the sometimes substantial

hard-dollar costs, payments fraud

can result in lower productivity

among employees tasked with

dealing with the fallout, adverse

customer experiences, the ac-

tual loss of customers, a stained

corporate reputation, and, for

publicly traded companies, losses

in stock market valuation.

For CFOs charged with safe-

guarding corporate coffers,

there is no silver bullet that

can stop payments fraud in its

tracks. Managing and minimizing

the problem is a discipline unto

itself. Done well, it is a holistic,

proactive undertaking that com-

bines best-practice processes

with dedicated detection and

monitoring programs built on

the latest advanced technolo-

gies. Done well, it also allows

CFOs to do a better job of keep-

ing corporate directors apprised

of the risks their companies face

in this area, and the safeguards

in place to mitigate them.

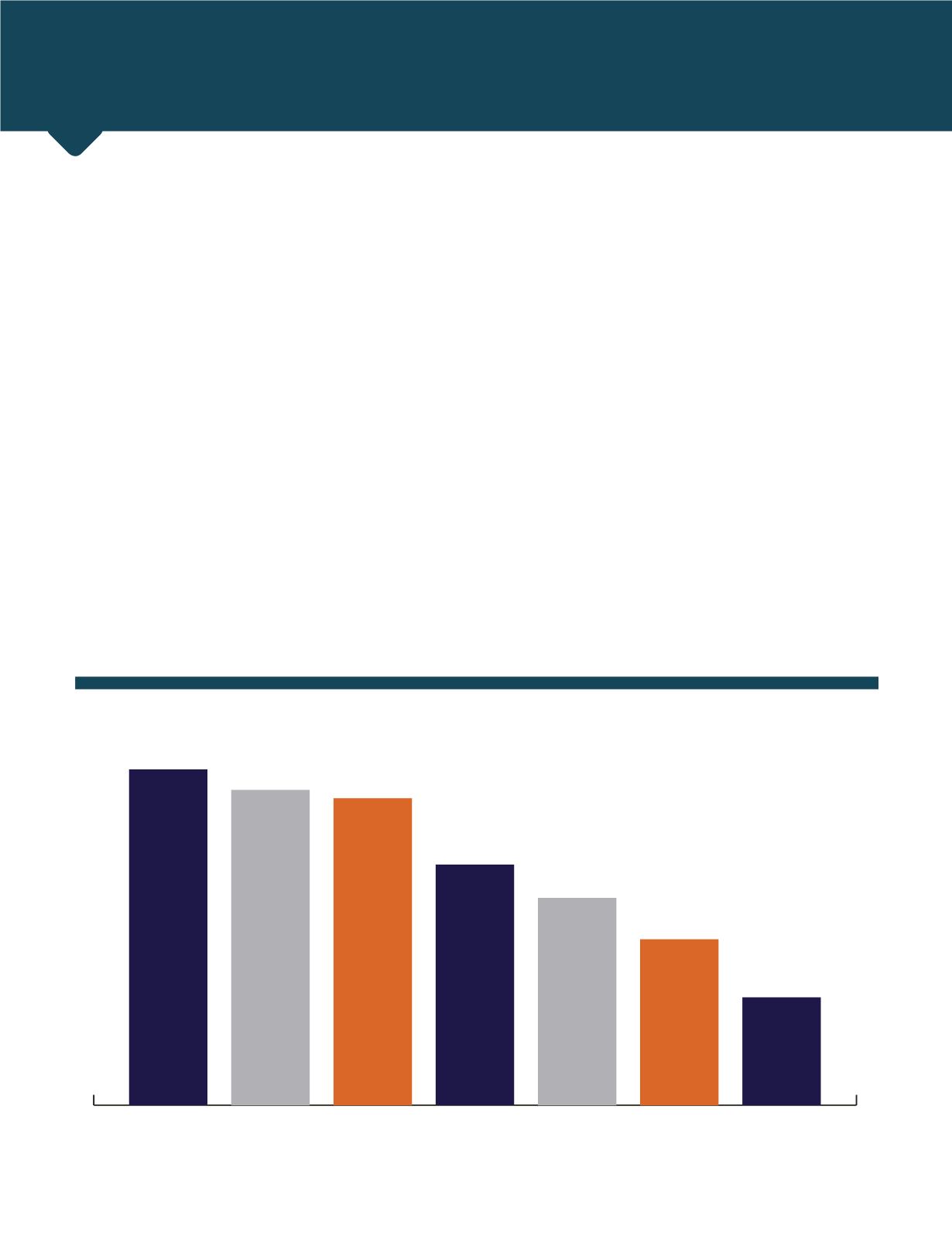

IDENTIFYING—AND RESOLVING—

THE CHALLENGES TO SUCCESS

The biggest challenge that CFOs

face in combatting payments

fraud is finding and implementing

the right technology. Technology

was cited as a key challenge by

nearly one-in-two (45 percent) of

survey respondents in the recent

CFO Research survey. Conduct-

ed in collaboration with Kyriba,

the survey polled 167 U.S. finance

executives at companies with

more than $100 million in annual

revenues across a wide range of

industries. (See Figure 1).

Other commonly cited obsta-

cles include securing the bud-

get for anti-fraud initiatives (38

percent), and finding the time

to pursue them (37 percent).

Rounding out the top five chal-

lenges, finance executives say

it’s a challenge to assemble

a team with the skill sets (29

percent) and knowledge base

(25 percent) needed to fight

payments fraud effectively. And,

anecdotally, some respondents

2

I

FIVE KEY CFO CHALLENGES FOR ADDRESSING PAYMENTS FRAUD

FIGURE 1

The biggest challenges my finance team faces in trying to combat payments fraud

Multiple responses allowed

45%

38%

37%

29%

13%

25%

20%

Technology Budget

Time/

availability

Talent/

skill set

Knowledge

base

Corporate

culture

C-Suite

buy-in