Blog

Continued Rise of Corporate Currency Headwinds in 2022

The latest Kyriba Currency Impact Report which chronicles the impact that currency volatility and currency moves has on reported corporate financial results documents pretty much what was expected. Net/Net, with dollar strengthening and more volatility, the number of corporates reporting currency headwinds has shot up significantly.

Corporate Currency Risk Management: A very challenging market with no end in sight

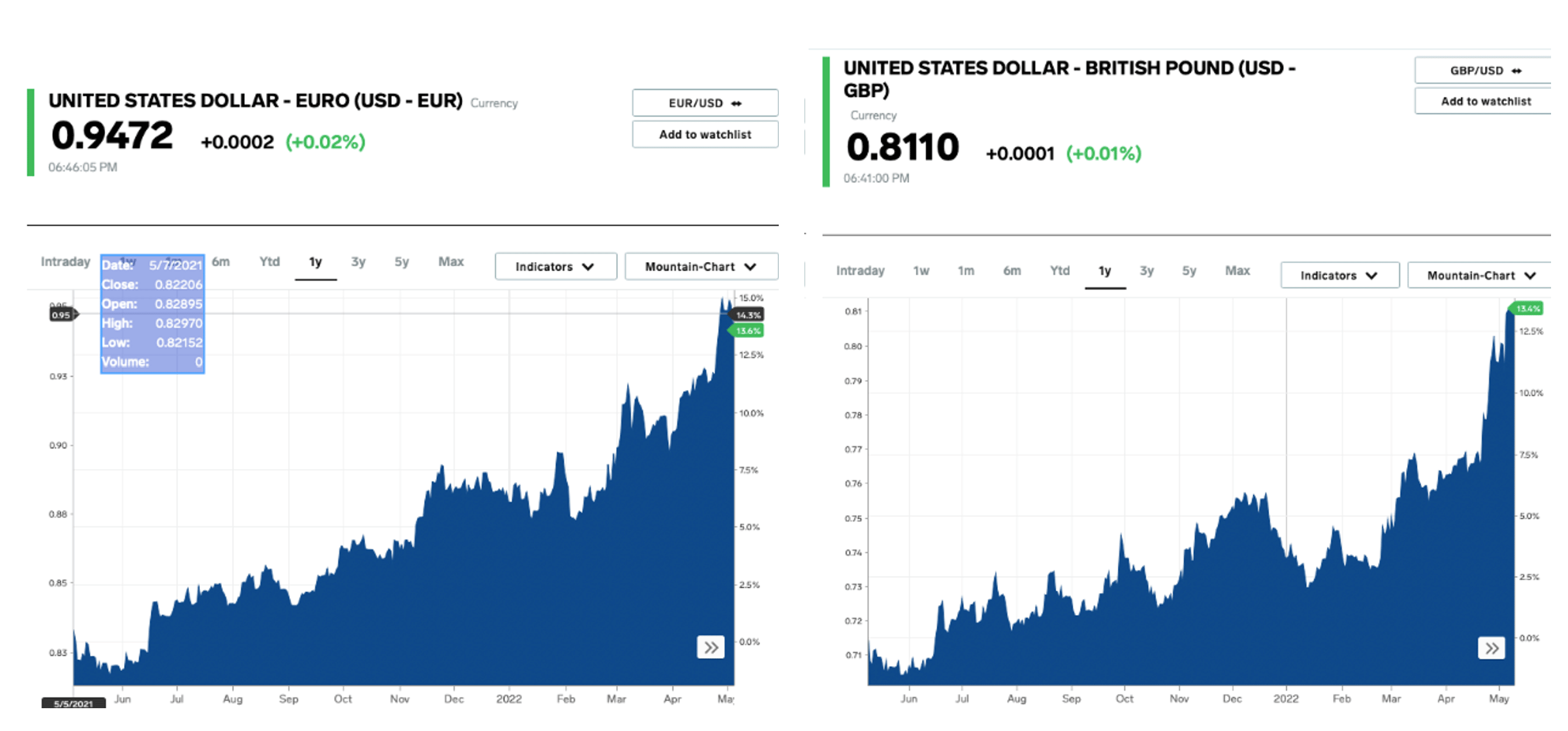

The USD has been very strong against a broad basket of currencies and its run up against major currencies such as the Euro and British Pound started in earnest towards the end of summer in 2021 and has been continuing well in to 2022.

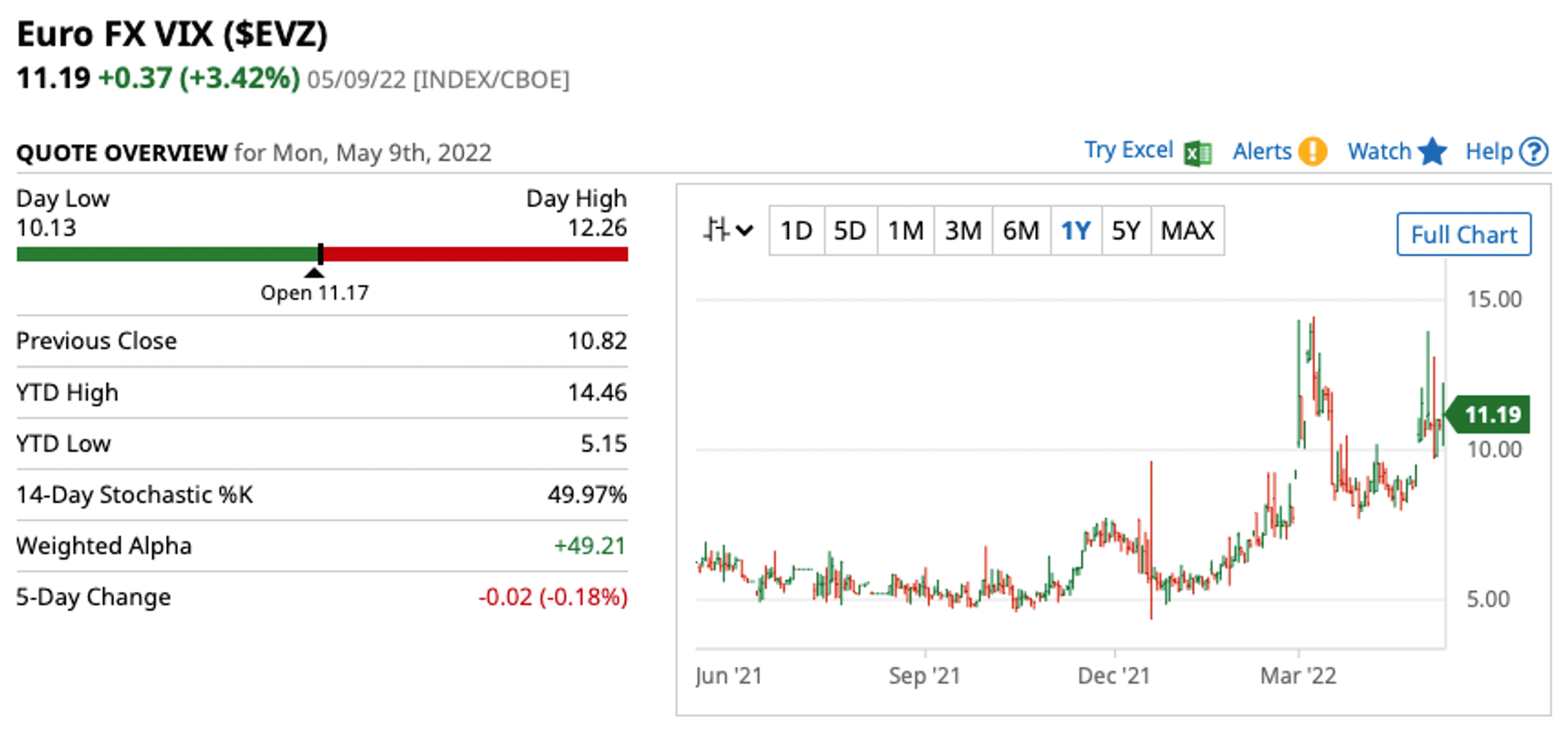

The run up alone has and will cause many North American corporates to experience strong currency headwinds. However, we have also had significant volatility embedded in the strong dollar run that has accentuated the corporate risk management challenge. A variety of geopolitical issues, the ongoing economic dampening of the COVID-19 pandemic, the rise in inflation as well as persistent supply chain disruptions have made managing corporate currency risk more challenging than ever. The FX VIX (An indicator of relative FX market volatility) went through the roof in mid-December, and the same indices is showing even more volatility since the beginning of 2022 with two sharp spikes in early March and late April.

What do the numbers tell us

Based on our FX research team’s Value at Risk modeling simulations we have seen nearly a doubling of Value at Risk for corporate FX exposure portfolios, both on a non-correlated and correlated basis since late October 2021. While we saw similar increases in VaR model risk quantification at the outset of the COVID-19 crisis in the spring of 2020, what is different now is the cost of hedging. While in 2020, many central banks took aggressive actions to sustain or stimulate their economies resulting in many cases a lowering of the cost of hedging. However, in the current market environment with inflation and interest rates on the rise, the cost of hedging is also increasing.

So what are CFOs, Treasurers and FX Risk Managers to do?

Based on our interactions with corporate FX risk management teams, our research surrounding business headwinds indicates there is a strong appetite to move quickly to upgrade Currency Risk Management Programs. Automation and Analytics are in high demand to enable Risk Managers to keep their finger on the pulse of the currency markets as well as the quickly changing internal business plans and activities that give rise to FX exposure as companies buy and sell products and services around the world.

In addition, FX risk management teams are incorporating more sophisticated VaR and Cost of Hedging analysis to inform their hedging strategies. Fortunately, with increasing adoption of SaaS-based FX solution for managing FX exposure and risk, what used to be available to large sophisticated multi-national companies with highly skilled capital market teams, is now available to companies of all sizes.