Fact Sheet

Kyriba Financial Risk Management Solution

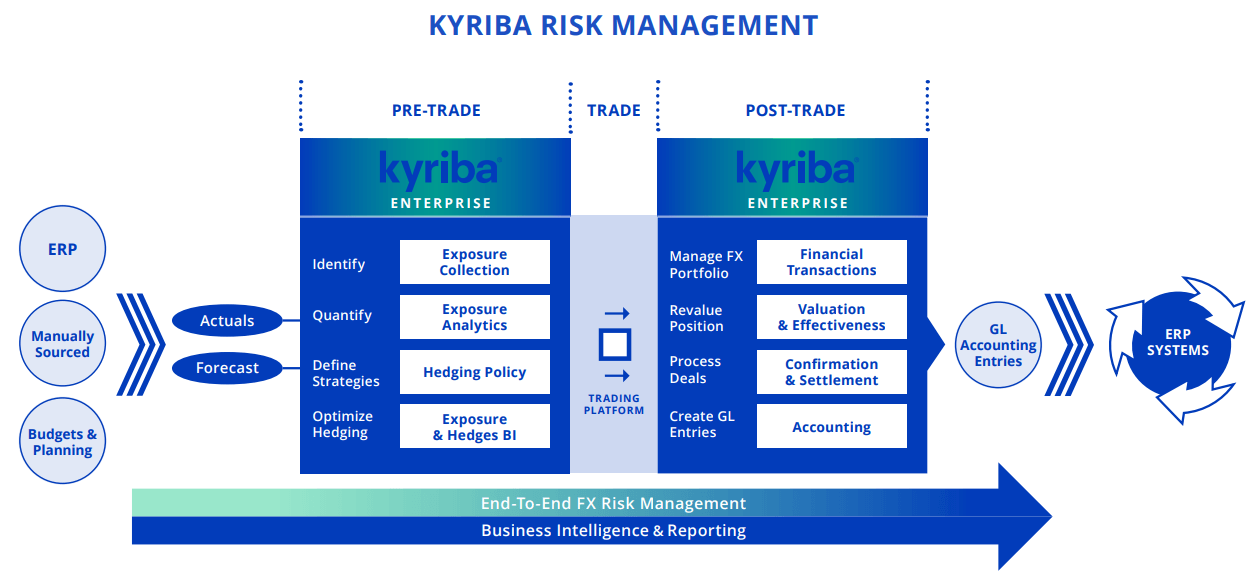

With Kyriba Financial Risk Management Solution, CFOs and treasury teams can now manage currency risk and compliance in a single cloud platform.

Since its acquisition of FIREapps, Kyriba has extended the reach of its FX risk management solution. Kyriba uniquely delivers end-to-end risk management with advanced analytics capabilities, providing more functionality to identify and understand risk than any other treasury and risk management system.

“Our goal is to support the overall business and so getting that visibility, transparency and having the availability of the details is really critical to meeting the overall business needs.”

Dawnette Blake, Global Benefits Director, Agilent Technologies

Table of Contents

Exposure Capture

Kyriba’s enhanced financial risk management solution comprehensively extracts data directly from ERP systems and allows for uploading of data from spreadsheets and other source systems for timely and accurate data collection of balance sheet and cash flow exposures. Kyriba offers certified exposure data extract toolkits from leading ERP systems such as SAP and Oracle, as well as support for all other source systems.

FX Exposure Analysis & Management

Kyriba gives CFOs control over currency risk by explaining the meaning of currency impacts and offering solutions to protect the business from currency volatility. With extensive data and FX exposure analytics, CFOs can gain insight into currency risk, execute proven strategies to manage EPS targets without FX surprises, weigh the cost vs. risk of managing individual currencies, and leverage trade netting opportunities to reduce transaction costs.

Trade Management

Kyriba is a single source of record for FX trades, including spot, forward, swap, and option instruments, enabling two-way integration with trading portals for trade confirmations, settlements, update of treasury forecasts, and analysis of open and hedged FX exposures against FX policies. Kyriba clients can interface with any trading portal, including FXall, 360T and Bloomberg.

Valuation and Accounting

Kyriba’s mark-to-market engine calculates fair values based on integrated market data within the system. Kyriba also supports CVA/DVA as well as scenario risk analysis and value-at-risk. Kyriba also includes a separate accounting engine for journal entry calculation, generation, and integration to the ERP.

Kyriba supports derivative and hedge accounting for ASC and IFRS regulatory compliance, with extensive workflow for designation, documentation, and reclassification of balances.

Business Intelligence with Kyriba Analytics

Kyriba offers rich, interactive dashboards for comprehensive data visualization and business intelligence with its newly launched Kyriba Analytics module, enabling treasury teams to quickly illustrate overall FX exposure and risk. Dashboards include easy-to-understand “top of the house” summary of corporate FX exposure, hedge coverage and Value at Risk (VaR), as well as quick insight into underlying sources of exposure by currency, entity, and geography so users can easily spot unexpected changes in their risk exposure.