Fact Sheet

Unlocking Enterprise Liquidity Management: Developing Your Ironclad Business Case for Liquidity Transformation

Establishing a Compelling Value Proposition for Liquidity Transformation: What, Why and Why Now?

Digital transformation continues to occupy front and centre stage across all areas of finance and banking. The pandemic and geo-political shocks have amplified the need for real time insights enabling confidence in financial decisions, especially as they relate to liquidity. These events have caused companies to adapt their business models, ensure the availability of sufficient liquidity even in the worst-case scenarios and further accelerated existing digital transformation initiatives. Treasury & finance organizations are being called upon to provide more reliable and timely insights in support of executive strategic decisions.

However, for those organizations with existing legacy manual processes and tools providing such real-time insights to executive boards proves quite challenging. We find that organizations across all sectors in the treasury space are looking for digital solutions to help improve the maturity of their processes and elevate treasury to a more prominent role in the organization.

Despite the urgency in acting, many Treasury organizations are challenged with successfully securing funding for digital transformation. Unlike many of their sister finance organizations, Accounting, FP&A, who have had a long tradition of justifying significant investments to support corporate objectives, treasury has struggled to get priority for its investments. Too often, a treasury business case is developed to address tactical operational needs and does not address how the investment will benefit the entire organization.

Chief financial officers typically receive requests from multiple departments for project funding. The challenge is that they can only approve a fraction of these projects. Funding is scarce. Projects are approved based on meaningful, measurable, and provable business outcomes. Historically, treasury departments have not been heavily invested in, and operated with rudimentary offline tools. This makes it even more critical to produce a comprehensive case for change that clearly articulates all the positive business outcomes of the project and further links these benefits to the strategic objectives of the organization.

The good news is that this struggle is not unique to treasury. A recent Gartner survey of 2,500 business leaders in 25 countries, “Gartner Digital Markets: “Global Software Trends and Buyer Behaviour Insights 2022”, published in May 2022, states that the most valuable information in “the final decision” of technology buyers is the “Value Assessment”.1 In this whitepaper, we will share best practices garnered through 1,600 client engagements to assist in improving the formulation of a case for change that addresses both treasury needs and corporate goals. In other words, what is required to create a compelling Value Assessment to support technologyenabled transformation.

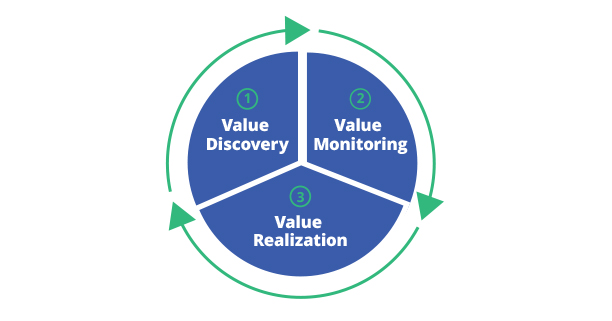

When building a case for change, Kyriba Value Engineering has identified three best practices to secure funding for any technology-led initiative. Properly articulating the business outcomes and value of a technology investment will structure an appealing and credible value proposition and greatly improve the chances that a project gets approval from the executive team.

Here is what we believe to be your must do list:

- Process Analysis: Understand what processes are working well and what processes offer an opportunity for improvement. Solves for the “What” question.

- Build a financial business case that will provide a meaningful and actionable return for the enterprise. Takes care of the “Why” question.

- Perform a Risk Assessment to understand the vulnerabilities and threats from the existing status quo, identify impact and develop mitigation strategies. While this return is hard to quantify, the impact can be very detrimental to an organization. Addresses the “Why Now” question.

The Kyriba Value Engineering team has assisted over 1600 companies, across all sectors, revenue sizes and geographies, to perform the right process diagnostics, develop ironclad, board-ready value assessment, and provide risk and threat profiles with implications and mitigation strategies. To conduct this level of analysis, the Kyriba Value Engineering team has recruited the best in the business. Each Value Engineer has over 15 years of field, treasury and finance experience, and hundreds of assessments under her/his belt, and are relentlessly focuses on client satisfaction. Each Value Engineer will collaborate with your team to create the compelling case you need to secure the required investment to support your treasury transformation.

See Where Your Organization Stands

Compared to Industry Leaders