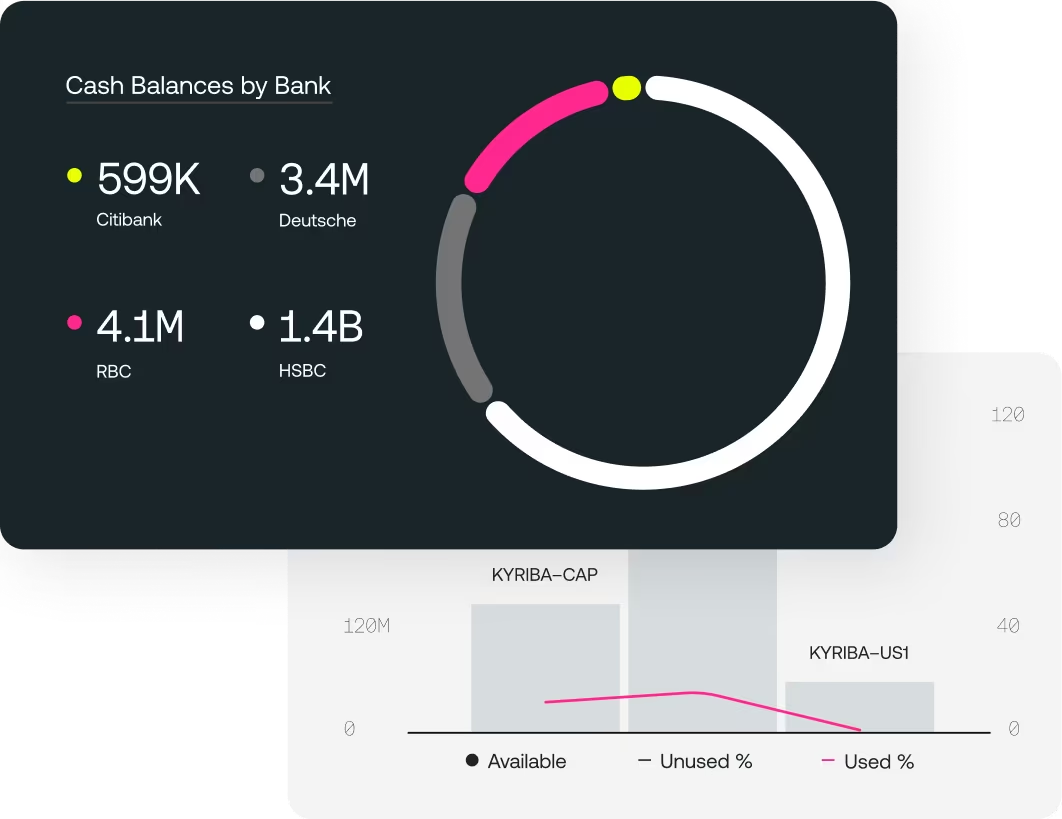

Tägliche Verbindungen zu über 9900 Banken.

Vereinheitlichen Sie Ihre Bank- und ERP-Daten, um die Liquidität zu automatisieren, zu verschieben und zu kontrollieren.

Beseitigung des Gesamtrisikos

bei der Betrugsvermeidung

Gesamte Risikominimierung

Verknüpfen Sie Banken, ERPs, Apps und Portale, um Unternehmensdaten zu vereinheitlichen und die Liquidität zu automatisieren, zu verschieben und zu kontrollieren.

Steigern Sie Ihre finanzielle Resilienz, indem Sie Risiken reduzieren, Prozesse standardisieren und die Geschäftskontinuität verbessern.

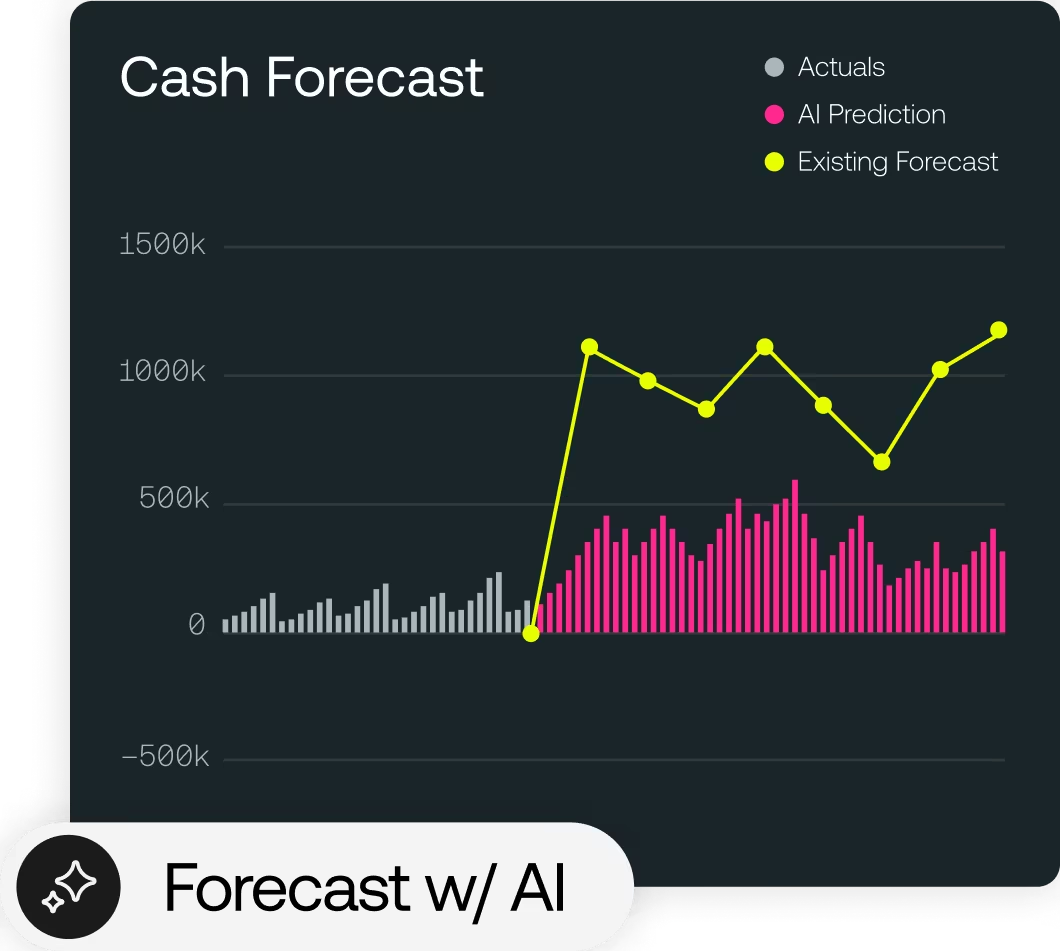

Prognostizieren Sie Cash, Liquidität und Risiken mit größerer Genauigkeit und eliminieren Sie gleichzeitig manuelle Prozesse und Fehlerrisiken.

Treffen Sie sichere und datengestützte Liquiditätsentscheidungen bei komplexen Investitionen und holen Sie alles aus Ihrer Unternehmensliquidität heraus.

Vereinheitlichen Sie Ihre Bank- und ERP-Daten, um die Liquidität zu automatisieren, zu verschieben und zu kontrollieren.

Zentralisieren Sie Finanzprognosen, um datenbasierte Liquiditätsentscheidungen zu treffen.

Sichern Sie sich ab und reduzieren Sie das Risiko, um die Auswirkungen von Marktschwankungen auf die Finanzentwicklung zu mildern.

Planen Sie Cash, Liquidität und Risiken mit höherer Genauigkeit und mehr Flexibilität.

Beschleunigen Sie den Zahlungsverkehr zwischen ERP und Banken mit Echtzeit-APIs, optimieren Sie die Kosten und reduzieren Sie Zahlungsbetrug.

Gestalten Sie Ihre User Journey so, dass Daten und Prozesse optimal fließen, damit Sie immer zur richtigen Zeit die richtigen Informationen bekommen.

Verbessern Sie die Finanzleistung und steigern Sie den strategischen Einfluss durch eine hervorragende Liquiditäts-Performance.

Treiben Sie die optimale Liquiditäts-Performance mit datenbasiertem intelligentem Treasury-Management voran.

„Mit Kyriba haben wir eine 100%ige Bargeldtransparenz erreicht, 9 Milliarden Dollar an Investitionskapital freigesetzt und das Working Capital um 90 % reduziert.“