© 2017 Strategic Treasurer.

All rights reserved.

| 2 |

TREASURY UPDATE NEWSLETTER - 2017 Q 2

CORPORATE TREASURY’S

FORECASTING WOES

Cash forecasting is a vital, core functionality

for treasury operations. In fact, in a recent survey

conducted by Strategic Treasurer, 79% of corporate

respondents indicated that forecasting functionality

was regularly used or needed as part of their

ongoing operations. However, of those that were

using a treasury management system (TMS), a full

14% were either dissatisfied or very dissatisfied

with the forecasting functionality it had to offer. An

additional 26% of firms were no longer using the

forecasting module of their TMS because it was

not working properly or was ineffective. As part of

the same survey, 31% of practitioners stated that

their organization used only Excel for managing

treasury-related tasks, including forecasting.

FORECASTING CROSSROADS:

GROWING PAINS

At an organization’s inception, it usually takes

nothing more than a few Excel worksheets to keep

track of company finances. At the start, there are a

minimal number of transactions occurring and only

a handful of accounts that need to be managed.

However, as a company grows, the number of items

that must be accounted for also grows. New banks

and bank accounts are added. Growth means more

transactions are being conducted across more

business units and locations and with more clients.

Ultimately, it is only a matter of time before most

companies arrive at the same crossroads and ask the

same question: “How can we update our technology

infrastructure to meet the evolving needs of the

organization?”

For treasury, the answer to this question commonly

involves leaving their primarily Excel-based

processes to make way for a solution such as a

TMS. However, for companies that have come to rely

on Excel for virtually all their treasury operations,

this is an incredibly daunting task. What’s more,

the skepticism and hesitancy many treasurers have

regarding the use of treasury management systems,

especially for processes such as forecasting, can

cause some companies to consider alternative

approaches and solutions to fill their technology

void.

CHICK-FIL-A’S FORECASTING

CONUNDRUM

The dilemma posed above is a reality that the

corporate treasury department at Chick-fil-A,

an American quick service restaurant chain,

has recently faced as they look to advance their

Excel-based forecasting operations. Until recently,

Steven Peterson, Senior Manager of Treasury at

Chick-fil-A, was content with handling the bulk of

Ultimately, it is only a matter of time

before most companies arrive at the

same crossroads and ask the same

question: “How can we update our

technology infrastructure to meet the

evolving needs of the organization?”

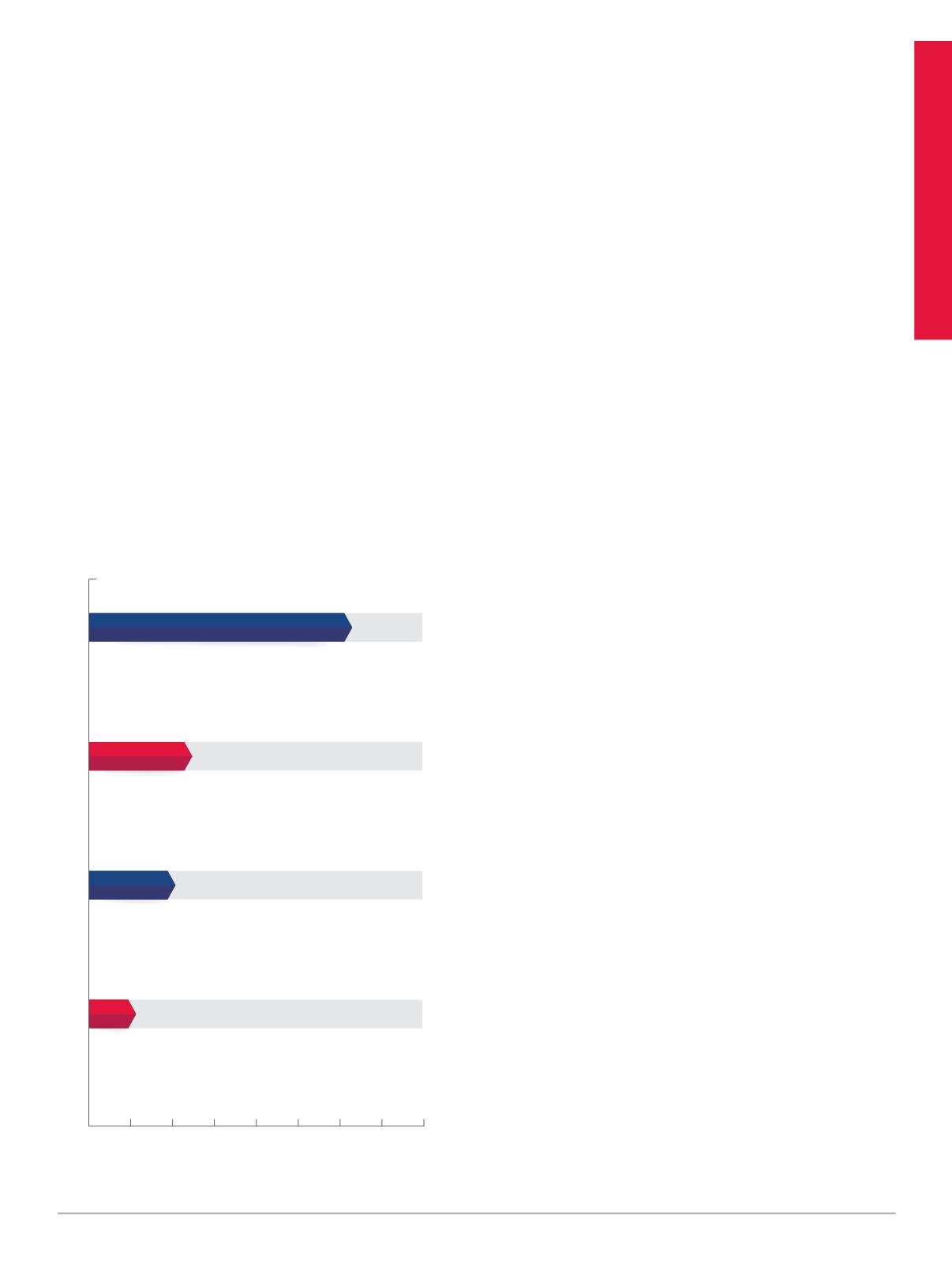

Source: 2016 Strategic Treasurer Technology Use Survey

Corporate Treasury’s

Forecasting Woes

79% of respondents indicated that forecasting

functionality was regularly used or needed as

part of ongoing treasury operations.

31% of respondents were using nothing more

than excel for handling the bulk of their treasury

operations, including forecasting.

26% of respondents had originally purchased a

forecasting tool through a TMS, but were no

longer using it due to inefficiencies.

Of those respondents currently using the forecasting

tool of a TMS, 14% were either dissatisfied or very

dissatisfied with its performance.

0

%

10

%

20

%

30

%

40

%

50

%

60

%

70

%

80

%

14

%

26

%

31

%

79

%