eBook

Aite Matrix Evaluation: Corporate Treasury Management Systems’ Readiness

Table of Contents

INTRODUCTION

Corporate treasurers are aware that the personal computing systems used for handling administrative and repetitive tasks are quickly becoming unfit to deal with frequent market changes and to manage complex data transactions between multiple parties and institutions. Therefore, corporate treasurers (especially in small and midsize enterprises [SMEs]) are replacing their basic personal accounting system with a more robust TMS and are in the process of learning how to select the right solution.

It is not so infrequent that corporate treasury officers are put in front of myriad alternative solutions that only confound their selection process, as treasurers remain entangled in product demos and features-and-functions “fireworks” that make the short-listing decision harder. Aite Group is fully aware of this and proposes an evaluation approach that factors in all the key elements for a successful selection and, more important, an ongoing positive business relationship with the chosen vendor.

This Aite Matrix evaluation report explores some of the key trends within the TMS market and discusses the ways in which technology is evolving to address new market needs and challenges. This report compares and contrasts the leading vendors’ offerings and strategies, and it highlights their primary strengths and challenges. In particular, it assesses each vendor’s readiness to offer product functionalities that Aite Group expects will become mainstream in the next two years.

Finally, to help corporate executives make more informed decisions as they select new technology partners, this report recognizes specific vendors for their strengths in critical areas.

METHODOLOGY

Leveraging the Aite Matrix, a proprietary Aite Group vendor assessment framework, this report evaluates the overall competitive position of each vendor, focusing on vendor stability, client strength, product features, and client services.

The following criteria were applied to develop a list of vendors for participation:

- International presence

- Functional coverage for corporate treasuries, assessing the vendors’ capabilities to offer a portfolio beyond the “basic” functionalities of a TMS: cash and liquidity management, payments initiation, bank account management, and cash forecasting

- Focus on companies with annual revenue over US$500 million

Participating vendors were required to complete a detailed product RFI composed of both qualitative and quantitative questions, conduct a minimum 60-minute product demo, and provide active client references.

THE PLAYERS

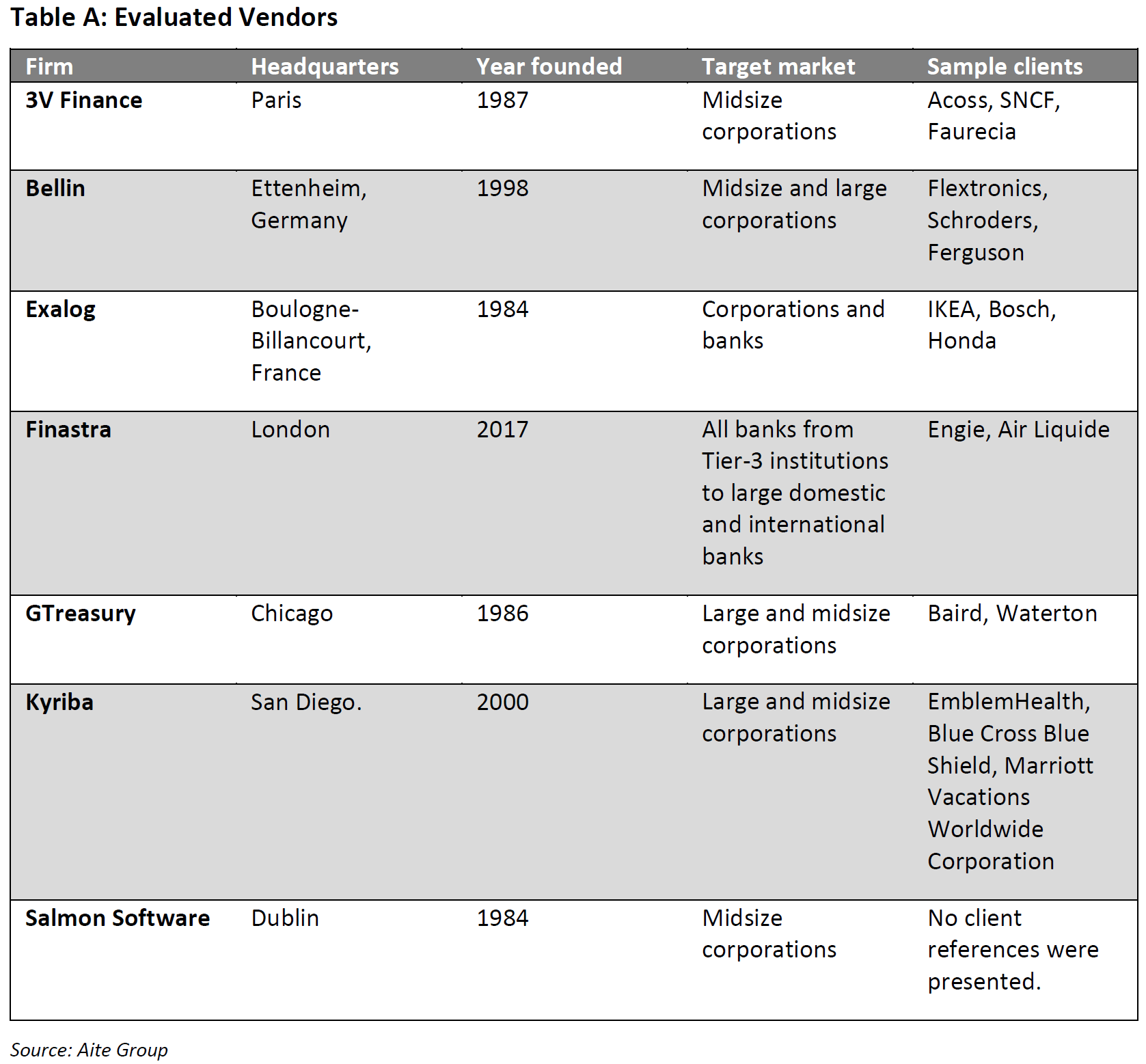

This section presents comparative data and profiles for the individual vendors that participated in the Aite Matrix evaluation. This is by no means an exhaustive list of vendors, and firms looking to undergo a vendor selection process should conduct initial due diligence prior to assembling a list of vendors appropriate for their own unique needs. Table A presents basic vendor information for the participating solutions.

THE MARKET

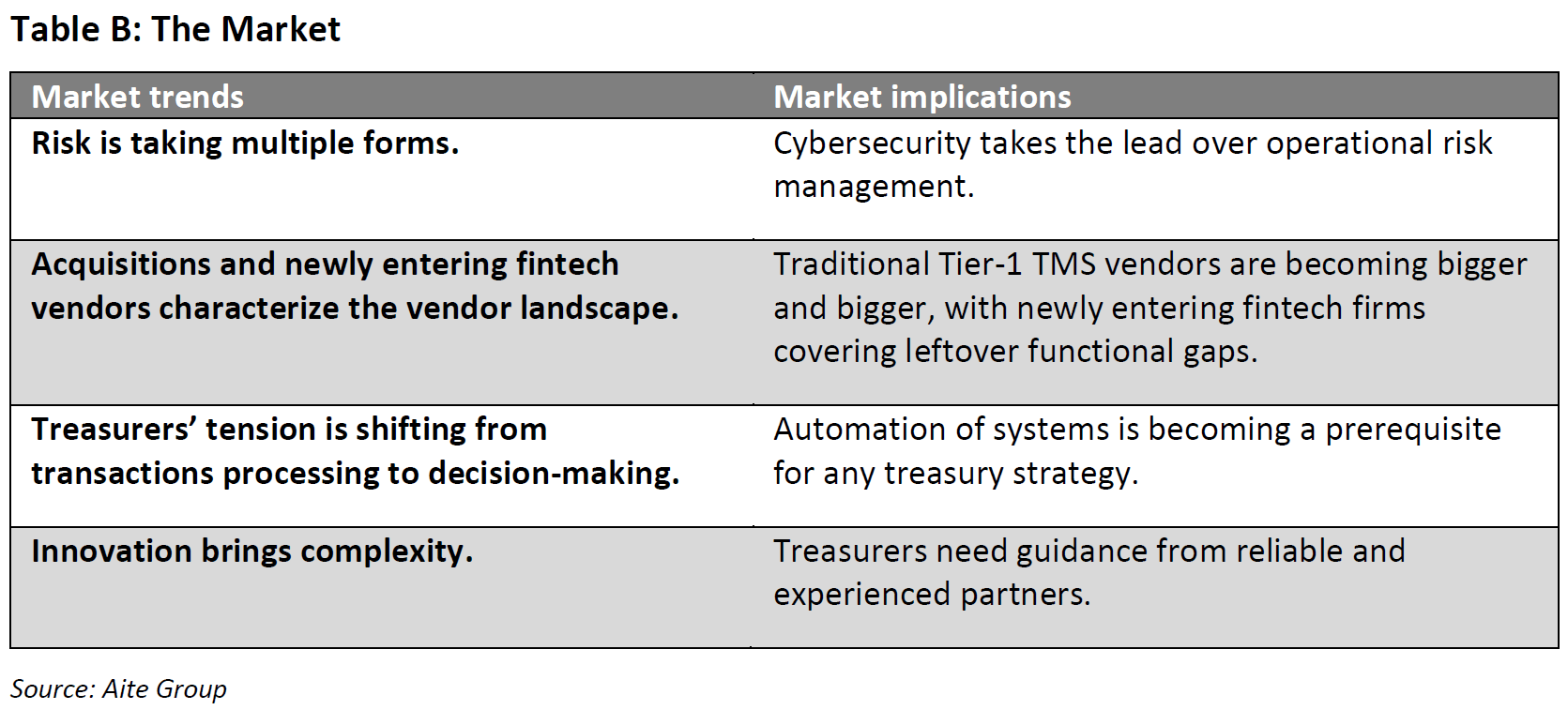

The following market trends are shaping the present and future of the TMS market (Table B).

KEY STATISTICS

This section provides information and analysis on key market statistics as well as projected IT spending related to the vendor market.

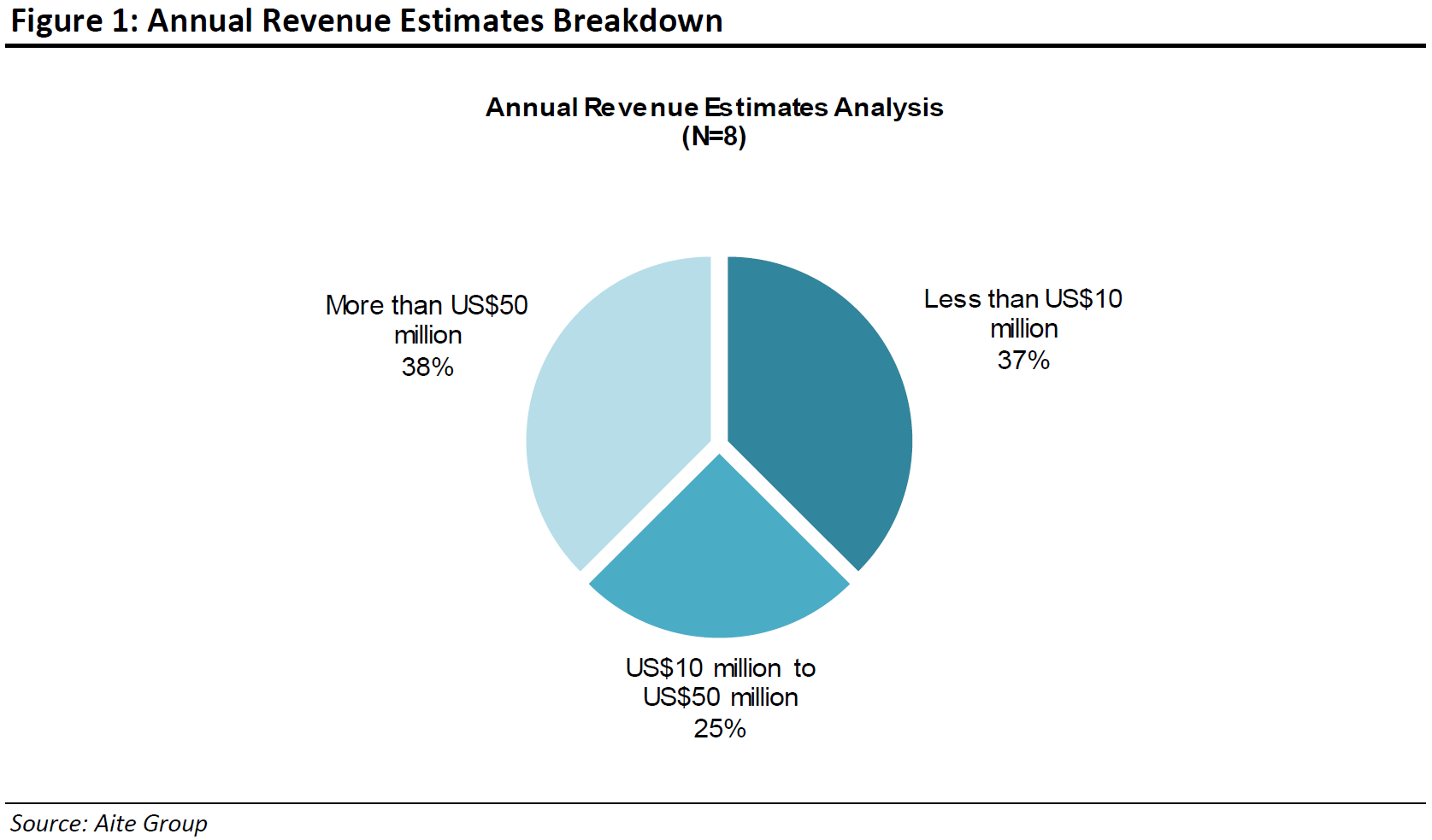

ANNUAL REVENUE ESTIMATES ANALYSIS

The market presence of TMS vendors is evenly distributed among various revenue tranches (Figure 1). The consolidation of the largest players has opened space for lower-tier vendors that have improved their international presence and enlarged the scope of their product portfolio.

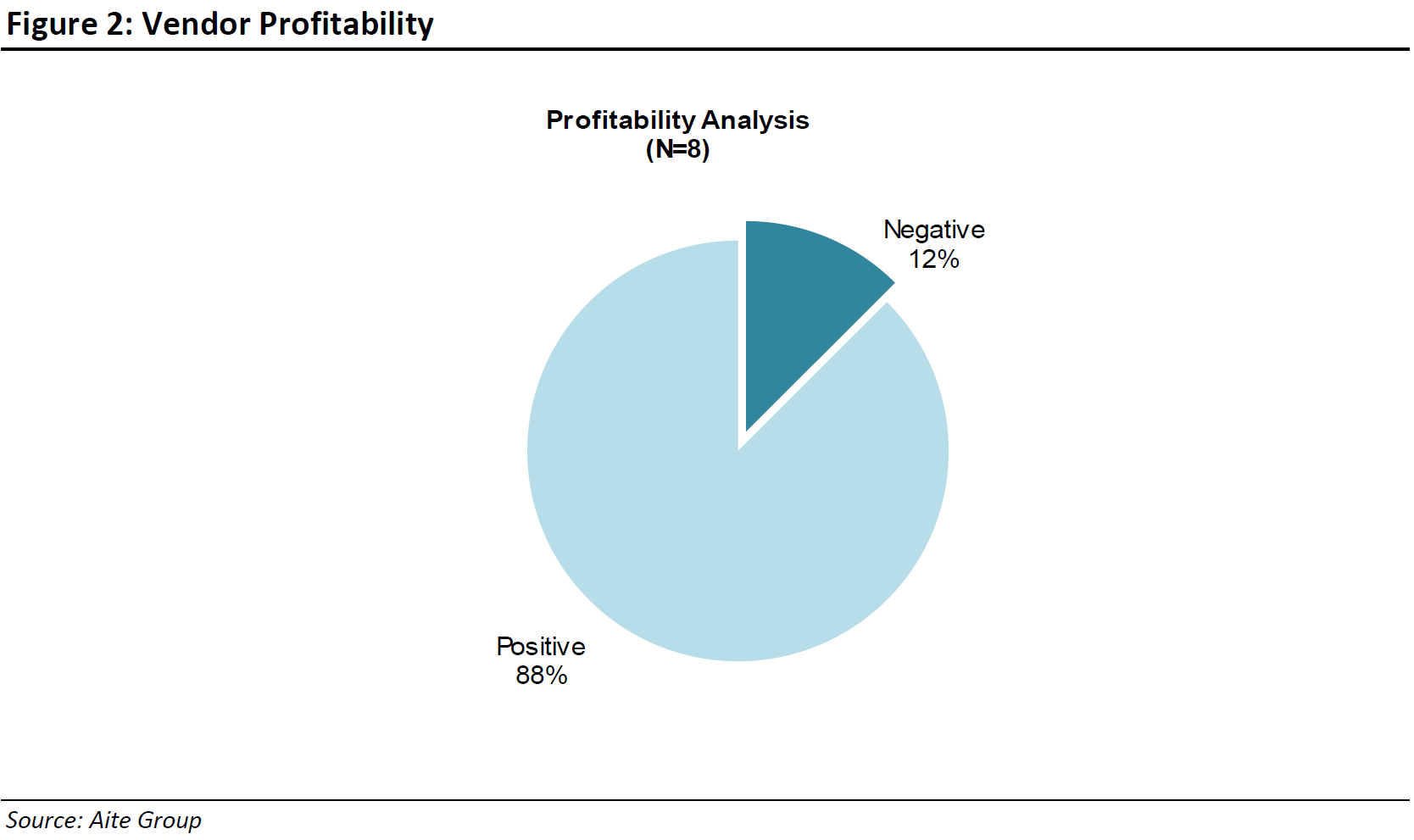

PROFITABILITY ANALYSIS

Although TMS vendors still find some resistance to change by corporate treasurers who prefer to remain loyal to their proprietary electronic spreadsheet tables, the demand for robust treasury software applications is strong. TMS vendors that are capable of corresponding to purchasing requirements (i.e., features and service) of their corporate prospects enjoy healthy returns (Figure 2).

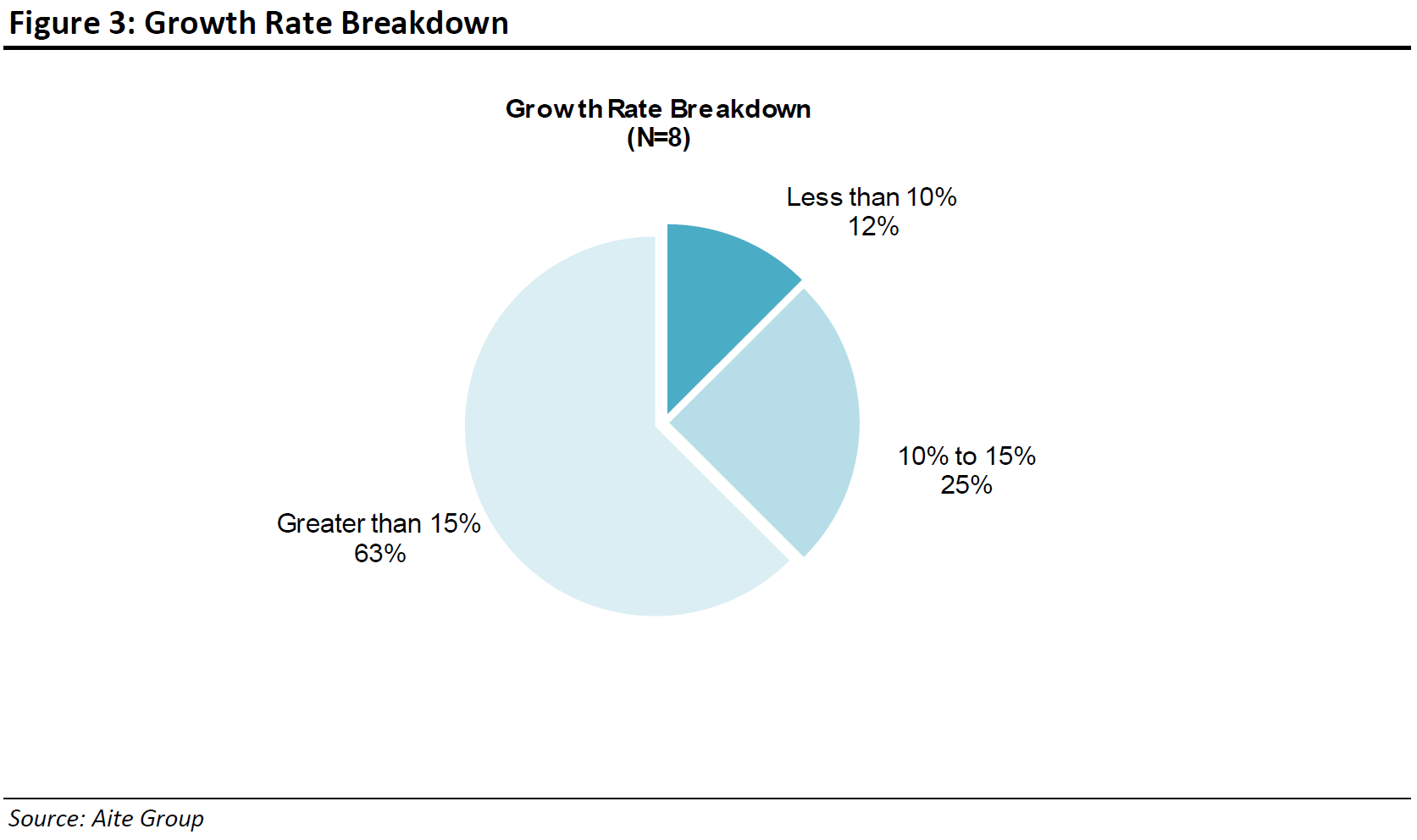

GROWTH RATE ANALYSIS

The positive results of vendor profitability are reflected in the breakdown of the assessed vendors’ growth (Figure 3). A consistent majority (63%) experienced a double-digit growth over 15%. Only a relative minority (12%) had limited—yet still positive—business success. The results were lower than expected in only one case.

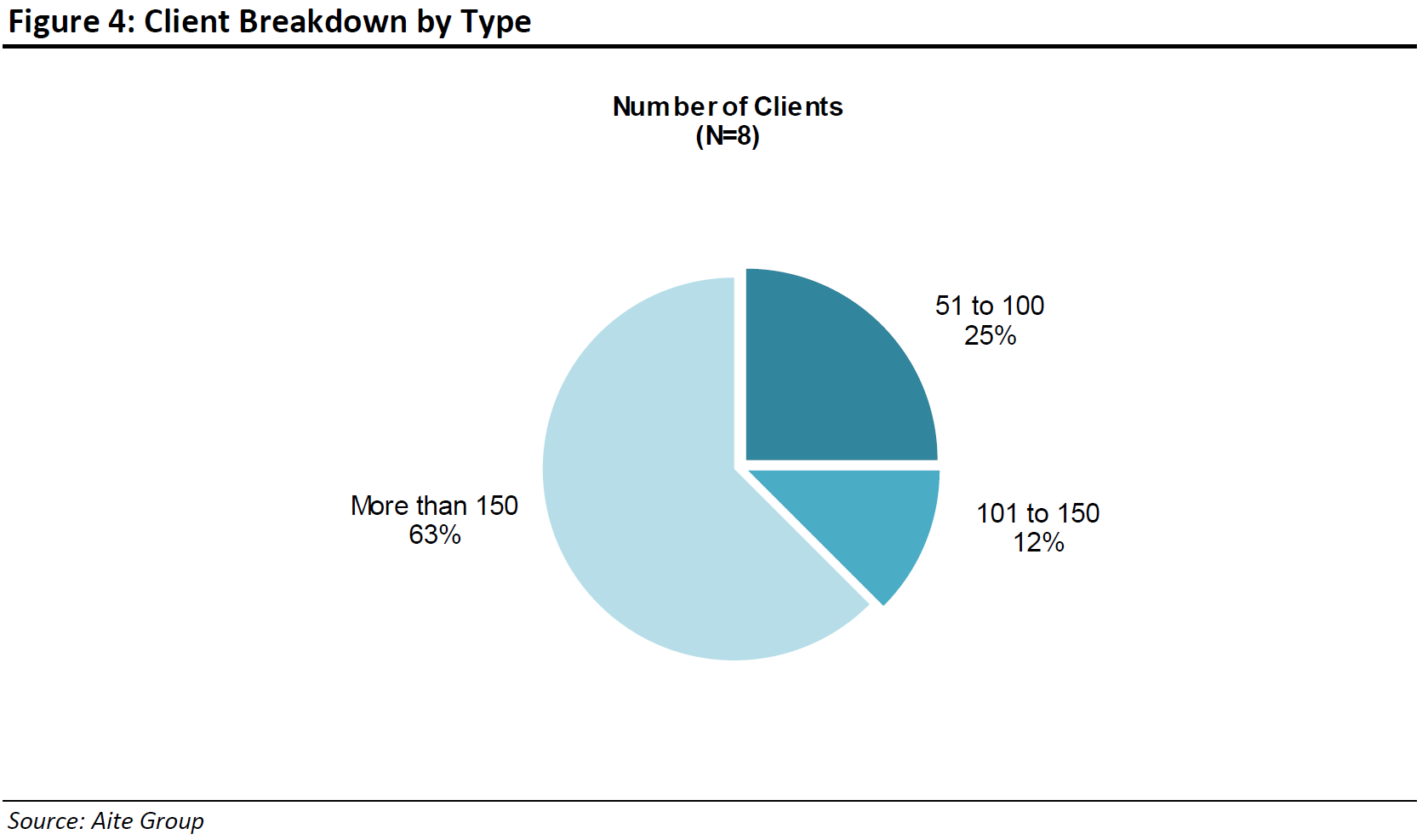

CLIENT BREAKDOWN BY TYPE

An analysis of the distribution of number of clients among TMS vendors (Figure 4) suggests a form of correlation with the vendors’ business profitability (Figure 2); the more clients served (a client is a registered company—multiple installations at same registered company count as one), the higher the profitability.

As soon as the client base diminishes, the profitability drops significantly, only to increase again when there are fewer than 100 clients. The explanation may reside in the fact that profitable clients are large or very large corporations with budgets that recognize the value of the software and services combination and are ready to pay for it. With such a group of clients, TMS vendors are ready to expand their sales campaigns and are confident of two important elements: They have a good set of client references to leverage, and the profitable returns can subsidize the costs for extended sales programs that conclude with an increase in the market share and new client acquisitions.

As soon as the resources to invest diminish, however, the client base is reduced, and this may create a vicious circle. Only by focusing on a limited—yet more controllable—pool of clients, the TMS vendors can generate efficiencies and offer standardized solutions that allow them to see their returns increase again.

AITE MATRIX EVALUATION

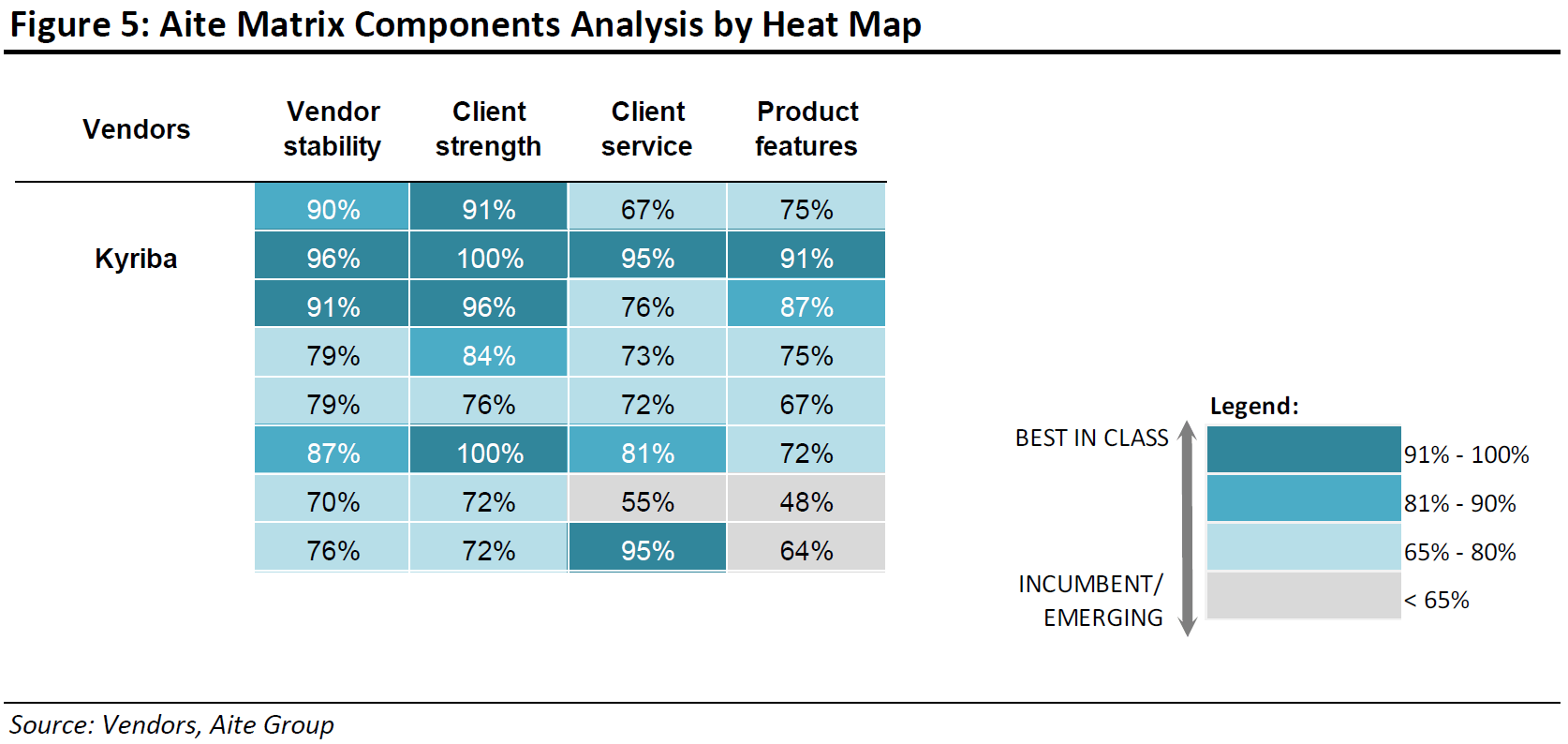

This section will break down the individual Aite Matrix components, drawing out the vendors that are strong in each area and how they are differentiated in the market.

THE AITE MATRIX COMPONENTS ANALYSIS

Figure 5 overviews how each vendor scored in the various areas of importance. Each vendor is rated, in part, based on its own data provided when responding to the RFI distributed by Aite Group as well as on product demos and follow-up discussions as part of the Aite Matrix process. Ratings are also driven by the reference customers of the examined vendors to support a multidimensional rating.

VENDOR STABILITY

Kyriba leverages its long-lasting presence in the market and global geographical presence. It also has a robust workforce with significant treasury management experience.

CLIENT STRENGTH

All vendors serve clients in multiple geographies and in a diversity of industry segments. Kyriba, in particular, received high scores from client reference checks for vendor reputation.

CLIENT SERVICE

Kyriba stands out from the competition. This must not induce in error believing that the other vendors are not careful to their clients. They all offer global and localized support as a standard service with no additional fees. They also measure their performance by contractualizing service-level agreements. The elements that differentiate Kyriba are relative to client reference feedback for service and support, as well as the low implementation costs relative to its pure Software-as-a-Service (SaaS) offering.

PRODUCT FEATURES

All analyzed vendors deliver fundamental treasury management features of cash and liquidity management, cash forecasting, risk management, payments, investments, funds trading, and debt and equity deal management. The analysis for this report has gone deeper in assessing the vendors’ capabilities to deliver product features closer to the needs of the evolving role of the corporate treasurer: artificial intelligence (AI)-based application that suggests course of action based on the standards being followed in the country of reference, alerts from supply chain events that impact treasury operations (e.g., large purchase order will require funding, delivery delay to client requires cash inflows rescheduling, peak in production requires liquidity to pay extra working hours and temporary staff), and direct integration with major supply chain finance (SCF) platforms via APIs.

The above are the specific features that Kyriba displays alongside an already robust TMS applications portfolio.

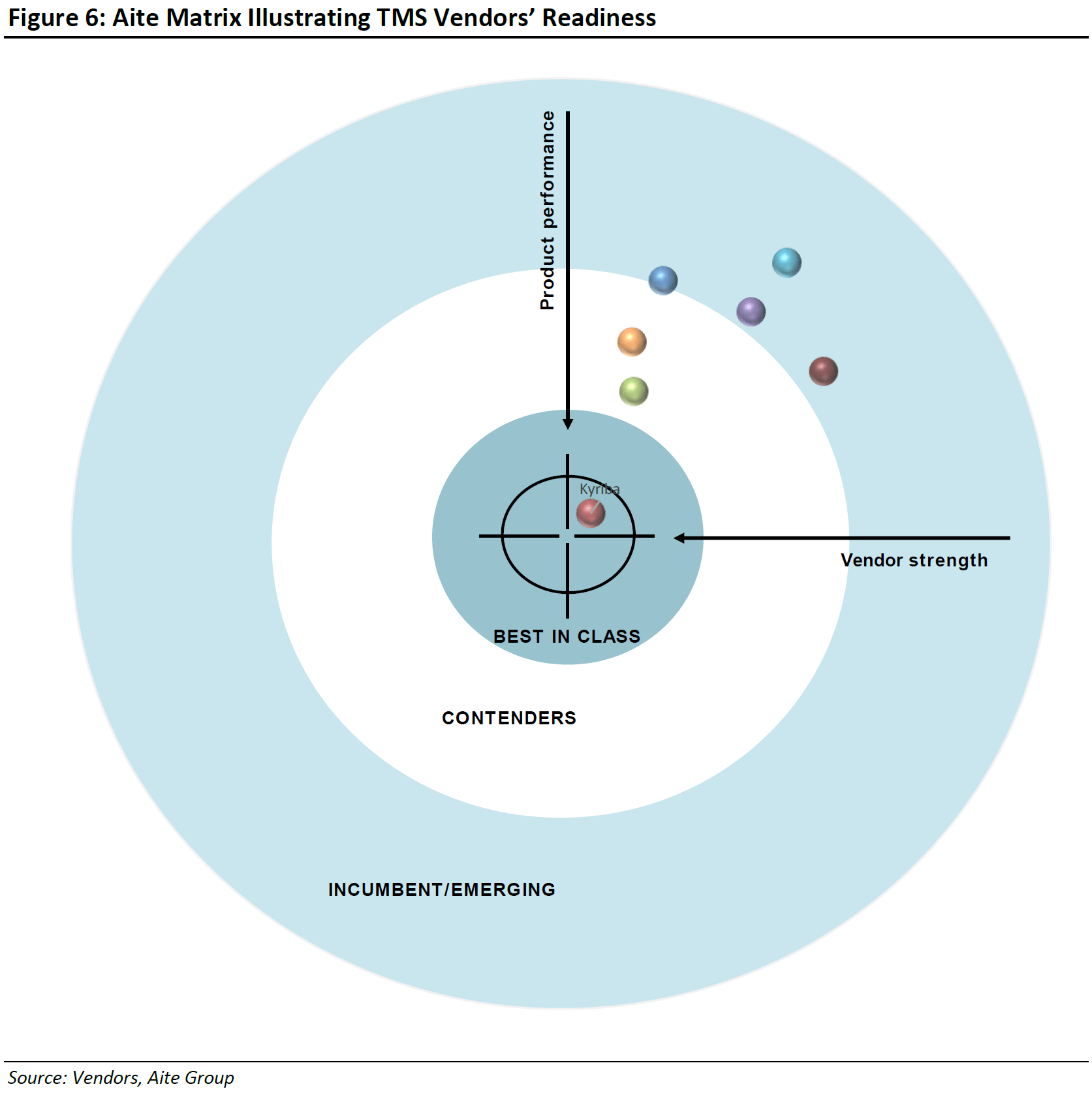

THE AITE MATRIX RECOGNITION

To recap, the final results of the Aite Matrix recognition are driven by three major factors:

- Vendor-provided information based on Aite Group’s detailed Aite Matrix RFI document

- Participating vendors’ client reference feedback and/or feedback sourced independently by Aite Group

- Analysis based on market knowledge and product demos provided by participating vendors

Figure 6 represents the final Aite Matrix evaluation.

BEST-IN-CLASS VENDOR: KYRIBA

Kyriba emerges as the clear winner among the examined contenders. Aite group appreciates the vendor’s extended product footprint to cover a large portion of a treasurers’ daily routine operations—namely, supply chain, trade finance, and bank account operations management from the corporate ERP or TMS. Kyriba excelled in the following:

-

- Vendor strength:

Kyriba has a clear vision of corporate treasury’s needs and expectations. Its out-of-the-box thinking led the vendor to anticipate the benefits of integrating a supply chain finance engine as part of its core product’s stack. Its attention to leveraging APIs to create ERP and bank plug-ins is a further testament of this continuous attention.

- Product performance: Of particular relevance are cash forecasting tools, bank connectivity interfaces, and ease of use and implementation due to its native SaaS construct.

BEST IN CLASS: KYRIBA

Kyriba began operations in France in 2000 as a spin-off from Sage XRT (now part of Aritmos). The headquarters was relocated to the U.S. in 2004. Private equity firm Bridgepoint Capital became a majority shareholder in April 2019 and added a US$160 million growth investment to help Kyriba continue its product innovation and growth strategy.

Kyriba delivers an in-house-developed pure SaaS finance software platform with integrated bank connectivity. Through its fully virtualized, multitenant treasury cloud, Kyriba offers a suite of solutions for corporate treasury and finance: treasury, payments, risk management, and working capital. The SaaS nature of the solution allows the firm to keep implementation time typically between six and nine months. Smaller, less complex projects can be rolled out in weeks.

Kyriba is a SWIFT-certified application for cash management and an authorized reseller of SWIFT Alliance Lite2 for business applications. Kyriba’s SWIFT Service Bureau offers clients their own SWIFT BIC, fully managed by Kyriba, alongside an outsourced MT Concentrator model that allows organizations to utilize a SWIFT BIC specifically provisioned for Kyriba clients, instead of becoming a SWIFT member. The bank or corporate subsidiary data is consolidated, normalized, and integrated into a portal that provides liquidity dashboards, cash flow forecasting, daily cash positioning, and zero-balance account structure, as well as intercompany loan balance and transaction data, FX capture, tracking, and revaluation.

After the injection of fresh funds from Bridgepoint Capital, Kyriba is focused on product development and continued customer support while expanding its partnership ecosystem. While the full list of implementation partners cannot be disclosed, the vendor employs an extensive partner program spread across regions, ranging from large partners such as Accenture to smaller domestic treasury-specific associates.

Kyriba’s SaaS cloud-based solutions automate an “on-demand” collection of data from multiple banks and company subsidiaries, leveraging connectivity channels for both treasury and ERP that reach over 100 international banks with a prebuilt inventory of bank formats. Kyriba supports over 125 payment formats with over 45,000 different payment scenarios (e.g., by type, geography, bank). Relevant attention and investment are dedicated to APIs. The API integration builds upon Kyriba’s leading connectivity options, considering that recently published figures tell that the vendor processes more than 83 million bank transactions, 30 million payments, and 530 million ERP transactions on behalf of its clients each month through its global connectivity hub.

Kyriba’s main target is to be recognized as the treasury management and payments hub solution provider that offers real-time payments to its bank partners’ corporate customers. In February 2019, Kyriba announced an API-based integration with Citi.1 Later in May, it announced a real-time payments feature using JP Morgan’s API that will enable joint Kyriba and JP Morgan clients to send real-time corporate payments in the U.S. through The Clearing House’s RTP network.2

Commenting on how the competitive environment will evolve over the next two years, Kyriba representatives believe that there is a possibility for further consolidation, as some competitors are challenged financially. It is unlikely that more competition will emerge, as recent entrants have struggled. As new technologies such as RPA and AI become mainstay requirements for treasury, the vendor expects a divergence between platforms that can evolve their technology and those that cannot. Another variable is the broadening of treasury responsibilities into areas such as risk management and procure to pay. Competitors that cannot extend their functionality to meet these additional requirements will find themselves uncompetitive.

Kyriba is predicting growth across all sizes of organizations, including smaller midmarket businesses, with the Americas and the Asia-Pacific representing the highest growth markets.

AITE GROUP’S TAKE

Kyriba’s strong tradition of long-term partnerships and its one platform that blends typical treasury and risk management functionalities, with additional features for payments and working capital optimization, create unique selling points that set a benchmark in the TMS market. Reference clients told Aite Group that the deciding factors to select Kyriba were the vendor’s company viability, its history of long-term well-established partnerships, the richness of treasury functionalities, and Kyriba’s value engineering support during the final evaluation process that provided the corporate decision-makers with the right elements to build the business case.

An element that still creates a barrier to further adoption by prospective clients is the price of the TMS that may discourage companies with smaller treasury budgets than those traditionally served by Kyriba. Other business challenges are represented by the continuous demand from corporate treasurers to have immediate TMS solutions to manage unexpected FX volatility, adapt to innovative cash optimization techniques (e.g., dynamic discounting, real-time invoice discounting), and apply data intelligence algorithms to unstructured data sources (e.g., website transactions, social media data flows).

Aite Group finds that Kyriba is well poised to exert and maintain competitive leadership by further investing monetary and intellectual resources to leverage the top technology trends that impact its corporate clients’ business: APIs, open banking, data visualization, real-time data analysis, RPA, and AI.

BASIC FIRM AND PRODUCT INFORMATION

- Headquarters: San Diego, California

- Founded: 2000

- Number of employees: 700

- Key financial information: Annual revenue US$110 million (estimated 2018)

- Key products and services: Kyriba (with modules that can be sold separately: Treasury, Payments, Risk Management, and Working Capital)

- Target customer base: Large and midsize corporations

- Number of clients: 2,000

- Average client tenure: 10 years

- Global footprint: Global

- Implementation options: Pure SaaS

- Pricing structure: Based on module use, complexity, and number of users

KEY FEATURES AND FUNCTIONALITY BASED ON PRODUCT DEMO

- AI-based application that pops up relevant KPIs based on business event triggers (e.g., bank change of price conditions, change in insurance premium)

- Cost accounting structure for treasury managed costs (e.g., staff, bank accounts, commissions)

- Alerts from supply chain events that impact treasury operations

- Alerts relative to political events in countries in which the client company does business—these alerts pop up any time the treasury office is executing operations related to that country

- What-if scenario planning triggered by financial event

- Integrate directly with major SCF platforms (e.g., Premium technology, Taulia, C2FO) via APIs

TOP THREE STRATEGIC PRODUCT INITIATIVES OVER LAST THREE YEARS

- Real-time fraud detection for treasury and supplier payments

- End-to-end risk management from exposure identification and analysis to hedge accounting and compliance

- Data warehousing, business intelligence, and data visualization

TOP THREE STRATEGIC PRODUCT INITIATIVES IN THE NEXT 12 TO 18 MONTHS

- Standardize API development across the entire banking and ERP community

- Further introduction of AI and machine learning throughout the platform

- Working capital management and analysis

CLIENT FEEDBACK

Interviewed clients appreciate Kyriba’s commitment to security and risk prevention. By improving efficiency and automation with the TMS, clients recognize they have made substantial time and resource savings. TMS-enabled cash pools and in-house banks have enabled corporate treasury departments to reduce bank charges, lower borrowing costs, and achieve tax efficiencies.

Clients like Kyriba’s SaaS architecture, as it gives them access to a mission-critical platform from any location, without any hardware investment and without the headache of upgrades. Alongside the cloud-based structure, corporate users enjoy more basic, yet important for the daily routine, gained efficiencies of their cash operations. The TMS provides the tools to forecast cash more accurately and effectively, especially when accompanied by efficient implementation and support teams.

Totally cloud-based software may be seen by customers in different ways. Large multinational treasury departments prefer a standardized set of modules that do not require (nor are designed for) customization. Smaller firm clients may expect the possibility to change the software features to adapt to their preferences. Over time, though, these users appreciate the opportunity to use software modules continuously adapted and upgraded based on the input of thousands of users that run the same software. The requests to change and adapt the software to every specific requirement significantly diminish, although some form of parametrization (i.e., configuration) is expected for functionalities that have natively high levels of personalization, such as FX exposure management, business intelligence, data visualization, and connectivity APIs.

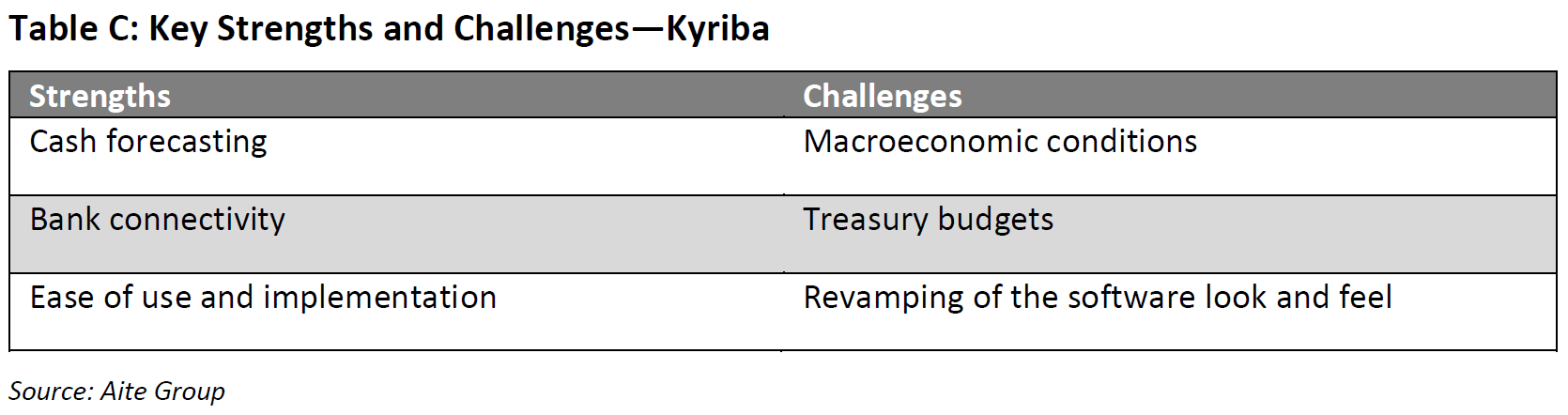

Table C displays the vendor’s strengths and challenges.

CONCLUSION

Buyers:

- Evaluate the overall competitive position of each TMS vendor by focusing on multiple selection criteria: vendor stability, client strength, product features, and client services.

- Don’t ask for continual customizations; rather, rely on the vendor’s acquired experience of working with numerous corporate clients and leverage the offered solutions that bear the fruits of industry best practices and techniques.

- Look for TMS vendors that don’t require a total transformation of your treasury operations but that allow for a smooth transition that blends your current information systems with the newly introduced treasury software.

ABOUT AITE GROUP

Aite Group is a global research and advisory firm delivering comprehensive, actionable advice on business, technology, and regulatory issues and their impact on the financial services industry. With expertise in banking, payments, insurance, wealth management, and the capital markets, we guide financial institutions, technology providers, and consulting firms worldwide. We partner with our clients, revealing their blind spots and delivering insights to make their businesses smarter and stronger. Visit us on the web and connect with us on Twitter and LinkedIn.

AUTHOR INFORMATION

Enrico Camerinelli

+39.039.21.00.137

[email protected]

CONTACT

For more information on research and consulting services, please contact:

Aite Group Sales

+1.617.338.6050

[email protected]

For all press and conference inquiries, please contact:

Aite Group PR

+1.617.398.5048

[email protected]

For all other inquiries, please contact:

[email protected]

1. “Kyriba Unveils API Integration With Citi,” Finextra, February 26, 2019, accessed July 18, 2019, https://www.finextra.com/pressarticle/77412/kyriba-unveils-api-integration-with-citi.

2. David Heun, “JPMorgan, Kyriba Turn to Open Development for Real-Time Corporate Payments,” Kyriba, May 23, 2019, accessed July 24, 2019, https://www.kyriba.com/company/media-coverage/jpmorgan-kyriba-turn-open-development-real-time-corporate-payments.