eBook

Optimizing ERP Payments During a Cloud Migration

Table of Contents

Introduction

Many companies will embark on an ERP cloud migration project in the coming years, with 70 percent of SAP and Oracle customers due to migrate in the next three years. Where payments are concerned, this can be a major undertaking. Companies that put their current payment processes in place some years ago will find that the payments landscape has evolved considerably since then. A few years ago, fraud prevention was not as pressing an issue as it is today, bank connectivity was more straightforward and there were far fewer payment formats to consider.

Moving on Up

When companies embark on their ERP payments project, they will need to consider what has changed and how they can use the project as a catalyst for approaching payments more strategically. In practice, that means looking at areas like fraud detection, bank connectivity and payment formats.

Companies should also consider how achieving agility and scalability with their payments can boost their negotiating power with banks and how global visibility can open up opportunities to optimize cash balances and consolidate bank accounts.

Accelerate the Project

In practice, the payments component of an ERP cloud migration can be costly and time-consuming. But this doesn’t have to be the case. By utilizing a SaaS-based, multi-tenant solution to access pre-built connectivity and bank format transformation capabilities, companies can considerably simplify and accelerate the project – while also taking the opportunity to harness innovation and increase the overall maturity of their payments processes.

In This eBook

You will learn about the key areas to look at during an ERP cloud migration payments project, including:

- Fraud detection

- Bank connectivity

- Payment formats

- Agility, scalability and visibility

You’ll also find out how you can significantly reduce the cost and time required to complete your payments project.

Moving Payments Forward

Rather than seeking to maintain the status quo, many companies are taking advantage of an ERP cloud migration to streamline and consolidate different systems and ERP instances. Likewise, where payments are concerned, they are looking at opportunities for transformation that might otherwise be more difficult to achieve.

But transforming existing processes can come at a considerable cost. For companies that embark on a custom project to build and maintain bank connectivity using internal IT resources or external consultants, additional costs can range from $200,000 to $1.5 million. And the time investment can be equally significant – such projects are likely to take more than 12 months to complete.

The challenge, then, is to update payment processes and achieve a higher level of maturity in payments while avoiding delays and hefty costs. For CIOs and CFOs, the goals of a payments project may include:

- Fraud prevention

Detecting fraud, adopting robust controls, achieving real-time visibility - Project acceleration

Reducing the cost and implementation time of the project - Agility and scalability

Achieving bank independence - Global visibility

Optimizing liquidity and reducing fees

Payments Maturity Process

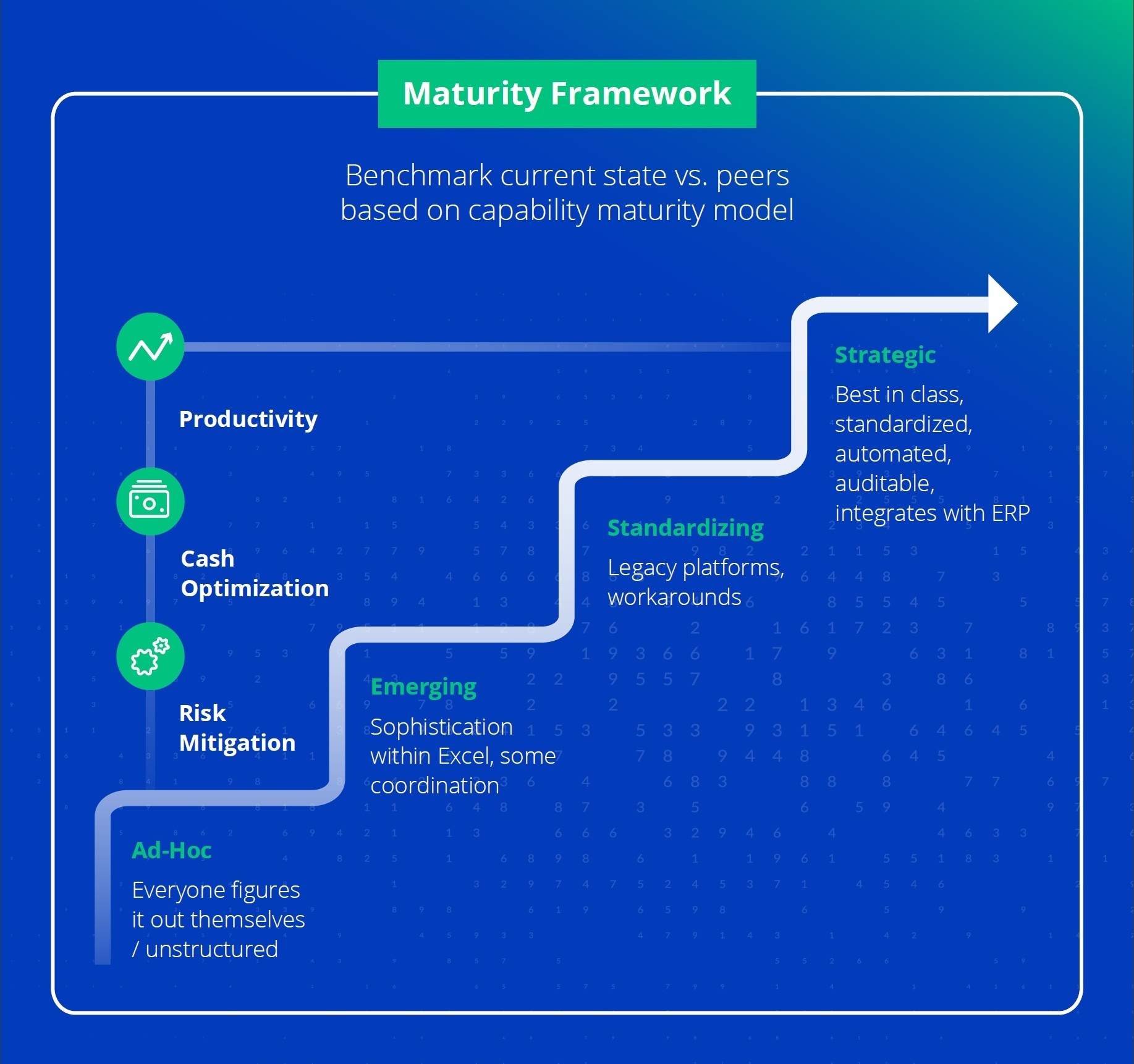

Different companies have achieved different levels of maturity within their payments. Typically, there are four stages within the payments maturity process:

Defending Against Payment Fraud

It’s no secret that fraud is a more pressing concern than ever before. The 2019 AFP Cyber Risk Survey found that 88 percent of organizations have experienced an actual or attempted cyberattack in the past 18 months.

But despite the gravity of the threat, many organizations have yet to implement effective safeguards in order to identify and defend against payment fraud. According to research by Strategic Treasurer in 2019, only nine percent of organizations have implemented payments monitoring/screening, while only three percent are taking advantage of AI/Machine Learning.

As well as financial loss, payment fraud can also damage a company’s reputation and lead to the loss of essential data. It’s therefore essential to put measures in place to protect the organization from these risks. This should include digitizing payment workflows, standardizing controls and screening payments.

Digitizing Payment Workflows

Having digital payment workflows in place is key to reducing the risk of fraud. Workflow controls should be used to standardize how transactions are initiated, approved and transmitted to the bank or banks. This means setting up mechanisms such as:

- Automated confirmations

- A single source of record

- One set of approvals

- Consistent security protocols

- Real-time visibility

Standardizing Controls

The value of an ERP can be greatly enhanced by standardizing controls across all payments and geographies. Some companies lack a consistent approach to this, with different levels of approval applied in different markets.

Such inconsistencies can leave companies vulnerable to payment fraud, so it’s important to adopt a standardized approach across all people, geographies and payment systems. For example, controls applied to ERP payments should also be applied to manual payments initiated outside the ERP.

Screening Payments

The key to fraud detection is the ability to screen payments against external sanctions lists and for instances of internal fraud. While a treasury team handling 10 payments a day may well spot any suspicious activity, it’s impossible for individuals to screen high volumes of payments manually on a real-time basis.

Machine learning and automation can play an important part in overcoming these limitations. Rules-based automation can be used to identify anomalies in payment behavior, such as a change in a supplier’s payment instructions or an unusually high-value payment to a particular supplier.

Just as important as screening is the ability to review any suspicious payments before they are settled. The screening process therefore needs to have a quarantine component, so that any payments flagged can be halted while investigations take place.

Beyond Fraud

As well as mitigating the risk of fraud, taking a more critical look at payments can give companies the opportunity to review the types of payments being used for different situations. For example, a company that has been sending expensive cross-border wire payments to France may find there are opportunities to take advantage of the local cash pool and send local SEPA payments instead.

Connectivity

Bank connectivity has evolved considerably in recent years. There are now many different ways to connect to banks, both directly and indirectly:

- Direct Connection – Direct connectivity methods include the use of APIs or secure FTP to connect to the bank via the ERP system or a payments hub.

- Indirect Connection – Companies can also connect via an intermediary – for example, via SWIFT solutions such as Alliance Lite2, a SWIFT Service Bureau or Alliance Access/ Gateway. They can also connect using a regional network such as EBICS, but there are complexities to navigate, not least because France, Germany and Switzerland each have their own EBICS network.

Which Connection?

With so many options available, companies need to decide the right way of connecting to their banks in each country – and what’s right for one company may not be right for another. Key factors will include the types and volume of payments used by a particular company, as well as its geographical footprint and future goals.

Equally, an organization’s chosen connectivity routes need to be standardized across the organization, which requires collaboration between the CIO and CFO.

Connectivity as a Service

For companies looking to connect to multiple banks, Connectivity as a Service (CaaS) can help streamline the process. Companies should look for technology providers that offer a CaaS service whereby it actively manages bank connections on behalf of clients. As a result, companies do not need to secure internal IT support for their bank connections or undertake file testing with their banks, and the technology solution then becomes the company’s IT banking resource.

Payment Acknowledgments

Companies also need to consider how they will connect to banks to receive acknowledgments (ACKs). Payment acknowledgments confirm that a payment has been sent and received. But different payment protocols will have their own ACKs. There may be opportunities to use ACKs more effectively, both as part of the intra-day review of which payments have been sent and for reconciliation purposes.

Payments Formats

An essential part of a payments project is making sure the company is able to send payments to banks in the right format. But this is more complex than it sounds – particularly if the company embarks on a custom project to build new bank format scenarios.

Ten years ago, companies only needed to know about a handful of commonly used payment formats. But today, there are hundreds of different formats in play, each of which encompasses many different variations. In practice, companies need to be able to handle as many as:

- 250 unique formats – including XML, SEPA, EDI

- 1,400 variations – each bank has its own version of these formats

- 45,000 bank payment scenarios – different pieces of information are required for different types of payments

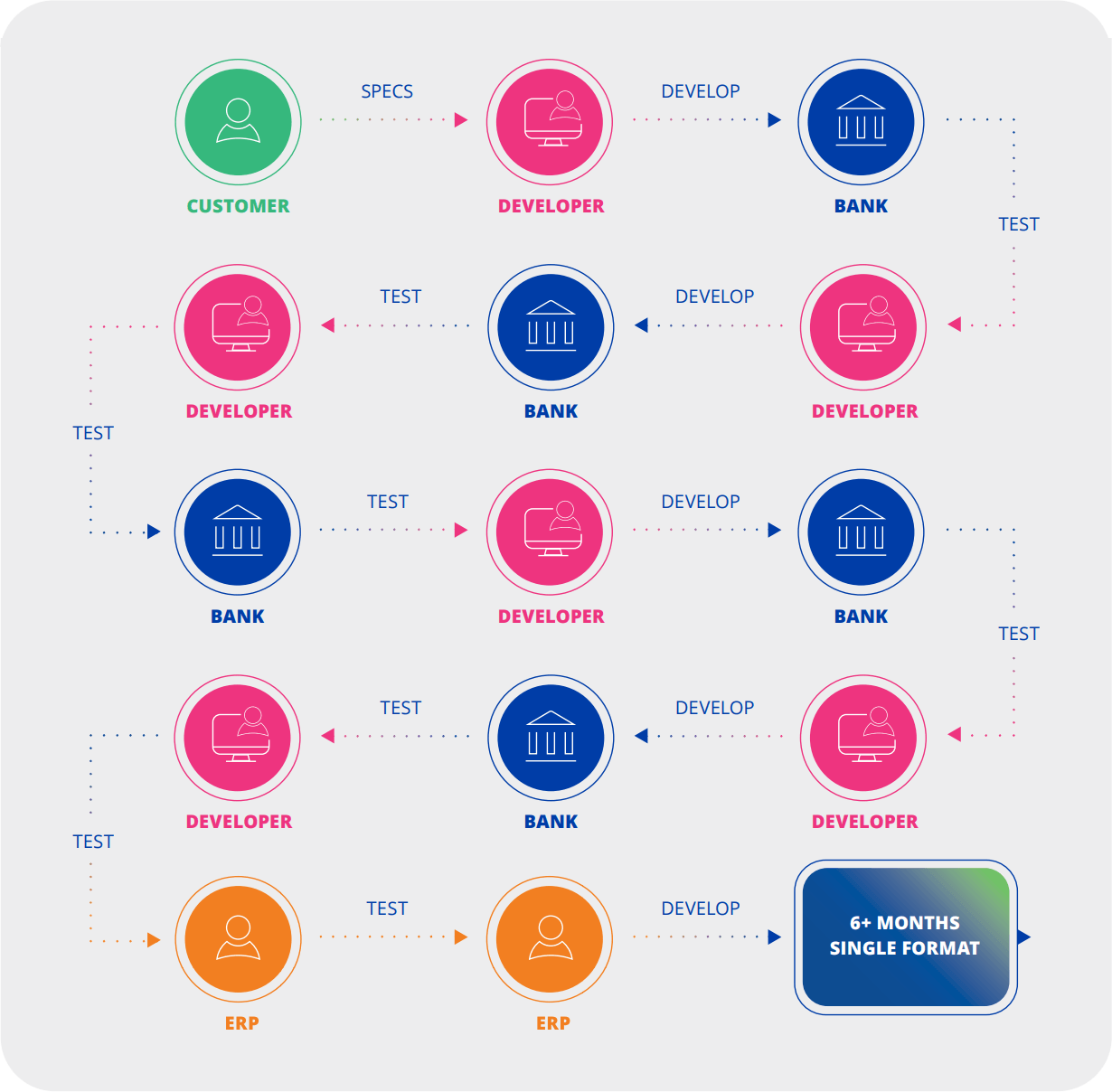

Developing Payment Formats

For any particular payment type, companies will need to ensure that payments are formatted correctly for a specific bank’s requirements and that they contain the information the bank needs to complete the payment.

This will involve looking closely at the types of payments the company is sending and considering how those payments should be handled. Key factors include the banks a company uses for payments and the countries in which payments are being made.

Developing and testing payment formats to ensure payments can be sent in the correct format for every scenario is a major undertaking. This process typically takes three to six months and can take 12 months or longer when dealing with complicated formats.

Traditional ERP Payment Development

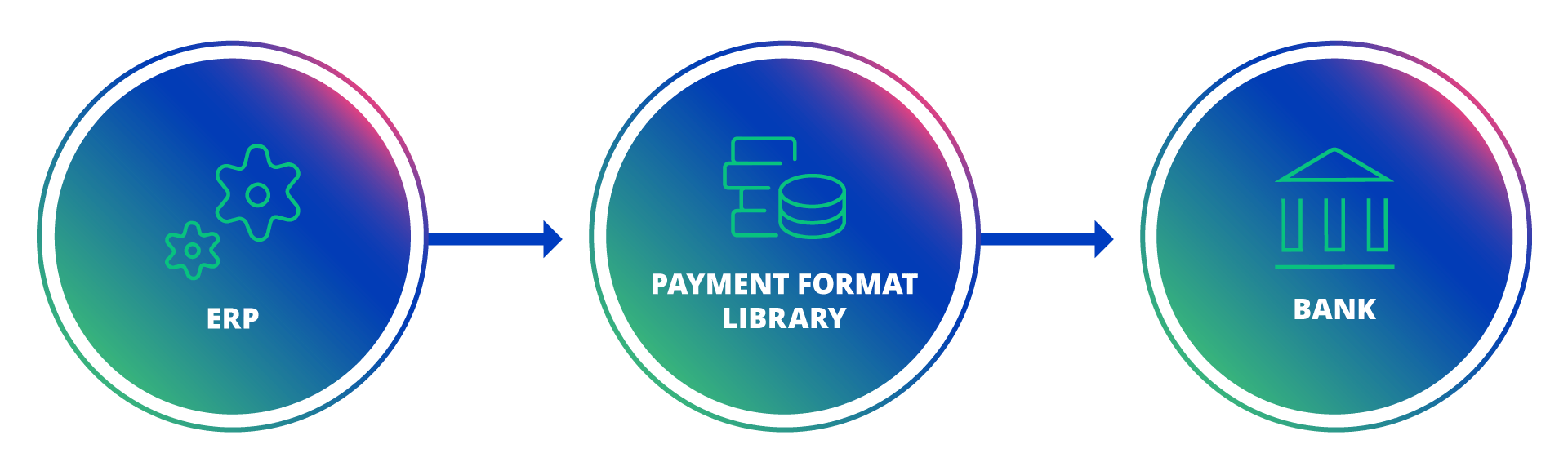

Fortunately, there are opportunities to simplify and accelerate this part of the project considerably. There are technology vendors that maintain a large, pre-built and pre-tested inventory of formats and scenarios, enabling companies to streamline format transformation and reduce the project timeline to as little as two to three weeks.

Kyriba Payment Format Library 45,000+ off the shelf formats

- Single payment file from ERP, Kyriba interprets and transforms all payments to approved format per bank

- Payment formats are shared across multitenant architecture

- Ongoing maintenance of all formats

- Formats are productized under SLA

- No client IT resources required

- Governed under SOC 1 and SOC 2

Agility, Scalability, Visibility

In order to advance along the payment maturity scale, companies should be able to navigate the complexity of today’s connectivity options and payment formats. They should also position themselves to take advantage of new opportunities for innovation.

Goals to consider include:

Agility and Scalability

Achieving bank independence can make it easier for companies to change, add, expand or remove bank relationships. Bank independence also gives companies the ability to add new services such as SWIFT gpi, real-time payments or SEPA instant payments.

As such, companies that achieve agility and scalability within their payments will be better placed to:

- Enter new markets quickly and efficiently

- Quickly push outgoing payments to different banks and formats for low-cost routing

- Migrate to new formats and technologies

- Increase their negotiating power with banks

Global Visibility

By centralizing all payments into a single system, companies can achieve complete visibility over their outgoing cash. As a result, they’ll be able to:

- Identify the most efficient payment scenarios

- Optimize cash balances and make effective decisions about where to deploy cash and liquidity

- Unlock working capital with dynamic discounting or supply chain finance

- Find opportunities to consolidate accounts and save costs

- Receive instant acknowledgment of transmitted payments

Ingredients of a Successful Payments Project

When companies embark on a payments project, there are a number of steps to consider. These should include the following:

- Identify the project scope:

- Which banks, countries and payment types will be included?

- Will the project include supplier payments only or will it also include treasury and manual payments?

- Are there any payments that are not currently centralized but will need to be centralized?

- Are there any new payment banks that will need to be connected (for example, payments that are currently handled manually)?

- Confirm whether existing payment requirements still apply

- Consider whether new connectivity methods, formats or payment services should be included – such as APIs, XML ISO 20022 harmonization, real-time payments, SWIFTgpi tracking and cross-border payments services

- Confirm both existing and new payment scenarios – all format testing scenarios will need to be identified, as bank format requirements can differ

- Decide whether all banks will be implemented at the same time or whether a smaller group will be implemented in the first instance

Implementation Steps

- Prioritize banking partners

- Align with internal IT for the overall system architecture and workflow design

- Define payments scope – scenarios, types, regions

- Identify payment controls and approval hierarchies

- Determine additional screening (e.g., OFAC, fraud detection)

- Test and go live

Accelerating Your ERP Cloud Migration Project

The good news is that your payments project doesn’t need to be a huge investment of time and money. It is possible to accelerate your ERP cloud migration project while enhancing the value of your ERP investment.

Managing Connections and Formats

Kyriba runs the world’s largest bank connectivity service. That means Kyriba can manage all your connections and formats, enabling you to benefit from new payment innovations such as real-time payments, SWIFT gpi and fraud detection.

- Kyriba’s pre-built format library supports 45,000+ payment scenarios for 1,000 banks around the world – meaning there’s no need for you to carry out custom format development.

- With integrated global bank connectivity, Kyriba supports connectivity options such as SWIFT Alliance Lite2 and SWIFT Service Bureau, as well as APIs, direct bank connections and regional protocols such as EBICS, BACS and EDITRAN. Kyriba is also compliant with SWIFT gpi.

Detecting Fraud

Real-time fraud detection, fully integrated sanctions list screening and payment controls ensure all payments activity complies with your payments policy.

Digitizing Payment Workflows

Kyriba enables you to put workflows in place to standardize how payments are initiated, approved and transmitted to the bank.

Supporting Bank Independence

Easily scale banks to achieve bank independence and benefit from innovation.

Supplying Innovation and Intelligence

Kyriba enables you to benefit from new payment services, formats and standards without the need for internal IT support. What’s more, you can optimize your payment decisions by taking advantage of real-time data visualization and payment analytics.

Kyriba may be able to accelerate your ERP cloud migration project by up to four months and reduce costs by $200,000 – $1.5 million.

Conclusion

Many companies will be embarking on ERP cloud migration projects in the next few years – and where payments are concerned, this brings a significant opportunity.

The payments landscape has moved on considerably since most companies first implemented their current ERP payment processes. By taking a fresh look at their requirements, companies can make sure they have the fraud detection capabilities needed to counter the threats they face today. They can also position themselves to take advantage of opportunities for innovation.

That means putting in place the best fraud detection capabilities to protect the business. It also means positioning the organization to make better use of the wide range of bank connectivity options available today, while ensuring payments can be sent to banks in the right format and with the right information attached.

The time and cost considerations of an ERP migration payments project can be significant. But by working with a specialized technology provider, companies can accelerate the project from more than 12 months to a few weeks while reducing payment connectivity and format costs by up to 80 percent.

Check out this webinar to learn how Treasury and IT worked together at Hilton Grand Vacations with Kyriba to speed up connecting more than 10 banks and 300 bank accounts as part of their Oracle ERP cloud migration project.