What is Cash Forecasting?

Cash forecasting is the process of predicting near future cash flows, including both inflows and outflows, based on current business conditions and past performance. It is a crucial component of effective cash and liquidity management, as it enables organizations to anticipate changes in their liquidity and plan for them accordingly.

Proactively managing cash flow enables organizations to make more informed decisions, mitigate risk, and optimize cash investments. Generally, cash forecasting is concerned with identifying liquidity requirements for the next 30 days, 60 days, or 90 days.

Differences between Cash Management, Cash Forecasting and Liquidity Planning

Cash management looks at daily cash positioning and reconciliation of prior day bank transactions, including bank reporting, bank transaction tagging, and target balancing of accounts.

Cash forecasting projects cash surpluses and requirements of days/weeks/months into the future. Forecast data is captured from internal and external sources with the ability to model simultaneous forecasts in parallel and stress-test against multiple business scenarios.

Liquidity planning is an evolution of traditional cash flow forecasting surrounding the cash forecast with data which supports better-informed liquidity decisions. It looks into more data sets including cash, credit, debt and investments and extends focus on medium to long-term cash needs.

Table: Key differences between Cash Management, Cash Forecasting and Liquidity Planning

| Cash Management | Cash Forecasting | Liquidity Planning | |

| Primary focus | Operational | Tactical | Strategic |

| Purpose | Optimize cash | Forecast cash inflows/outflows | Manage available cash to meet future obligations |

| Time horizon | Short-term | Up to 90 days | Up to 12 months |

| Frequency | Daily / Weekly | Daily / Weekly / Monthly | Monthly / Quarterly / Yearly |

| Importance to Business | Essential for daily operations | Critical for short-term stability | Essential for long-term financial health |

| Tools used | Bank accounts, cash receipts/payments, cash pooling | Cash flow statements, Cash flow projections, budgets | Financial statements, ratio analysis, cash flow analysis, scenario planning |

Why is Cash Forecasting Important?

Accurate forecasting gives businesses the ability to understand their cash position at any given moment, enabling them to anticipate and plan for any potential shortfalls.

Businesses can also use the cash flow forecasting to identify opportunities to reduce costs and maximize returns on investments. Additionally, forecasting can help businesses manage their liquidity, allowing them to minimize the risk of running out of cash and prepare for any potential cash crunches.

In summary, effective cash flow forecasting allows organizations to:

- Ensure efficient and accurate cash flow management by identifying discrepancies between actual and expected cash flows and taking corrective action if necessary.

- Optimize cash flow planning with more accurate cash flow projections. Forecasting enables companies to anticipate potential cash flow problems and take the necessary steps to avoid them. Companies can also use forecasting to develop more effective strategies for financial planning and budgeting.

The Benefits of Forecasting Cash Flow

Having a reliable forecasting process is essential for businesses of all sizes. Organizations accurately forecasting cash flow are better equipped to make informed decisions about investments, capital expenditures and working capital management, and eventually achieve greater cash flow efficiency.

It is important to ensure the forecasting process is regularly reviewed and updated to reflect changes in the business environment. This includes monitoring external factors such as changes in interest rates, inflation, and market trends, as well as internal factors such as changes in business strategy or operations.

By continuously improving their forecasting process, businesses can maintain a competitive edge and achieve greater cash flow efficiency in the long run with the following visible positive business outcomes:

- Improved Planning and Budgeting: Organizations can plan and budget based on the most up-to-date and accurate financial data. By using the right tools, organizations can predict the timing of inflows and outflows, giving them a better understanding of their short-term liquidity needs.

- Better Decision Making: By understanding the company’s future cash flow, businesses can make informed decisions about investments, expenses, and other financial activities.

- Early Identification of Cash Shortages: Organizations can identify potential budgeting issues before they become a problem, allowing them to take corrective action quickly and efficiently.

- Improved Cash Management: The information gained from accurate forecasting enables companies to better predict future cash flows and calculate future cash balances, equipping finance teams with the cash visibility they need to plan for the future.

What Is Cash Forecasting Method?

An accurate forecast includes having a clear understanding of when funds are coming in and when those funds will be needed to pay bills. By using the right cash flow forecasting techniques, businesses are able to better prepare for unexpected expenses.

There are two main cash flow forecasting techniques that are commonly used:

- Direct method estimates future cash flows based on actual inflows and outflows, providing detailed operating cash flow information. It involves forecasting cash receipts and payments on a detailed level, that's why it's difficult and time-consuming. It's often used for short-term forecasts as it requires a high level of detail about specific transactions. It typically involves an analysis of cash receipts from customers and cash paid to suppliers and employees. The direct method requires a significant amount of data, but it tends to be more accurate in the short term.

- Indirect method starts with net income and then adds or subtracts items to adjust for non-cash transactions and changes in operating assets and liabilities. The indirect method is often used for longer-term forecasting because it is less detail-oriented and relies more on trend analysis than specific transaction data. It's often easier and quicker to compile than a direct forecast but might be less accurate in the short term. Large companies often prefer it.

Aligning the indirect method used by financial planning and analysis (FP&A) for budgeting operational and free cash flow, with the direct method traditionally used by treasury, treasury can better guide leadership and the board on cash flow performance, risks, and opportunities.

How to Build a Cash Flow Forecast in Your Business

Organizations can implement cash forecasting by following some straightforward steps.

Step 1: Assess Current State

The first step is to assess the current state of your organization’s cash. Assessing the current state will help you identify areas of risk and opportunity as well as develop a plan of action for improving cash flow. Key areas to assess include cash balance, cash flow, bank fees, and liquidity.

Step 2: Establish Cash Flow Goals

The next step is to establish objectives for your organization’s cash flow, including setting specific goals that are in line with your organization’s mission and objectives. These goals should be measurable and achievable with the resources available to you to ensure that your cash forecasting efforts are in line with your overall strategy.

Step 3: Design Cash Forecasting Process

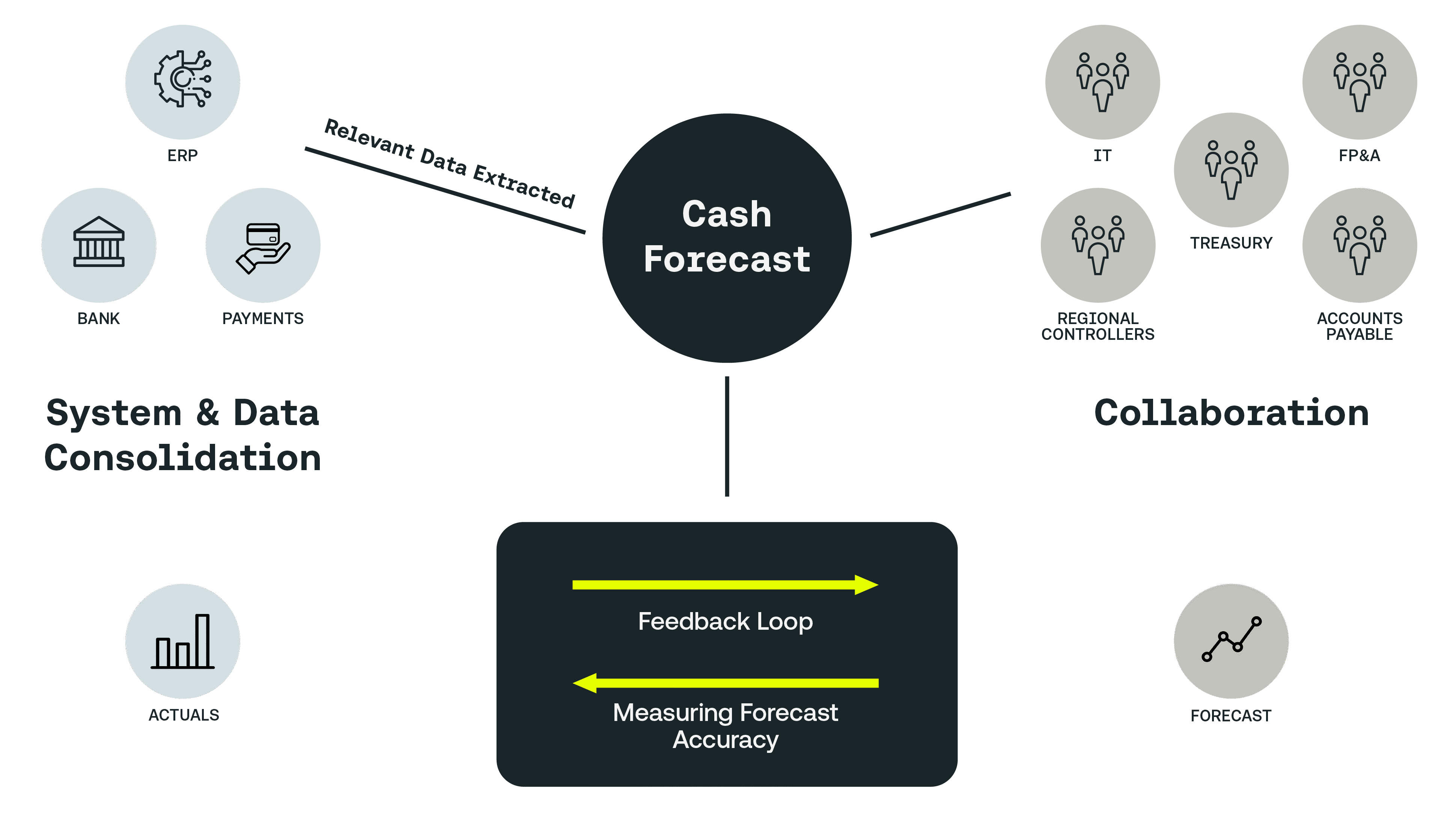

Once you have assessed your current state and established your goals, you can begin to design your cash forecasting process. Designing the process includes identifying the data sources, the tools and methods used, and the metrics you will use to measure success. This process should be tailored to the specific needs of your organization and should be regularly reviewed and adjusted as needed.

Common Cash Forecasting Mistakes to Avoid

Without accurate forecasting, companies are unable to assess financial performance, identify areas of opportunity, or manage risk. Poor forecasting can result in:

- Ineffective cash management

- Inadequate liquidity

- Lack of capital

- Increased debt

Some of the most common forecasting mistakes include:

- Overestimating Future Sales: One of the most common forecasting mistakes is overestimating future sales. This misstep occurs when the forecast is based on an overly optimistic and unrealistic expectation of sales, leaving the business with a cash flow shortfall.

- Tips: Businesses should focus on realistic sales targets and be aware of any unique factors that may affect sales, such as changes in the market or customer base.

- Not Taking Seasonality into Account: It is important to consider seasonality when forecasting cash flow. Many businesses have periods of high and low sales during the year and must be prepared for these fluctuations.

- Tips: Businesses should monitor past sales trends and plan accordingly. Businesses should also be aware of any external factors that could affect sales, such as social, economic, and political conditions.

- Ignoring Cash Reserves: It is the mistake of taking into account the amount of cash a company has set aside for emergencies or other purposes, which can lead to inaccurate forecasting.

- Tips: Businesses should always have an adequate amount of cash reserves to cover any unexpected costs or economic downturns. Companies should also review their forecasts on a regular basis to ensure that cash reserves are up-to-date and adequate for their needs.

What Is an Example of a Cash Flow Forecast?

Cenveo is the world leader in the management and distribution of print and related offerings, encompassing 20 facilities across the United States with a long history of delivering top value for customers.

Cenveo chose the Kyriba Enterprise Liquidity Management platform to improve visibility into overall liquidity and provide management on-demand insights into the performance of their strategic liquidity objectives and Cenveo achieved outstanding business results, seeing 93% forecast accuracy and 90% productivity improvements.

According to a Kyriba Value Realization Assessment (VRA) assessment, Cenveo saw the following improvements post Kyriba deployment, including but not limited to:

- Cash Management: 100% real-time liquidity visibility, 95 hours per month productivity gain.

- Cash Forecasting: 43% liquidity forecast accuracy improvement, 113 hours per month productivity gain.

- Liquidity Payment Optimization: Increases in data integrity and workflow controls ensured no loss of discounts, 137 hours per month productivity gain.

The Role of Technology in Cash Flow Forecasting

Technology has revolutionized cash forecasting, giving businesses access to powerful and precise insights into their cash flow and liquidity. With automated data gathering and advanced analytics and automated workflows, businesses are now able to quickly and accurately forecast their cash position, identify areas of risk, and manage their liquidity with confidence.

The potential for cash flow forecasting technology is vast and rapidly expanding. With new technologies such as artificial intelligence (AI) and machine learning (ML), businesses will have access to more powerful insights into their cash flow and more precise forecasting capabilities.

With Kyriba’s advanced solutions, businesses can make more informed decisions, accurately forecast cash positions, and ensure their financial goals are met. Kyriba enables businesses to gain more control over their cash flow with advanced analytics and real-time visibility.

Related Resources