Daily connections to

9900+ banks.

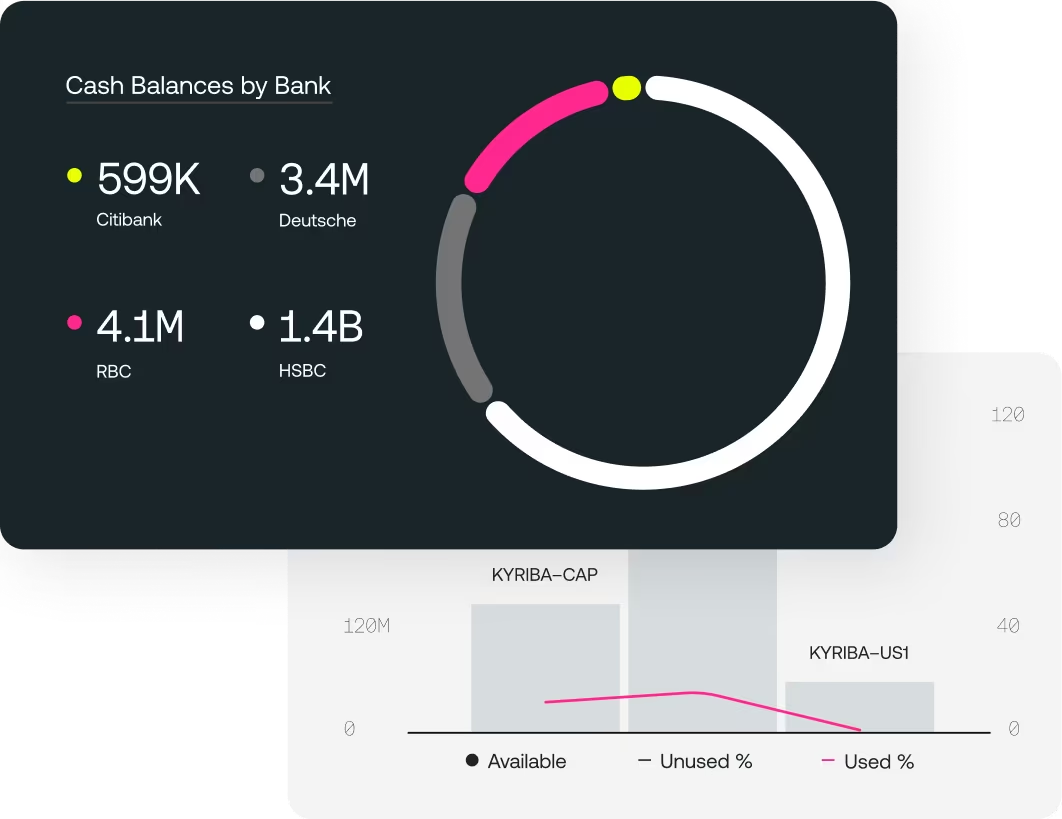

Unify bank and ERP data to automate, move, and control liquidity.

reduction in idle cash

in fraud avoidance

overall risk elimination

Connect banks, ERPs, apps, and portals to unify enterprise data and automate, move, and control liquidity.

Increase financial resilience by reducing risk exposures, standardizing processes, and improving business continuity.

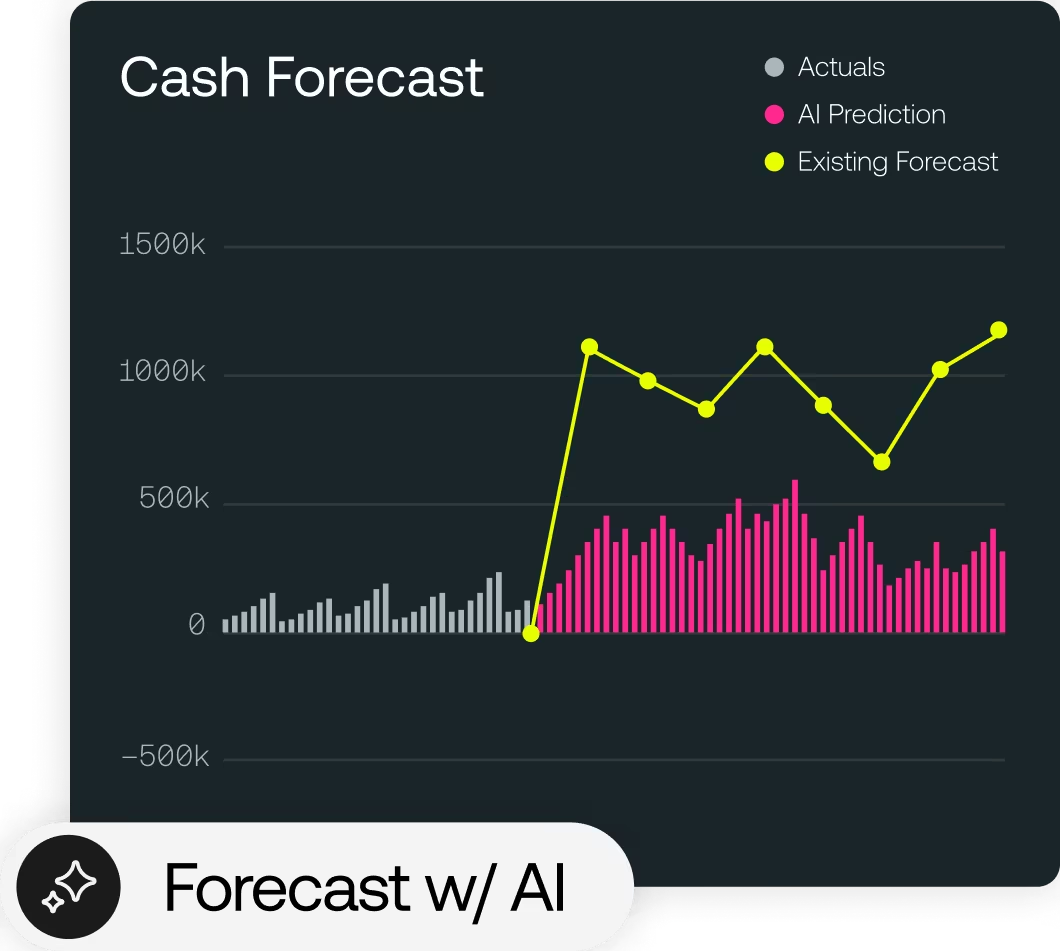

Forecast cash, liquidity, and risk exposures with greater accuracy while eliminating manual processes and risk of error.

Make confident, data-driven liquidity

decisions when managing complex

investments—and get the most from your

enterprise liquidity.

Drive optimal liquidity performance with data-driven treasury management and intelligence.

Unify bank and ERP data to automate, move, and control liquidity.

Centralize financial projections to drive data-driven liquidity decision-making.

Hedge or reduce exposure, mitigating the impact of market volatility on financial performance.

Project cash, liquidity and exposures with greater accuracy and improved flexibility.

Accelerate the ERP-to-bank payment journey with real-time APIs, optimizing costs and reducing payment fraud.

Design your user journey to optimize data and processes, so you get what you need when you need it.

“With Kyriba, we achieved 100% cash visibility, unlocked $9B in investment capital, and reduced working capital 90%.”