Blog

Tips and Tools for Working Capital Optimization

With the COVID-19 pandemic, global supply chain issues and overall market volatility enduring for the foreseeable future, companies are focusing on optimizing working capital. According to a February 2022 Deloitte poll, nearly half the C-suite and other executives rank working capital optimization and management as a top priority for this year.

In a session at KyribaLive 2022, Bojan Belejkovski, director of treasury for Ilitch Holdings, shared some of his experiences in shoring up working capital throughout turbulent times and for the foreseeable future.

Building a Cash Culture

Belejkovski began by noting that, throughout the COVID-19 pandemic, most treasury and finance teams were forced to prioritize working capital just to survive. “Everyone was focused on building strong processes and procedures around working capital optimization,” he said.

He explained that effective working capital management begins with building a “solid, cash culture.” This requires treasury to acquire data from the ERP system, and then work with internal stakeholders to discuss payables and receivables trends and tactics. From there, treasury can use that knowledge and insight to propose solutions that can potentially boost cash flow.

But to do so properly, treasury also needs to understand what drives free cash flow. Cash flow drivers are typically a company’s working capital, capital expenditures and EBITDA. Working capital, at one point, wasn’t as prioritized as the other two factors, but this has changed in recent years, Belejkovski said.

Michael Lomax, director of working capital solution structures for Kyriba, added that optimizing working capital can drive a company’s CapEx. “You need to have different levers to pull depending on your cash position,” he said. “If there is a large CapEx need, then your working capital may be depleted. That can affect your free cash flow.”

Optimizing the Cash Conversion Cycle

A company’s cash conversion cycle (CCC) is the time it takes for the organization to convert purchases into cash flows from sales. Breaking it down into an equation, the CCC consists of days sales outstanding (DSO), plus days inventory outstanding (DIO), minus days payable outstanding (DPO). The CCC is one of the most valuable metrics to determine working capital efficiency.

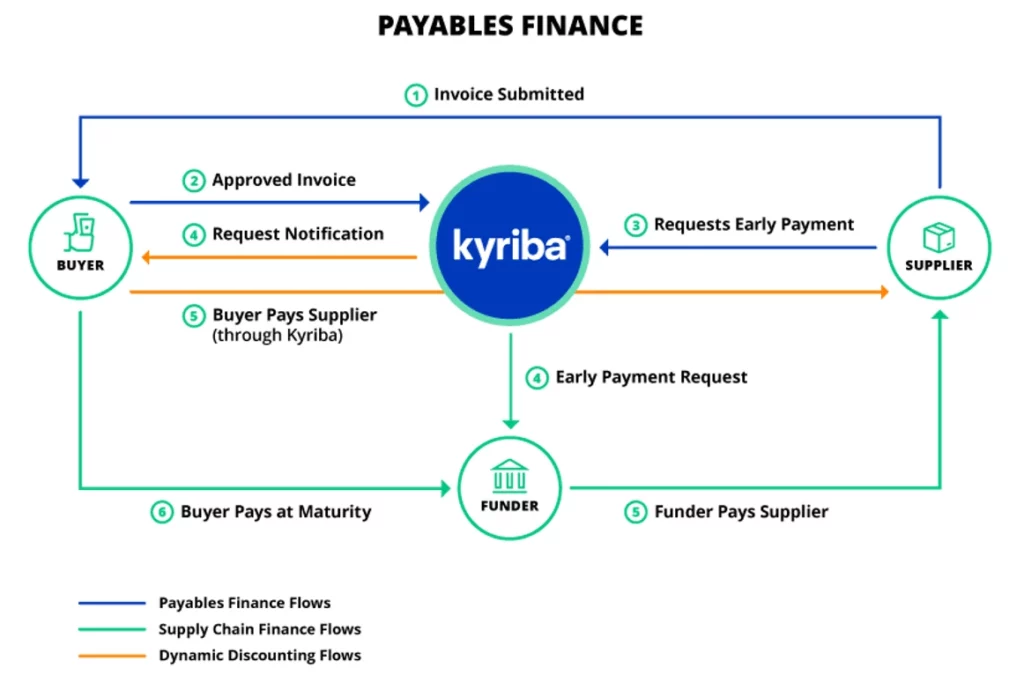

One way to improve the CCC is through payables financing. Ideally, buyers want to pay as late as possible for product or service, while suppliers want their money as early as possible. In payables finance, a third-party funder pays the supplier upon invoice approval, while allowing the buyer to pay the funder on a later, agreed upon date.

Belejkovski views payables finance as a “win-win” for buyers and suppliers. “I’ve used payables finance solutions in the past in a few different industries,” he said. “I’ve seen firsthand; it not only helps the relationship [between buyer and supplier] but it also helps the company overall from a cash perspective.”

Lomax agreed, noting that payables financing is an ideal solution for the situation; the buyer is trying increase its DPO and the same time the supplier is trying to decrease its DSO. “There’s really no way to do that except creating an intermediary solution that bridges that gap and creates a win-win,” he said.

Payables Finance Solutions

Companies commonly have one of two cash scenarios; they are either operating under a surplus or a deficit. Belejkovski has observed treasury departments at companies in a surplus position investing excess cash in low-return, risk-free investments like overnight deposits and short-tenor money market funds. Rather than keeping things at status quo, effective working capital programs can allow cash-flush companies to increase returns and reduce the cost of goods sold (COGS).

For companies operating under a deficit, they may have to borrow substantially from their revolving credit lines. Working capital solutions can benefit these companies by helping them reduce borrowing, free up more capital and stabilize the CCC.

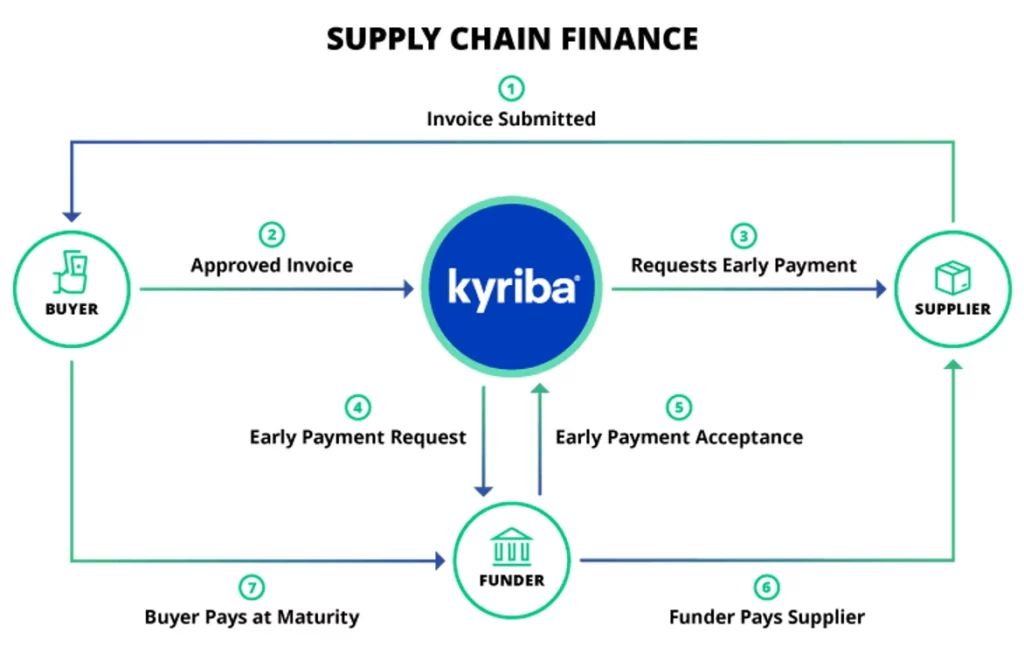

There are generally two core payables finance models—supply chain finance and dynamic discounting. Which solution is more appropriate will typically depend on whether a company is in a surplus or deficit position.

In supply chain finance, a supplier “sells” approved invoices to financial institutions for a discount that is dependent on the buyer’s credit risk. The supplier then receives early payment, while the buyer can further extend its payables, improving cash flow performance.

Supply chain finance is particularly useful for companies in a deficit position who need to use third-party financing to negotiate longer terms and release cash. Buyers will enjoy uninterrupted supply from vendors without excess pressure on working capital.

Additionally, through a third-party system, a company can create a cash pool from multiple sources. “Maybe there is excess liquidity somewhere that comes at a better rate, so you can pick and choose what you do with that,” Belejkovski said.

In dynamic discounting, the buyer offers the supplier early payment in exchange for a discount or financing fee at a lower cost of funding than it can achieve on its own. This helps the buyer generate higher returns on free cash, reduce COGS and increase profits.

Belejkovski noted that companies in a surplus position can leverage excess cash to generate a higher, risk-free return compared to some other investment options. “So, during COVID, many companies benefited from strong working capital management because it yielded high returns, compared to government funds,” he said. “They utilized their dynamic discounting programs that they put in place.”

Furthermore, dynamic discounting allows buyers to cultivate better relationships with suppliers. Suppliers have greater control over when they are paid, which helps when buyers need to negotiate term extensions.

The Best of Both Worlds

As a company’s cash position changes, one working capital solution may no longer be a fit. Your working capital solution provider should be able to assess your position and advise you on whether the product you’re using is your best option. Even if you start out with supply chain finance, dynamic discounting might be preferable somewhere down the line. “As we look at the cash position and the goals of a company, we may start with one [solution] but switch to another and you can easily toggle between the two,” Lomax said.

Treasury may ultimately benefit from a solution that combines both models—hybrid dynamic discounting. This solution enables the treasury team to select whether supply chain finance or dynamic discounting is more appropriate, depending on the company’s excess liquidity. It provides the organization with the flexibility to optimize working capital either through a funder or through its own cash. With the option to access third-party funding, liquidity is always available to the buyer while the supplier’s experience remains consistent.

“It allows you to get the best of both worlds,” Belejkovski said. “It allows your company to gain more flexibility and switch seamlessly between making a direct payment for financing. I think this is the key for treasury professionals. They can build this kind of module; it will help them not only utilize their cash today but really plan their forecasting.”