Blog

Currency Volatility is Down: How Smart FX Teams are Preparing for the Next Wave

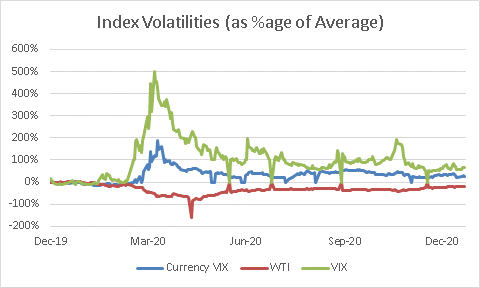

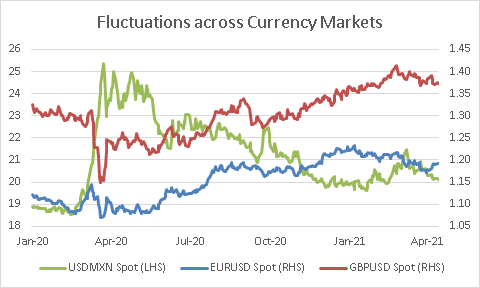

The Kyriba Currency Impact Report reveals largely what was anticipated by risk managers and treasury leaders, as overall currency volatility returned to pre-pandemic levels and the US Dollar weakened against most major market currencies during the last quarter of 2020. The US currency weakened in Q4 due to a variety of factors, but the most noticeable driver was the significant amount of fiscal stimulus from the Federal Reserve who were focused on revitalizing the pandemic-impacted US economy. Given how the greenback weakened, a majority of North American corporates sustained tailwinds in their quarterly results. In contrast, European firms largely were shaped by headwinds, although to a lesser extent than the prior quarter.

Market data provided by Bloomberg

In contrast to the Q4 2020 currency markets, there has been a somewhat unexpected strengthening of the US Dollar throughout Q1 2021. This strengthening is due to several factors. Most Industry Analysts are tying the US Dollar strength to the large disparity between European and US efforts at rolling out COVID-19 vaccines. Whereas the US has been forging ahead with aggressive vaccine efforts and opening up for business again, Europe has continued to struggle with high infection rates and patchy success with its vaccine rollout.

How are Corporate Risk Managers responding to the currency markets?

Based on Kyriba’s work with more than 2,000 corporates around the world, many companies that felt the sting of the surge in volatility and tight liquidity in Q1 and Q2 of 2020 have taken steps to fortify their risk management programs. Even those companies that had not yet implemented FX exposure management programs have been directed by senior management to put the foundational capabilities in place as quickly as possible. Corporates that had already invested in FX exposure management programs have actively taken steps during this period of relatively low volatility to further optimize their programs.

Kyriba is seeing two major themes for optimization.

The first theme for optimization is to reduce exposures. The key is to increasingly identify and exploit opportunities to reduce exposures organically through better visibility and analysis of the underlying drivers of exposures. Armed with these insights, smart treasury teams are working cross-functionally with their peers to continuously eliminate exposures through intelligent movements of cash, settling intercompany positions and monitoring supplier payments.

The second area of focus is on more intelligent and cost-effective hedging. This includes examining hedging tenors, using automation to net currency trades in order to reduce the size and volume of currency hedges, and using VaR and Cost-of-Carry efficient frontier analyses to balance the tradeoffs between risk reduction and the cost of hedging.

If we learned nothing else from 2020, it’s that we never know what’s around the next corner that could cause major disruptions in the currency markets. The companies that have invested in modern risk management technology largely weathered the storm unscathed, whereas those that have yet to do so are moving quickly to install capabilities before the inevitable next spike in volatility occurs.