Enhanced Financial Control

Kyriba provides comprehensive tools for financial oversight and control, ensuring that public sector entities can maintain strict adherence to regulatory requirements and internal policies.

Find out how the Government of Sharjah achieved full cash visibility and significant operational cost savings by leveraging HSBC’s digital transaction banking solutions and Kyriba’s cloud-based Treasury Management System.

Finally, a unified solution that lets public sector finance leaders and their teams manage cash, liquidity, risk exposures, and capital market needs—all in one place.

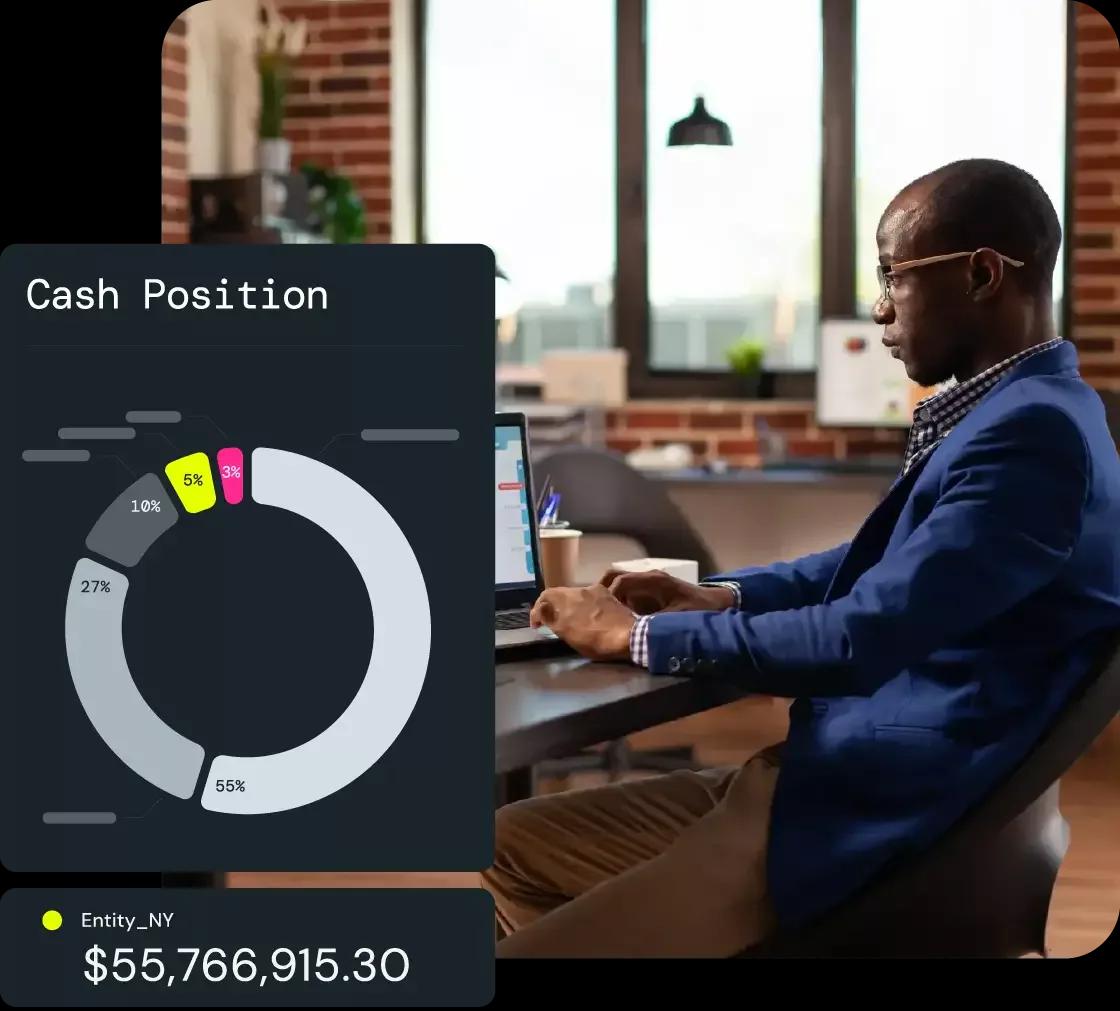

Kyriba delivers automated bank reporting across bank accounts, driving full visibility and enabling transparency of bank reporting information across agencies and departments.

Kyriba enables sophisticated cash forecasting while simplifying the aggregation of forecast data across systems and agencies. It helps Public Sector organizations and departments understand variances between forecasts and actuals with clear business intelligence forecast variance analyses.

Kyriba’s payment hub centralizes payment workflows while adding key capabilities like sanctions list screening and real-time fraud detection.

Public Sector entities require connectivity between banks, systems, and departments. Learn more about how Kyriba clients save up to 80% in cost and time for banking and payment connectivity projects.

Kyriba provides comprehensive tools for financial oversight and control, ensuring that public sector entities can maintain strict adherence to regulatory requirements and internal policies.

Kyriba assists in optimizing budget allocation and management, helping public sector organizations to plan more effectively and use resources more efficiently.

Kyriba’s platform is designed to help public sector institutions identify and mitigate financial risks while ensuring compliance with relevant laws and regulations.

Hours saved per month by public sector customers using Kyriba .

Reduction of idle cash balances by public sector customers using Kyriba.

Daily cash positioning / decision hours saved per month by public sector customers using Kyriba

"Circa il 70% delle transazioni viene ora elaborato elettronicamente e abbiamo acquisito piena visibilità sulle nostre transazioni finanziarie e di liquidità". I nostri tempi di elaborazione si sono ridotti e abbiamo ottenuto significativi risparmi sui costi operativi, che hanno più che compensato i costi di implementazione".