eBook

Busting Payable Finance Myths: KeyTrends & Issues in the Digital Age

Table of Contents

Introduction

Busting the Payable Finance Myths is designed to help Finance, Procurement, Treasury and Supply Chain professions evaluate the latest trends, issues, and perspectives impacting buyer-led early pay techniques. We know most companies are under tremendous pressure to manage their cash flow. Your spend portfolio, the things you buy from your suppliers, whether they be direct materials, commodities, manufactured items from contract manufactures, or marketing, transportation, and general and administrative expenses, can represent hundreds of millions if not billions of spend. Many organizations now put cross-functional teams together to come up with ideas to improve working capital across both the supplier and customer ecosystems.

The 2018 Corporate Practitioners Guide provides an independent source for anyone determining how their company should proceed with both self-funded and third party buyer-led early pay solutions. Whether you are simply assessing what is available on the market today or just trying to understand what this space is about, this guide will help keep you informed about developments in this important sector.

Trade Credit and liquidity is especially relevant given both the availability and cost of capital within a Buyer-Supplier supply chain is very challenged, especially for non rated and non investment grade companies. Companies need to better understand the issues around buyer-led techniques as the need to inject capital or increase capital into their supply chain continues to evolve, especially as the corporate business model becomes more globally distributed, new technologies emerge, and new players outside the traditional space look to provide solutions.

GBI conducted over thirty interviews with corporate treasurers who have implemented various programs and are thinking about implementing various programs to provide deeper content than press release type information.

Developing Solutions Across the Total Supply Base

Legacy solutions

Up until about 2010, companies had few options to pay suppliers early. In fact, if you were not a large, investment grade corporate that could offer bank funded Supply Chain Finance (“SCF”) to your top tier suppliers, your options were limited to pcards and using prompt payment discounts.

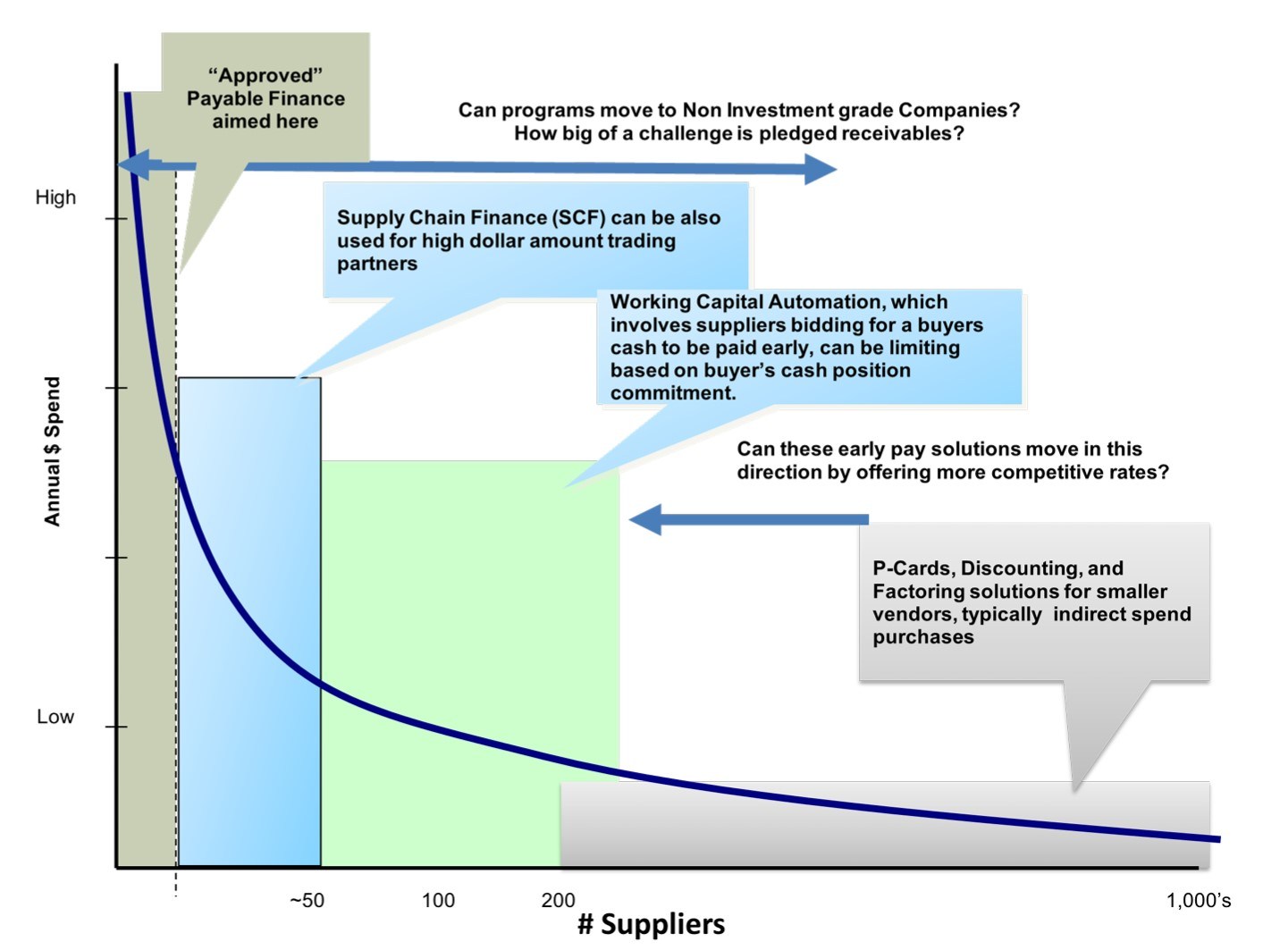

Since 2010, our findings indicate early pay solutions offered by Buyers to their suppliers continues to have big gaps around addressing total spend. Companies that have $500M, or $1bn, $5bn or even $30bn in spend still have a small percentage of total suppliers on some early pay solution. Figure 1 shows the supplier focus of early pay programs, and some of the key questions impacting the early pay technique today.

Figure 1. Developing Solutions Across the Total Supply Base

While there are many reasons these techniques only reach a small subset of suppliers, our analysis has shown it comes down to a few:

- Suppliers’ Capital Structure – understanding how suppliers fund their business relative to early pay offerings is important for supplier acceptance. The vast majority of suppliers >$20M are serviced by an array of conventional (banks, factors, ABL) and non conventional (asset managers, insurers, specialty finance, etc.) financial firms. In addition, to a supplier, most customers are a small percentage of overall receivables and thus it’s more important for companies to leverage their total financial assets for the best structure and rates.

- Payment terms – this is a win/lose proposition and only the largest companies with leverage in their supply chain can push terms and then offer some form of early payment. Adjusting payment terms is a complex coordination issue between buyer and seller.

- Indirect versus Direct Spend suppliers – Most large companies have adopted some form of eProcurement, eInvoicing, or Supplier Business Network as part of an overall Purchase-toPay solution and have added some form of early pay offering. But for most of these solutions, the spend covered is indirect, or Sales, General & Administration as opposed to direct materials, commodities, and other spend relevant for product creation. Early pay techniques such as pcards and dynamic discounting are more focused at indirect spend suppliers. For large companies, much of their connections with direct material companies is done via EDI or some other form of direct connection.

- Developing Sustainable Funding sources – Using third parties to fund suppliers or even Treasuries own cash is not to be taken lightly, as any company would want to ensure funds provided are not “here today, gone tomorrow”.

Bank funded Supply Chain finance is still the dominate form of early pay finance. It has been estimated the global supply chain finance sector reached US$450bn in 2016 and the amount of funds in use as at the end of 2016 is estimated at US$167bn.

A company such as Intel or MMM at any time may have $3 bn in Payables and $10bn in cash, so this type of lending makes sense. For banks, SCF is a low risk form of unsecured finance where the contractual law uses the buyer, typically investment grade, as the backstop, because you have accounts with them and other relationships as well. This model gets the term reverse factoring for a reason, it’s like factoring on an efficient scale, where the invoice is paid early but you are not doing holdbacks like traditional factoring.

Early Pay Solutions in 2018

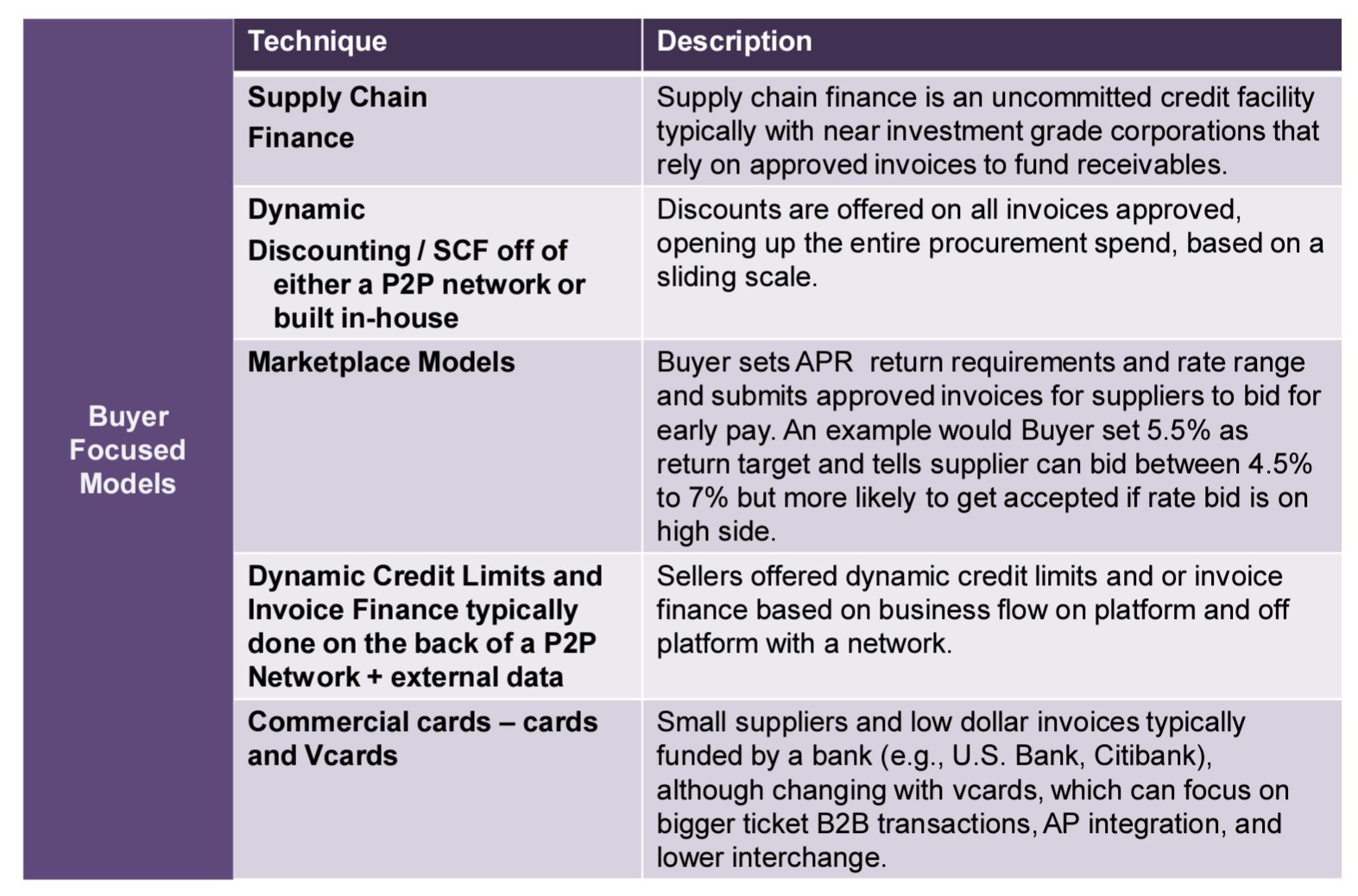

Corporations now have more early payment options when looking to support their suppliers who would like to extinguish an invoice before due date.

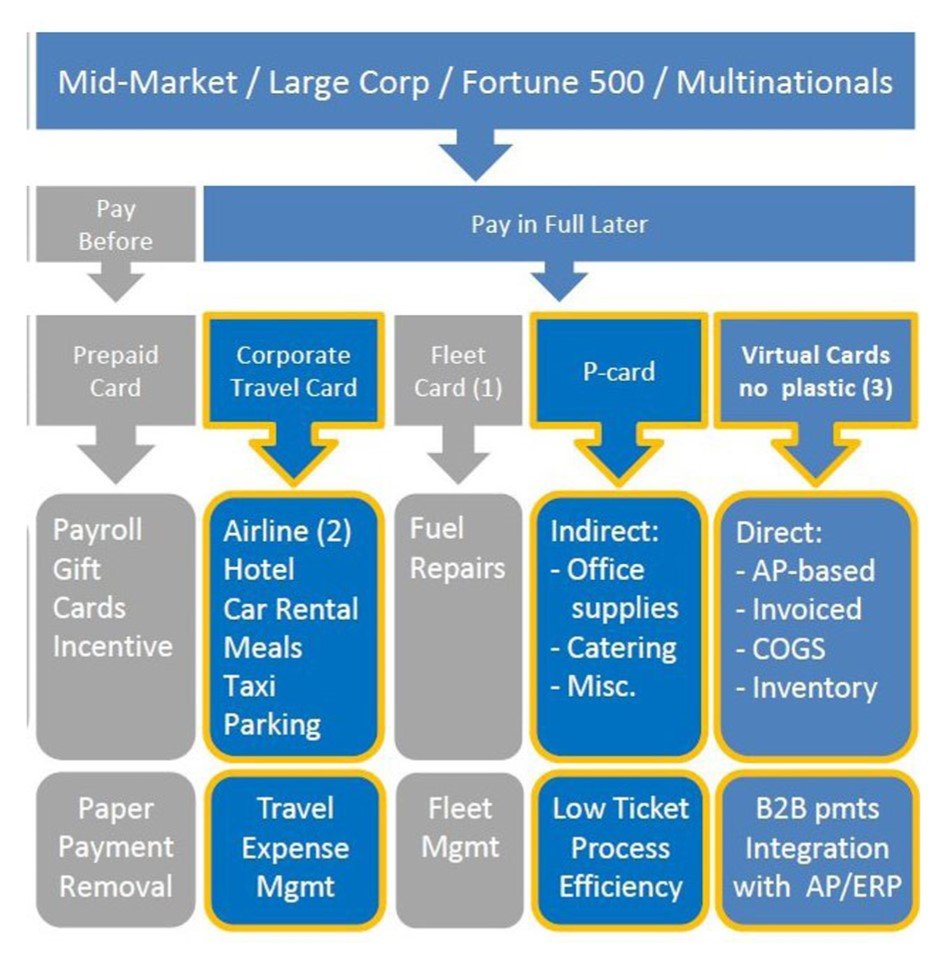

Figure 2 shows large corporations have a menu of opportunities to pay their suppliers early, supported by their banks, their purchase to pay vendors and other financial partners. These payment options tend to get segmented based on spend size, supplier type (examples include Tiers 1,2,3; strategic; critical; indirect; tail, etc.), and of course overall supplier revenue (Micro business, small business, etc.)

Figure 2. Early Pay Menu Options for Companies

Bank Funded Supply Chain Finance

Large Tier 1 and critical suppliers are offered Reverse Factoring or Approved Trade Payable Finance if the corporate is able to fund a program with their credit. Some of these programs are moving downstream to smaller spend suppliers, but that is still less the norm because of the costs involved with onboarding. Typically these programs will require some minimum spend threshold (eg. $25M or more) to be eligible.

Dynamic Discounting

Supplier portals provide supplier self-help services and dynamic discounting is a popular feature. More and more large companies offer some solutions here, whether the functionality is built in-house or they use a third party vendor solution.

The practice of offering discounts for early payment (eg. 2%, net 10) goes back decades. For most large companies, there is nothing like standard payment terms. Their payment terms proliferate across legal entities, divisions, regions, and with time, to the point it is rare if a large company has less than 40 to 50 different terms.

The simple practice of early payment terms has evolved into Dynamic Discount Management (“DDM”). Dynamic Discounting is different than the static practice of one size fits all (eg. 1%, 10 day) discounts in several ways. Discounts are offered on all invoices approved, opening up the entire procurement spend, not just ones that are approved and ready within the allotted 10 day (or other) time period. Successful discounting is dependent on fast invoice processing – ideally less than 14 days. Since only approved invoices can be used for dynamic discounting to work, the volume and number of invoices awaiting payment is the critical ingredient to unlocking the opportunity in DDM.

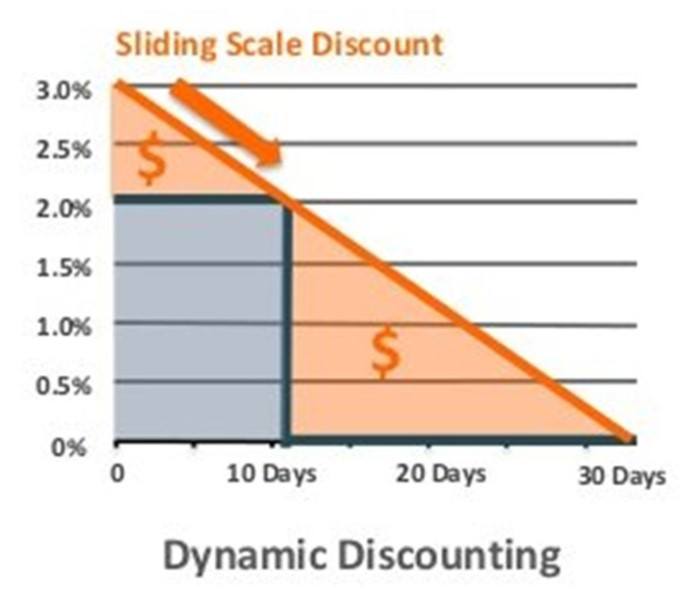

Dynamic discounts differ from traditional discounts as the discount is calculated as a function of the time of payment, in other words, it is based on a sliding scale, see Figure 3. This allows the buyer to set terms based on internal hurdle rates, supplier groupings, and other factors.

Figure 3. Simple Example of Sliding Scale for Dynamic Discounts

A number of trends are driving DDM:

- E-invoicing solutions have enabled a much higher capture rate of invoices. While some companies have deployed EDI solutions with their partners for some time, the amount of electronic capture is much higher as solutions like Web EDI, PO-based invoices, ERS, invoices originating electronically from a vendor portal or an e-invoicing network such as SAP Ariba. are deployed. The fact is early payment works off of a network that has invoices that are approved by a company’s ERP system.

- Software that now “systemitizes” the process of managing discounts. Without technology, most companies have little idea how much earlier they are paying suppliers than they ought to be, due to immediate terms or too short terms. This can be a challenge at many companies due to slow approval processes.

- Low interest rate investing climate for Treasurers. Rates earned on dynamic discounts far exceed short term Commercial Paper, Bank CDs, Treasuries, etc. The issue here is once you start a program, you commit the company to investing some of its surplus cash.

Commercial Cards

Pcards have historically provided a way to manage very long tails and distributed and decentralized buys and are a valued early pay technique for this purpose. There are more spend categories being covered by pcards than ever before by buyers that accept card, with items such as office and computer suppliers, industrial supplies, printing products, and others gaining share over the last few years.

But the addressable spend by Pcards is currently less than two to five percent of total business expenditure for most industry sectors. Figure 4 shows card companies are attempting to extend their value proposition beyond the traditional p-card market.

The addressable spend by Pcards is currently less than two to five percent of total business expenditure for most industry sectors.”

From a buyer’s perspective, pcards have become a convenient buying tool for low dollar purchases and as a payment / finance vehicle (source of rebates as well), but it’s also been poorly adopted in part because of perceived shortcomings related to fees, lack of detailed / flexible spend reporting, and poor integration into the broader procurement / AP process (“P2P”).

Excluding the rebate benefits, many in Procurement see pcards as another system that is not well integrated into other supplier payment methods. This lack of visibility of p-card spend may impact how the Procurement organization views detailed spend through all channels. When total cost is taken into account, there is certainly recognition that the costs passed to suppliers in the form of interchange may benefit treasury but not procurement in the long run.

Figure 4. Card products offered to companies

Virtual Cards

Virtual cards can automate and accelerate procure-to-pay / order-tocash processes. Virtual cards have become more commonly used for transactions into the six figures and can provide substantial business process automation support in AP and provide for strict controls around:

- Velocity limits (spend / txns)

- Merchant category code restrictions

- Tax rules

- Authorization / decline queue

- Dynamic funding – the ability to authorize only exact purchase amounts for individual virtual account transactions (e.g., specific suppliers, dates) where the purchase amounts may be continuously changed in real-time in the online solution

- Single-use numbers

- Buyer initiated / push payments

- Tolerance ranges for transaction authorizations

Figure 5 shows that virtual cards are growing fast at $162 bn in U.S. B2B card spend, but still a relatively small amount relative to total B2B spend.

Emerging Models

Companies buy from a wide portfolio of suppliers. It is difficult to offer a one-stop solution for all suppliers.

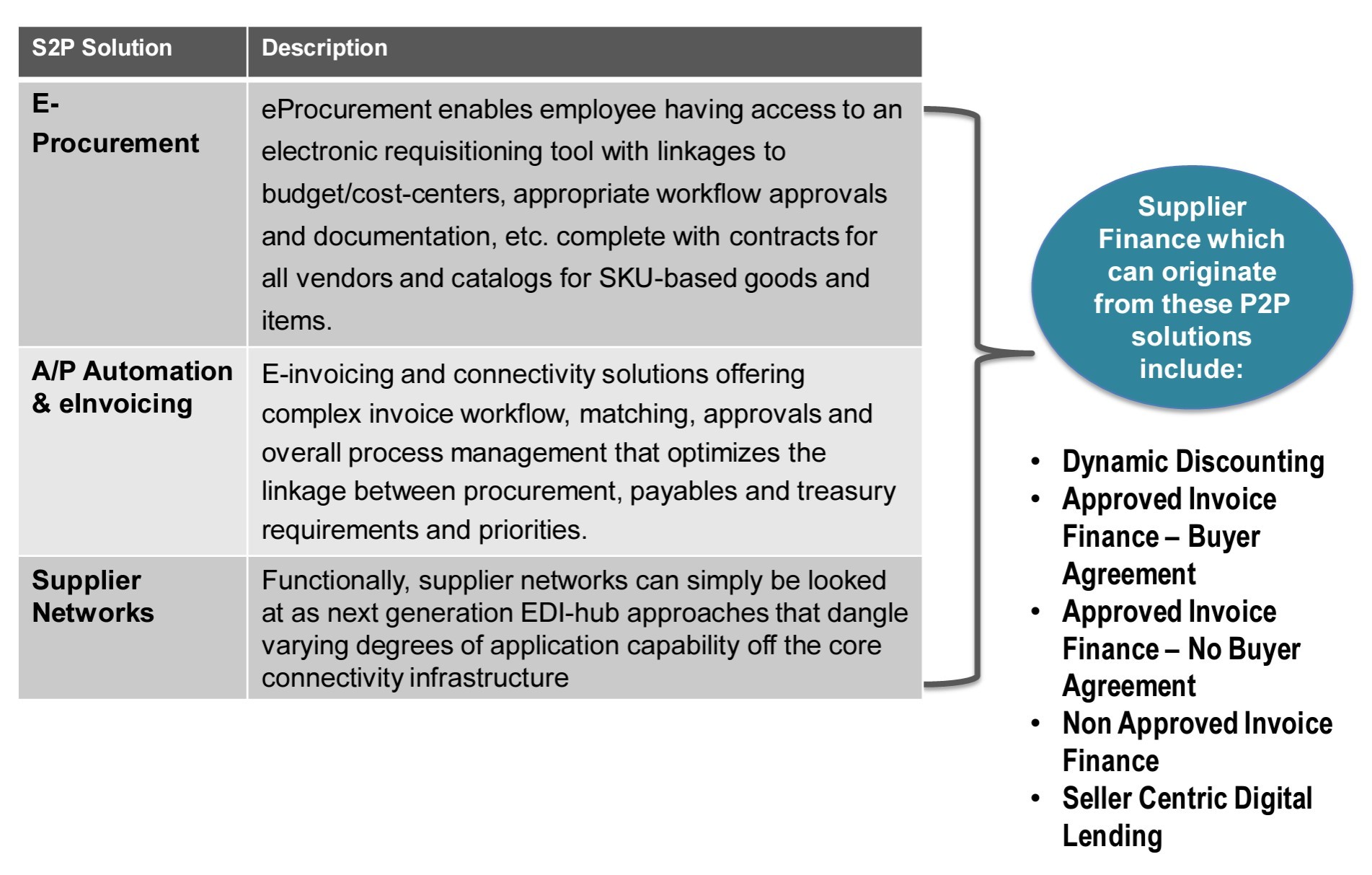

Many procurement organizations are entering new levels of maturity with their purchase-to-pay (P2P) programs and systems that can serve as a foundation for a range of trade financing initiatives, starting first with approved invoices as a trigger for early payment. Figure 5 shows that these Source to Pay solutions such as Eprocurement, AP Automation, Einvoicing and Supplier Networks are common implementations with large corporates, enabling supplier or early pay finance.

These different networks are leading to new forms of supplier finance, both those based on the network platform volume and non platform volume to offer suppliers both invoice finance and lines of credit

Figure 5. High Level Description of Eprocurement, Einvoicing and Supplier Networks