Fact Sheet

SCF White Label for Financial Institutions

Table of Contents

As Supply Chain Finance Evolves and Grows, Stay Ahead of the Curve

Now more than ever, CFOs and senior finance leaders are turning to Supply Chain Finance to stabilize their supply chains and minimize risk of disruption. Demand for working capital solutions continues to grow, and so do the market options. To compete more effectively, Financial Institutions (FIs) can partner with a technology provider who will help them elevate and differentiate their offering – now and over the long term. As a global provider of corporate treasury, payment and liquidity solutions, Kyriba is an ideal partner. Our cloud technology serves more than 2,500 corporate CFOs and treasurers including one quarter of the Fortune 500. Kyriba is a name your customers know and trust.

Kyriba Working Capital Solutions

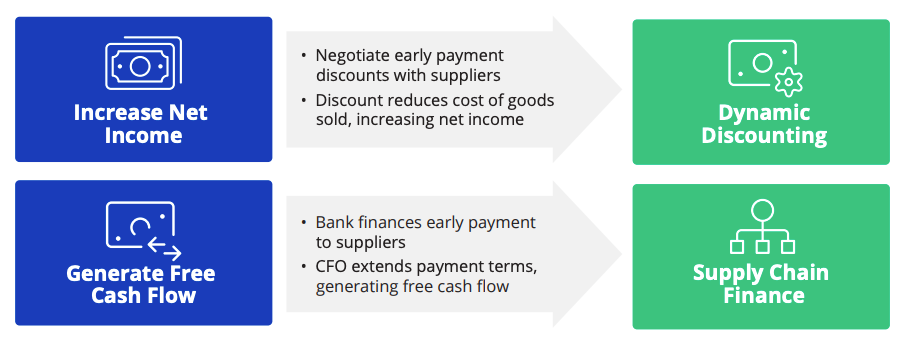

Kyriba supports both dynamic discounting and approved payables financing (supplier finance), including a special hybrid of both. FIs can enable customers to self-fund their suppliers and then seamlessly switch to bank funded SCF as needed to ensure continuity. Receivables Financing is in pilot phase and Purchase Order Financing will be supported in 2023.

Kyriba’s SCF solutions prioritize the customer experience – from supplier onboarding to ERP integration to funding requests and reporting. System users enjoy a seamless experience, keeping informed and engaged without sacrificing convenience.

Accolades and Awards

Kyriba’s been recognized as “best in class” by Aite Group and was awarded “Best Supplier Engagement”, “Best Dynamic Discounting”, and “Best Open Banking” by Global Finance Magazine.

Kyriba Supply Chain Finance – Leading Technology, Security and Support

Corporate ERP Connectivity Experts

At Kyriba we know ERP connectivity with extensive integration experience across our global customer footprint. We support both API and host to host options for SCF and beyond.

Strong White Labeling Functionality

Kyriba makes it easy to deliver a fully integrated product that can be customized and branded to proper specifications. This includes marketing and web site content, translations, URLs, privacy notices, email templates, and branded web portals.

Quick Time to Market

Financial institutions can get up and running quickly with Kyriba thanks to proven SaaS infrastructure and a design team that helps to set up and model the SCF program.

Flexible Backend Integration

Kyriba’s SCF solutions are designed to interface with a wide variety of third-party banking applications – including trade finance, payment and core banking systems.

Bank Level Security and Data Protection

Financial institutions and their clients require the highest levels of security. Kyriba delivers across four pillars of security: physical security, vendor security, application security and process security, including SOC 1 Type II and Soc 2 Type II certification. Finance data is also secured with ISO 27001 certification.

A Proven Global Approach

Kyriba enables SCF anywhere and everywhere with support for 23 languages, global implementation capabilities, global onboarding teams and a “follow the sun” support service approach.

Why Partner with Kyriba for Supply Chain Finance

- Customer facing and focused solutions – address the most critical differentiators

- Fully integrated SCF and TMS solutions can be white labeled together for maximum benefit

- Modular solutions – only white label what you need

- Supplier Onboarding can be used independently and leveraged bank wide

- We don’t fund. We support rather than compete with our FI partners

- Our Partnership extends beyond technology, we will work with your FI to Aite ensure mutual success!