IS IN-HOUSE BA NKING RIGHT FOR YOUR ORG A NIZ ATION?

|

© K Y RIBA CORP. 2017

|

K Y RIBA COM5

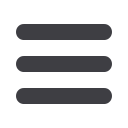

Financial Counterparties Before

FX, external lending

and borrowing

Intercompany

loans and payments

Typical Model Prior to an In-house Bank

Most financial activity (FX, loans, deposits) and

inter-entity payments involve physical cash transfers

to and from legal entity’s bank accounts.

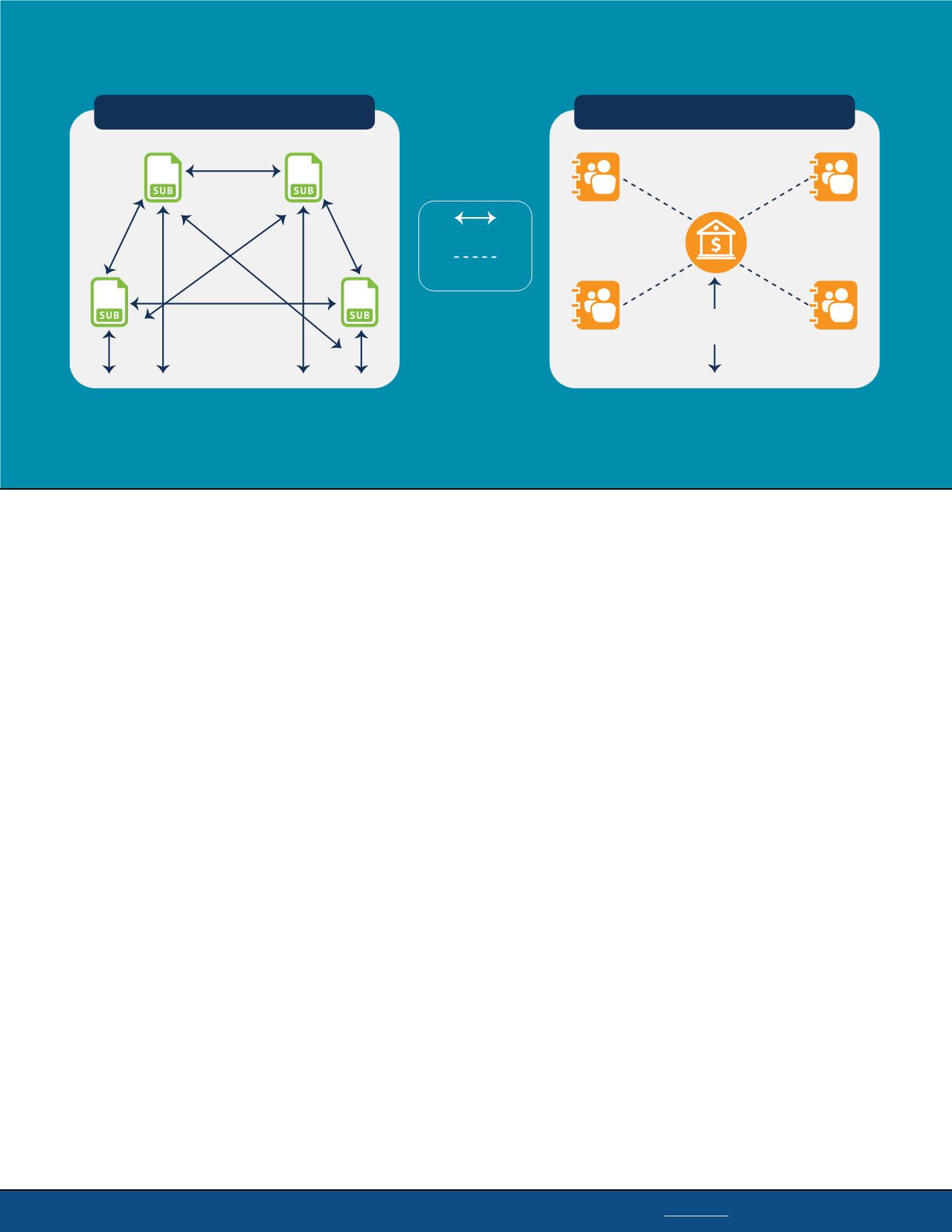

Financial Counterparties After

In-house Bank Model

Intercompany loans/deposits, FX and payments settle through

book accounting entries at the in-house bank. Only transactions

between the in-house bank and external banks involve cash.

Payments on Behalf, FX,

external lending and borrowing

Internal cashflow

External transaction

I N-HOUSE BANK ACCOUNT DE S I GN

B

y creating an in-house bank structure and

moving to a mostly internal transaction basis

and “on-behalf-of” processing (i.e. corporate

headquarters executing transactions on behalf of

subsidiaries), bank accounts can be rationalized.

The in-house bank account design should be

based on the following:

•

Internal payments are settled without the

need for physical cash transfer whenever

possible. Specific exceptions (e.g. dividend

payments) should be identified by the Tax

department.

•

Cash is only moved to manage the

consolidated needs of the IHB.

Account Structure (Master vs. Sub Accounts)

•

The in-house bank owns multi-currency

master accounts with banks.

•

The in-house bank manages liquidity in the

master accounts through external borrowing

or lending.

•

Business units maintain current accounts with

the in-house bank sub accounts.

•

Business units may run net credit (cash) or

debit (overdraft) balances in the sub accounts.

•

Business units earn/pay interest on net debit/

credit balances.

•

Overdraft balance limits are set and reviewed

in accordance with company policy.

The graphic below shows the impact of introducing an in-house bank