Fact Sheet

Kyriba’s Enterprise Liquidity Management Platform: Optimize Liquidity, Reduce Risk, Unlock Growth

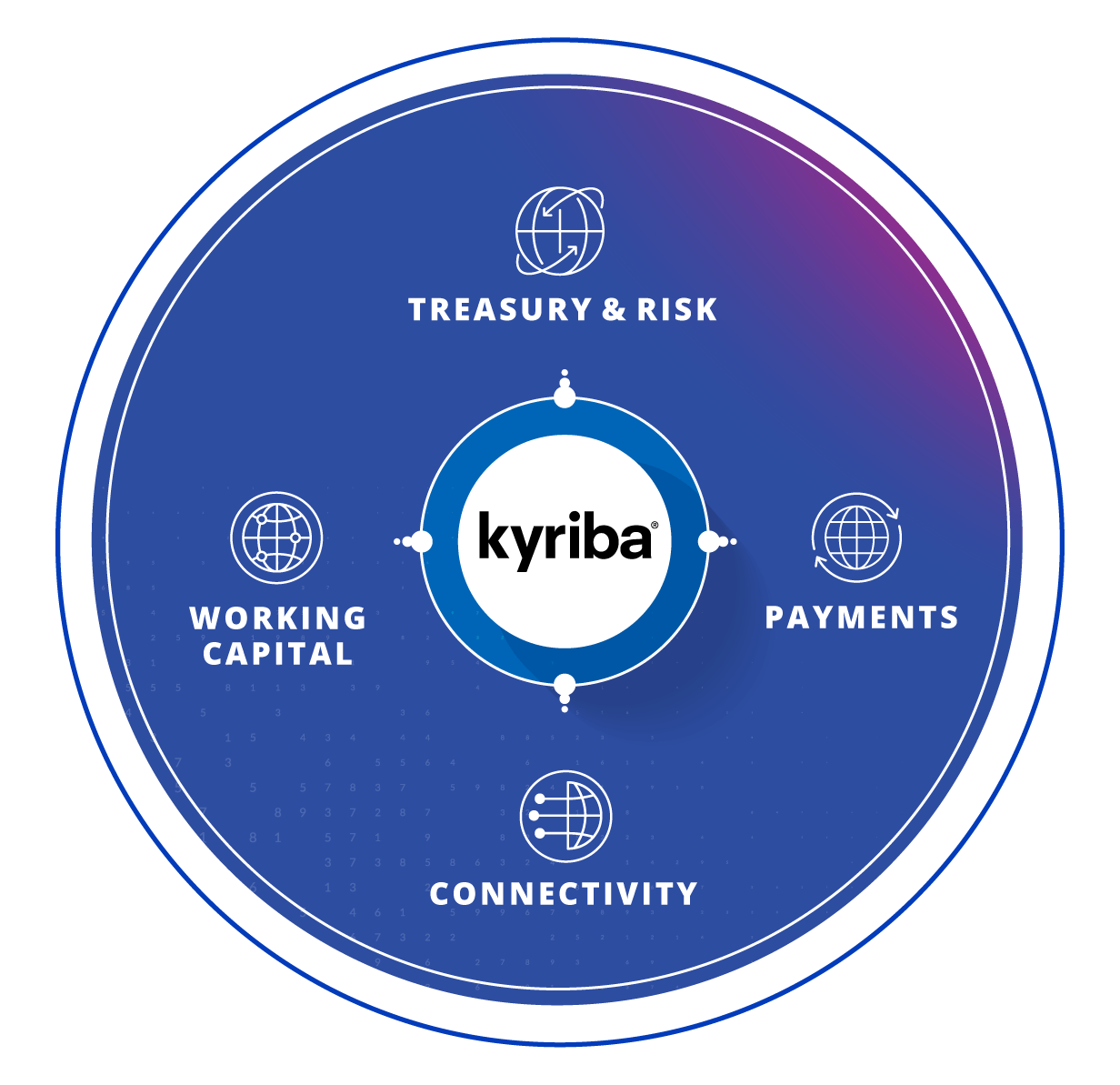

Kyriba’s Enterprise Liquidity Management Platform offers Connectivity, Payments, Treasury, Risk and Working Capital solutions delivering visibility, controls, productivity and data-driven decision making for CFOs and their teams. Delivered through our open API developer platform and Marketplace, finance gains access to new products and services coupled with enterprise-wide integrations with banks, ERPs, third party systems, and internal data sets.

With Kyriba, CFOs can see, protect, grow, and move liquidity with unprecedented velocity, precision, and efficiency.

Products

- Treasury and Risk Management

- Connectivity

- Payments

- Working Capital

Solutions Coverage

- Enterprise Organizations

- Mid-Sized Companies

- Industry Verticals

- Domestic and Global Organizations

Open Cloud

- Developer Portal

- API-Driven

- Analytics and Data Visualization

- SOC2/ISO27001 Certified

Kyriba combines these leading products to deliver a proven, holistic Enterprise Liquidity Management platform with open end-to-end connectivity across your systems and banking partners.

Table of Contents

Treasury & Risk Management

Kyriba provides CFOs and treasurers with the visibility and reporting they need to optimize cash returns, control bank accounts, drive reporting and compliance, and manage liquidity.

Treasury Management System

Cash Management

Complete cash visibility with flexible cash position dashboards and full reconciliation capabilities makes it easy to view prior-day and intraday postings.

Cash Forecasting

Kyriba offers extensive options for modeling and measuring the effectiveness of forecasts, so clients can extend the accuracy and horizon of their cash forecasting.

Cash Pooling and In-house Banking

Clients can manage notional and physical cash pools to offer real-time intercompany positions, interest calculations and automated reporting.

Multilateral Netting

Multilateral netting calculates net payables and receivables positions by participant, optimizing exposure management and in-house bank integration.

Bank Relationship Management

Bank account management (BAM), signatory tracking, FBAR reporting and bank fee analysis provide improved control of bank accounts and more transparency into bank fees.

Financial Transactions

Fully track treasury financial transactions for your investments, debt, and risk instruments with complete integration to the payments, accounting and cash forecasting modules.

Accounting and Compliance

Journal entries can be generated for all cash and liquidity models. With automated ERP integration with the general ledger, Kyriba delivers bank-to-book reconciliation for monthly matching of bank actuals with uploaded accounting balances.

Risk Management

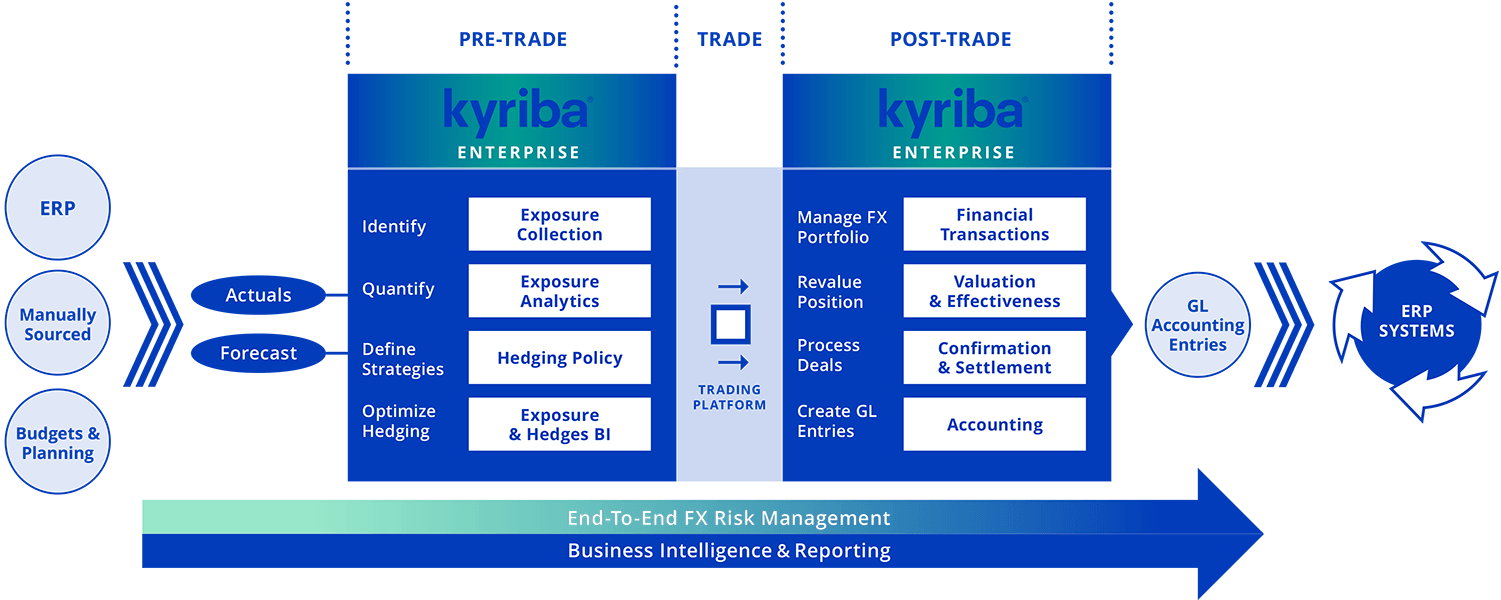

FX Exposure Management

In-depth analytics drive visibility into currency exposures and enable better assessment, mitigation and reporting of currency impacts on earnings and financial statements.

Mark-to-Market Valuations

Kyriba supports full valuation capabilities, including credit risk and CVA/DVA support, leveraging Kyriba’s integrated market data.

Derivative and Hedge Accounting

Derivative and hedge accounting capabilities for FX and interest rate hedging programs offer full support for FASB, IFRS and local GAAP requirements.

Lease Accounting

Intuitive workflows support IFRS16 lease accounting standards, including lease management, calculations and general ledger integration.

Non-Financial Risk Management

Kyriba delivers enterprise wide payment fraud detection and advanced security services which provide strategic business value and risk mitigation and include regulatory compliance and automated scrutiny of bank account management.

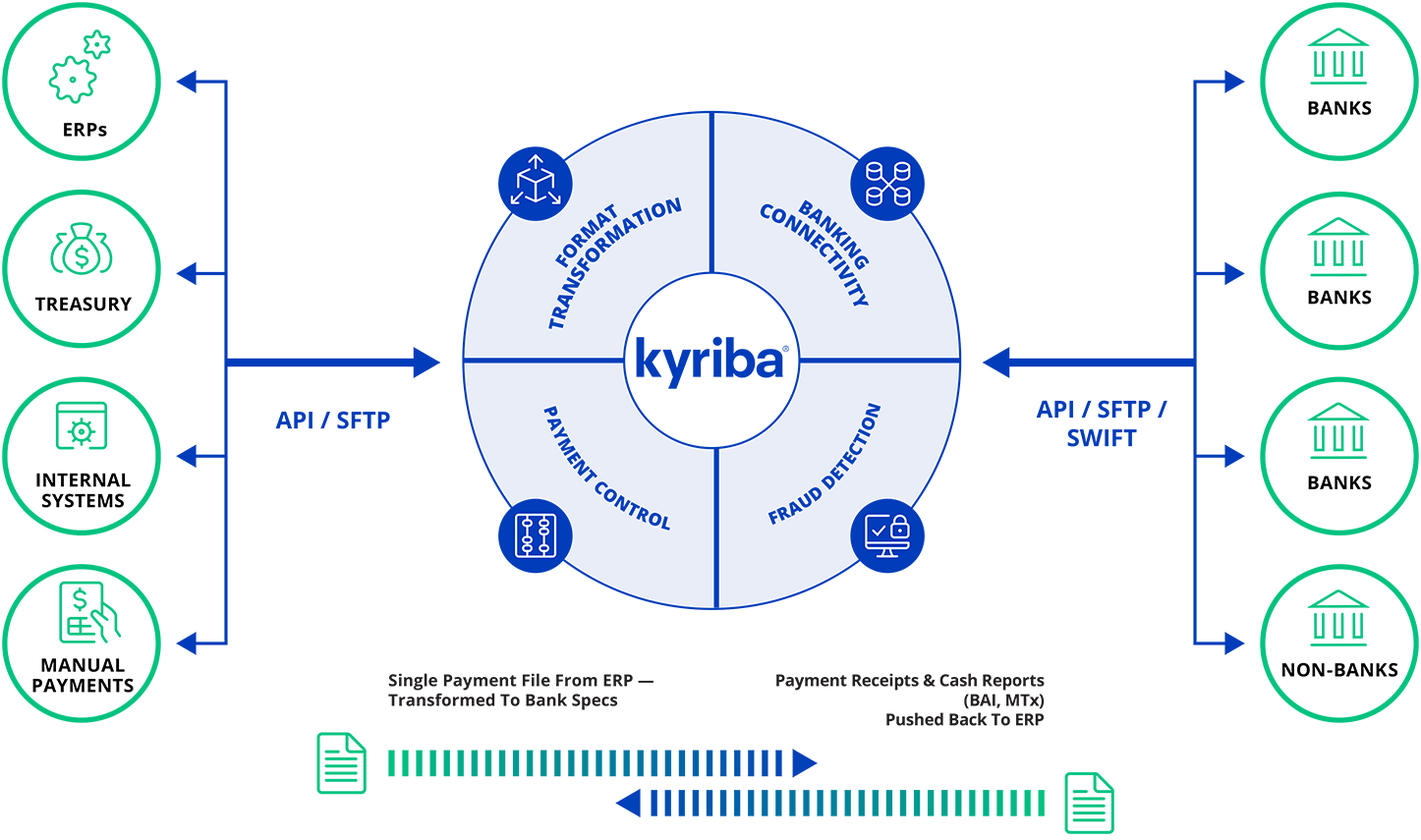

Connectivity

Kyriba’s in-house developed, leading Enterprise Connectivity-as-a-Service gives our customers a complete connectivity solution for ERPs, internal financial systems and a large global selection of over 600+ ‘out of the box’ pre-configured, pre-tested connections with financial institutions across the globe. Kyriba’s solution includes application processing interfaces (APIs) delivering real-time integration, payments and reporting. Kyriba delivers the largest global banking network, multi-ERP connectivity, omni-channel payments experience, and real-time connections using robotic process automation, artificial intelligence, and distributed ledger technology.

Kyriba delivers the largest global banking network, multi-ERP connectivity, omnichannel payments experience, and real-time connections using machine learning, artificial intelligence, and advanced solutions with leading practices built in.

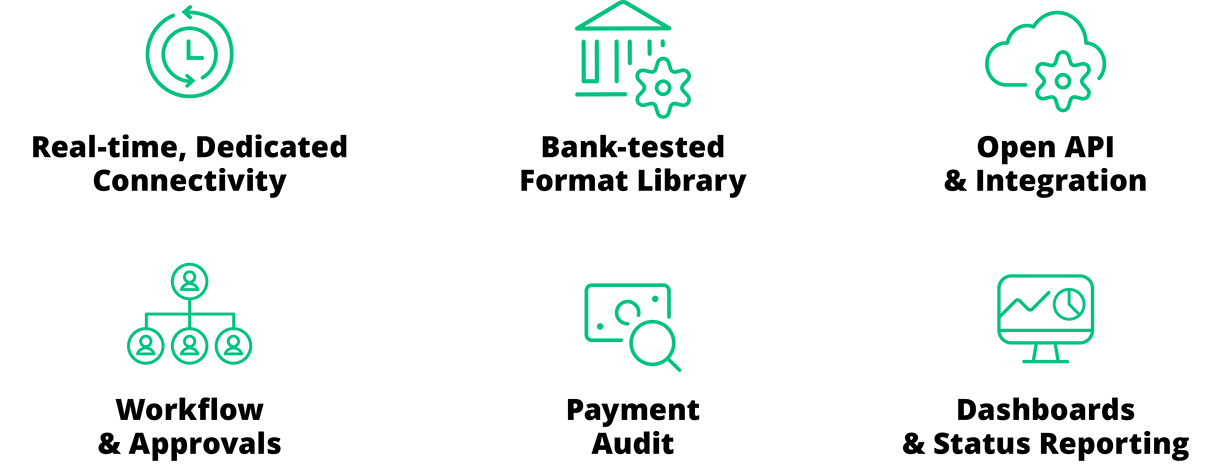

Key Features and Benefits

- Out-of-the-box connectivity to multiple ERPs (GL, reporting, market data feeds, working capital solutions like supply chain financing)

- Pre-defined Formats for Payments, Payment Status Reports and bank reports; access to new payment rails (distributed ledger, real-time payments)

- Liquidity Data Hub – single store of all daily cash transactions performed on any client bank account

- Central point of static and security access data (Supports SSO capabilities) Regional and Country Protocols

- Future-proofs customers against future connectivity and format changes

- 24/7 monitoring of connectivity performance

Value Drivers for Companies

- Faster payments, reporting and finance implementations for ERPs, Treasury, Finance projects

- Easier onboarding of new business units (i.e., M&A activity support)

- Consolidate ERP to partner bank payment and reporting transmissions

- Cost savings and efficiency gains

- Greater visibility to costs, payments fraud risk and mitigation effectiveness

- Increased internal policy compliance

- 99.9% up-time, disaster recovery embedded in our solution

Kyriba has customers that connect directly to over 1,000 banks globally.

Host-to-Host Direct Connections

Kyriba offers ‘direct-to-bank’ host-to-host connections via Secure FTP to hundreds of banks and is working with some of the largest global banks to establish direct API-based connectivity. This will require no intermediary services or networks, to minimize transaction costs and bank fees.

Host-to-host connections are often used for high volume bank relationships in combination with other connectivity methods to minimize connectivity charges and increase speed and security.

Open API Connectivity and Integration

More than just bank connectivity, our Open API platform gives your organization access to new products and services – in real-time.

One API connects customers to our 1,000 predeveloped bank connectors and 50,000 payment format scenarios.

Our solution is ready now and does not require custom development, coding or special project implementation.

Regional and Country Protocols

Many countries often require the use of regional networks that support connections to local banking partners. Kyriba connects to many of these special, regional or country-specific networks:

- Zengin and Anser in Japan

- EBICS in France and Germany

- BACS and Faster Payments (including the Direct Corporate Access option) in the UK

- CBI in Italy

- EDITRAN in Spain

SWIFT Connectivity

SWIFT is the gold standard when it comes to connecting to a large number of banks worldwide.

SWIFT Service Bureau

Kyriba’s SWIFT Service Bureau offers clients their own SWIFT BIC, fully managed by Kyriba, which includes SWIFT membership and enables unlimited volumes of payments and statements. Leveraging MQ messaging for higher transmission speeds, it is specialized for higher connectivity volumes and those wanting a completely managed SWIFTNet service, including complete monitoring of end-to-end bank connectivity.

Global SaaS Operations and Security

- SaaS Mode of Operations on a secured 24/7

- UI available in 14 languages

- Business Continuity services (with 99.9% uptime SLAs)

- Disaster Recovery Point and Time Objectives (RPO / RTO)

- Seamless Upgrades

- Best in Class Security process

Payments

Kyriba offers a global, real-time payments solution through pre-connected, multi-bank payments hub solutions along with instant fraud detection for enterprise payments processes including treasury or ad hoc payments.

With complete security and separation of duties, Kyriba offers standardized payments controls alongside real-time payments fraud detection and sanction list payment screening.

Treasury Payments

Automated payments allow teams to initiate, approve and transmit treasury payments in compliance with their organization’s payment policy. With Kyriba, treasury can standardize payments control to increase resilience against fraud and cybercrime.

Payments Hub

Kyriba offers a complete payments hub for initiation, management and delivery of supplier and corporate payments to bank and non-bank payment channels. Kyriba’s 45,000+ payments format scenarios offer the most complete ERP-to-bank connectivity, eliminating the need to manage bank protocols and format transformation in house.

Payments Connectivity

Kyriba supports multiple connectivity channels, including SWIFTNet, Open APIs, host-to-host and country networks, so clients can maximize automation, ensure payments security and minimize total costs. Kyriba offers the most connectivity options globally.

Payments Fraud Detection

Kyriba’s fraud detection module offers scenariobased, real-time detection and prevention of suspicious payments activity, to ensure that digitized payments policies and procedures are enforced at all times.

Working Capital

Kyriba delivers a best in class technology solution, giving CFOs tools and programs to boost free cash flow and improve financial results with early payment financing solutions that support payables term extension or improved return on cash.

Working Capital – Beyond Technology

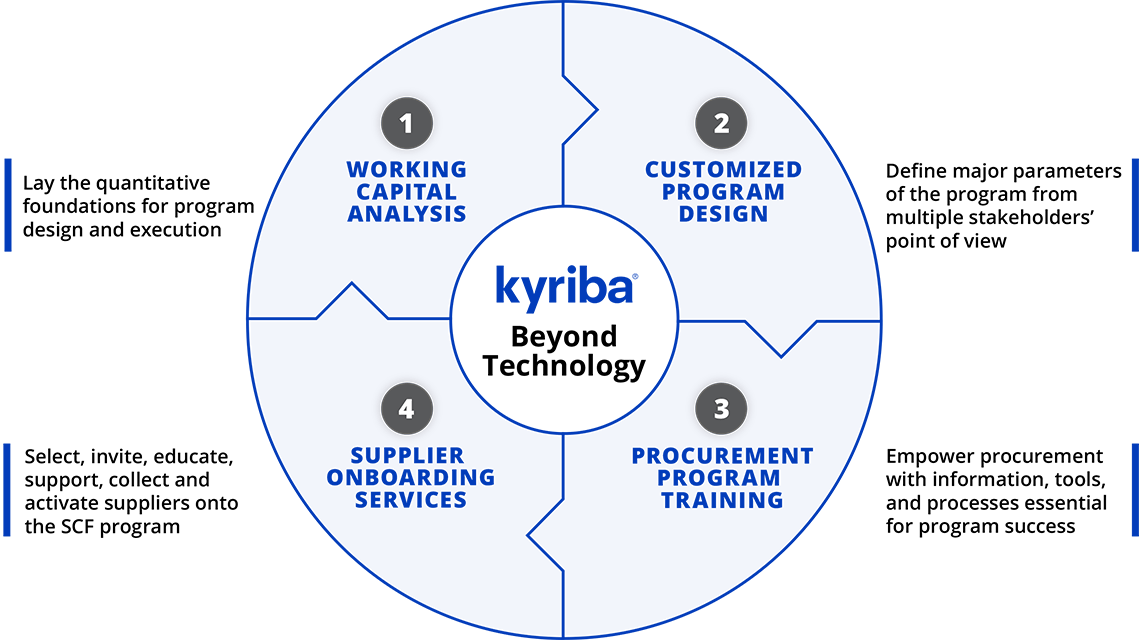

Kyriba goes beyond technology in providing a full service market-leading working capital offering. Whether this is through our in-depth working capital analysis that lays quantitative groundwork for the working capital solution or the customized program design whereby we will define program KPIs and work to achieve a program that meets all stakeholders needs including funding strategies.

Supporting the Procurement Function

Kyriba’s Working Capital team supports your procurement function, empowering your teams with the required tools to achieve success and lastly to use our award winning supplier on-boarding solution alongside our international, multi-lingual supplier onboarding team to ensure we deliver on your program strategy.

Kyriba delivers an all-in-one Working Capital and Payments solution through our Enterprise Liquidity Network. Now actionability for purchase orders and invoices can be delivered in a single global platform.

As a bank-independent solution Kyriba gives you the option to leverage leading practice technology and services to access SCF liquidity in the most efficient and flexible ways to meet your program objectives:

Control and ownership – As the owner of your program, our funding model puts our partners in control.

Bank Relationship – You can select and reward multiple key relationship banks.

Risk – Eliminate single bank risk and diversify funding sources.

Pricing – The competitive nature of our open solution, drives bank competition and best pricing at all times.

Kyriba is not a funder – We are not beholden to any specific credit risk process or supplier onboarding policy.

Supply Chain Finance

Supply chain finance provides suppliers with a complete reverse factoring solution to extend DPO (days payable outstanding) with full integration between the buyer, the supplier and the financing partner.

Kyriba’s supply chain finance platform is ideal for organizations looking for term extensions on their payables to improve cash flow performance.

Dynamic Discounting

Dynamic discounting programs are best suited for organizations that have excess cash and liquidity, and are looking for an alternative to low-yield, short-term investments to earn risk-free returns on cash. With Kyriba, buyers can structure early payment programs in return for dynamically calculated discounts.

Receivables Finance

Kyriba’s Receivables Finance solution accelerates payment on your receivables to get cash into the business quickly, where needed, giving CFOs a new tool to optimize working capital and strengthen the balance sheet. Seamless integration across your entire platform means easier liquidity management and working capital stability.