eBook

What is Treasury Management?

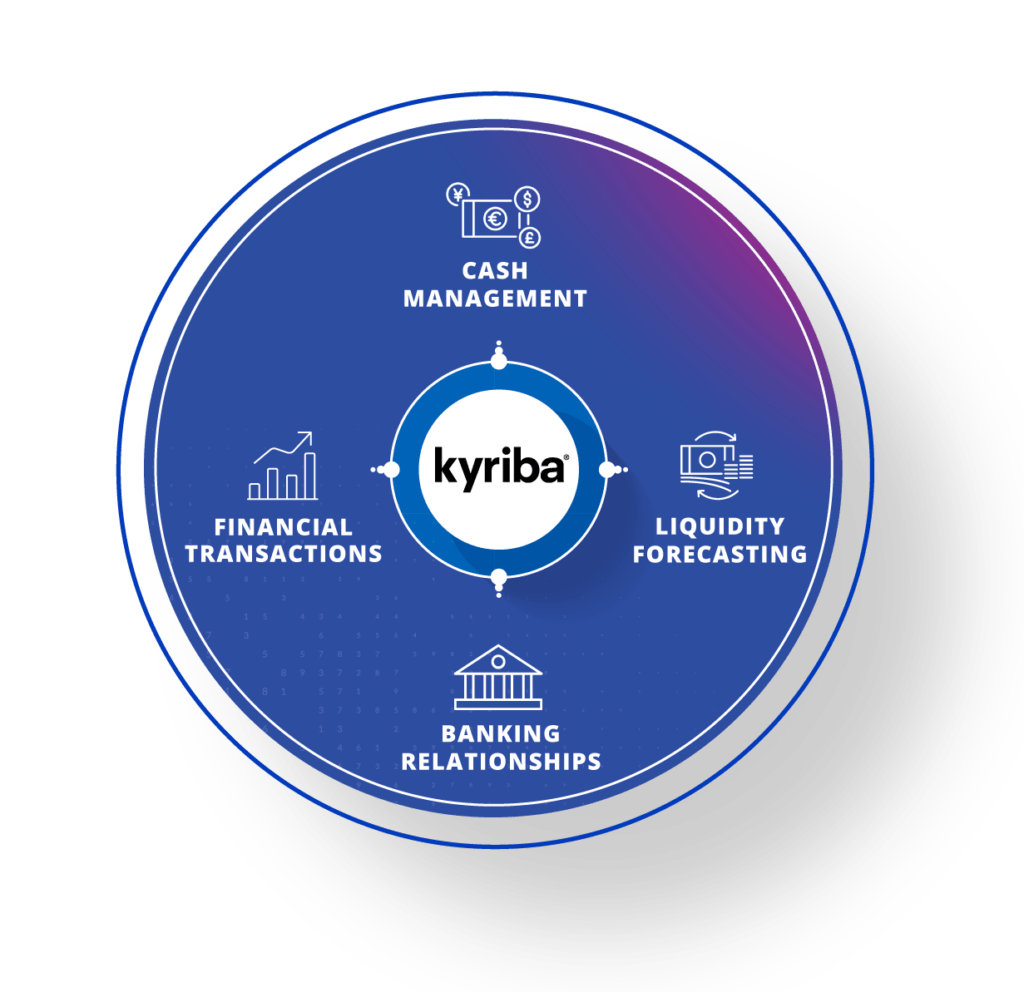

Treasury management is the process of managing an organization’s liquidity, money market instruments, banking, concentration and disbursement activities. Treasury constantly monitors cash inflows and outflows in order to optimize the company’s liquidity position. This includes managing all the financial risks associated with running a business.

Table of Contents

Treasury Management Objectives and Processes

The objective of treasury management is to ensure that an organization’s short- and long-term goals are achieved. Treasury management provides a means for an organization to effectively manage its liquidity, minimize risk exposure, and maximize the efficient use of resources.

Treasury management also plays an important role in financial planning. If you want to know when your business will be profitable or how much debt or equity funding is needed for expansion plans over the next few years, having accurate projections about your company’s financial health will be essential.

Treasury management is especially important for large organizations that need to ensure they are never short on cash but also don’t have too much cash available at any time. Examples of these organizations include banks and other financial institutions, governments and major corporations. Treasury management is critical to a company’s success.

Treasury Management has a number of objectives to consider:

- Liquidity Management: The ability to meet short-term obligations when they arise (like paying employees or suppliers) is critical for any business that depends on cash flow from customers paying them later rather than sooner (like most businesses). Liquidity management involves planning and implementing strategies that ensure that an organization has enough money on hand to meet all its obligations, as well as maintaining adequate reserves for unexpected expenses.

- Working Capital Management: Working capital refers to the difference between current assets and current liabilities. It is important for treasury to manage this ratio so that it remains in balance with other financial metrics such as profitability and liquidity ratios. If your company has too much or too little working capital, it could negatively impact its ability to pay bills on time or invest in new projects that could help grow sales over time.

- FX Risk Management: To avoid impacts to earnings, treasury works to manage their FX exposure and risk. This can be done by organically eliminating exposures internally or by hedging exposures.

- Interest Rate Risk Management: Interest rates can change depending on economic conditions, which means they may go up or down depending on where we are in our business cycle at any given moment—and how much confidence people have in their investments at any given moment affects those rates as well. Managing interest rate risk means making sure that if interest rates rise while a company has outstanding debt obligations, then those debts won’t become unaffordable when payments increase due to higher costs associated with servicing those loans.

Challenges of Treasury Management

Treasury management continues to become more complicated, thanks in part to global connectivity and multinational expansion. Here are some of the challenges companies can face in treasury management:

- Managing cash flow around the world is much more challenging than it once was.

- Companies must protect themselves from currency fluctuations by hedging their foreign exchange risk or investing in other currencies.

- Treasury departments need more sophisticated risk management tools to ensure they aren’t exposed too much when they trade currencies on behalf of their subsidiaries or clients overseas.

- Payments fraud continues to evolve with technology, and treasury must always be one the lookout for the latest schemes.

Keeping track of where money is coming from and going to is perhaps the greatest challenge for treasury. A company’s cash flow can come from multiple sources—customers, suppliers, banks and shareholders.

It’s important for companies to always know where its money is in order to make sure it has enough funds available when needed. This is especially true for multinational companies whose business operations span multiple countries or regions with different currencies; if there are discrepancies between what an organizations thinks its balance should be and what it actually turns out to be after accounting for all incoming and outgoing payments, then there could be serious problems in the future.

Differences Between Treasury Management and Cash Management

Treasury management and cash management are terms that are often used synonymously by financial institutions as they offer similar services. However, they have important differences.

Cash management is the process of managing a company’s money flow and ensuring that it meets all its near-term obligations.

Cash management can involve several different activities:

- Monitoring daily balances in bank accounts and other financial instruments that are used for payments

- Forecasting future inflows/outflows from these accounts

- Deciding how much money should be held at any given time based on forecasts

Treasury management is much broader than cash management. Treasury management allows corporations to manage all aspects of their finances, including cash flow and liquidity.

In terms of technology, both cash management and treasury management systems are designed to help an organization better manage its money. However, they do so in different ways.

A cash management system helps to keep track of how much money an organization has at any given time by making it easy for employees to make payments through the company’s bank account or credit card account (if applicable).

A treasury management system goes one step further by helping companies track all their accounts in one place so they can see where every dollar goes at any given time–including the ones used outside of normal business hours or during special projects such as purchasing new equipment or renting space at an event venue.

Treasury Management Advantages

Treasury management is a crucial part of any business, but it’s especially important for multinational companies. This is because they have to deal with both local and global factors that affect how money flows around their operations and between countries. If a company does not properly manage its finances, then it could potentially lose out on much-needed capital or even face legal penalties for violating regulations in other countries.