eBook

Understanding the Real Value of Supply Chain Finance

Cash management is a critically-important piece of the corporate puzzle. For the continued health of the average business, maximizing cash on hand has become a top priority, forcing organizations to seek new strategies and solutions that support this need. Supply chain finance (“SCF”) is tailor-made to solve this problem, helping to extend days payable outstanding (“DPO”) without impugning supplier relationships, an issue that may occur when enterprises extend invoice payment terms directly. Enterprises seeking ways to more effectively manage cash as well as retain the supplier relationships that allow them to remain competitive in an evolving business paradigm would do well to consider SCF as a solution. This Ardent Partners research report details the opportunities inherent in supply chain finance programs and provides a framework for enterprises seeking to leverage this financial solution.

Table of Contents

The Evolving Role of Cash Management

From hard coinage to electronic funds, cash has been the basic building block of business success for centuries. Cash allows enterprises to pay employees, fulfill debt obligations, invest in new projects, and purchase goods and services. This indisputable truth has driven organizations large and small to emphasize the management of cash since the first businesses arose in ancient times. The modern era has complicated matters with a persistently low-interest-rate environment, forcing enterprises to seek out new cash management frontiers in order to maintain just the right amount of liquidity to survive in an increasingly competitive marketplace now and in the future.

Cash management is as much an art as it is a science. The finance team must decide which financial tactics and vehicles to use as part of their overall cash management strategy, calculating the risks and benefits of each and determining what options are the “best fit” for the enterprise. In doing so, finance must develop forward-looking cash forecasts that anticipate future needs and market conditions while working to ensure that the business will have enough cash available to fund its short- and medium-term obligations. The future is literally unpredictable, but finance must vigilantly perform its cash management duties to keep the enterprise adequately prepared. This is a difficult task that requires hedging against known and unknown risks — the “art” of cash management — which is further complicated by a sometimes volatile credit environment and persistently low rates of return on capital.

A Persistently Low Interest Rate Environment

Once upon a time, enterprises could store free cash in a money market account and expect a reliably high rate of return. In fact, until the Great Recession in 2008, the US Federal Funds Rate had averaged more than 4% for almost 30 straight years. Similarly, money market accounts (one of the most common vehicles for enterprise capital) had rates of return above 2% for all but two years in the same period. This meant that leaving money in the bank would result in adequate returns that could help boost the enterprise bottom line.

This is no longer true. The Federal Funds Rate has hovered near zero for the last 10 years, and the European Central Bank’s (“ECB”) overnight deposit rate entered negative territory in late 2014 and is still there. The rate of return for money market accounts in North America has stayed below 0.25% for some time now. Because of these historically low interest rates, most finance and treasury leaders have had difficulty finding higher yield (risk-adjusted) investments and as a result are more actively examining alternate ways to drive a sufficient return on enterprise capital.

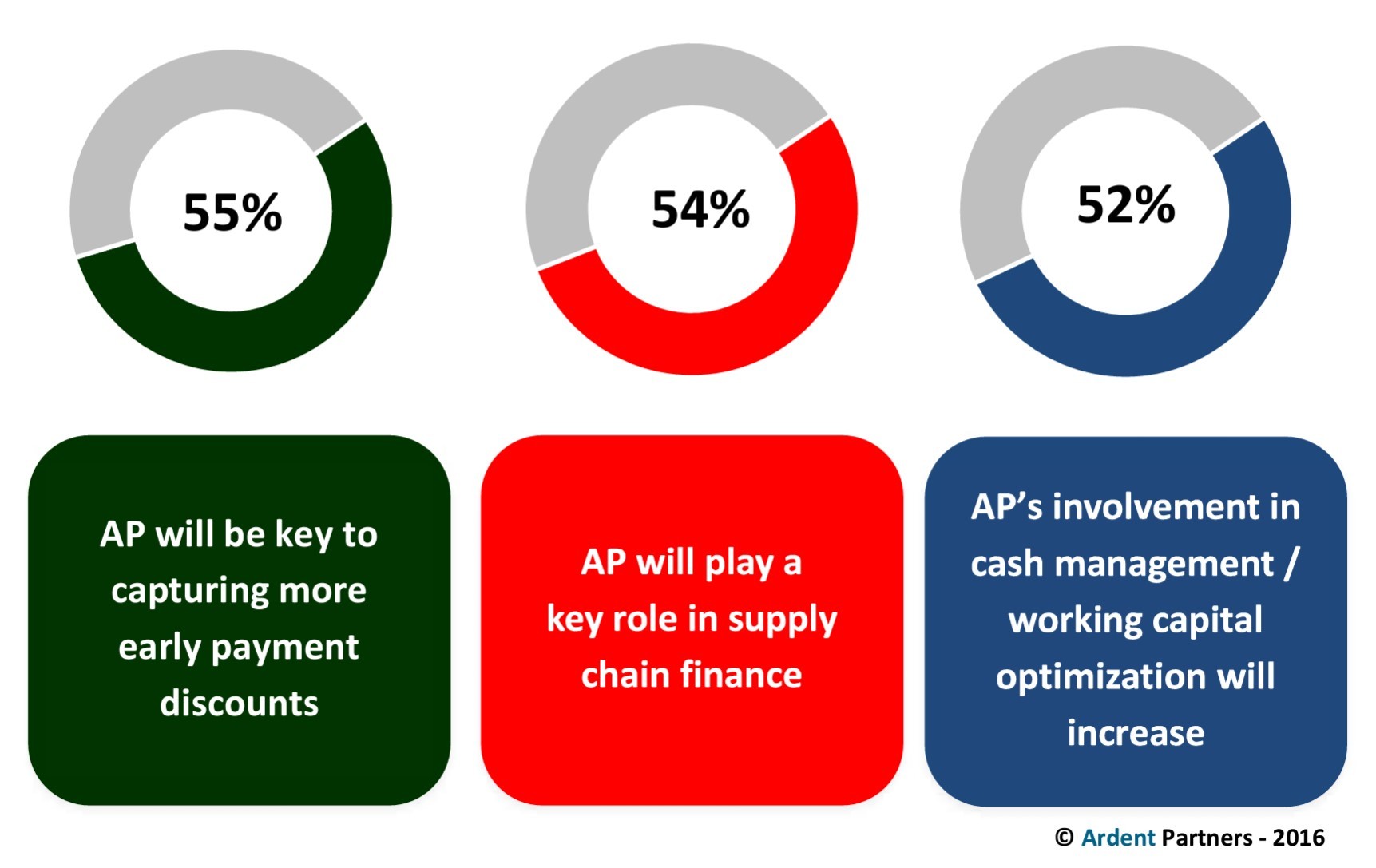

The historically low interest rates worldwide have thus created an environment where the traditional methods of generating competitive returns on cash no longer work as well as in past years. The persistently low rate of return from bank accounts has resulted in finance/treasury looking for alternative investment opportunities as a way to grow cash on hand. One of the most straightforward opportunities to optimize cash is through cost savings from internal processes, which is where accounts payable (“AP”) can play a significant role in the financial health of the enterprise. Moreover, AP can have a strong impact on cash management via supplier (or “B2B”) payments, and based upon a 2016 Ardent Partners survey of nearly 200 AP and finance professionals, is expected to do so within the next few years (see Figure 1).

Figure 1. Expected Changes (Next 2 to 3 Years) Regarding AP’s Cash Management Impact

AP also frequently reports into the finance organization, which means the finance team has some input and control over the function. Either with or without this reporting relationship, however, AP is expected to have a much greater impact on enterprise cash in the next few years. The increase in AP expected role in capturing early payment discounts (55%) can result in significant sums of money back to the enterprise through the lower amounts paid on invoices. Additionally, 54% of organizations expect AP to playa key role in supply chain finance (“SCF”), an early-payment method that offers frequently unexploited cash management opportunities to enterprises. Moreover, that 52% of enterprises expect AP to have a larger role to play in working capital optimization programs indicates that many enterprises have begun to realize the effect AP can have on the organization’s cash stockpile.

Overall, these expected changes showcase that accounts payable is slowly becoming a more value-added department within the wider enterprise. Many organizations now see the AP team as a vehicle to drive financial value, which is indicated by the high percentage of survey respondents that expect AP to have a larger role in finance-related tasks through the supplier payment activity that AP goes through every day. AP has experienced many changes over the past 15 years and, if anything, the pace of that change — and AP’s impact on working capital — will only expand over the next few years.

Why Pay Suppliers Early?

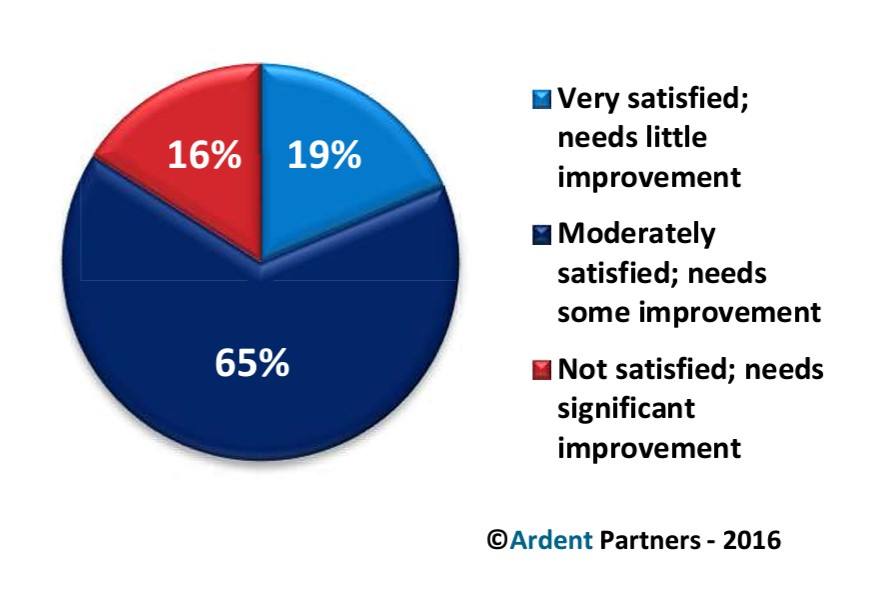

Many enterprises, particularly when times are tough, view their supply chains as a source of incremental returns. One way that this incremental “profit” can be accessed is by delaying the timing of supplier payments. Nearly one-quarter of all AP teams have prioritized extending payment terms and optimizing DPO as a top priority this year. In fact, nearly 81% of businesses (see Figure 2) feel their DPO needs some improvement (65%) or significant improvement (16%) That such a high percentage of AP professionals expressed dissatisfaction with their DPO indicates broad-based challenges with B2B payments, but also a significant opportunity for financial value.

Enterprises are, on the whole, not satisfied with their DPO, which can be improved by extending supplier payment terms. Problems arise, however, because suppliers prefer to receive their money faster. The low interest rates that have made finding high yields difficult further complicates matters, and turns managing DPO into a delicate balancing act between holding onto enterprise cash as long as possible and paying suppliers on-time or early in order to maintain a good relationship and/or capture a discount.

Financial and stock analysts, as well as members of the investor class, frequently use DPO to evaluate performance trends and the financial health of a company. A DPO that it is in line with the industry average is considered healthy, while DPOs consistently lower or higher than that trend line can signify potential financial difficulty. The question for enterprises faced with this conundrum then becomes how to achieve both a satisfactory DPO and strong supplier relationships. This tension points to supply chain finance as a method to avoid the “balancing act” all together and create an equitable arrangement for everyone.

The Real Value of Supply Chain Finance

Supply chain finance (“SCF”) is an advanced financial solution that accomplishes two primary goals: suppliers are paid more quickly, but at a slight discount, and buyers preserve their DPO and cash on hand. At its core, SCF is an early payment discount technique that uses third-party capital, typically from a financial institution or third-party lender, to pay an invoice early (instead of internal buyer funds). The early payment is sometimes scheduled and processed the instant an invoice is approved. This allows a supplier to receive its money on a pre-selected schedule at an agreed-upon discount, while the buyer pays the third-party the full cost of the invoice at the original maturity date.

SCF also increases the buyer’s free cash flow through extending payment terms, which can generate higher, mostly risk-free returns as well as enhance corporate liquidity. Improved liquidity can make the enterprise more equipped to deal with financial risks in the short term, and also bolster the organization’s long-term financial health. Depending on the SCF provider, the buying organization could also receive rebates as an incentive to increase volume.

Since the credit risk in the transaction for the third-party financer is tied to the buyer instead of the supplier, SCF can be an innovative way for large enterprises to help their suppliers access credit and improve cash flow at a below-market cost. In these transactions, both buyers and suppliers “win:” suppliers are paid early and buyers are able to delay payment without impugning the relationship. Invoices paid with supply chain finance thus create a “float” for the enterprise and obviate the choice between paying suppliers early and maximizing DPO.

That is where the true value of supply chain finance lies — in creating a “win-win” situation where buyers are able to deepen the supplier relationship and improve their financial results at the same time. Supply chain finance acts as a third option in what has historically existed as a binary decision point. With SCF, enterprises can maintain their high reputation among the supply base while also preserving, or improving, financial results. It is worth noting, however, that SCF is far from a panacea, and is most often used as one of a number of innovative financial solutions leveraged within a richly-detailed cash management strategy. This does not negate its value, however, which can be — and frequently is — significant.

The Supply Chain Finance Technology Landscape

B2B payments have risen as a “new” and viable source of value for financial organizations across the globe, and, as more attention is paid to this aspect of the AP function, businesses are realizing that they can take further advantage of the efficiencies created on the front of the AP unit (e.g., less paper, faster invoice-processing, etc.). The increased interest in payments has largely been driven through this reduction in paper on the front end of the AP process. Less paper has resulted in efficiency gains and increased visibility for the opening stages of the invoice management process. This means AP groups today have more opportunities than before to extract value from their B2B payments, particularly within the realm of early payment discounts.

The emergence of electronic payment (“ePayment”) solutions has further driven a fresh and renewed interest in the B2B payment arena. Collectively, these notions have pushed “extended financial value” platforms within the financial ecosystem, such as SCF, into a new and strategic limelight. The emergence of ePayment solutions has also presaged an increased interest in the B2B payment process generally. This has resulted in greater interest in payments, which is now becoming an area of strategic importance.

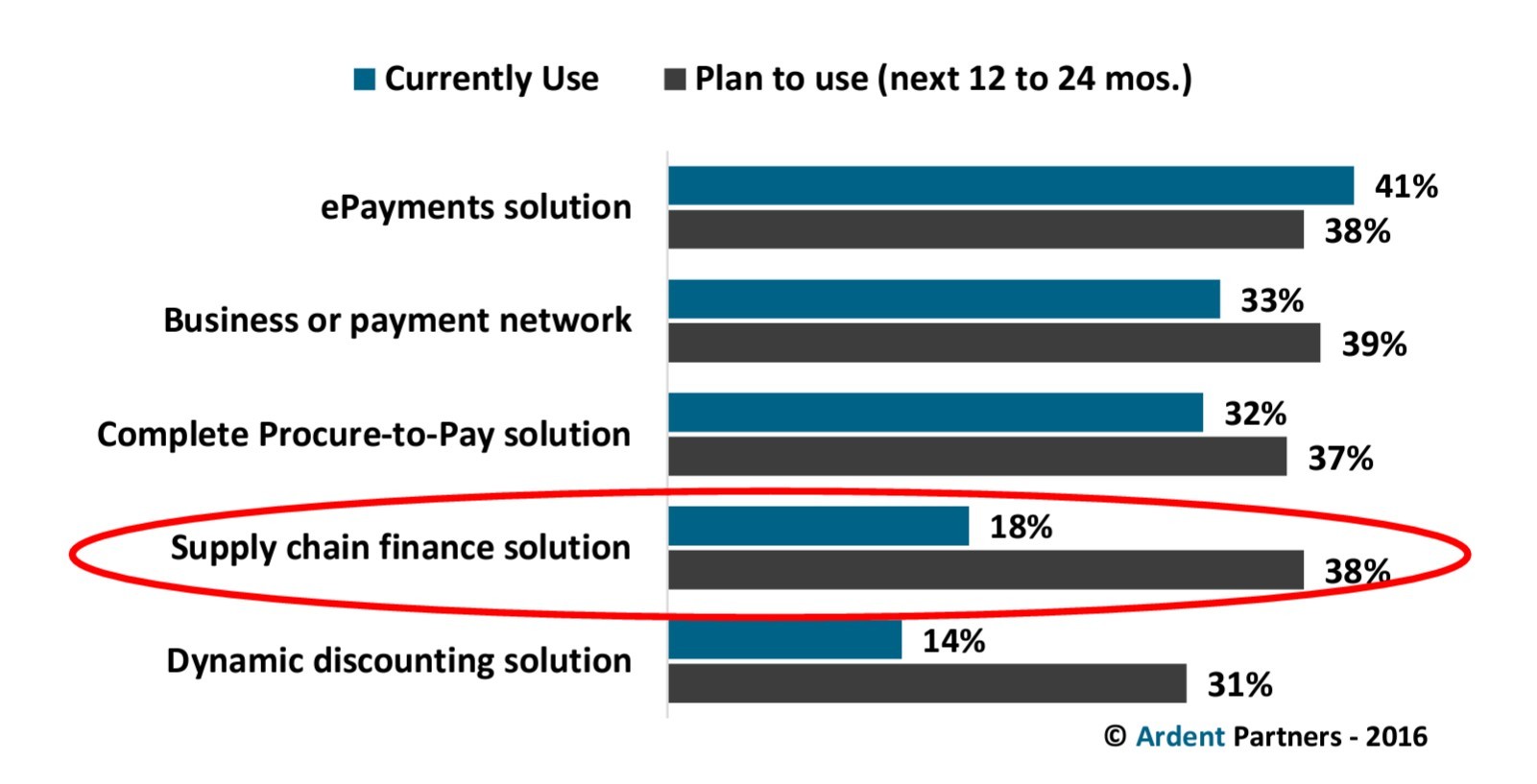

Historically, legacy SCF solutions were oriented in services-based offerings, presented by large financial institutions (e.g., banks) to their large enterprise-sized clients that had significant supply chains. These bank-led initiatives were largely manual, involving huge teams of employees. Those largely-manual solutions lacked the structure, seamlessness, and “power” of today’s SCF platforms, which have the ability to scale users’ strategic payment plans and drive value via early payment discounts and improved visibility into the financial supply chain. However, while supply chain finance offerings have been transformed over the years, these solutions are still emerging and not widely adopted (see Figure 3).

Figure 3. Finance Solution Adoption in 2016

Part of the issue is that SCF has had a historically low penetration into the AP marketplace, which is indicative of its history as a service-based solution offered on a limited scale. As a result, only 18% of enterprises leverage an SCF solution. This has begun to change in recent years, however, because a new breed of financial technology solution providers have developed SCF tools with a broad-based market applicability — far more than SCF ever had before. These new solution providers have targeted the small and mid-sized enterprises that large financial institutions typically did not serve with SCF, which has the potential to significantly increase the solution’s adoption in the near future.

It is because of the B2B cloud revolution that these new solution providers have arisen to “scale” the value of SCF through new financial technology. SCF’s adoption rates have so far been hamstrung because of its legacy as a service-oriented solution instead of a technological one. It is as a result of this new type of solution, however, that 38% of enterprises plan to implement SCF within the next 12 to 24 months — one of the highest planned adoption levels in the past five years. This level of attention paid to SCF can be attributed not only to the persistently low financial yields forcing enterprises to look for new ways to maximize their return on capital, but also the increase in cloud-based solutions leveling the playing field in the first place. The low adoption of, but high interest in, SCF could indicate a sharp rise in the solution’s adoption in the near future — especially as more enterprises begin to look for new ways to extend the value from their cash management activities.

Strategies for Success

The proliferation of cloud-based supply chain finance solutions has opened the door to a wider array of buyers that are often eager to benefit from the ability to maximize DPO without the negative reputational impact of extending payment terms. This does not mean that adding SCF to the roster of financial solutions is advisable without careful consideration of the enterprise’s technology infrastructure as well as its overall cash management goals. As with other new solutions and processes, enterprises must develop a roadmap for implementation that includes understanding current processes and involves all relevant stakeholders. More specifically, for enterprises seeking to implement SCF as part of their financial solutions portfolio, Ardent Partners recommends that AP/finance teams:

- Integrate supplier payments into the enterprise’s cash management strategy. Supplier payments are frequently the single largest non-payroll source of cash outflow for a business. Finance teams should integrate the relevant data on current and upcoming payments into their cash management decisions if supply chain finance is to have a demonstrable impact on working capital; if finance does not account for supplier payments, AP could decide to offer SCF as an early payment option in a vacuum — without the larger insights that finance can provide, which would fit the solution neatly into cash management initiatives.

- Understand the SCF solution offerings in the marketplace and how such technologies can integrate into current cash management strategies. The rise of cloud solutions has made SCF accessible for more and more businesses. It is imperative that the finance team understands the current solutions available in the marketplace, as well as how SCF can be most beneficially integrated into current cash management activities. This understanding can make the difference between a successful implementation of an SCF solution and one that causes unnecessary logistical headaches for the IT team as well as other finance employees.

- Ensure AP has the tools they need to execute the SCF strategy/solution. Given AP’s command over supplier invoices, they are a critical participant in the supply chain finance process. Because of this, it is absolutely vital that AP has the operational capabilities and technological acumen required to successfully operate a SCF program. Every effort should be made to ensure that AP has all the tools and competencies necessary to be successful in the implementation phase and beyond.

- Consider which suppliers will be given the option to participate in the SCF program. SCF has traditionally been offered only to large suppliers, but the rise of cloud solutions has made it possible to offer these terms to additional vendors. This does not necessarily mean that every supplier should be offered SCF — the enterprise may not do enough business with certain suppliers — or even want to participate. Either way, the enterprise must build the SCF program carefully to ensure maximum working capital benefits.

Conclusion

The old adage that “cash is king” will never fade. Current global financial conditions dictate that businesses find alternative avenues to boost liquidity and optimize cash management. Supply chain finance has become a viable option for those companies seeking new cash management strategies that can ease the tension of cash management and provide the greater organization with enhanced visibility and access to capital. SCF programs that improve their supplier relationships create one of the few “win-win” propositions in the business world, and the increase in cloud providers offering the solution class has opened up the door for new enterprises to take advantage of this innovative cash management method.

About Ardent Partners

Ardent Partners is a Boston-based research and advisory firm focused on defining and advancing the supply management strategies, processes, and technologies that drive business value and accelerate organizational transformation within the enterprise. Ardent also publishes the CPO Rising and Payables Place websites. Register for exclusive access to (and discounts on) Ardent Partners research at ardentpartners.com/newsletter-registration/ and join its LinkedIn Group.

©️ 2016 Ardent Partners, Ltd. All rights reserved. Reproduction and distribution of this publication in any form without prior written permission is forbidden. Solution providers and consultancies should take special note that Ardent Partners reserves the right to seek legal remedies including injunctions, impoundment, destruction, damages, and fees for any copyright infringement (which includes but is not limited to usage of any Ardent Partners content in company collateral, presentations, and websites) in accordance with the laws of the Commonwealth of Massachusetts and the United States.