eBook

Volatile Times Require Effective Working Capital Solutions

In this e-book, you will gain an understanding of how supply chain finance (SCF), dynamic discounting and receivables finance can create a win-win solution for both buyers and suppliers while enabling treasury and procurement to work hand-in-hand to deliver working capital improvements.

Table of Contents

- Driving Growth and Profitability Through Working Capital Solutions

- Supply Chain Finance

- Dynamic Discounting

- Receivables Finance

- An Incentive for a Sustainable Supply Chain – Minimizing Risk

- Working Capital Programs Best Practices

- Scientist.com

- Benefits of Integrating Treasury Management and Working Capital Solutions

Driving Growth and Profitability Through Working Capital Solutions

Companies around the globe generally deal in two opposing cash positions – a cash deficit or a cash surplus.

In today’s hyper-competitive and ever-advancing world, companies need capital to grow, address existing debt, or distribute more shareholder value through dividends or share buy-backs. One way to generate this capital is to optimize working capital – the less capital that is tied up in the working capital cycle, the more there is available to drive growth and create shareholder value.

Companies with a surplus of cash often find themselves bound to low-return, risk-free investments such as money market funds with traditional financial instruments. Driving the profitability or addressing the cost of goods sold (COGS), which is one of the major contributing factors to profitability, is also an area of focus. For many companies, using the cash surplus of the working capital equation to enhance profitability is proving to be a game changer.

Supply Chain Finance

Extend DPO to Generate Free Cash Flow with Support of SCF

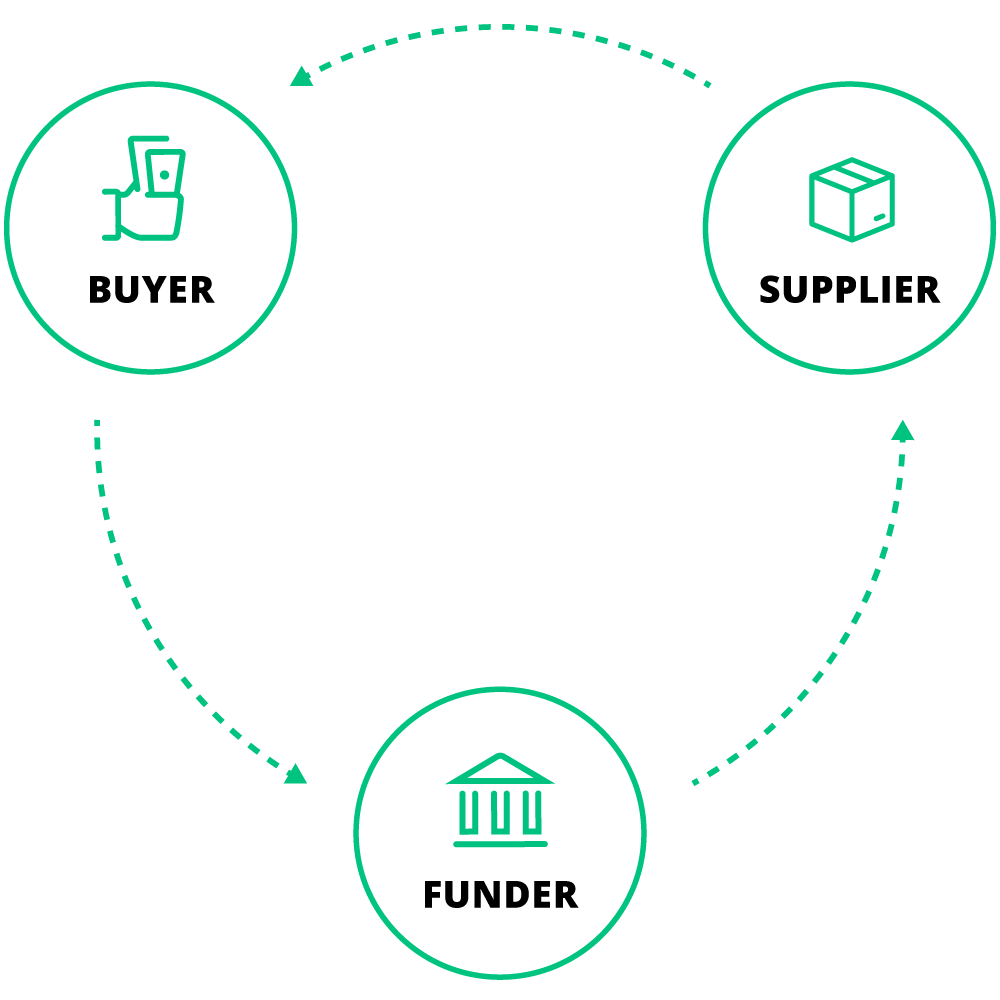

Companies often have a large amount of capital tied up in working capital, which doesn’t generate any return and is unavailable for growth investments. A simple solution to reduce this working capital is to increase payment terms with suppliers and hold on to cash longer. However, this can have an adverse effect on suppliers as it could increase their working capital needs. Supply chain finance, also known as reverse factoring. is a financial instrument that offers early payment programs to suppliers and a win-win for both buyers and suppliers.

Providing supply chain finance as an alternative means of financing in buyer-led programs helps buyers negotiate longer payment terms, which is the actual objective.

Dynamic Discounting

Deploying Free Cash to Deliver Risk-free Returns

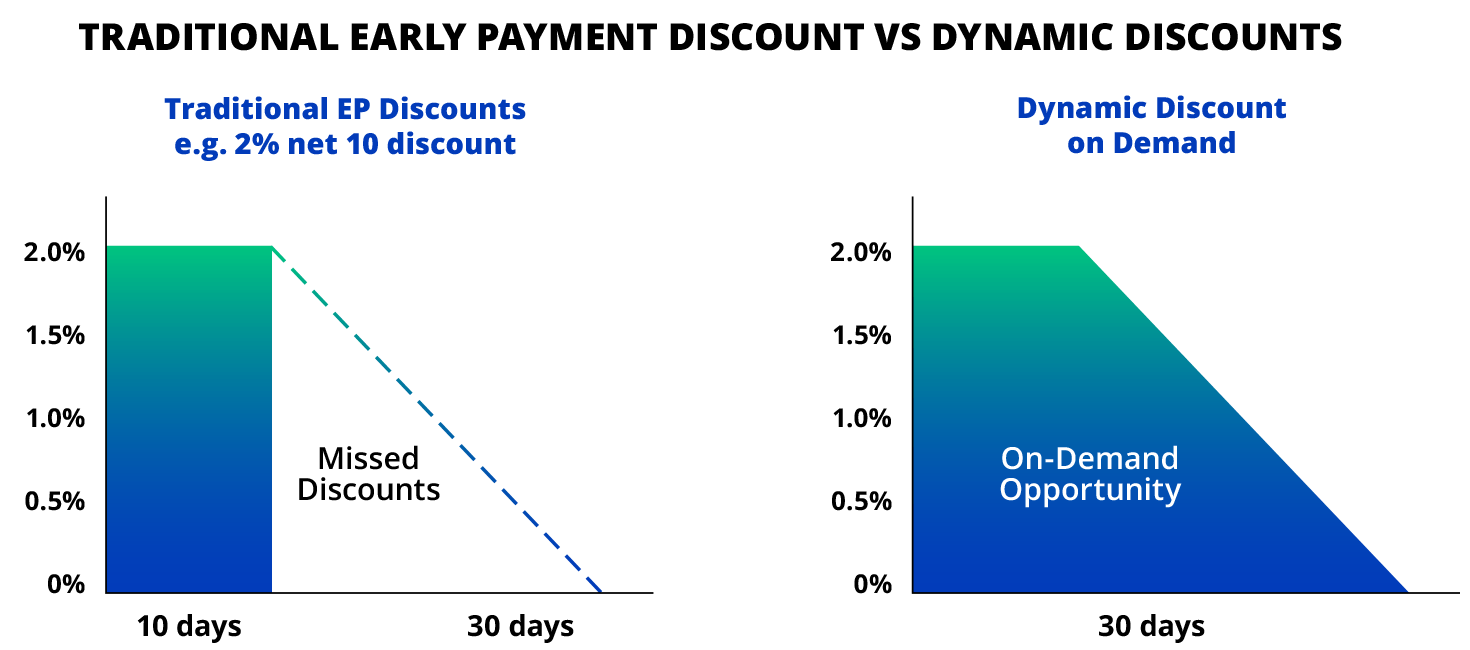

Dynamic discounting is a buyer-led program that gives organizations the option to pay their suppliers early in exchange for a discount on the invoice value. It offers greater flexibility than standard payment discount programs by providing a pre-agreed upon sliding scale discount that moves toward zero as the payment nears its due date. This enables the buyer to choose a payment date that fits both its ability to process payments promptly and its availability of free cash. Providing supply chain finance as an alternative means of financing in buyer-led programs helps buyers negotiate longer payment terms, which is the actual objective.

Dynamic discounting programs offer an increased window to take advantage of the discount and offers flexibility for both sellers and buyers. Sellers are able to choose which invoices to enter into the dynamic discounting platform and buyers can pay at a time that fits the needs of their organization.

Receivables Finance

Convert Outstanding Accounts Receivables into Cash

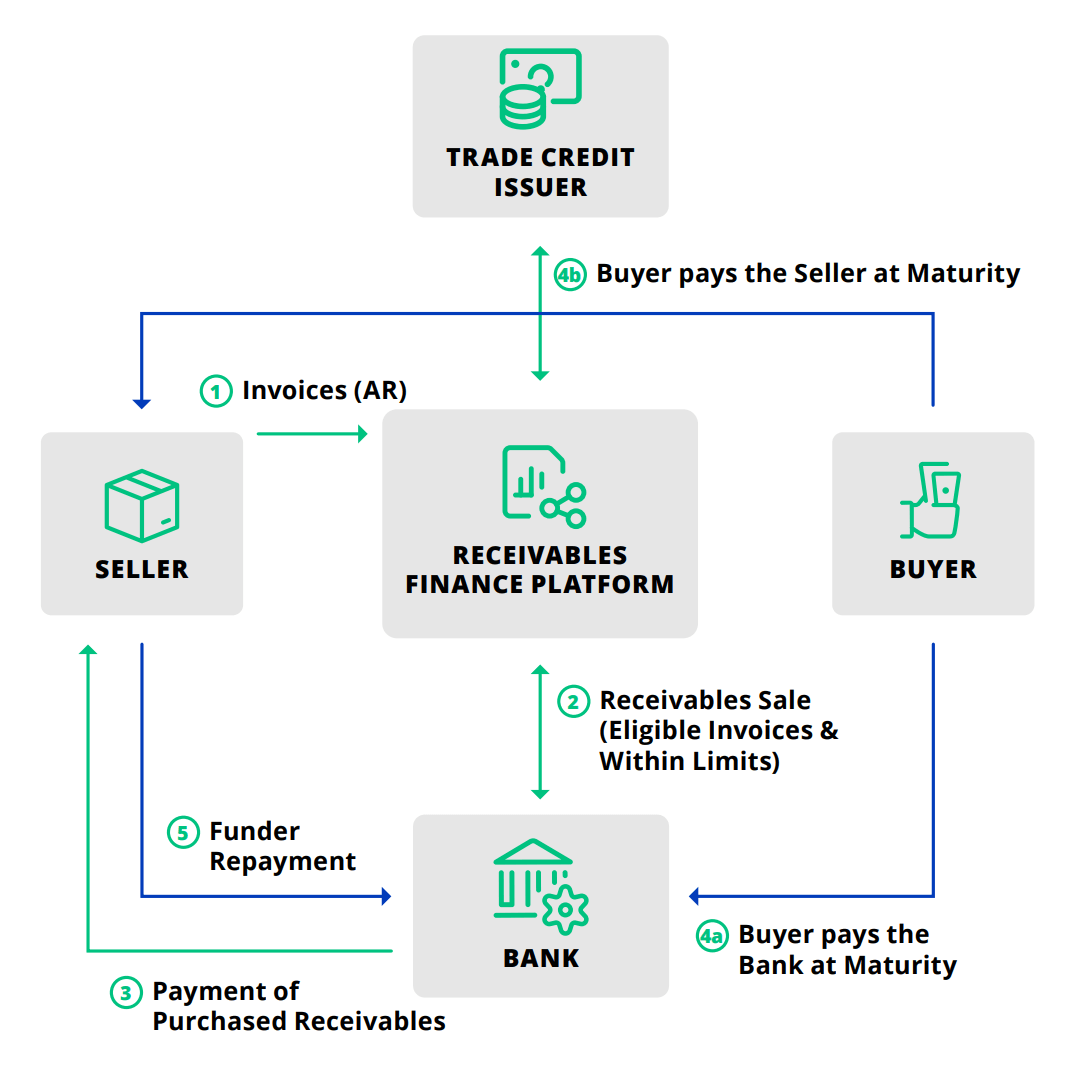

Late payments from customers can negatively impact both a company’s cash position, as well as its working capital. Receivables finance is a useful strategy to mitigate this risk.

Receivables finance provides organizations with the ability to convert their outstanding accounts receivables (AR) into cash. Receivables finance platforms accomplish this by connecting sellers with financial institutions.

Receivables Finance is useful for sellers anytime their receivables have longer payment terms or when liquidity deficits call for accelerating the use of the AR funds before collection is due. There are multiple types of RF: Factoring, Selective Invoice Discounting, Securitization and Asset Based Lending.

An Incentive for a Sustainable Supply Chain – Minimizing Risk

With the rise of a global supply chain, the need for a code of ethics and responsible sourcing has grown exponentially. An increasing number of companies are putting environment and social governance (ESG) or corporate social responsibility committees in place to meet consumer demands and investor preferences as sustainable businesses tend to be less risky.

One area of difficulty in implementing these standards is the lack of tangible or financial incentives for suppliers, who are the ones giving the resources to meet the implied standards. This lack of incentive leads some suppliers to be non-compliant and susceptible to penalization.

In this type of scenario, solutions such as supply chain finance and dynamic discounting can be used as green finance through the association of the financing rate with ESG parameters.

In the last few years companies that perhaps didn’t take sustainability as seriously before now see it as one of the primary risks to their business and there is a greater realization that financing and sustainability need to be more closely linked in order to achieve better results.”

—Farzin Mirmotahai, CTP, FCT, Assistant Treasurer for Specialized Bicycle Components

Liquidity has always been an area of concern, especially for SMEs and emerging markets suppliers. Regular financing costs associated with other instruments in the market, such as corporate loans, factoring, letter of credit, etc., are generally quite challenging and costly. This, combined with late payments, can lead to severe liquidity issues for suppliers and increase the risk of supply chain disruption should suppliers be forced into bankruptcy or unable to support growth due to lack of capital.

Since the financing cost of these working capital solutions – especially that of SCF – is quite low for SMEs and emerging markets suppliers, these solutions provide a sustainable approach to avoid supply chain failures resulting from financial difficulties.

| Benefits of Working Capital Solutions for Buyers | ||||

| SUPPLY CHAIN FINANCE | DYNAMIC DISCOUNTING | |||

| Increase Free Cash Flow (Increase DPO) | ||||

| Increase Risk-free Return on Short-term Cash Investment | ||||

| Improve Gross Margin / Reduce COGS | ||||

| Reduce Account Payable Inquiries | ||||

| Reward Bank Relationships | ||||

| Improve Critical Supplier Relationships | ||||

| Provide Financial Incentive for Sustainability / Responsible Sourcing | ||||

| Benefits of Working Capital Solutions for Suppliers | ||||

| SUPPLY CHAIN FINANCE | DYNAMIC DISCOUNTING | |||

| Enhance Cash Visibility / Predictability | ||||

| Reduce Financing Cost (Relevant For SME Suppliers with Higher Credit Risk than the Buyer) | ||||

| Remittance Information at No Cost with Reduced Account Receivable Queries | ||||

| Receive Financial Incentive for Sustainability / Responsible Sourcing | ||||

Working Capital Programs Best Practices

A working capital program is often a multimillion-dollar initiative involving multiple internal and external stakeholders whose success is dependent on various factors. To deal with this multi-faceted approach and drive a successful program, companies need to determine a methodology that fits their needs. When looking for a technology to help implement a working capital program, companies should look for a solution that offers:

- Support for Multi-language & Multi-currency Programs: Global supply chain demands for coverage of working capital programs and support of local languages to accommodate suppliers is a top consideration for many. Similarly, supporting multiple currencies has become essential when dealing with suppliers around the world.

- ERP Integration: Multiple ERP systems, or multiple versions of the same ERP system across different entities within an organization, is a common occurrence. According to a recent survey conducted by Strategic Treasurer, 52 percent of corporates named internal system integration (i.e., transmitting information to/from an ERP and/or TMS) as the primary source of difficulty associated with their current SCF program.

- A Multi-funder Model: Financing is a crucial element of a program, especially an SCF program where companies need a third- party financial institution for funding. Companies should issue a liquidity request for information (RFI) at the outset of the program as there is more to the liquidity piece than just the price (e.g., ease of KYC requirements, credit capacity, etc.) that can severely impact implementation. A bank-independent technology platform provides this capability to companies so that they can avoid the pitfalls associated with a bank proprietary platform.

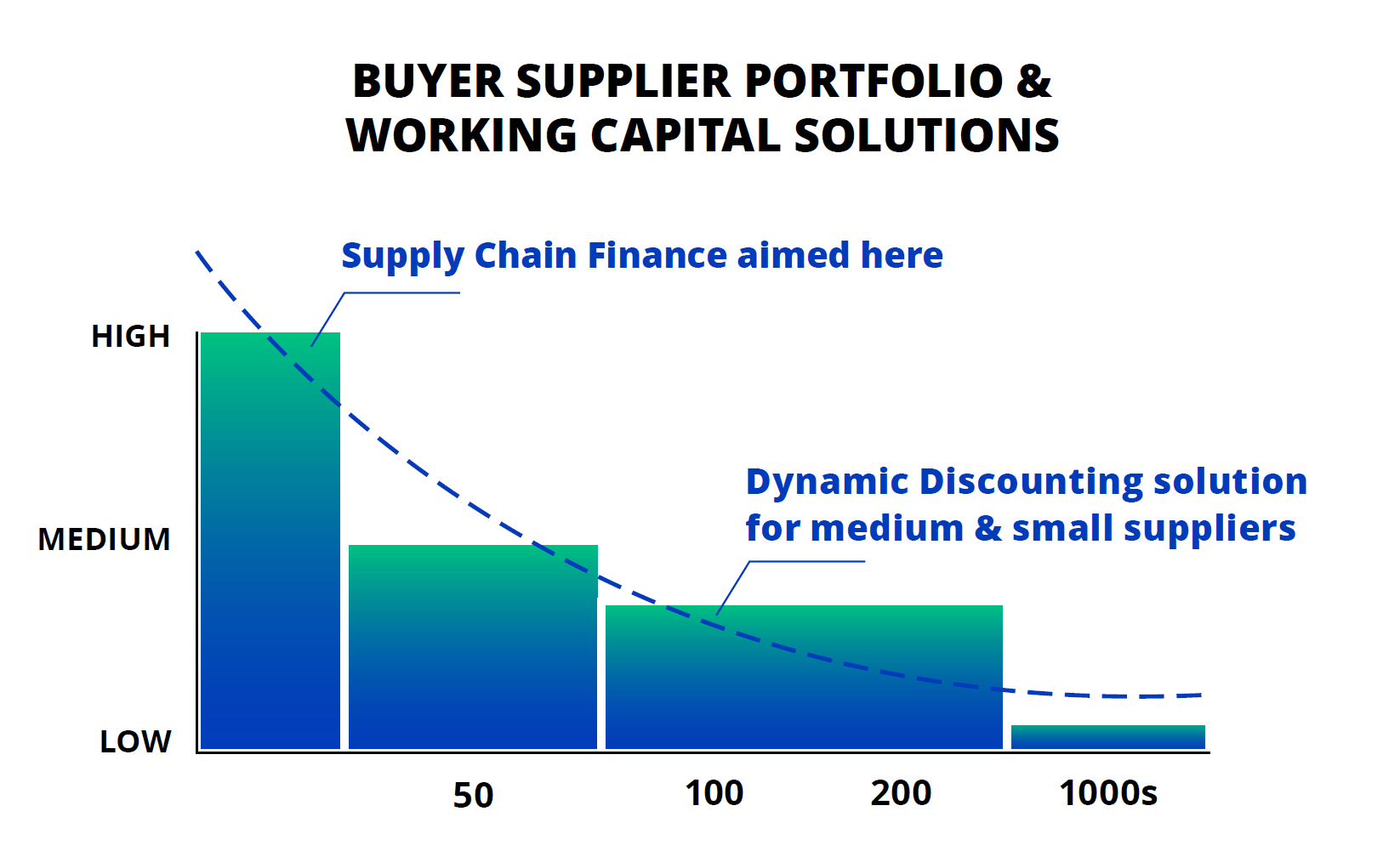

- Flexible Program Options: 39 percent of organizations using SCF had a dynamic discounting program in place, according to a Strategic Treasurer survey. This represents a growing corporate preference for flexible program options that allow for both self-funding and borrowing as needed to support different categories of suppliers.

- Clear Goals & Objectives: As with any project, working capital programs require clear identification of targets and KPIs to create a framework and process for execution. This exercise becomes critical as a working capital program usually involves multiple internal stakeholders such as treasury, procurement, IT, legal, accounting and account payables. Absence of clear objectives can lead to cross- functional misalignments. Analyzing the supplier base through quantitative working capital analysis combined with qualitative objectives helps to set the needle and avoid any confusion.

- The Right Program Strategy: Cross-functional alignment is a significant element of working capital. Drafting a program strategy at the outset can help mitigate alignment failures through concert deliverables, responsibilities and timelines. An essential element when implementing a successful program is to have a negotiation strategy for payment term extension. Companies need to put together a proper negotiation and objection handling framework in addition to defining a messaging strategy aimed at varying supplier categories. Segmenting suppliers into different categories to prioritize and tailor solutions is critical. Well-defined objectives established through a dedicated working capital council is a the key to having a successful SCF program.

- Education & Training: SCF is not necessarily well-known, despite its many years of existence. As such, suppliers and internal stakeholders need to be educated on the benefits of SCF in order to convince them to join the program and to secure executive buy-in. Successful programs require champions to communicate the goals, program frameworks and processes, and to train others. Tools and data, such as a supplier’s percentage of a buyer’s business, cost of supplier debt, supplier payment terms, etc., can help guide these discussions.

- Supplier Onboarding: Marketing the solutions to suppliers, convincing them to join and then onboarding them is a tedious and intensive task considered to be a top challenge. Therefore, a company should inquire about the length and breadth of available services and support for supplier on- boarding before they choose a partner to implement such programs.

Bank Proprietary Syndication

Risk

Banks may withdraw from products or geographies due to finances/regulations.

Inefficient Pricing

Lead bank controls price and won’t have best pricing in all regions. Also, syndication adds 20+ bps.

Inflexible Solution

Must conform to existing solution for all industries. Supplier limited by size, geography, etc.

Bank Independent

Eliminates Single Bank Dependency Risk

Banks can be added or replaced for different currencies, geographies, etc.

Price Competition

Enables best pricing in each jurisdiction. No syndication costs.

Highly Flexible Solution

Can be configured to meet client needs.

Scientist.com

Deploying Free Cash to Deliver Risk-free Returns and Help Suppliers Free-up Cash Flow

Scientist.com operates a B2B online marketplace that connects buyers and sellers in the pre-clinical research industry. In 2015, the company was named one of Entrepreneur Magazine’s ‘Best Entrepreneurial Companies in America’ and was also ranked 9th on Inc. Magazine’s 2018 ‘5,000 Fastest-growing Privately-owned Companies in the U.S.’ list.

Scientist.com noticed that small vendors wanted access to large pharma projects but couldn’t accommodate long payment terms. Meanwhile, large pharma companies wanted access to innovation but didn’t offer short payment terms. To solve this issue, Scientist.com bridged the payment term gap by allowing vendors to receive payment early at a discount through their dynamic discounting program, SciPay, using their excess liquidity. Vendors, Scientist.com and its clients are all seeing the benefits of this new program.

Vendors

- Amplified business opportunities for small vendors thanks to global access to large pharma projects

- Real-time status queries for outstanding invoices and remittance

Scientist.com

- New revenue stream – up to 12.8 percent annualized return on financed vendor invoices

- Reduced vendor correspondence with invoice management portal

Scientist.com Clients

- Access to 2500+ vendors with innovative products without having to offer shorter payment terms

Benefits of Integrating Treasury Management and Working Capital Solutions

Critical to the success of any working capital solution program is for purchasing organizations to have a clear view of their current and forecasted free cash, which enables them to decide what – if any – type of supplier financing program works best at a given point.

Kyriba’s working capital solutions are unique in their ability to provide in-depth, on-demand visibility into global cash balances and forecasts. Kyriba also helps foster collaboration between treasury and procurement to more efficiently deploy free cash and drive risk-free returns.

Customers of Kyriba’s integrated treasury management and working capital solutions can go through a single implementation and be technology-ready quickly.

Conclusion

Working capital programs can provide great financial and operational benefits for both suppliers and buyers. On the buyer’s side, it provides the flexibility to either leverage free cash to pay invoices early or extend payment terms without harming cash flow or supplier relationships. On the vendor side, working capital solutions provide the opportunity to speed up payments when needed, ensuring optimal cash flow and reducing liquidity concerns.