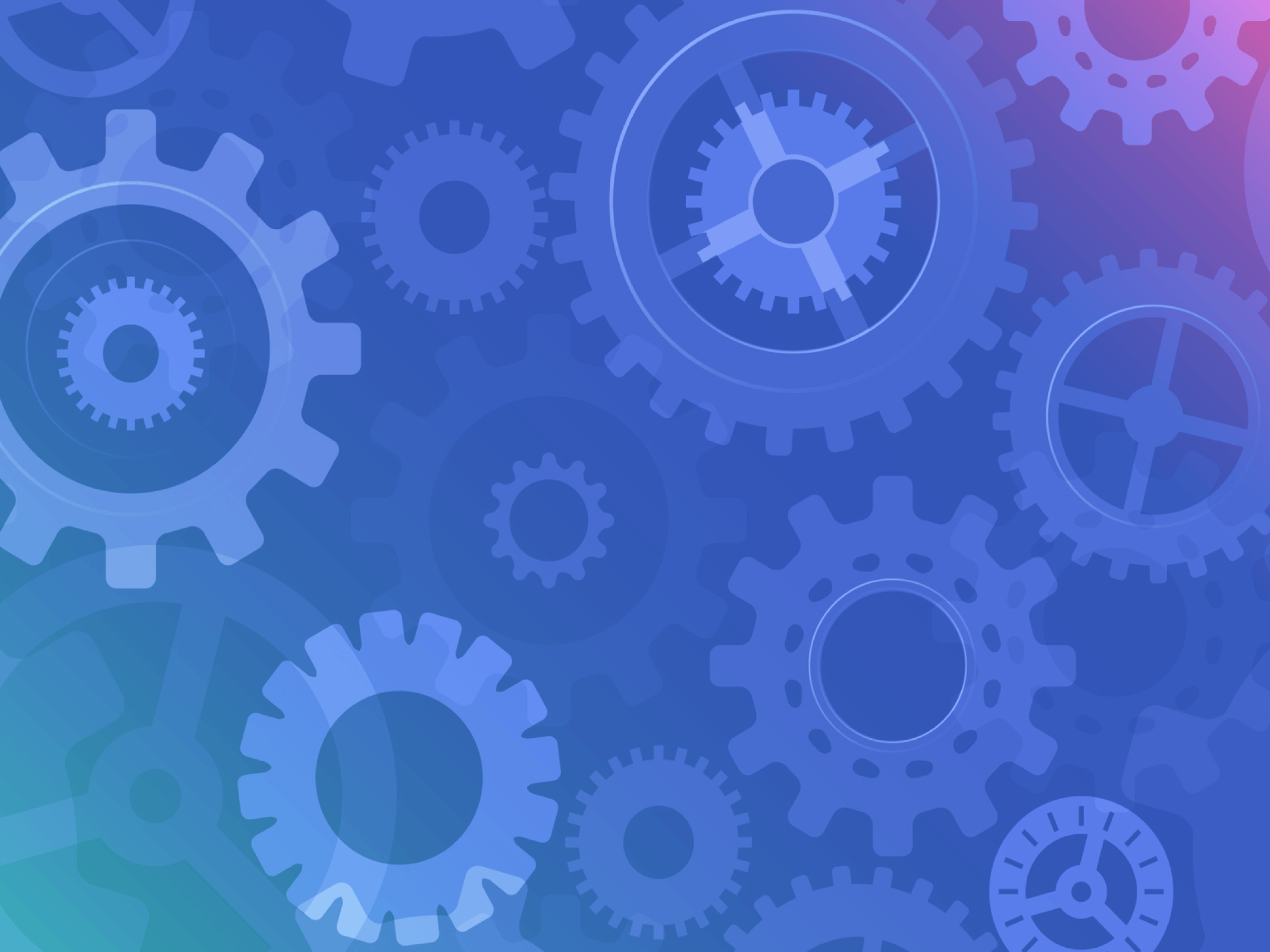

TMS Functionality

Functionality:

TMS typically come with core functionality and additional functionality that can be purchased as needed. The diagram on page 4 shows how the core functionality, which typically encompasses cash management and visibility, undergirds the additional capabilities.

Core: Cash Management and Visibility:

By automatically pulling balance and transaction data from all connected bank accounts, the TMS allows users to bypass the manual bank portal login and download processes. Within the system, users have visibility to all account balances in one place and can sort and view both past and present transaction data.

The system’s cash positioning capabilities take the bank data pulled to show the location of the organization’s cash and identifies actions for the day, enabling users to make wise borrowing and investing decisions.

Syncing with the cash position is cash forecasting, a liquidity planning functionality that shows a schedule of planned payments and anticipated receipts over various timeframes (week, month, quarter and/or year). In recent years, vendors have experimented with the use of machine learning (ML) in forecasting, and many have found it highly effective at improving forecasting results and decreasing the headaches usually involved in this area of treasury. ML’s uses in treasury technology will be discussed in more detail later on page 16 of this report.

Some accounting functionality is typically also a core feature of a TMS. Since all the transactions and activity passing through the TMS needs to be recorded on the books, the accounting module automates that process as much as possible via rules and logic.

Payments: In addition to core modules showing scheduled payments, a payments module allows the TMS to double as a payment platform. Users can initiate and execute payments through this single system with controls built in, allowing for greater efficiency and enhanced security.

Compliance and Security: With the ever-growing regulatory and compliance burdens and the relentless frequency and increasing sophistication of fraudulent attacks, treasury departments need help. While all TMS come equipped with multiple security features, some offer additional security and compliance elements that can aid in reducing the headaches of security and exposure to various threats.

Debt and Investments: Syncing with both cash position and forecasting, the debt and investment management functionality shows your current debts and investments, including availability, maturity dates and any scheduled payments.

Risk Management—IR, Commodity, Counterparty: Add-on risk management functionality revolves around helping treasury see, manage, and drive out exposures, especially in the areas of interest rate, commodity, and counterparty risk.

FX Management: Technically, foreign exchange management falls under the umbrella of risk management, but its level of complexity and magnitude often leads to it appearing as a separate module in a TMS. As with risk management functionality, an FX module will aid the treasury department in handling the exposures inherent in foreign exchange.

Different vendors often focus more deeply in one area or another. Some may offer a module for each of the functionalities listed above, while others may specialize in one or two areas. Many vendors first entered the market with smaller, specialized systems designed as an add-on to help with only one element, such as payments or FX management, and gradually built out a TMS from there. These vendors are still likely to be strong in their original specialty. For organizations looking into purchasing a TMS, identifying areas of intensity in your own operations and needs and collecting data about the past, current, and projected scope and focus of various solutions’ functionality will prove a vital step in finding the right partner.

Hosting Models

A TMS may be installed on-premise (hosted on the organization’s own servers) or hosted in the cloud via the ASP (Application Service Provider) model or the SaaS (Software-as-a-Service) model. Most installed and ASP systems are now considered “legacy,” whereas SaaS is the current industry standard due to its cost-effective nature, low-hassle implementation and maintenance, enforced updates, and ability to continue developing as technological advances are made. That said, some firms may still choose installed or ASP solutions to suit their unique needs and situation.

TERMS TO KNOW

INSTALLED

The hardware and software is managed internally. This includes the application of upgrades and management of test, development and production instances.

HOSTED/ASP

The hardware is managed externally by a third party on a single instance for the company. The software program can be supported internally or by the third party.

SaaS

The hardware and software is managed externally by the third party in a multi-tenanted manner.

Who Needs a TMS

Your company is seeing rapid growth, and spreadsheets are beginning to hold you back. Excel is a useful and flexible tool that is aptly suited for use in the treasury departments of small organizations. As the company grows, however, more functionality is needed, and financial data grows in both volume and complexity. Spreadsheets and the manual processes that accompany them inevitably become too inefficient and rudimentary to properly handle the expanding tasks. When spreadsheets begin to hold your department back, it is time to look into a TMS to support your company’s continued growth. This often happens when firms are working with several banks and have reached $100MM or more in annual sales/turnover.

Your treasury team is understaffed, and you need more people, automation or both. The demands on treasury are growing more rapidly than treasury departments themselves, leading to overwhelmed staff and important tasks that no one has time for. Staff are forced to spend their time pulling bank statements and manually handling data and handoffs and are left with no time for forecasting, learning, and other high-level tasks that their organization desperately needs. Using a TMS to automate some of the most time-consuming processes can help your team move from “barely scraping by” to excellence. Additionally, leveraging this type of automation allows organizations to more gradually and gracefully add staff than those running a manual shop.

You recognize the increased threat levels from fraud and have seen internal expectations for security rise. As the years go by, fraud becomes more frequently attempted, more often successful, and more costly to the victims. The corporate need for defense and payment security is constantly rising and changing as the criminals roll out new tactics. Both sides are learning to leverage technology more to their advantage, and manual processes are becoming increasingly vulnerable. TMS vendors are constantly working to ensure that their solutions are secure and able to counter the current threats, and automation by nature cuts down on manual handoffs by enforcing the controls inside the system. These enable better control of exposures by securing processes on an end-to-end basis.

Your organization has an area or areas of specific intensity or volume, and you might need specialized tools. Cash management and visibility tools provide the foundational layer of TMS functionality, meeting the common needs of all treasury departments. Some, however, find themselves needing more specific tools to support their organization’s areas of intensity of activity or complexity, whether this is payments, debt and investments, compliance, or etc. For treasury departments in this situation, a TMS is likely still a good option, but you may require a “specialist” TMS or one that has additional capabilities or sophistication in your area of intensity.

Why an Annual Report?

Over the decades, various economic disruptions and crises have brought the importance of treasury into sharp relief. Expectations briefly spiked for treasury in these times, as corporate leadership realized the value of liquidity and risk management. After most of these events, however, the general attitudes towards treasury tended to slide back toward the mean as the sense of urgency faded.

The 2008 financial crisis, like those before it, made treasury’s function top-of-mind for the rest of the finance world. However, whether due to its severity or some other factor, the heightened awareness and expectations surrounding treasury did not diminish at the same rate as before. Expectations remained high. Additionally, any sense of urgency that may have been lost has snapped back with COVID-19’s liquidity crisis. The industry will have to monitor emerging trends and expectations that may result as firms recover and seek to bolster themselves against newly felt risks.

While the steadier awareness of treasury’s vital function among corporate leadership is encouraging, the accompanying increase in demands placed upon the department comes as a challenge. Treasury professionals no longer have the flexibility of spending their time on inefficient, manual processes. With real-time or near real-time analysis and insight demanded of them, practitioners must find ways of streamlining and automating processes so that they can focus their own time on the higher-level tasks now required. These higher demands placed on treasury trickle down into higher expectations for treasury technology. Without specialized tools, the levels of accuracy, efficiency, integration and automation necessary to equip treasury for its growing expectations cannot be reached. Modern treasury departments of mid-size and larger companies, then, cannot excel in their function without a modern technology stack.

Steady Principles and Changing Tech

With data doubling every two years (40% growth rate) and computer processing power increasing even more rapidly (doubling every 18 months), technology and its use in the financial realm are relentlessly changing. For many elements of treasury technology, the information ages rapidly and dramatically. What were state of the art solutions a decade ago are legacy systems today, and methods of ensuring open treasury have developed rapidly as new technology has emerged. In such an environment, making technology decisions based on information from just a few years ago is akin to making investing decisions based on last month’s market data.

It is also worth noting, however, that many principles of technology usage either stay the same or shift rarely and gradually. Manual processes and manual handoffs, for example, cause defects. This problem and the resulting wisdom of implementing digital handoffs, validation, and confirmation are consistent principles of treasury management that have seen very little change over the years. Similarly, treasury’s need to interface with both internal and external sources is a consistent principle, as is the fact that new payment formats are added to old formats rather than replacing them, leading to a forward-looking but backwards-compatible aspect to the tech, and certainly to the data of treasury.

This report seeks to encompass both the changing and stable aspects by explaining the consistent principles and guiding the reader through current information on technology and its uses in treasury and finance. We publish this report annually largely for this purpose: providing the industry with data and ideas that will serve them today and tomorrow, not yesterday.

More Power and Availability, Less Cost

When we consider the consumer space in the twentieth and early twenty-first centuries, examples abound of what we call the “democratization” of technology. By this term, we mean the progression of certain technologies from prohibitively expensive for all but the topmost strata of society to an everyday item available to nearly everyone. Technology starts bulky, expensive, limited in functionality, and difficult to use and maintain, but it moves to sleek, convenient, more powerful, and affordable. Only a few decades ago, televisions and microwaves, mainstays of the twenty-first century home, were modern marvels afforded only by the wealthy. One generation was able to watch the computer itself go from taking up an entire room to fitting in our pockets at a miniscule fraction of the price and yet still boasting more power. The corporate world moves more slowly, but just as steadily in the same direction. When TMS were first developed in the 1980s, their high cost and the internal technological resources required to host them naturally made them exclusively available to the highest strata of large, multi-national corporations. Following the pattern of “democratization,” however, TMS have simultaneously become more robust and more affordable. Newer hosting models, such as SaaS, have accelerated this process and brought TMS to where they are today: powerful tools available to many firms with annual revenue under $500MM.

As the democratization of treasury technology continues, these analyst reports become relevant to a broader group. Since organizations with limited resources are often no less in need of tools to help them manage complex liquidity issues, we are excited to watch this expansion of TMS availability empower many companies to expand and grow efficiently.

Business Continuity and Work-from-Home

With business continuity planning (BCP) seeing renewed attention and with many industries rapidly adapting to a work-from-home (WFH) environment, many treasury departments face concerns with remote access to their tools. While slow, manual processes and lack of version control are problematic in the office, these issues can become crippling as we look at office-closure contingencies in a WFH environment.

A SaaS-based TMS can offer solutions to many of the WFH issues treasury departments struggle with and should be considered as a possibility as organizations seek to refresh and strengthen their BCP and potentially open the doors to long-term remote work. SaaS-based TMS are simple, secure solutions that are already in the cloud, allowing you to function in a secure domain whether users are in the office or at home. They drastically reduce manual, error-prone processes and handoffs and have built-in version control and audit features—all of which can be vital when dealing with the possibilities of sluggish home internet, overloaded VPNs, and other security and version-control concerns of remote work.

TMS in Light of Disruption and Volatility

As the managers of risk and guardians of organizational liquidity, treasurers spend much of their time preparing their organizations for the times of disruption and volatility they know will occur eventually. It can be easy to forget, however, to prepare the treasury department itself for such times.

When disruption hits, treasury is busier than ever. Urgent and vital questions, often from C-suite executives, must be answered. Forecasts, hedging strategies, and nearly every activity of treasury must be adjusted to reflect new and rapidly changing information, often with an increased demand for speed. In these times of stress, while carefully watching their organizational liquidity margin, treasury itself needs margin. A TMS can offer that margin by cutting down manual processes and supporting flexibility, insight, visibility, efficiency, and control measures, freeing up staff to manage critical situations. The robust functionality and the possibilities of reaching real-time or closer to real-time visibility across accounts help equip treasury teams during a crisis as well.

It may be tempting to help conserve resources by “making do” with manual systems, but treasury knows they need to be prepared, and that includes acquiring the tools that help provide margin during times of stability and times of crisis. We don’t know what will happen next, but we know something will happen. While the preparation and the equipment required will doubtless look quite different from one treasury department to another, all can agree on this principle: Do something about what you can anticipate and set up well for what you can’t.

The Problems and the Solution

The daily life of treasury professionals working on manual systems involves many, many discrete and repetitive steps in order to accomplish a single task. For treasury departments with only one bank, a small handful of accounts, and an otherwise simple organizational structure to deal with, these manual processes are likely to be perfectly sufficient.

Consider a couple of examples of the challenges you should expect to see as a result of implementing a TMS:

Data: Data exists in numerous places, in different formats and in different levels of completion and accuracy. Pulling more data together via technology will uncover problems with data quality. Where are the issues? What is the plan to fix the issues?

Staff: Improving the technology will cause disruption to the people. Some will thrive on the change, some will resist, and others may be unable to adapt sufficiently and may need to transition to another area of the organization. Consider: How will your choice of technology affect your ability to recruit new talent? How will your team need to adapt? How will the make-up of your team also need to adapt? What roles will you need?

Once an organization develops complexity beyond this level, however, treasury’s repetitive, manual tasks start to cause as many problems as they were initially intended to solve. Tasks grow out of hand and become too extensive for timely completion. The inefficiency drives up cost while driving out too little risk. Staff are rushing and operating under stress. With so many manual steps, errors are inevitable. Less urgent tasks, no matter how important in the long run, are pushed off in favor of keeping up with the most urgent functions of treasury. As a whole, the treasury department’s function of managing risk and protecting liquid assets devolves into a stopgap function of trying to protect a larger base of assets while its error-prone manual processes end up costing far more than a more mature automated solution.

To put it simply, a TMS solution responds to this problem by changing the treasury staff’s job from primarily performing manual tasks into primarily exception management of automated processes, allowing staff to focus their attention where it’s most needed. The TMS offers the lights on the car dashboard, so to speak, alerting the driver that the tires need air or the engine should be checked.

This conversion of processes from painstaking and manual to automated and exception-oriented can revolutionize the efficiency, effectiveness, and scalability of a treasury department. Treasury departments considering the purchase of a TMS should be careful, however, to keep their expectations realistic and not to view the solution as a panacea with no side-effects. When you upgrade your systems, you upgrade both your problems and your benefits. A TMS will bring up additional issues that must be taken into account no matter how many issues it also solves.

We don’t highlight this fact to discourage the use of TMS. On the contrary, we believe the benefits vastly outweigh the problems, but it’s still important to prepare and set realistic expectations. To draw a comparison, you don’t have to worry about diesel with a shovel, but a Bobcat® certainly moves a lot more dirt. It just helps to anticipate both the good and the bad and to realize ahead of time that the diesel will be necessary.

There are many similar challenges that a TMS might bring you. However, most would agree that these challenges are much more manageable than the problems you face when you need a TMS and do not have one. In the following sections, we will cover a few areas where treasury departments often face difficulty and will discuss how a TMS can help.

Increasing Fraud and the Need for Consistency and Scalability

While criminals are adding attack vectors and growing in sophistication, we ourselves add to the complexity of the defense. In our efforts and our organizations’ efforts to make moves that will better staff and further the organizational mission, complexity naturally accrues. New regulations are proposed, our organizations acquire new businesses, and with these things come new systems, new accounts, and new processes to guard and protect. As mixtures of old and new technology weave their way through our processes, and as those processes often seem to snowball larger and larger, our points of exposure multiply.

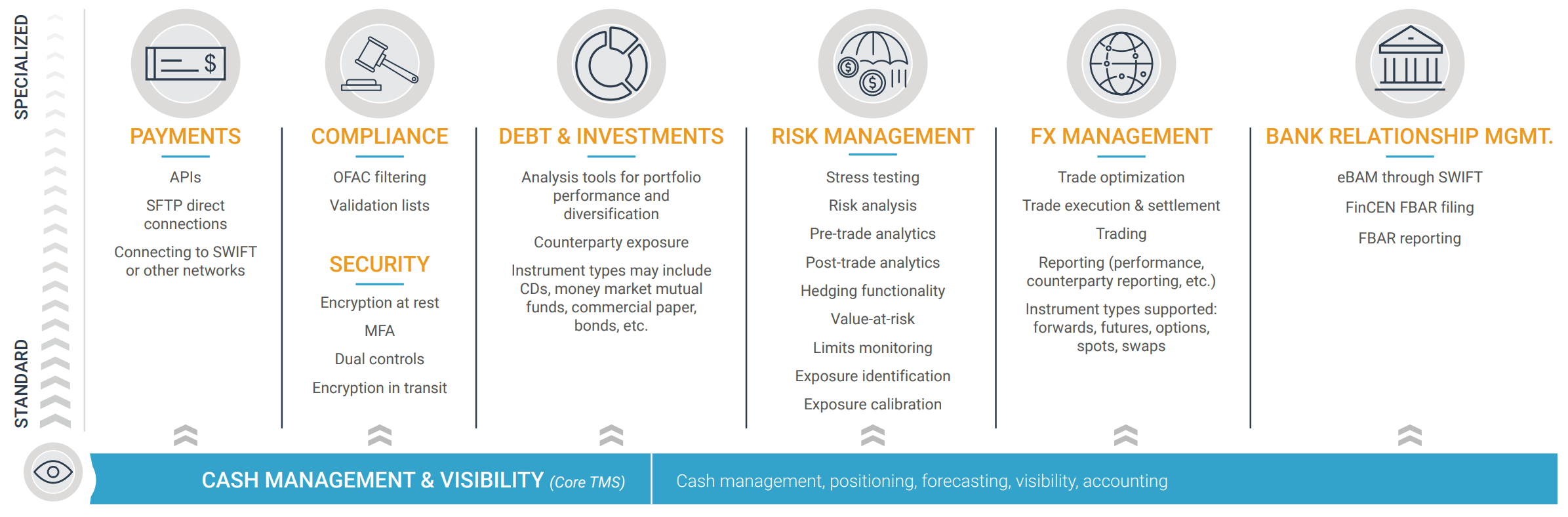

Treasury Technology Security Components

The complex defense required by this exposure cannot be solved simply with more people and more compensating controls, as this is both difficult to accomplish and inadequate in its effects. Instead, treasury must work to drive the complexity into consistent and efficient processes.

This is where the TMS can step in. It gives a single, secure environment through which payments can be executed and approved and data can be protected both in transit and at rest. Rather than having credentials for multiple employees for every bank, staff can view banking information through the TMS with a single login for each user. By minimizing what can be stolen and gathering it all together in a single, secured environment, a TMS already simplifies the defense enormously, but perhaps even more important is this: when payments are processed through a system such as a TMS, the controls are built in.

One of the most significant points of exposure in manual, “messy” payment processes results from certain actions being forbidden but still possible. These are “controls” that do not actually control anything. Whether from malicious motives (fraudulent) or from innocent but misled motives (trying to get a payment processed in time and being unable to get in touch with the second signer, for example), controls can be bypassed. Regardless of motive, this voids the control and creates exposure.

When payment processes have been consolidated into one platform, controls can be enforced. The TMS can be set to prevent a payment from proceeding without the proper steps being taken by the proper users. Two ids may have to approve a payment before the system will kick it to the next step, and transactions meeting certain criteria, such as those over certain amounts, may automatically generate notifications or the need for additional approvals. With the ability to digitally enforce controls, payments cannot be forced through inappropriately, thus drastically lowering points of exposure on a complex payment front.

This consistency is necessary on the front-end before an organization can safely grow. The security— not to mention efficiency—of driving all payment processes into a single, consistent system or process allows firms to scale their business without scaling their exposure. Since many treasury departments are short on manpower but still aim to equip their organizations for growth, a TMS with robust security and easily scaled and integrated payments can solve both time and risk management problems.

Treasury Staffing and the Need for Efficiency

The treasury staffing situation and treasury technology have, for some time, developed in tandem and mutually affected each other. Insufficient staffing creates demand for technology, and the use of technology within treasury influences the skills required of modern treasury staff.

That said, staffing is increasing at a slower rate than the demands placed on treasury. As noted on page 7 in “Why an Annual Report,” we see the expectations for treasury rising as firms experience disruption and volatility and recognize the importance of risk and liquidity management functions. This recognition is good news, both for treasury as an industry and for corporations as a whole. It does, however, create a challenge for treasury, since staffing increases alone cannot keep up with the heightened demands.

As treasury departments scramble, constantly trying to accomplish more with larger quantities of data in less time—all while holding off fraud—treasury technology can come as a welcome relief. With more efficiency, however, more challenges arrive. A TMS offers treasury departments the leverage to gain significantly more bandwidth. The relief from overwhelm is welcome, but for some, this may bring fears of staffing cuts when certain tasks are automated.

There’s no sugarcoating here: Without doubt, certain roles within treasury are dwindling. However, the human element is not less needed—it simply needs redirection to either technology-oriented or high-level tasks. Rather than seeing technology as an object blocking our path and preventing us from moving forward with our careers, treasury might view it as a leg up, an object we can use to reach higher ground.

Ultimately, a TMS added into the equation of a small treasury staff supporting a complex organization can act as a key, unlocking treasury’s ability to provide not only adequate, but exceptional, strategic liquidity management and advisory support to their organizations. This support, in turn, can act as a key to the organization’s ongoing success. The problem treasury staff face, then, is not how to oppose technology out of fear of becoming irrelevant, but how to develop the many skills that are increasingly vital to a technologically advanced treasury department. These skills include tech savvy, of course, but they also include being a strategic business partner, advisor, and proactive supporter of the larger organizational mission. Become an expert in how to leverage technology to your organization’s advantage, and your relevance will only increase as technology advances.

TERMS TO KNOW

DATA LAKES

Allows for storage of structured, semi-structed, and unstructured data. Hierarchically stored and optimized for business intelligence work and reporting.

BLOB

Binary Large OBject database—Non-hierarchical storage of structured, semi-structured, and unstructured data. Everything is stored in “containers.”

Note: A blob is more like the junk drawer in the kitchen, as opposed to a data lake, which is more analogous to a file cabinet. It is easier to set up a blob than a data lake, but you will need a data lake if you’re setting up massively large datasets.

DATA WAREHOUSE

Organized storage, prepositioned and optimized for reporting.

DIRECTORY

Location on corporate network, either physically present or in the cloud.

Data and Analytics Mindset: Supporting the Single Source of Truth

As companies grow and encounter new challenges, various departments build out new processes and integrate new technology. Rarely is this done with an eye to STP (straight-through processing) and inter-departmental collaboration. Instead, processes are calibrated to optimize only one department’s goals, new systems are never fully integrated, and each department gathers and stores up its own data.

The detriments of this siloed data management structure are familiar to most: repurchased data, financial and customer service problems arising from data that certain departments can’t access, errors and multiple versions, storage issues, the breeding of ill-will amongst departments that should be cooperating, and so on and so forth. No organization-wide inefficiency comes without ill effects. Few areas demonstrate so clearly as data silos both those ill effects and the ease with which inefficiency can slip in unnoticed if not prevented.

All the data is important to treasury. They use most of it themselves, and understaffed treasury departments know they can’t afford the inefficiencies of siloed data. Data management at large falls within treasury’s purposes in driving organizational efficiency, managing risk, owning cash, and supporting the organization’s overall mission. Treasury should work, then, to be an advocate for the “single source of truth” and the removal of data silos.

Getting rid of data silos is easier said than done, however. We all know they are to be avoided, and yet they seem to grow like weeds unless we actively work to root them out. To prove effective in the long run, this active work must involve proposing and enforcing an integrated data flow and a consistent organizational mindset aiming for STP. Since just one system that doesn’t integrate well with the rest can kink the hose and prevent STP, technology must be an area of focus for those seeking to remove and prevent data silos. For treasury’s part, selecting a TMS that “plays well with others” and securely stores, manages, and allows the smooth exchange of data is key to solving the silo problem. Within a properly selected and implemented TMS, a single instance of data can be used across all modules for every function treasury performs.

Silos do not represent the only issue with data in the modern corporation, however. Once the silos are torn down and the hoses unkinked, treasury must be prepared to make use of the massive amounts of data flowing in. This can also be difficult to do without a TMS. “Big Data” is both a blessing and a curse to the modern financial world, and in order to maximize the blessing and cancel out the curse, treasury will need robust, hyper-efficient tools. The solution must be appropriately focused and must have every ounce of functionality necessary if treasury is to properly and efficiently manage these levels of data.

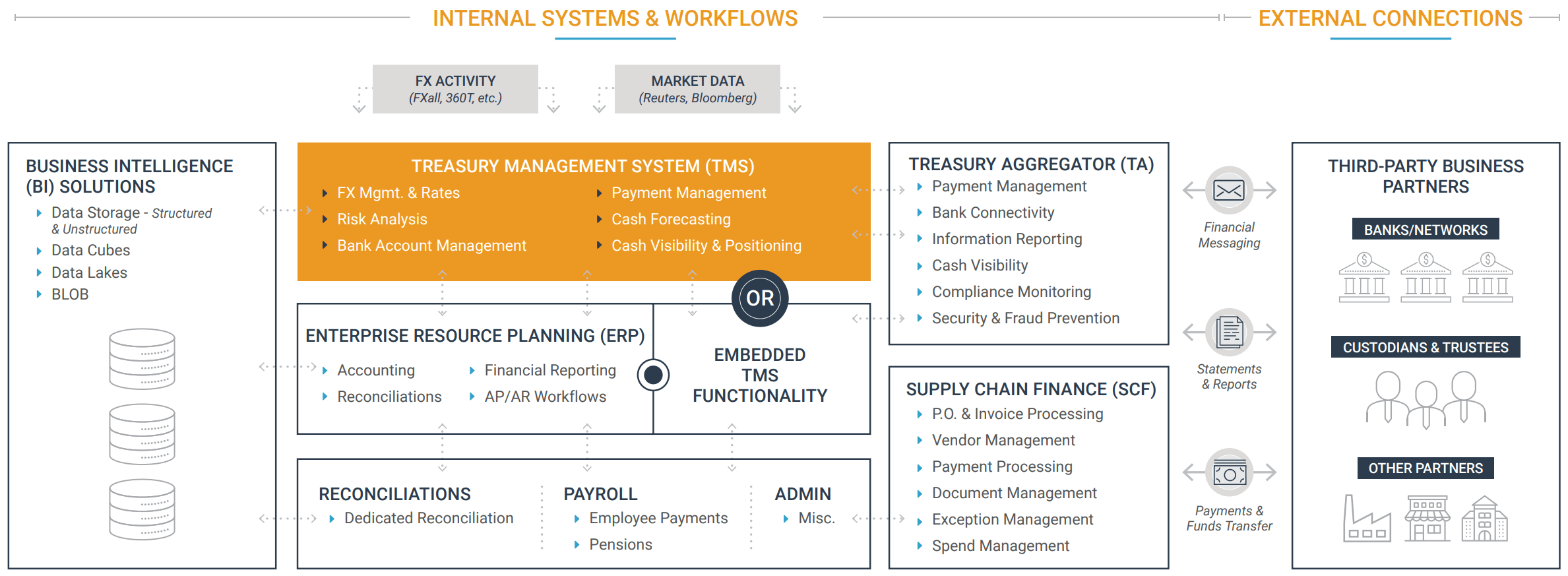

A Glance at a Sample Technology Infrastructure

Front-office and Back-office Integration and STP

Frequently, the front, middle, and back offices find themselves at the core of a silo problem. The functions of all three surround finance, but they each approach it from a different angle. The front office is where the trades are made, the middle office helps settle and confirm, and the back office handles accounting and reporting. Since the three are so tightly related, each needing the same information to perform their functions, seamless integration and STP are vital. In most firms, however, each office has found a set of solutions to suit its own needs over the years, and the solutions often integrate either poorly or not at all. The results are inefficiency, headaches, frustration, and even the breeding of resentment between offices who desperately need to cooperate. To solve this problem, front, middle, and back offices must work together to find a single, core solution that suits all three.

The core system, a role for which TMS are well suited, need not necessarily cover every area of technological need. In general, it is true that having more systems adds complexity in any organization, since additional handoffs need to be supported. Rationalizing the number of systems down is a reasonable operating principle. However, specialization can also be a significant advantage for many companies and can provide the needed rationale for an added platform. This rationale for adding specialized systems become easier to find when we look at “open treasury” capabilities, which allow for separate systems to more easily connect with one another, reducing the primary obstacle to multiple systems.

Best of breed, specialized systems for aggregation, supply chain finance (SCF), business intelligence (BI), and other elements can prove extremely useful alongside the core system. The imperative is only that all systems must integrate. Most TMS options can, however, cover the front, middle, and back office’s central functions in addition to integrating with best of breed for more peripheral or specialized capabilities. Certainly, having all three offices running primarily on a single system when possible can aid in building cohesiveness into the workflow, relationships, data, language, and perspectives, but excellent integration takes priority over finding an all-in-one solution.

Streamlining External Connectivity

Treasury’s needs for connectivity are unique. Not only does it require deep integration with other internal departments, but it also requires a vast web of external connections to partners such as banks, SWIFT, FX portals, and market data providers. In an environment of Big Data and global expansion, the external connections can become overwhelming for treasury staff if not properly facilitated by technology.

For many years now, TMS have come with built-in connections to many of the most commonly needed platforms and sources. APIs (application programming interfaces), however, are bringing significant impacts to connectivity as they become more and more prevalent. (See the section on APIs in the Treasury Technology Landscape on page 17 for more information on APIs and their uses.) “Open banking,” a movement to make banking information easier to pull and integrate without compromising security, has been followed closely by “open treasury,” a call to similarly streamline internal corporate financial connectivity.

With widespread implementation of APIs, open banking and open treasury are both in the process of shifting from ideas on the horizon to current best practices. The process is far from over, however, as open treasury especially still holds significant untapped potential. Whether another innovation appears, or API management continues to improve the mechanism for achieving openness, the basic model of a central, core system (typically a TMS) that can integrate with other systems as needed will be here for the long haul.

Treasury Technology Landscape

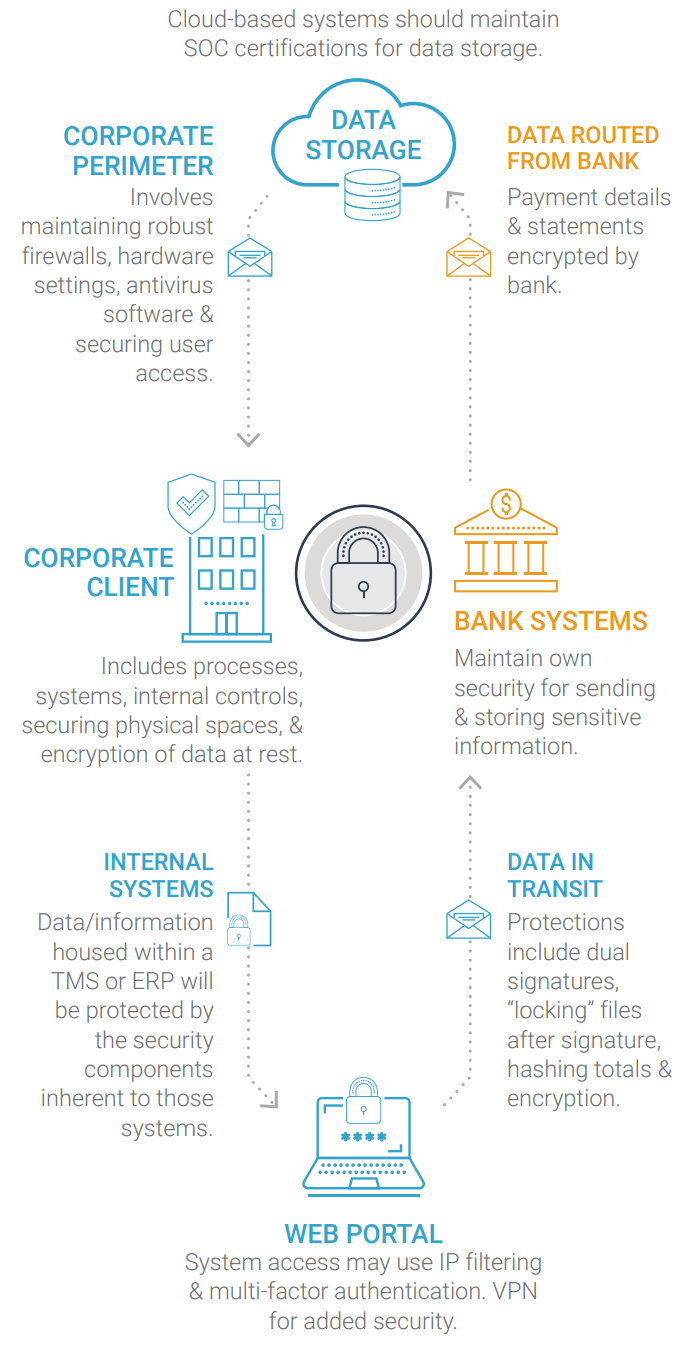

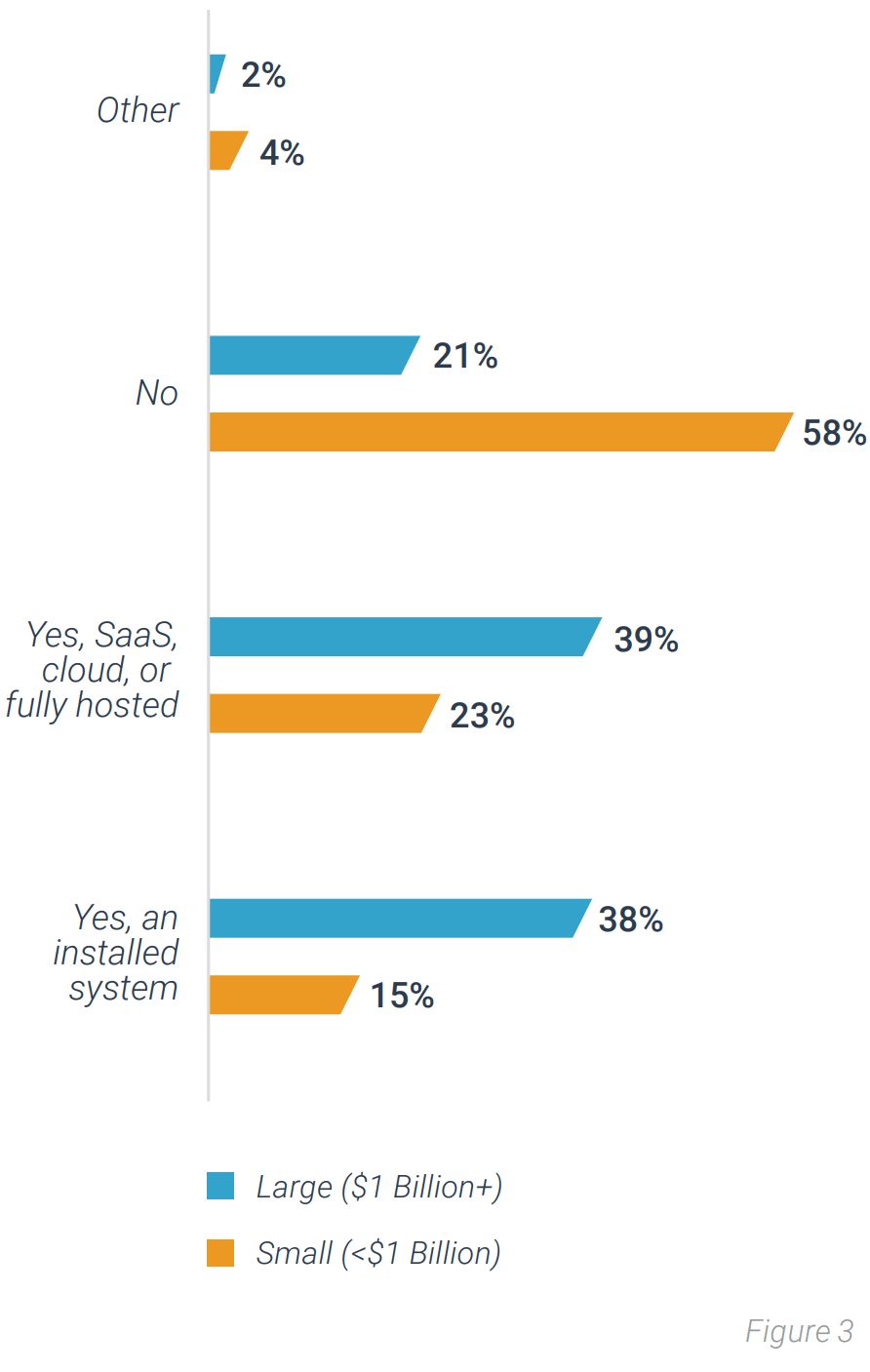

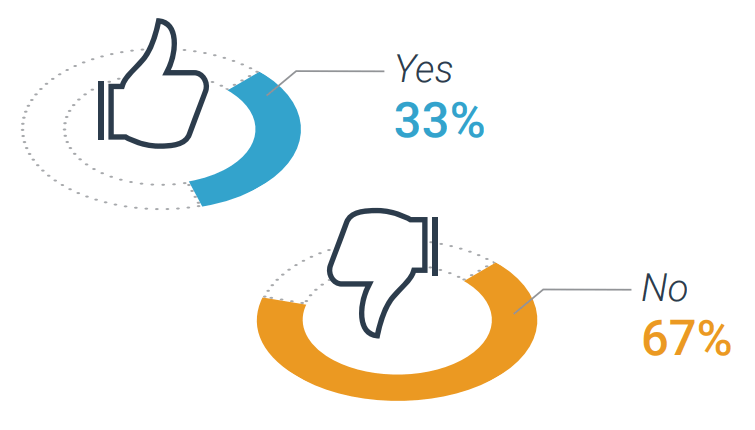

Over the next few years, we expect TMS—especially SaaS-based systems—to see significant adoption. However, we expect different types and rates of adoption among large and small companies.

Do you have a treasury system besides Excel?

In the past, TMS have seen much higher use rates among large organizations than among smaller organizations. Large organizations are defined for these purposes as those with annual revenue over $1B. Adoption has historically been slower among smaller companies (those with annual revenue under $1B), with well over half of these organizations still using only Excel for their treasury operations. However, as rising complexity drives automation, and as solutions become more scalable and more accessible to smaller companies, TMS have begun to see their most rapid adoption rates among these groups. We expect the use of TMS among smaller organizations to exceed 50% by 2025.

While most large organizations already have a TMS, there is growth in this sector as well. In addition to those buying a TMS for the first time, of which there are still quite a few, many of these large firms were early adopters of TMS, and as such, their solutions may be old and out-of-date. We expect that 75% of those with an installed system are likely to replace them with a SaaS-based solution within five years.

Tech Democratization and Open Treasury

As we discussed in More Power and Availability, Less Cost on page 8 of this report, treasury technology has its own history of democratization. Its progression runs from resource-demanding, expensive installed solutions all the way to the affordable, scalable, and powerful cloud-based solutions of today. The development of the open treasury model traces a parallel path to democratization, with its roots in the shift to cloud-based systems and its continued progression in the technological architecture and connectivity allowing best-of-breed solutions to integrate seamlessly.

Between differences in industries and individual corporate situations, treasury departments vary wildly from one another in their circumstances, areas of intensity, and needs. Accordingly, a “one size fits all” approach to treasury technology is difficult to achieve. Instead, most vendors make their TMS scalable, with optional functionality that can be purchased if needed. In turn, many modern treasury departments opt for a best-of-breed approach in architecting their technology stack, finding specialized, standalone tools for their more unique needs and building them out around their core TMS.

The configuration of the technology stack can increasingly be customized, as democratization results in more options at lower costs. However, in order to implement best-of-breed and open treasury models with any level of success, treasury departments must acknowledge and follow one foundational principle: connectivity. All components of the stack must integrate with one another, as well as with accounting systems, BI systems, and of course external sources. Even a single component failing to integrate can produce unnecessary headaches, errors, and breakdowns in the workflow.

The TMS, as the most multi-purpose, core usage system in most treasury departments’ technology stacks, has a foundational role. As such, it must have a robust and flexible ability to connect to any other systems in the treasury ecosystem.

All treasury’s data will be used and transformed within the TMS, so it’s vital that it be capable of bringing in all necessary data, as well as capable of allowing that data to flow into other systems for other purposes afterwards. Ensuring your TMS can integrate smoothly with all current and future components is one of the most fundamental steps to reaching open treasury.

TERMS TO KNOW

MACHINE LEARNING (ML)

Computer algorithms that “learn” by trial and error. These algorithms are given targets and adjust to meet them as they run iterations of data.

ARTIFICIAL NEURAL NETWORK (ANN)

A subset of ML and closely related to deep learning, neural networks are a way of determining patterns through complex sets of data.

DEEP LEARNING

A subset of ML, typically indicating the use of large neural networks geared towards image recognition tasks.

NATURAL LANGUAGE PROCESSING (NLP)

A field of artificial intelligence and linguistics focused on developing the abilities of computers to process human language.

OPTICAL CHARACTER RECOGNITION (OCR)

The conversion of images of text into electronically recognized and processed text.

Emerging Technology and Its Context

In terms of technology, the consumer space informs the corporate space. People have grown used to rapid improvement, sleek user interfaces, and robust functionality for the applications they use in their personal lives, and they expect the applications they use at work to be of a similar quality. Technology for use in the corporate environment, however, is slowed in its development by the need for sufficient protection and by complexities such as employee turnover and MFA (multi-factor authentication) with multiple users. Nonetheless, slow adoption does not mean no adoption. Even while emerging technology’s corporate use may seem to lag significantly behind the take-up rate in the consumer space, once certain issues are solved, corporate adoption will scale. If we don’t want ourselves or our departments to be left behind or caught off guard, we need to learn about emerging technologies. We must begin to consider how they apply or will apply to the treasury function in general and to our departments’ situations in particular.

For example, while ML (machine learning) and RPA (robotic process automation) may sound similar at first blush, their positions within treasury’s technology stack are quite different. While both are tools that expand technology’s automation of tasks, the edges they expand are different. ML is built into the TMS, enhancing accuracy and efficiency in areas such as forecasting and error-checking. RPA, on the other hand, sits outside the TMS and facilitates digital handoffs between systems. Understanding and considering the position an emerging technology would occupy in relation to your other systems can help you plan ahead and architect an efficient, modern technology stack that appreciates over time instead of losing value.

Artificial Intelligence and Machine Learning

While the definitions of AI (artificial intelligence), ML, and their relationship to each other vary, we will speak of them in this report as related concepts. We accept the definition that shows that Machine Learning is one type of Artificial Intelligence. This category of technology is rapidly advancing, and as it advances, it narrows the field of activities that require significant human involvement. ML, in particular, has seen quick development and multiplied uses in finance technology recently, and its applications within treasury are set to equip the industry with far more efficient processes and previously unreached accuracy.

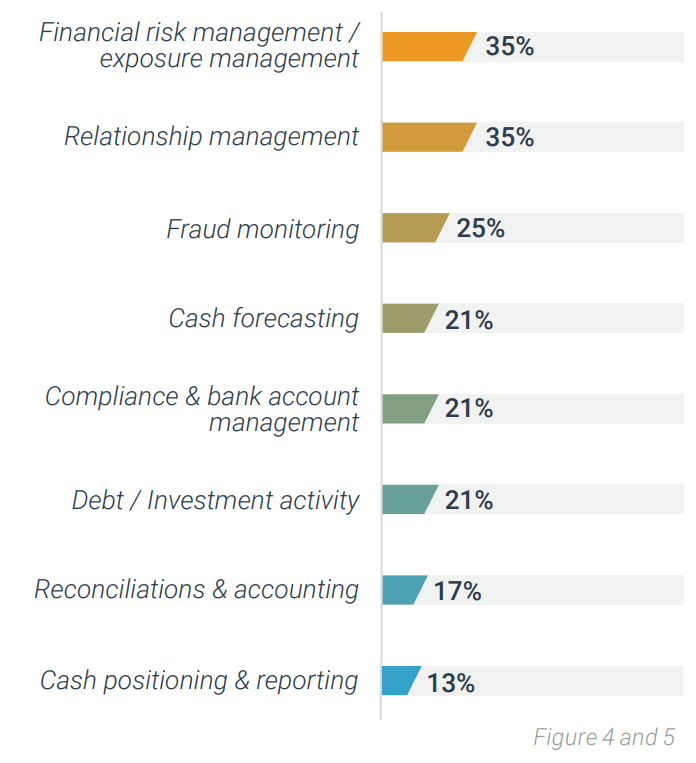

What are these responsibilities?

Machine learning includes various ways in which computers can be programmed to learn on their own (forecasting based upon history; identifying anomalous activity for security purposes or quality control functions). Typically, the computer is given a goal, parameters, or examples, and by historical information or running scenarios it learns how to better complete its designated task. This may include identifying activities that sit outside of the normal bands in a sample set (likely error) or identify the correlation between dependent and independent variables and distribution in order to improve the accuracy of a forecast.

This activity may also be predictive, which highlights one of the most important ways the technology can help in treasury. Cash forecasting and liquidity modeling is a vital part of the treasury function, but also a part that many departments struggle to keep up with. It’s also been an area where treasury technology has struggled, as the number and type of factors to be accounted for when creating an accurate forecast create complications in programming.

With machine learning, a computer can be fed data from prior time periods and can learn how to predict data for future periods. Significant amounts of prior company financial data must be available for this, and the program must be tested carefully with varied datasets for accuracy before its predictions should be relied on. That said, ML cash forecasting is rapidly developing into an incredibly efficient solution, allowing treasury access to highly accurate forecasts with very little manual work. Multiple vendors are already developing or testing ML in their forecasting modules with good success. Some are expanding the use with customers in a live (non-test) setting.

Machine learning is good for more than just forecasting, however. Other uses within treasury include quality control and error-checking, and anomaly detection for security and fraud. Both areas involve the computer learning how to identify expected ranges and parameters. When something falls outside the normal range, the program sends an alert requesting human intervention or confirmation.

Efficiency is the main driver for the quality control and error-checking side of this, with the machine enabling the user to focus on exception management instead of manual processes. The anomaly detection side is driven by security, with alerts triggered when a value surpasses a normal limit or when certain values coincide that rarely should, such as:

- When a payment is made outside of normal business hours,

- When a vendor master record is edited and a wire payment is created within a short period of time, or

- When more than 150% of the normal level of records are accessed within a 5-minute timeframe.

Think for a minute about how many defects such quality control measures could catch before they move too far downstream in a process.

While many uses of machine learning are still in development, vendors have already seen enough success with it that it seems highly likely to become an integral part of many TMS modules. This is one area of emerging technology where treasury professionals would do quite well to build some familiarity and consider how it might integrate with and affect their current technological ecosystem and workflows.

Application Programming Interface

Driven by PSD2, a regulation requiring European banks to make their data available, the use of APIs to facilitate open banking has seen rapid adoption in Europe. While regulations in other regions do not yet require the use of APIs, the influence of European banking has spread the adoption worldwide. Seeing the usefulness of APIs, vendors and firms are finding more ways to apply them, including between internal systems as a way of achieving open treasury. APIs run between systems, fetching and delivering data as requested. They are used extensively within consumer applications to integrate multiple functions into a single app, as the Uber app integrates data from maps, from Uber itself, and from payment services into a single platform for consumer convenience.

Similarly, APIs help treasury achieve STP by providing smooth integration between systems, whether internal or external. This erases the need for manual fetching of data and creates a seamless experience in which treasury can perform its function within a single system. A user can press a button in their TMS, and an API can fetch data from a bank or ERP system and present it without the user ever having to switch interfaces. APIs are, in many ways, the keys to open banking and to open treasury.

However, the use of APIs is not limited solely to facilitating digital handoffs between traditional systems. Some vendors have explored alternative uses, with one offering what is essentially an entire TMS contained within a company’s ERP system. This is made possible by a powerful set of API-enabled cash management applications embedded in the ERP. The API pulls data from the ERP, and the embedded cash management applications use that data to present treasury with TMS functionality. Since the applications are native to the ERP, this method results in highly efficient data management and integration, along with centralized security measures.

A range of APIs exist, with most of those that treasury will encounter falling into one of two categories: Web services and RESTful APIs (sometimes referred to as simply “REST APIs”). Web services are highly functional applications, typically created by the software vendor, that allow for movement of information in and out of a system without using the primary user interface (UI) in a manual manner. Once the data is out of the system, it can be transferred to another Web services API, which can move and inject it into another system. This type of API is somewhat indirect but is broadly available. When available, the increasingly common RESTful API is generally preferable for many functions, since it can move data directly from one system to another without two or three extra transition locations. While manual handoffs are the most important to eliminate, ridding the system of unnecessary digital handoffs is also beneficial.

Robotic Process Automation

As with many of the uses of machine learning, the use of RPA (robotic process automation) within treasury is driven by the need for efficiency in understaffed treasury departments. Put simply, RPAs give treasury a way to automate the handoffs between systems and “cheat” their way to STP.

RPA has been piloted in many treasury departments over the past few years, but their use continues to expand and deepen. As the name implies, robotic process automation involves programming a bot to perform a formerly manual process automatically, usually by copying the actions taken by a human. Unlike most other automated processes, RPA sits outside the primary system in order to facilitate digital handoffs.

Most commonly, RPA is used to automate processes such as downloading bank statements and cleansing data. They can also send exception alerts when issues arise or a process fails to complete correctly. Again, this moves the treasury staff to the much more efficient role of exception management and away from error-prone, time-consuming manual processes.

It should be noted that, when available, APIs are a sleeker, more flexible solution to the digital handoff problem. Since an RPA simply emulates the manual process, it can be prone to issues such as broken links that need frequent manual repair. However, with so many external connections, treasury finds itself handling a tremendous amount of activity between systems and data sources, and APIs are not yet available for each necessary handoff. RPAs do an excellent job of filling in the gaps and replacing steps that would otherwise be grossly inefficient.

Adjusting Mindset and Avoiding Pitfalls

The process of purchasing and implementing a TMS is a massive, high-stakes undertaking. The outcome can either be decades of increased efficiency and leverage that help treasury and the organization reach their goals, or it can result in years of costly problems, inefficiencies, and blemished track records. The following sections cover several of the most vital and difficult pieces of the process. We’ll identify common pitfalls and ways to avoid them and will discuss finding the right mindset to help you approach each issue with an eye towards the ultimate goal.

The Business Case

When treasury identifies the need for new or upgraded technology, even the first step constitutes a significant roadblock. Competition for funding can be fierce, and it’s a competition that must be won before your project can move forward.

Pitfall: Failing to Secure Buy-In

Making the business case comes with one primary pitfall that is seemingly obvious and surprisingly treacherous: failing to secure buy-in. Unlike many of the other pitfalls we’ll discuss, this is something everyone knows they need to avoid. What’s less obvious, and what makes this pitfall so common, is how much work is necessary to prevent it.

It’s easy for treasurers to clearly see the value of their project and to assume that others will see it too and support them rather naturally. Even if the supporters treasury is relying on also see the value, however, they may feel that another project is even more valuable, or they may have invested their political capital elsewhere already. Again, corporate competition for funding is fierce. This pitfall of assuming that buy-in is already in the bag—or can be easily or quickly obtained—and neglecting to perform the necessary heavy lifting kills many projects before they even begin.

In order to garner grassroots support and communicate the true value of the planned purchase to decision-makers, treasury must plan ahead and look beyond itself, its own needs, and its own terminology:

Make the Strategic Case

Showing the value that a purchase will bring to key stakeholders is vital, and the most important “stakeholder,” so to speak, is the organization itself. While ROI calculations seek to demonstrate how a purchase will ultimately work for the good of the organization financially, it’s important as well to show how the planned spend will support the organizational mission on a more strategic level. Make sure you understand the firm’s overall goals and can articulate clearly how a TMS will support those goals.

Get Other Stakeholders on Board

A new TMS will affect more departments than just treasury. Accounting, IT, and many other departments are likely to have concerns about how the TMS might change things for them. While it may be tempting to view these departments as competitors for funding or potential opponents to your business case, they can also become some of your strongest allies. To make that happen, treasury must proactively engage with these stakeholders, listen to their concerns, and work together to find a solution that addresses their problems.

Translate for Those Outside Treasury

No matter how clearly you understand how your TMS will benefit all involved, it won’t do you any good unless you can put that understanding into terms that make sense to your audience. Some of those you need to convince may have very little understanding of what treasury even does. Even between the different financial departments, terms as fundamental as “cash” bear different meanings. Keeping all of this in mind, treasury must be careful to present its arguments in terms that make sense to those outside of and in other parts of finance.

Underpromise, Overdeliver

Resist the temptation to offer stakeholders a best-case scenario of your project outcomes, costs, and timelines in an attempt to get buy-in. Don’t sell your project short either, but realistically leave room in your promises for a few unexpected problems and delays, plus margin. If you can deliver ahead of schedule at a lower cost than expected, you build trust and develop a track record that will help you gain support for future projects.

The Selection

With funding secured, treasury can move its project forward and tackle the next phase: selecting the vendor and product. Much can be said about what to look for and how to sift through the options, but we’ll focus here simply on avoiding some of the most common problems.

Pitfall 1: The Usual Suspects

With so many options to choose from, treasurers know they need to narrow the list. For many, it’s tempting to do this by focusing on whichever vendors they already have in mind as the best or most common providers in the market. Whether due to anecdotal evidence of good experiences or because a good and long track record in a vendor creates an impression of stability and excellence, these “usual suspects” can sometimes end up being the only ones carefully considered.

A good customer review, a good reputation, and a good track record are all valuable things to look for when choosing a vendor. However, they aren’t the only things to look for, and often, the information we have in our heads is out of date. Maybe the vendor that first comes to mind was truly the best several years ago, but that doesn’t mean they’ve kept up well with advances in technology and have continued to excel. Treasury’s technology vendor needs to be a long-term partner who will keep adapting and innovating as new problems and solutions appear over the years, and just because a vendor was good at solving yesterday’s problems doesn’t necessarily mean they will be good at solving today’s or tomorrow’s problems.

Rather than prematurely narrowing your search to the usual suspects, keep an open mind and an open ear. Don’t cross a vendor off your list without giving them a fair shot, and don’t bump a familiar vendor to the top of the list unless they truly earn it.

Pitfall 2: Too Much Time on Too Many Vendors

While narrowing the list by jumping to conclusions is one pitfall, failing to narrow the list until too late in the game can also cause problems. Treasury can become bogged down in the options, spending too much time on every vendor rather than spending the most time with those most likely to be a good fit.

It’s important to spend as much time on each vendor as is necessary before crossing them off the list. However, it’s just as important to spend no more time than is necessary. Treasury must find good, accurate ways of properly narrowing down the search to the best and most likely options. This includes understanding your organization’s points of distinction and the ways in which particular vendors can provide a fit to your functional and relationship requirements. Once that short-list is compiled, treasury can devote the additional time to making the best selection from the most suitable vendors.

The Implementation

Technology implementations are riddled with pitfalls, leading to their reputation for taking too long, causing headaches for all involved, and ending in suboptimal results. However, for those who come well-prepared and aware of the pitfalls to avoid, implementations can be highly efficient and successful. Below we’ll cover some of the most common pitfalls and how to prevent them.

Pitfall 1: Overaggressive Schedule

Many firms realize that implementations can hit roadblocks, lose momentum, and stretch out for years. In an attempt to prevent this, they choose an aggressive implementation schedule. As understandable as wanting to get the implementation over with quickly may be, these “aggressive” schedules are usually overaggressive, and an unrealistic, an overly aggressive timeframe is actually counterproductive and even disastrous.

Implementations simply take time. Many tasks (bank connection setup, for example) cannot be compressed regardless of manpower or determination. When insufficient time is allotted for various tasks, the entire project is often delayed, and treasury is left with a poorly implemented system, inadequately trained users, and a crushed reputation with those whom they told it would take only so long and cost only so much. If you’ve chosen to implement a TMS, understand—and make sure others understand—that this project will take a while.

To make sure it takes as little time as possible while still yielding good results, put in the work to make a realistic, detailed plan that leaves ample time for each task. As mentioned in the business case section, the goal is to underpromise and overdeliver. With careful planning and sufficient margin, your implementation can run smoothly and help you build a track record of completing projects ahead of time at a lower cost than promised.

Pitfall 2: Off the Side of Your Desk

Often, in the hopes of cutting down on the cost of an implementation, treasury departments will try to take on the project on their own, without significant assistance from either the vendor or a third party. Most treasury departments, especially those motivated to implement a TMS, are understaffed and overwhelmed by their daily tasks already. Few if any of those daily tasks can be put on hold to make room for an implementation, and as noted in the first pitfall, implementations demand a great deal of time.

Attempting to complete an implementation without help on top of a full schedule will typically lead to an excruciatingly long implementation and poor results. Get help with your project, and not necessarily just from the vendor. Partnering with a third party that assists with implementations gives you access to additional resources to support your team. Experience from those who have performed many implementations can help you reach your implementation targets more quickly by prioritizing the urgent and helping you navigate around the pitfalls.

Pitfall 3: Trying to Get All the Functionality at Once

The third pitfall common in implementations is the attempt to stand up all of the new system’s functionality at one time. Since each piece of functionality in a TMS is integrated and interrelated, this becomes complicated.

One problem can lead to problems in every other area, resulting in a delays and unrealized benefits. The most effective method, at least for projects of the scale and type of a TMS implementation, is usually the phased approach. Focus on setting up critical path items first and stand up each piece of functionality one at a time, in logical order.

Staffing and Workflow Changes

While most of the problems in staffing and workflow crop up during the implementation, it’s a category worth attending to on its own. A TMS, like any new system, brings change. When well-selected and well-implemented, the vast majority of that change should be positive. Even with positive changes, however—and especially with neutral or small but negative changes—people struggle. Our own responses are not always best, and the responses of those we work with can catch us off-guard and cause additional issues.

Pitfall 1: Failing to Plan for Change Management

A TMS brings many significant changes to how tasks are performed, and treasury must work with many individuals and with other departments who will need to adjust to using the new system. Another department may be accustomed to having certain information sent to them periodically, and now they may receive their own login so they can access the data themselves. Be prepared for the need to teach these other departments to self-serve and to use new processes and a new system. In addition, remember that this communication and teaching is likely to be a process, not a single event, as other departments may not be able to adjust all at once.

As for individuals, different people will react quite differently. Some shift and adjust rather naturally, for some it’s uncomfortable but quite doable, and for others the adjustment process can be a serious struggle. Those whose skillsets were grounded in manual processes may have the most difficult time, as they will have to perform an extensive overhaul on their skillset in order to remain relevant to the organization. After all, while a TMS does not make people irrelevant, it will render certain skillsets irrelevant. There will be plenty of work for staff, but to perform that work, they must be willing and able to learn the new skills required of them. Be prepared for the difficulties of this adjustment and help others prepare and learn.

Pitfall 2: Not Adjusting Process to the System

While TMS are customizable in many ways to the needs of different organizations, they will necessarily lock you in to certain processes for tasks. Many departments find this uncomfortable at first. They aren’t used to performing these tasks this way, and perhaps they had certain reasons for the old processes, and while there isn’t exactly anything wrong with the TMS process, they don’t like it.

The temptation at this point is to try to customize or bypass the TMS’s built-in processes. This is a pitfall. You may enjoy the familiarity that results from forcing the system to comply with your historical processes, but you will not enjoy the inefficiency that inevitably seeps in as a result. Instead of trying to customize the system, customize yourself and your own processes a little, leveraging the system’s built-in processes to achieve greater overall efficiency.

Works Cited

- Figure 1, Page 11: 2017 and 2020 Strategic Treasurer and TD Bank Treasury Perspectives Survey.

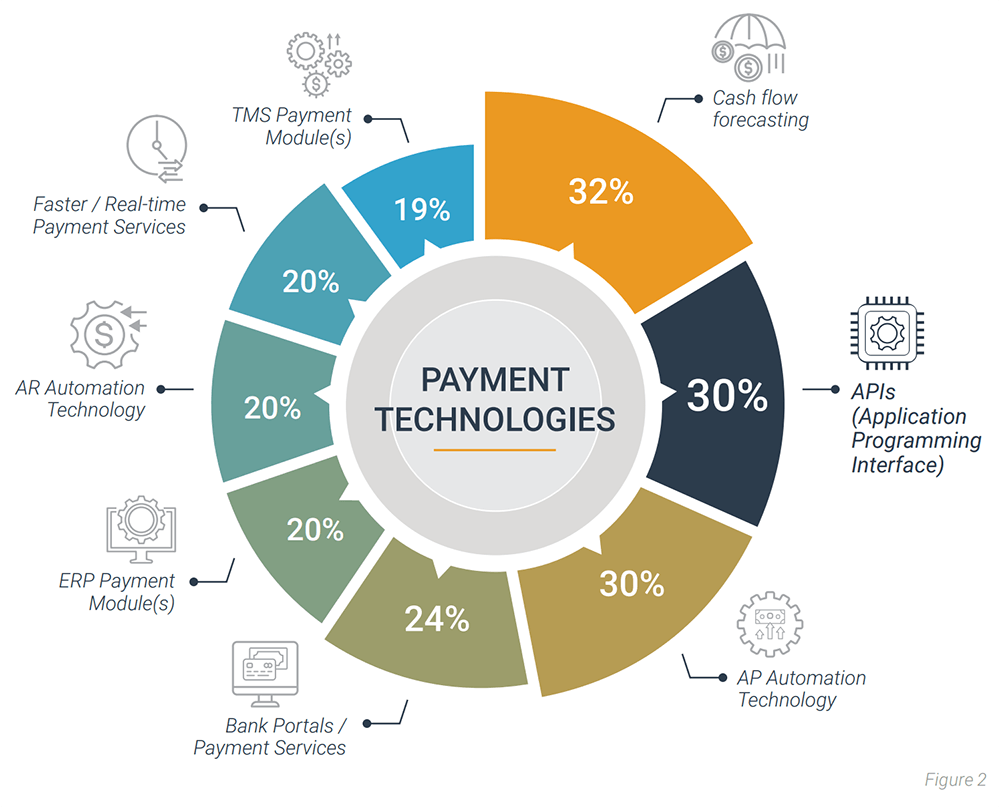

- Figure 2, Page 14: 2020 Strategic Treasurer and Bottomline Technologies B2B Payments Survey.

- Figure 3, Page 15: 2017 Strategic Treasurer and TD Bank Treasury Perspectives Survey.

- Figure 4 and 5, Page 17: 2020 Strategic Treasurer and TD Bank Treasury Perspectives Survey.

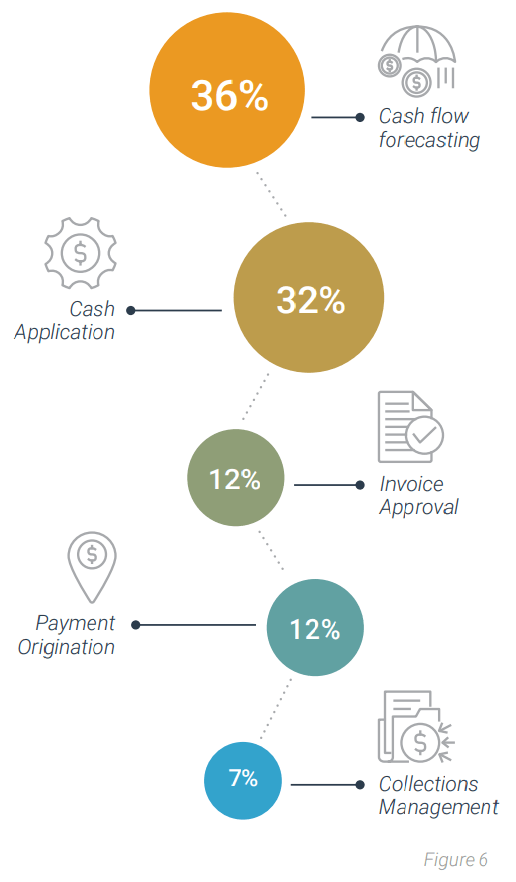

- Figure 6, Page 18: 2017 Strategic Treasurer and TreasuryXpress Treasury Technology Survey.

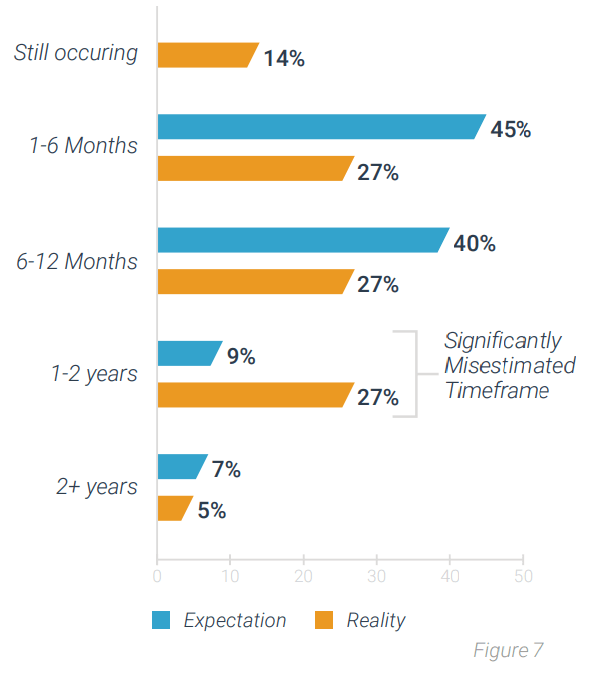

- Figure 7, Page 20: 2017 Strategic Treasurer and TreasuryXpress Treasury Technology Survey.