Research

Kyriba’s July 2022 Currency Impact Report

A Quarterly Report Assessing the Impact of Foreign Exchange to North American and European Corporate Earnings

About the Report

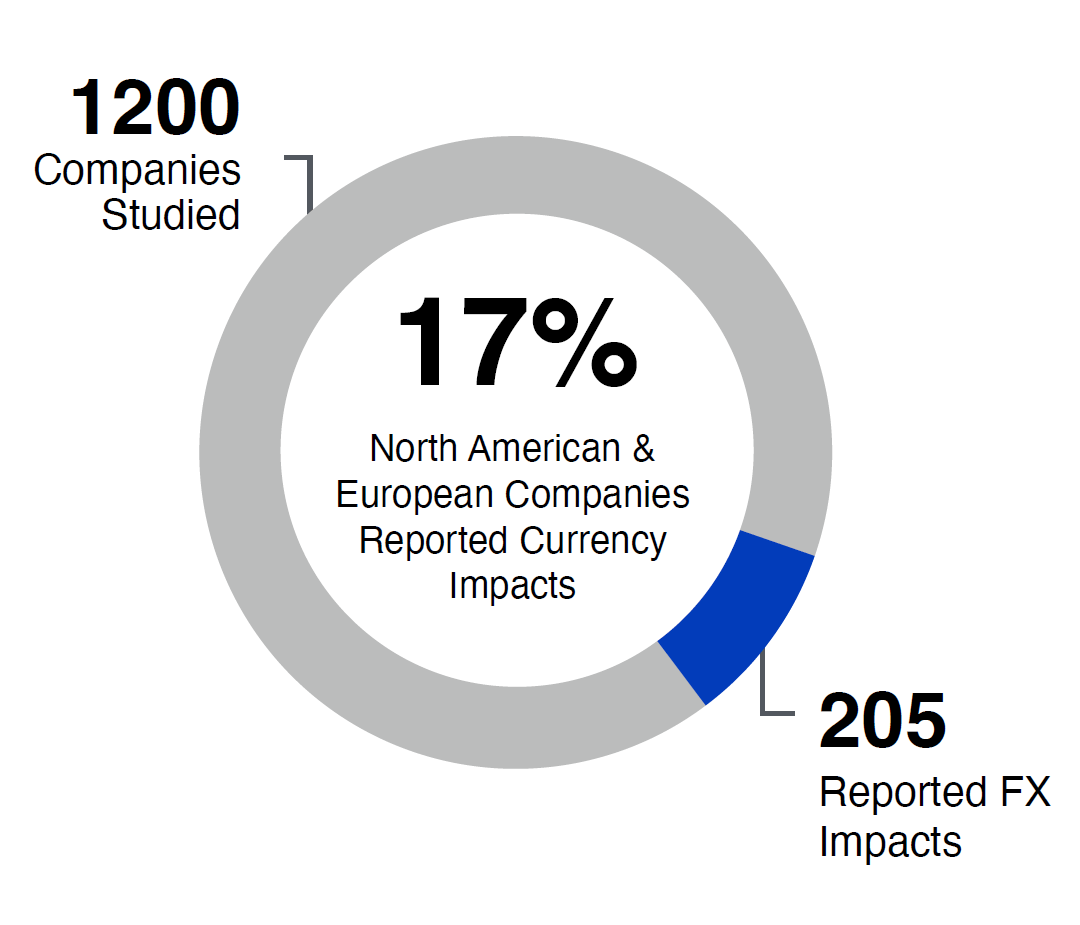

The July 2022 Kyriba Currency Impact Report analyzes the reported effects of currencies to North American and European companies’ earnings during the first quarter of 2022. To obtain this information, Kyriba analyzed the earnings calls of 1,200 publicly traded North American and European companies as part of a continued effort to provide insight into how foreign exchange impacts organizations. The companies included in this data set are large multinational firms doing business in more than one currency with at least 15% of their revenue coming from overseas. Table of Contents

Currency Impact Report – Overview

Kyriba Currency Impact Report: Key Findings

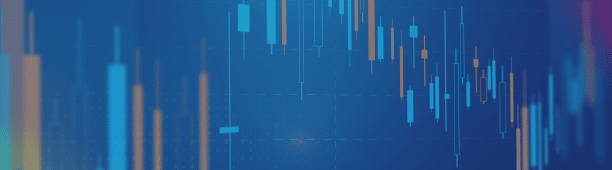

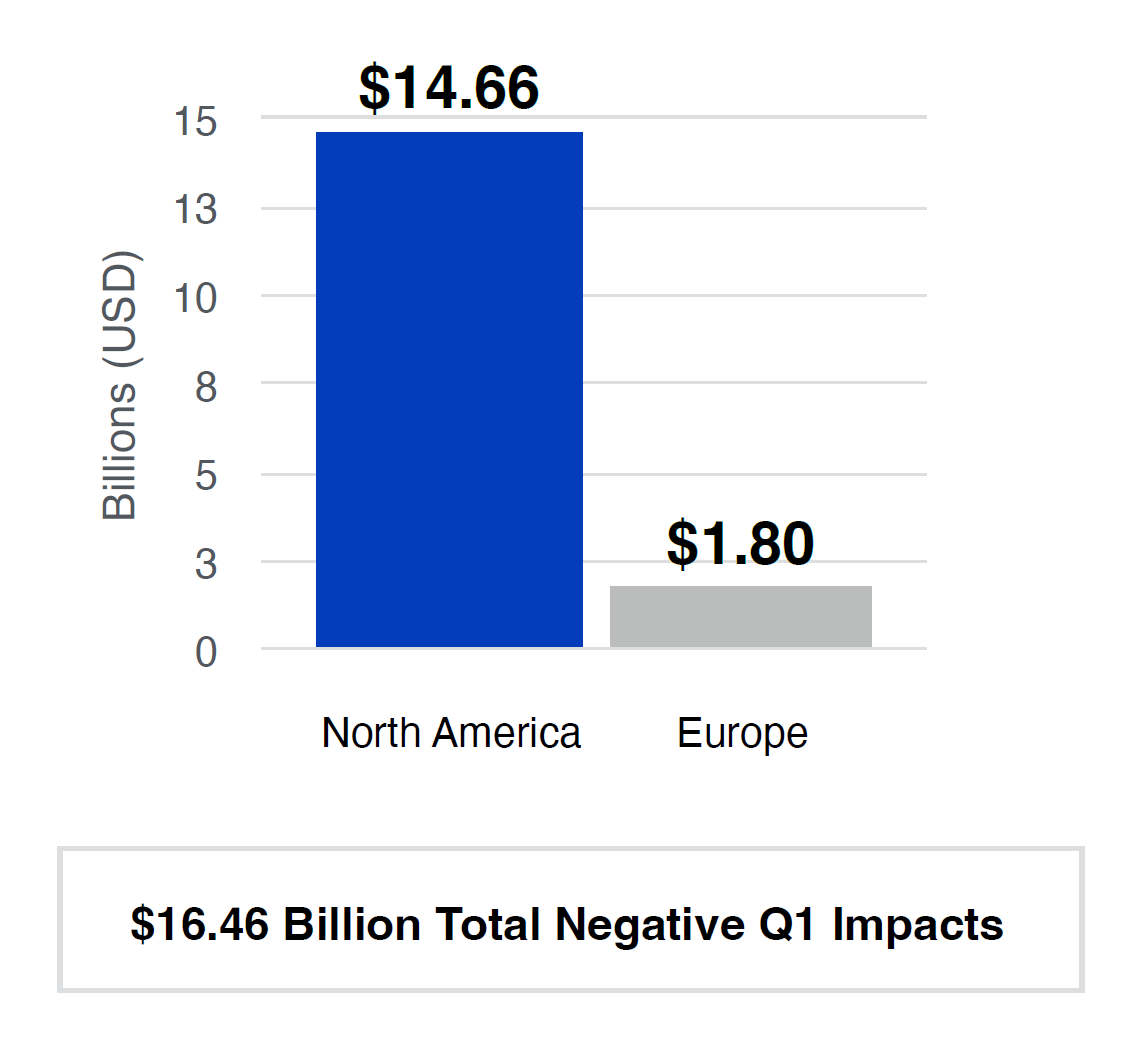

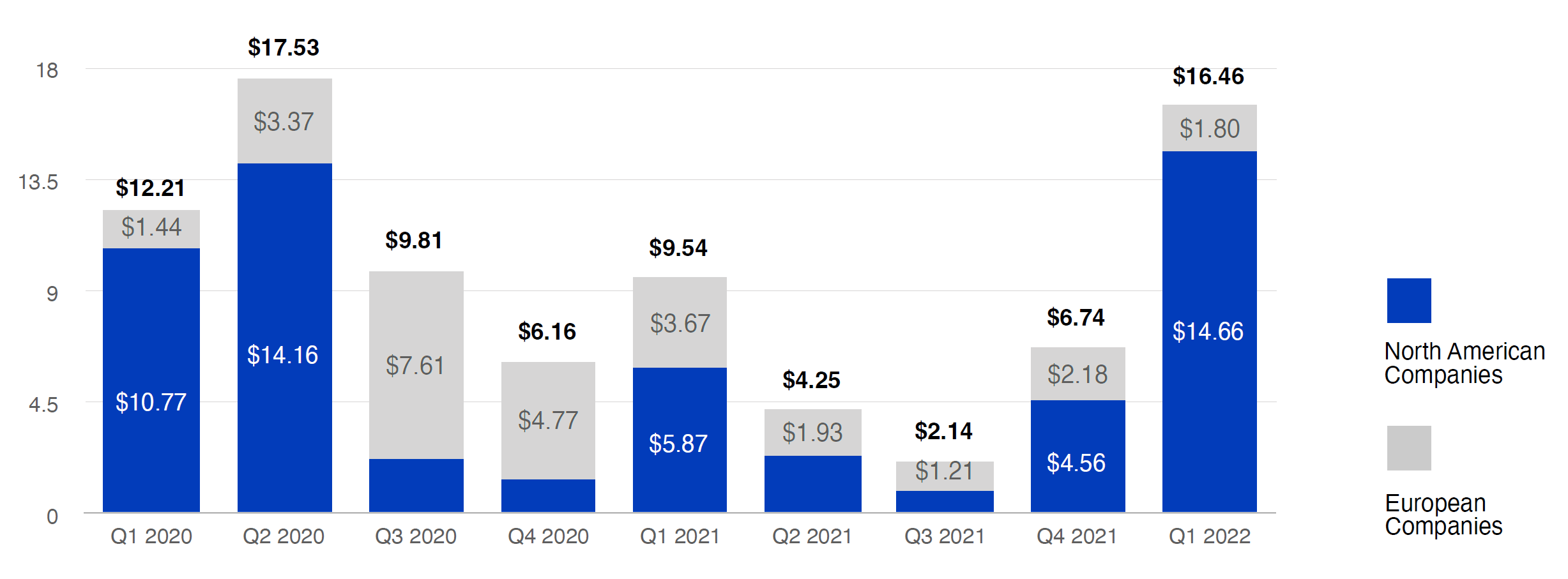

- The collective quantified negative impact reported by both North American and European companies totaled $16.46 billion in Q1 2022, a 144% increase from Q4 2021.

- 20% of corporates studied (236/1200) quantified +/- impacts totaling $24.03 billion ($16.46 billion headwinds), ($7.57 billion tailwinds).

- The Russian ruble was the currency most mentioned as impactful by North American companies as well as by European companies.

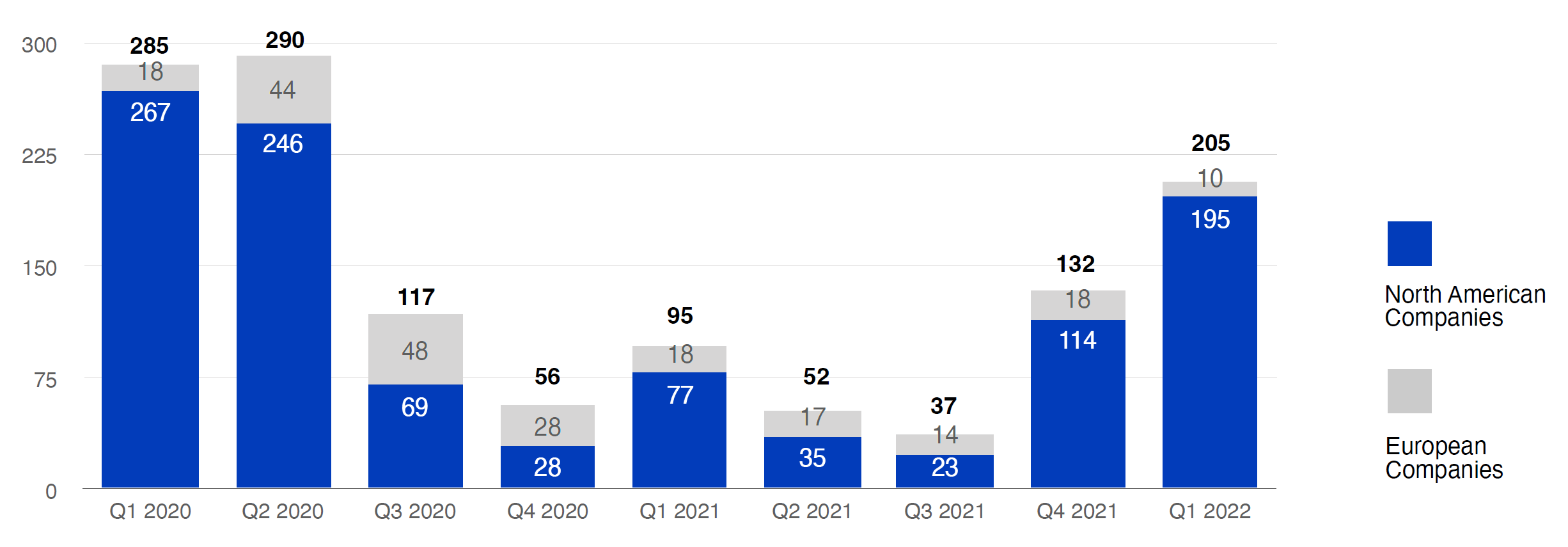

- 205 North American and European companies reported currency headwinds in Q1 2022. Of those companies, 194 companies quantified their FX impacts.

Total Quantified Currency Impacts by North American and European Companies (Billions)

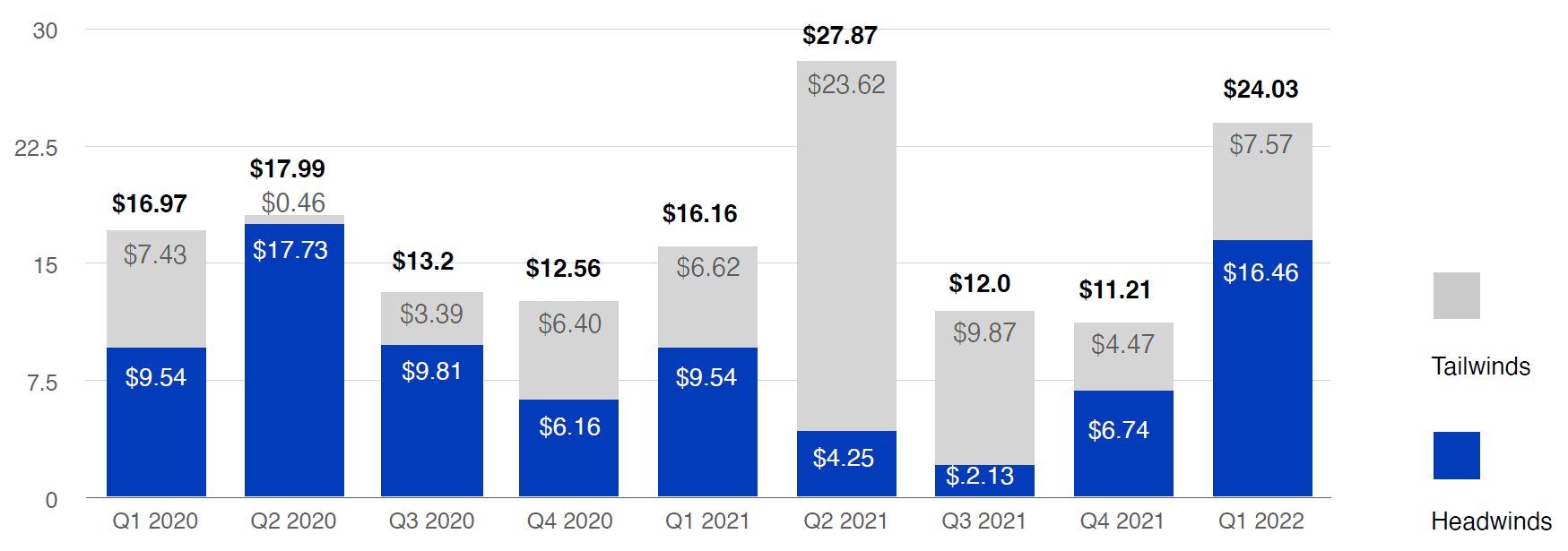

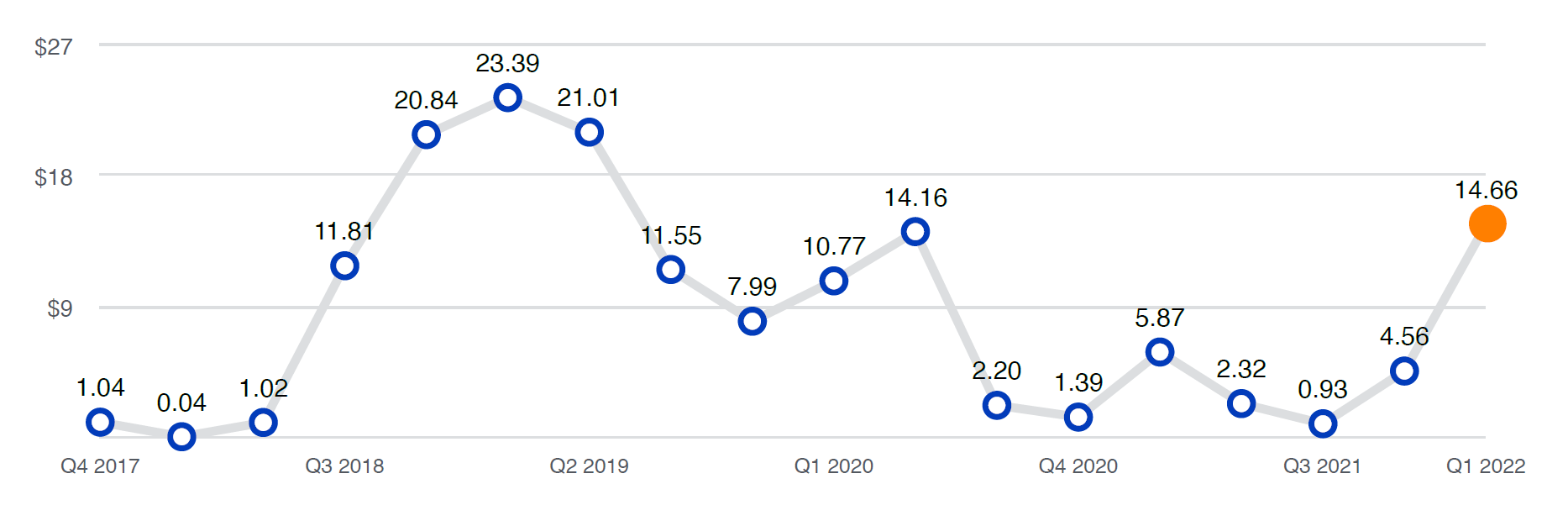

North American Companies’ Quantified Currency Impact (Billions)

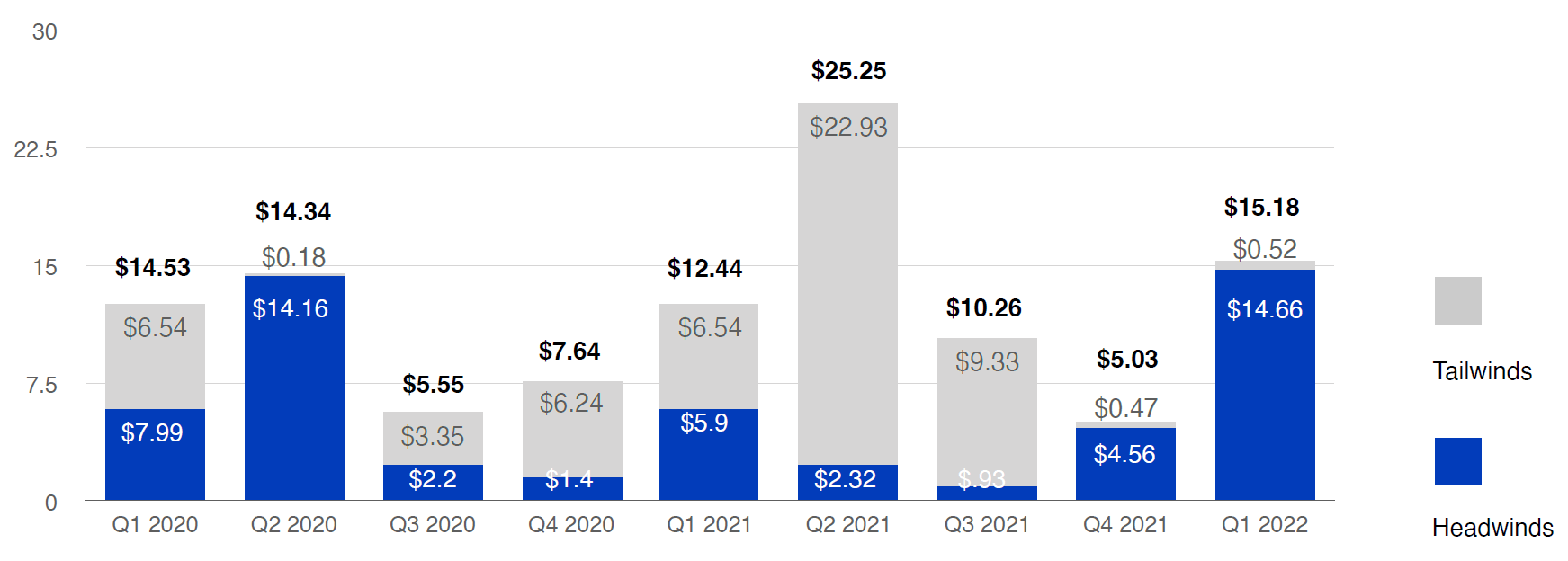

European Companies’ Quantified Currency Impact (Billions)

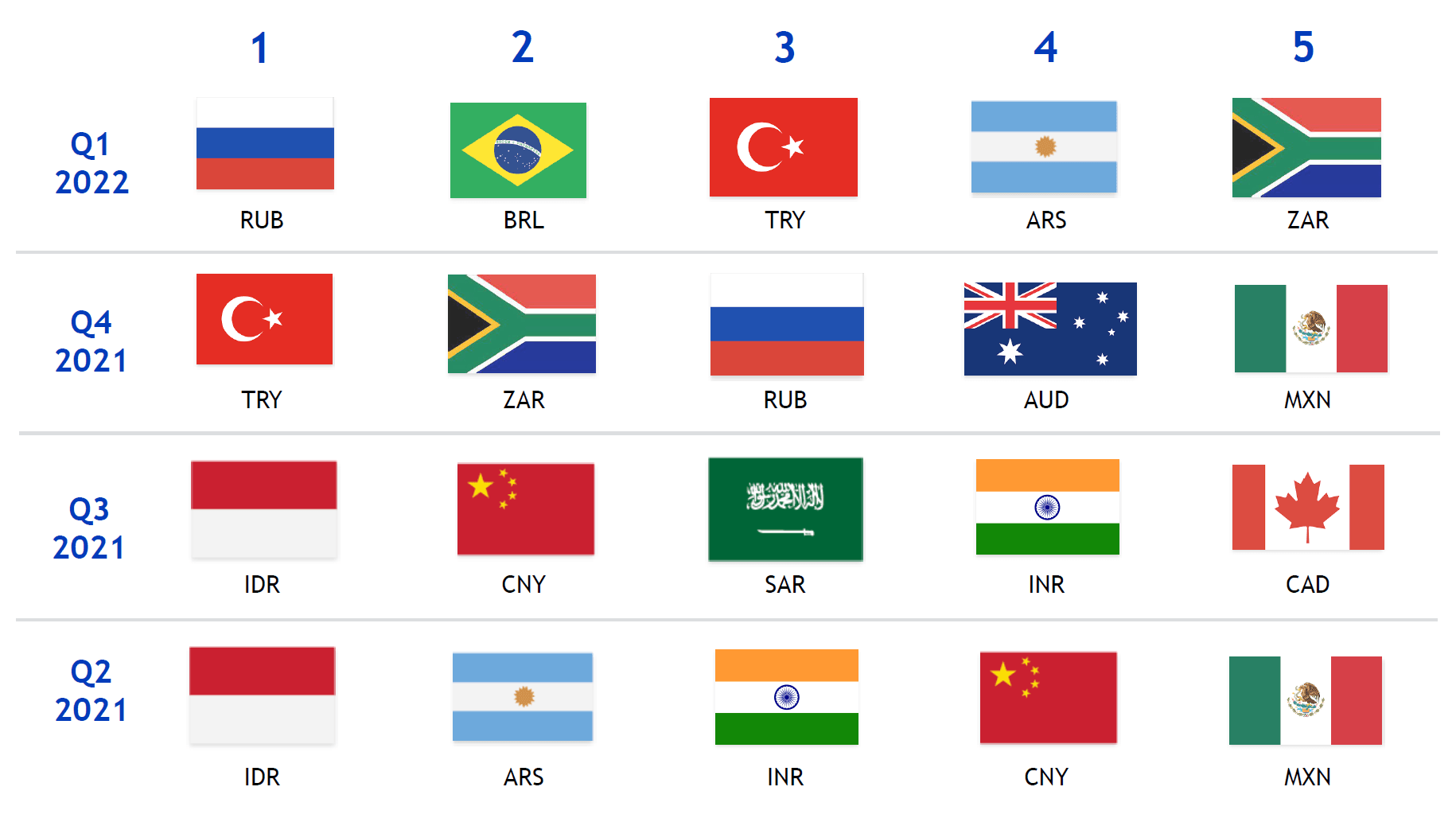

Top 5 Volatile G20 Currencies

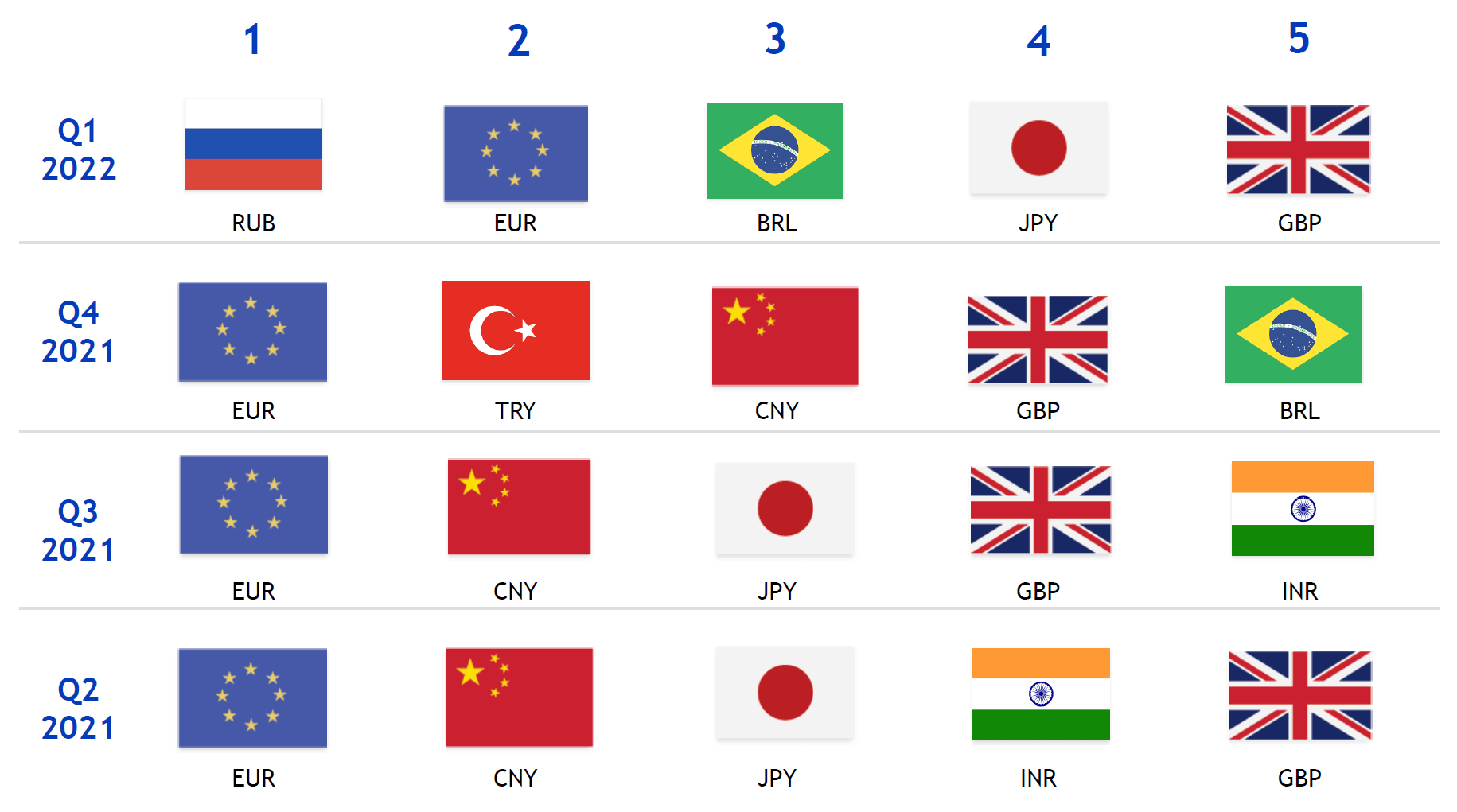

Top 5 Volatile Currencies as Weighted by GDP Percentage

Currency Impact on North American Corporate Earnings

Negative Currency Impact to North American Companies (Billions)

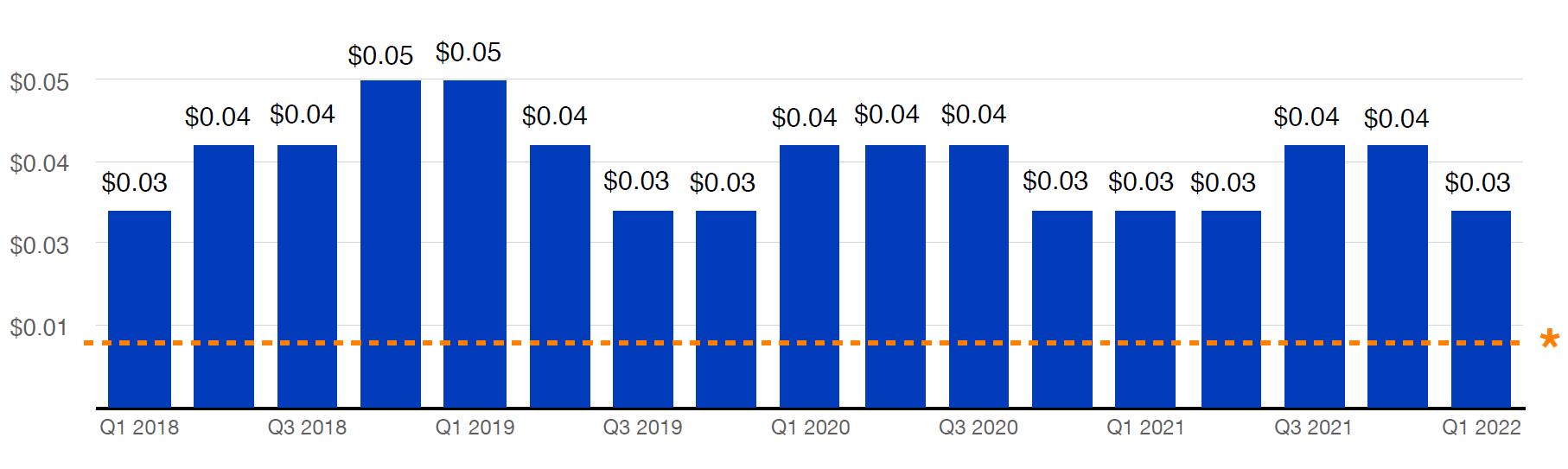

Average EPS Impact Reported by North American Companies

*Industry Standard MBO of Less than $0.01 EPS Impact

Currency Impact on North American Corporate Earnings

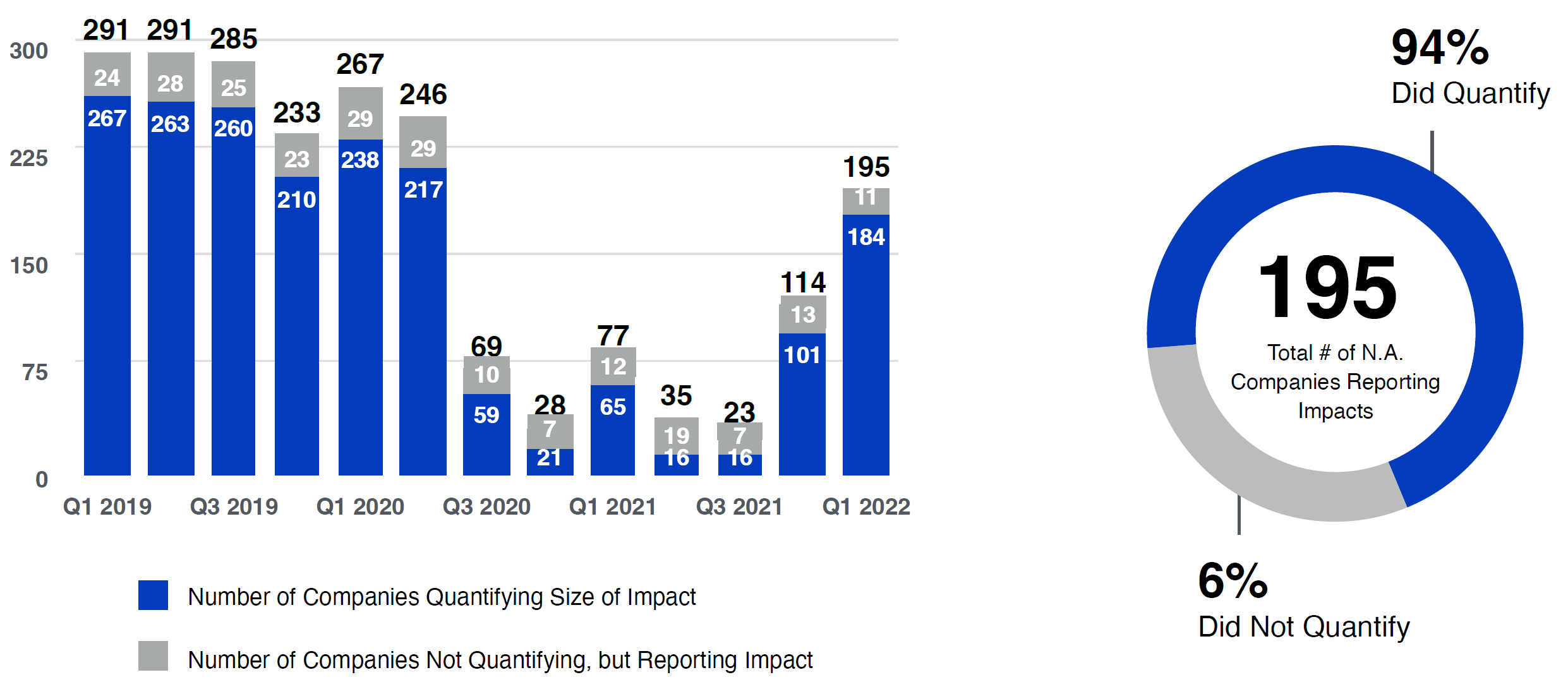

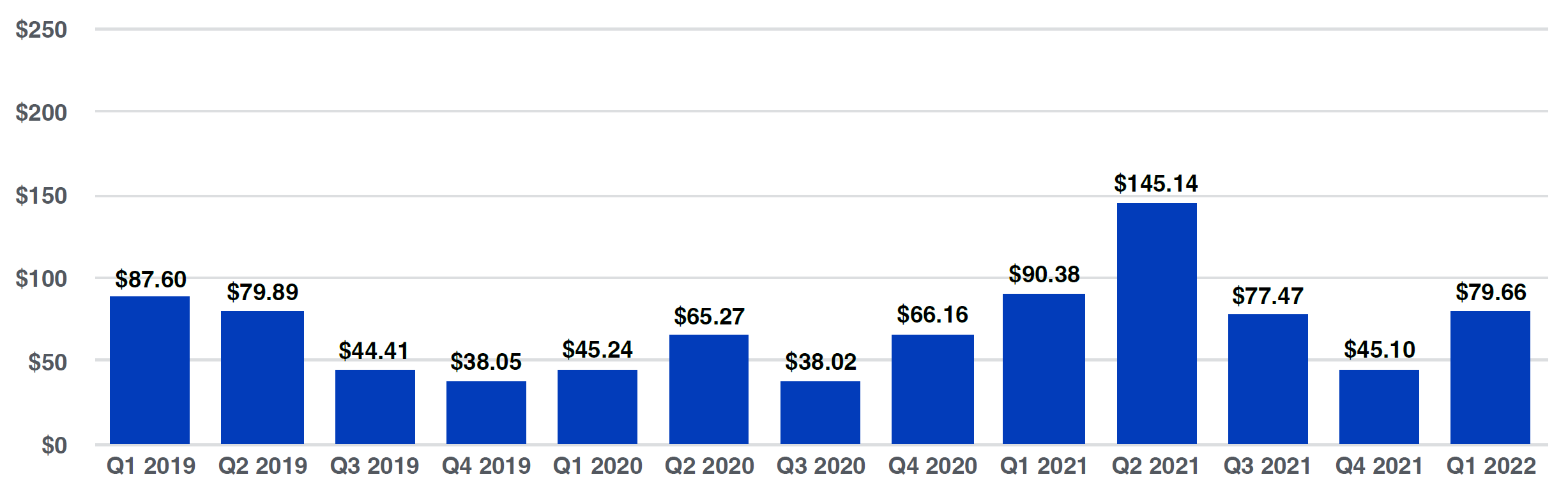

North American companies reported a $14.66 billion impact in Q1 2022, over 3 times larger than the impact in Q4 2021.1

The average earnings per share (EPS) impact reported by North American companies in Q1 2022 was $0.03, three times greater than the industry standard MBO of less than $0.01 EPS impact and a maintenance of the level set by the previous quarter.

1Impacts are likely underestimates as most companies with currency headwinds generally do not report them.

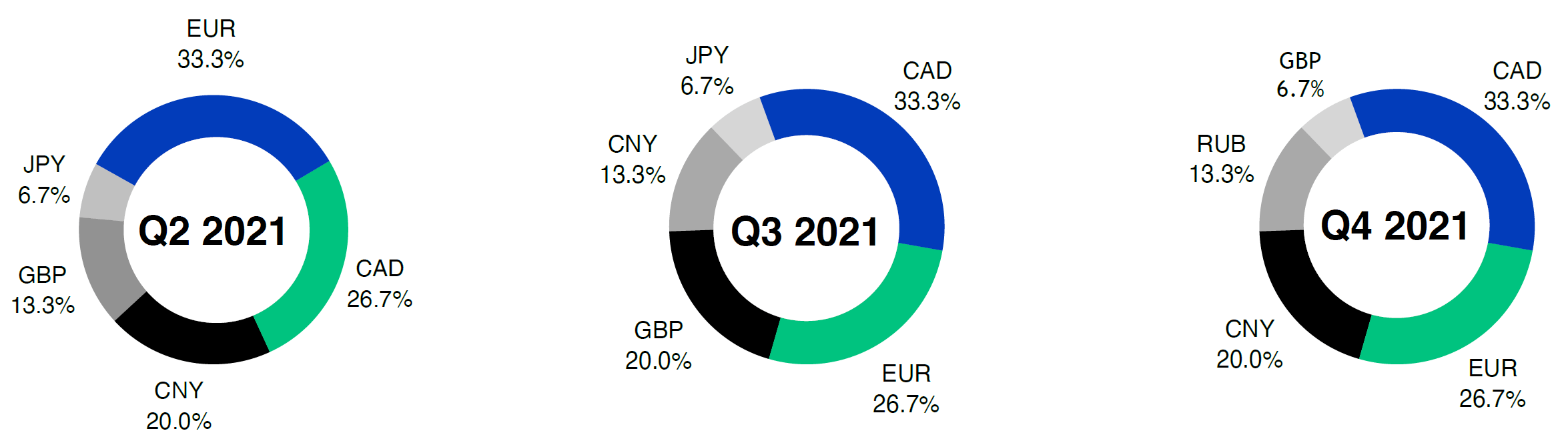

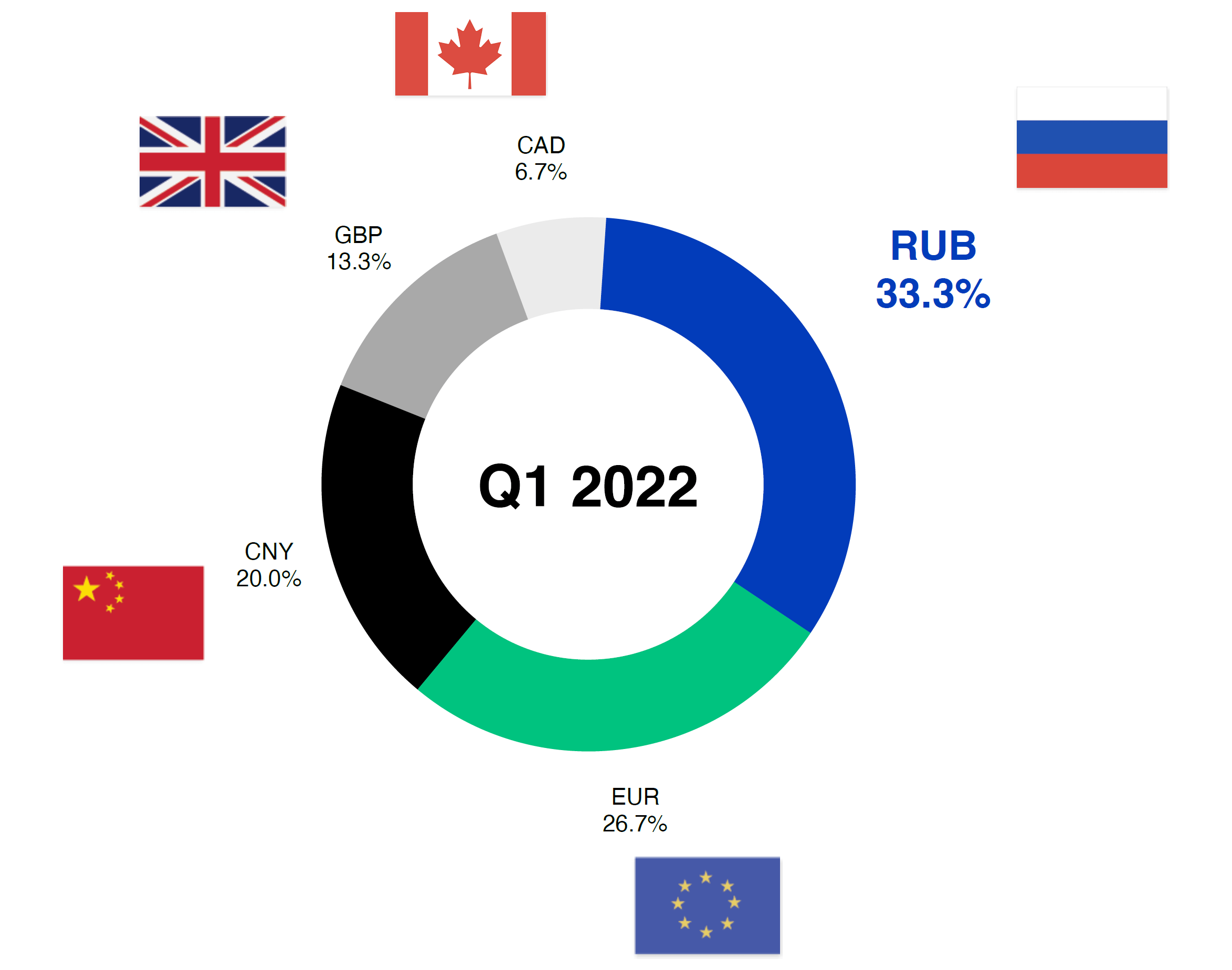

Top Currencies Referenced by North American Companies as Impactful

The ruble was the most mentioned currency, an increase from the prior quarter where the ruble was the fourth most mentioned currency in North America. The euro was the second most-mentioned, followed by the renminbi, the pound, and the Canadian dollar. The ruble was the most volatile currency as well as the most volatile weighted by GDP; the euro was the second most volatile weighted by GDP (page 6).

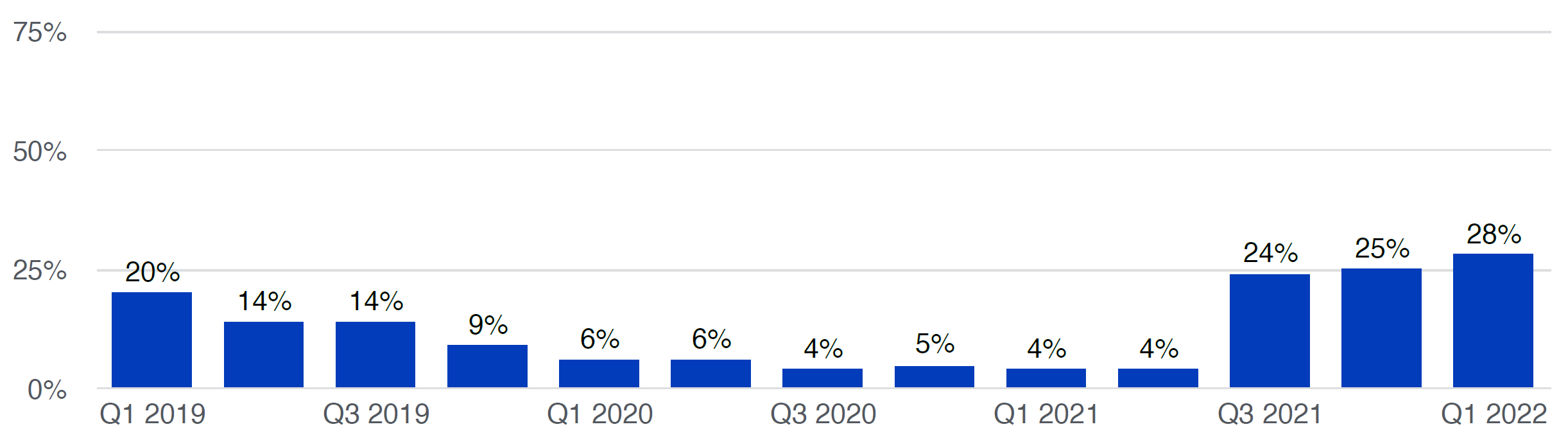

Number of North American Companies Reporting Negative Currency Impacts

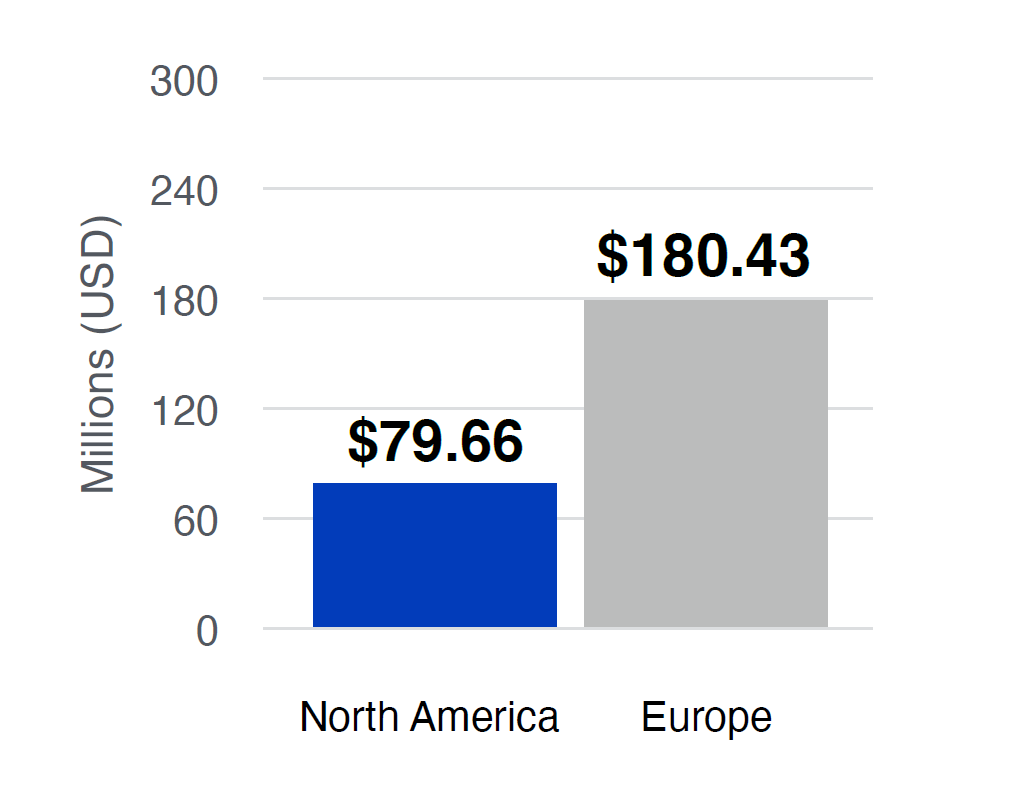

Average Negative Impact to North American Companies (Millions)

Percentage of North American Companies That Fielded Analyst Questions

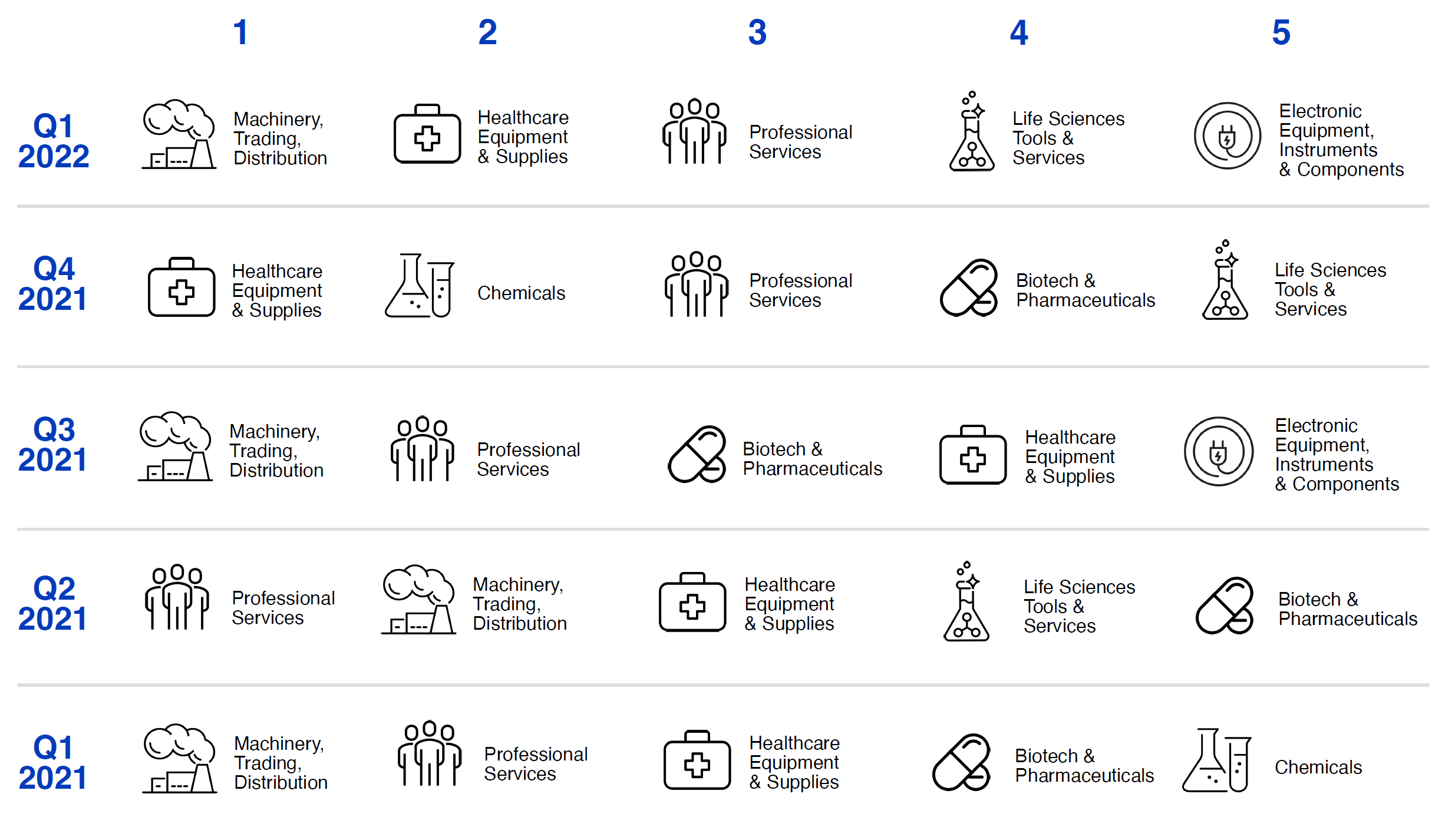

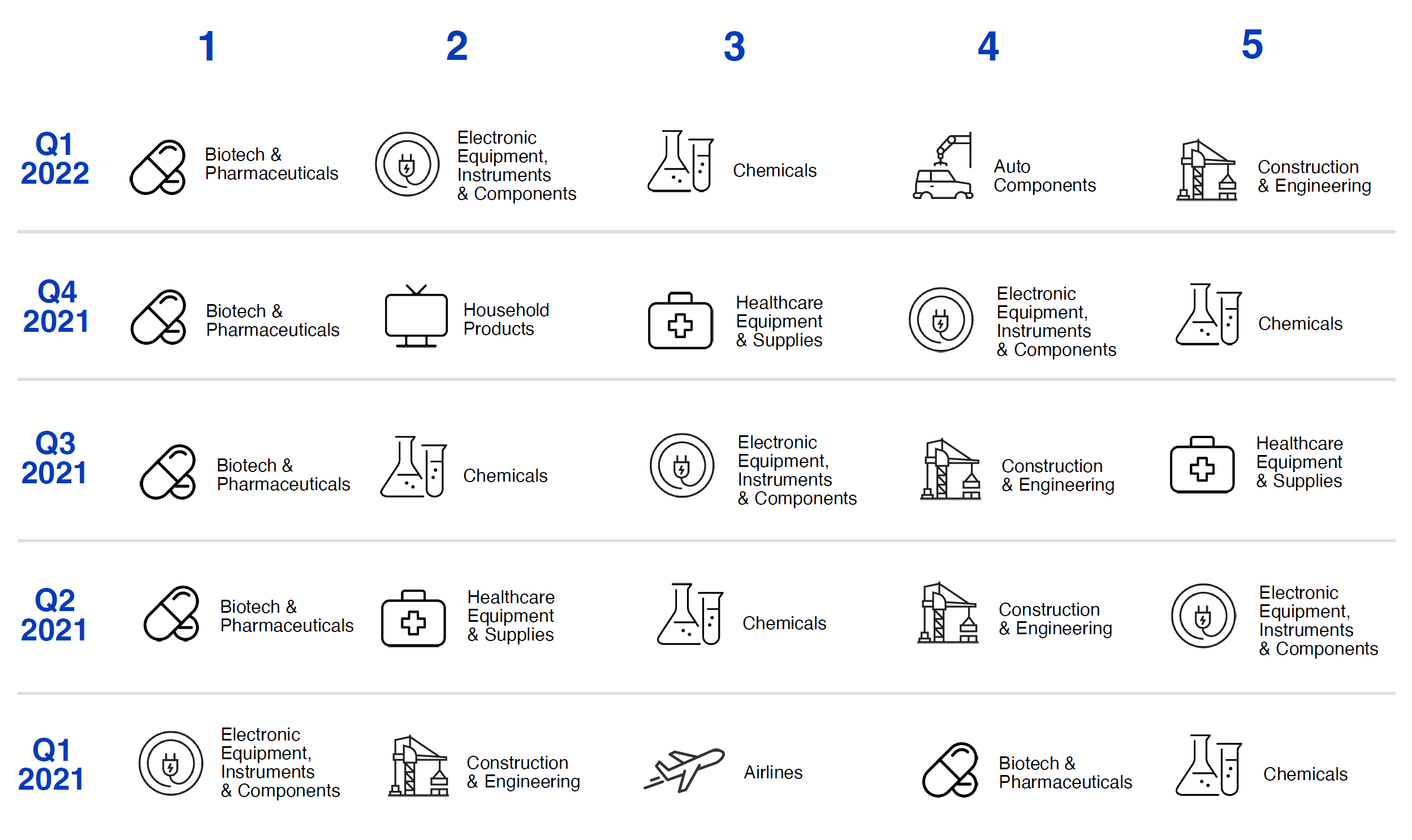

Most Impacted North American Industries

Currency Impact on European Corporate Earnings

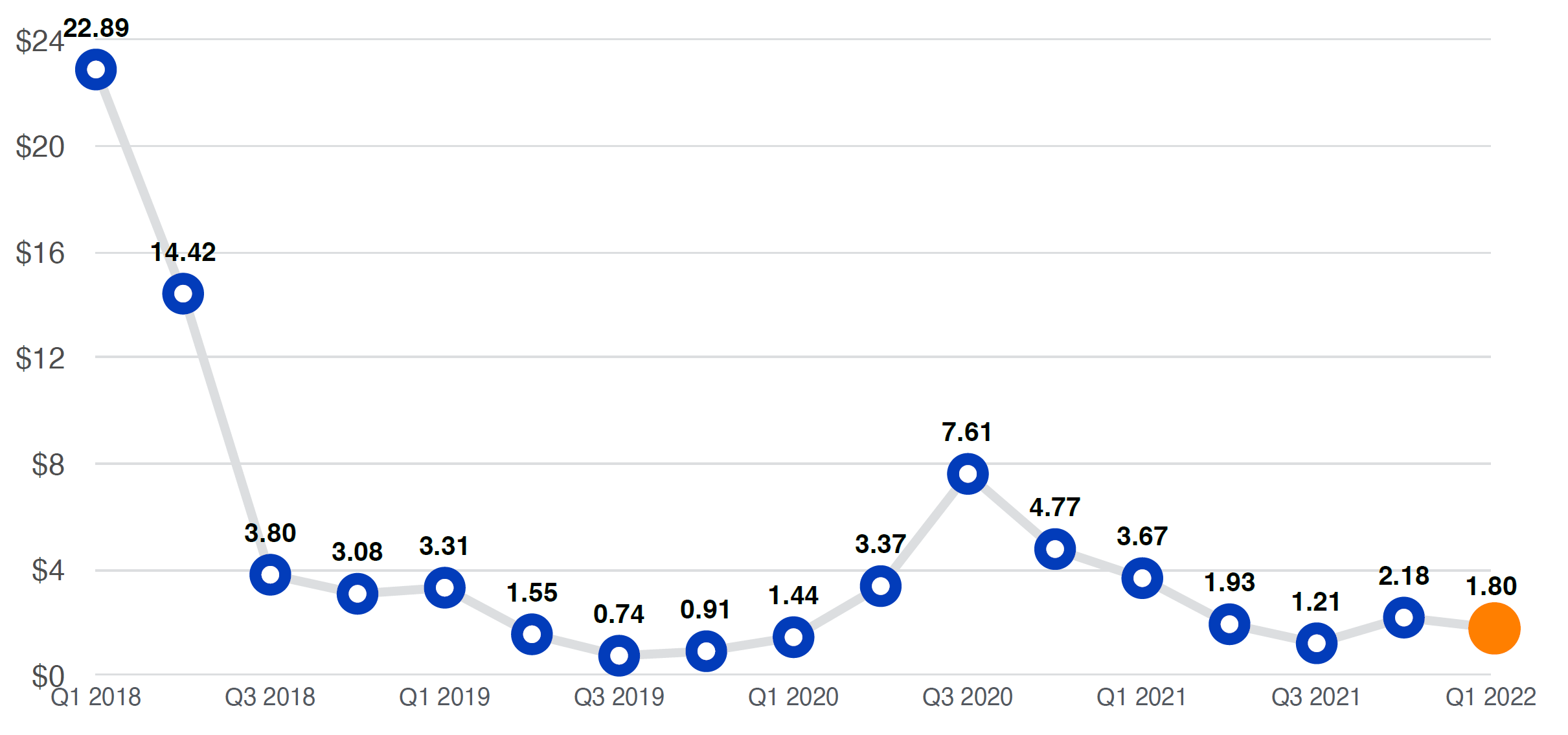

Negative Currency Impact to European Companies (Billions)

Currency Impact on European Corporate Earnings

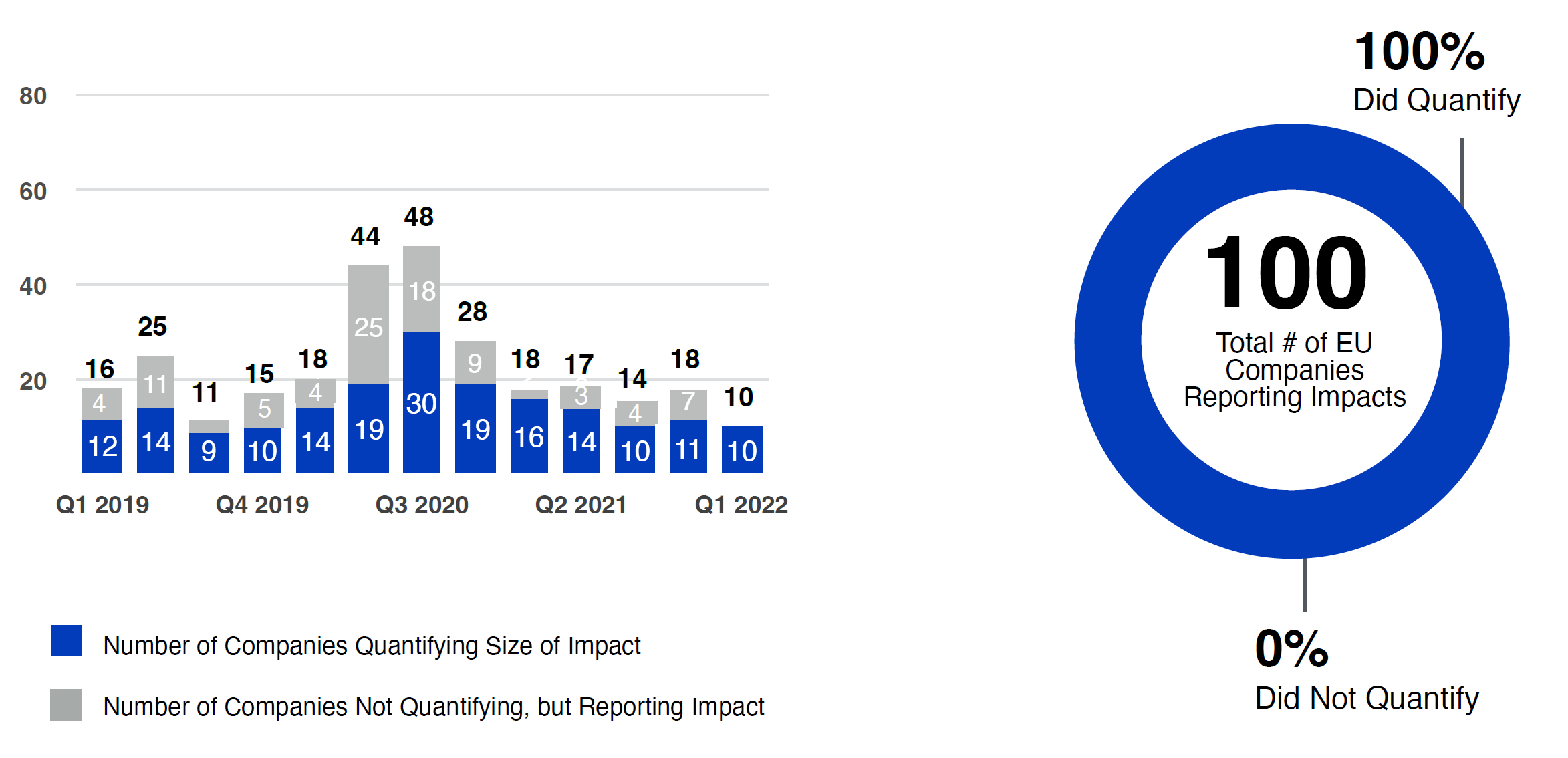

Decreasing from last quarter, European companies reported an 17% percent decrease in negative currency impacts, with companies reporting $1.80 billion in FX-related losses.2

Of the 350 Europe-based multinationals analyzed, 3% reported headwinds in Q1 2022. Of those, 100% quantified their negative impacts (see page 15).

2 Impacts are likely underestimates as most companies with currency headwinds generally do not report them.

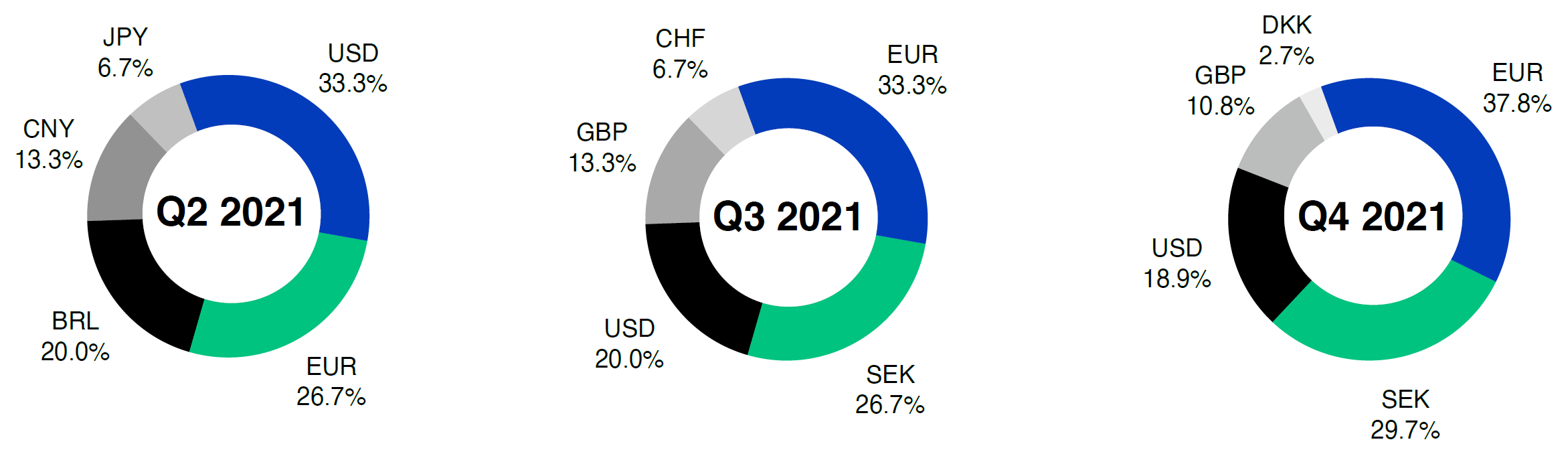

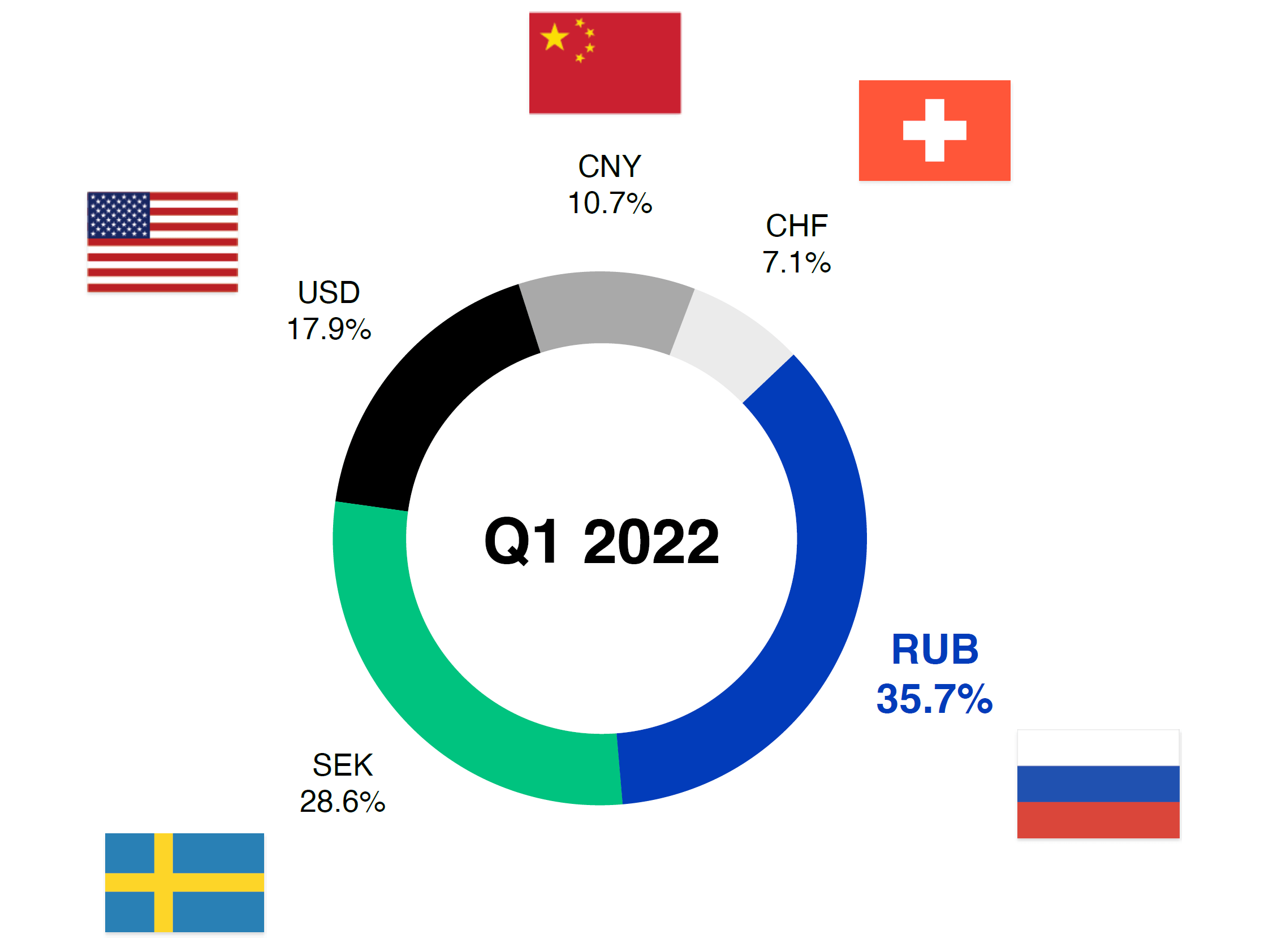

Top Currencies Referenced by European Companies as Impactful

The ruble was the most mentioned currency in earnings calls for Europe, followed by the krona and US dollar. The renminbi was the fourth most mentioned, followed by the franc. The ruble was the top most volatile currency as well as most volatile weighted by GDP (page 6).

Number of European Companies Reporting Negative Currency Impact

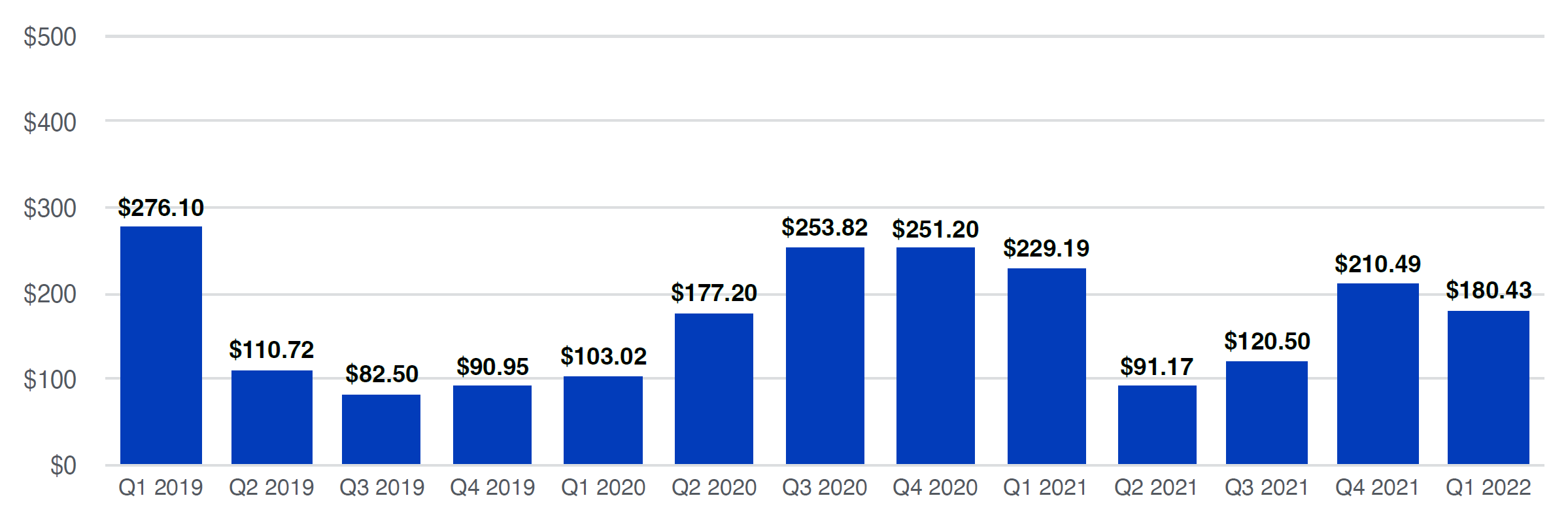

Average Negative Impact to European Companies (Millions)

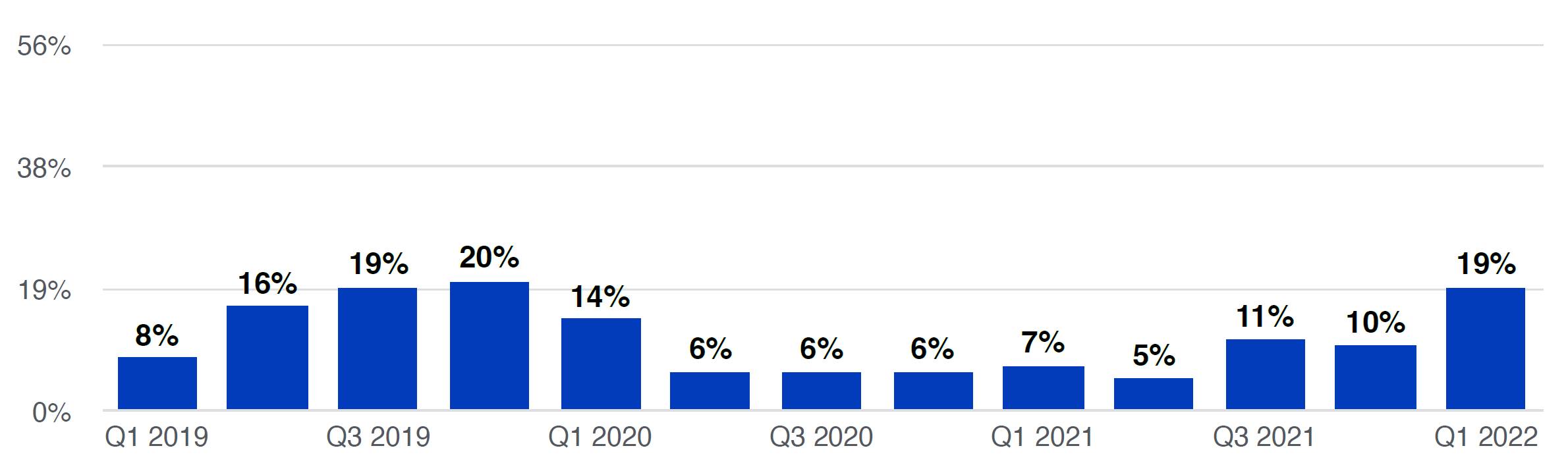

Percentage of European Companies That Fielded Analyst Questions

In Q4 2021 earnings calls, 10 percent of European companies that reported impacts fielded analyst questions.

Most Impacted European Industries

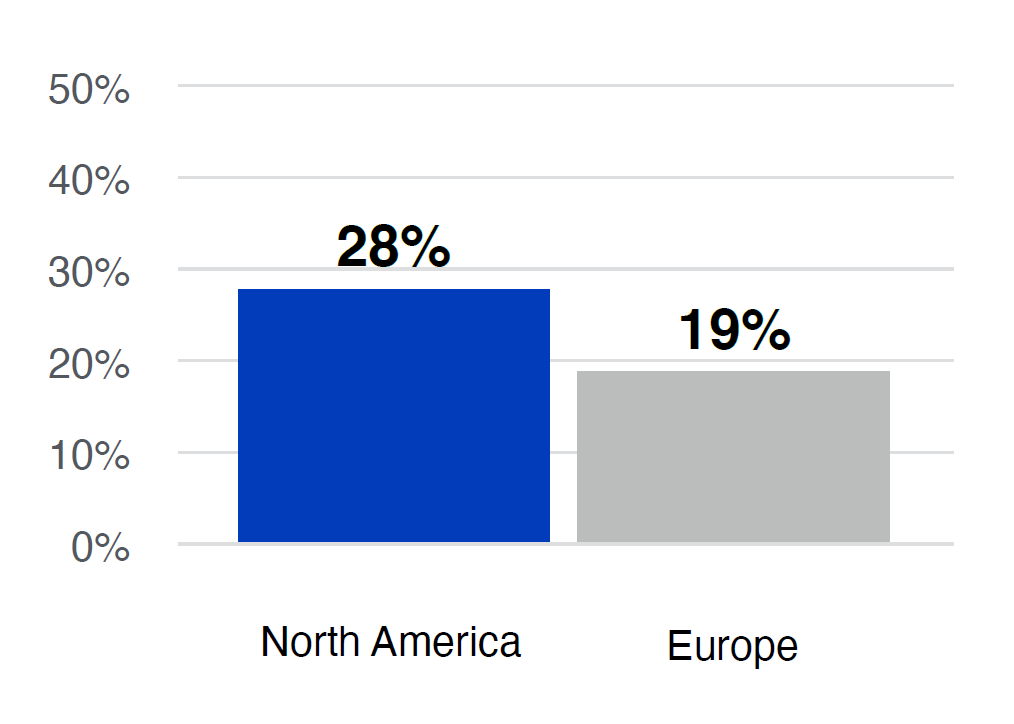

Comparison of Currency Impact to North American and European Companies

Average Quantified Negative Currency Impact (Millions)

Size of Quantified Negative Currency Impact (Billions)

Number of Companies Reporting Currency Impacts

Percentage of Companies Reporting Impacts That Fielded Analyst Questions

Quantified Negative Currency Impact (Billions)

Number of Companies Reporting Negative Currency Impact

FX Risk Management is one of the most difficult objectives handed to a CFO’s organization. Kyriba has a team of experts to offer extensive FX Advisory Services to our clients. Check out Kyriba’s latest demo session and see how Kyriba helps its clients mitigate the effects of currency volatility and reduce hedging costs.