eBook

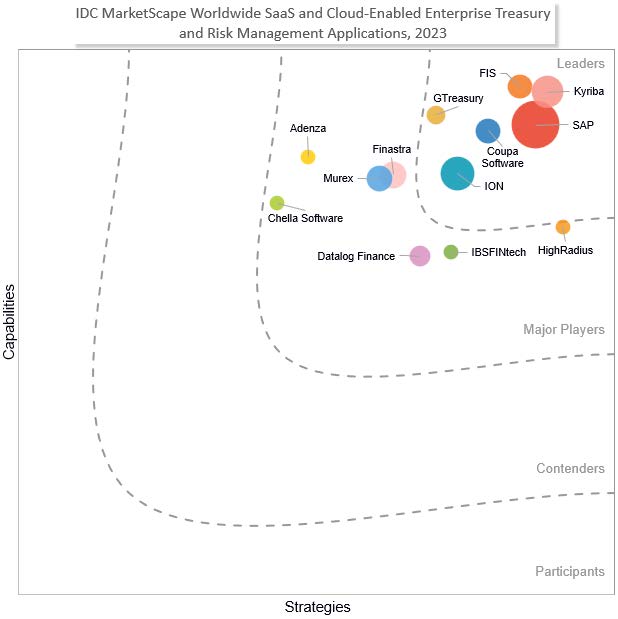

IDC MarketScape: Worldwide SaaS and Cloud-Enabled Enterprise Treasury and Risk Management Applications 2023 Vendor Assessment

Table of Contents

IDC Opinion

In times of uncertainty, businesses rely heavily on liquidity management to stay prepared for the unknown. Between global conflict, natural disasters, political unrest, and the ever-looming shadow of economic uncertainty, the ability to manage liquidity and cash is becoming a higher priority than ever. The current state of the world gives treasury management software (TMS) providers the opportunity to capitalize on an ever-growing need.

Businesses use liquidity to determine how easily assets can turn into cash. A liquidity ratio shows how financially stable a business is by demonstrating what a business owes versus what it owns. With a high liquidity ratio, businesses are more prepared to pay short-term liabilities and any unexpected expenses, bills, or obligations. A low liquidity ratio shows that it may be difficult for a business to turn assets into cash within a brief period if an unanticipated situation occurs and, therefore, is at a greater risk of bankruptcy. The ability to accurately determine a business’ current state of liquidity is essential for making wise business decisions.

In addition, a business’ liquidity ratio is usually a factor in decision making for lenders and investors looking to provide loans or funding. They want to have an idea of how easily the business could obtain cash if needed. In times of increased inflation and skyrocketing interest rates, liquidity ratios can make or break a business. For these reasons, the ability to accurately determine and manage liquidity and cash is an even greater concern to business owners now than ever. Using the proper treasury management system can assist with these liquidity concerns while guarding against error-prone manual processes, low cash flow awareness, compliance issues, and disorganized data.

Key features to take under consideration when determining the best treasury management solution for a business include automation capabilities, analytics and reporting, forecasting capabilities, compliance functions, reconciliation, security and, of course, liquidity tracking and cash management. These features assist with a variety of pain points a treasurer and accounting department may face and provide decision makers with real-time views of the business’ financial standings.

As a result of current events and a growing emphasis placed on liquidity and cash management, treasury management solutions are finding themselves in the spotlight. Common features of treasury management systems include liquidity and cash management, proving them invaluable to businesses struggling to maintain an accurate picture of their cash flow and current liquidity ratios. While these features are extremely useful, they can fall under scrutiny if not updated and streamlined according to the current needs of users.

Now is the time for treasury management software providers to highlight their liquidity and cash management features when interacting with potential clients. This is also a perfect opportunity to improve and streamline processes that may be outdated, overly complicated, or difficult to implement, as these features will be under greater scrutiny than usual. Taking the initiative to meet the evolving liquidity and cash management needs of today’s treasurer will set up a software provider apart from the competition.

Enterprise Difference

Within the enterprise segment, organizations often have dozens (sometimes hundreds) of back-office applications connected to the process or resulting data from travel and expense management. Data from treasury activities must flow between all the relevant finance functions, including accounts payable (AP), accounts receivable (AR), FP&A, order management, and procurement. In addition, the data must flow outside of the finance teams as well including investors and lenders, certain government agencies, banking/financing partners, and even to certain customers and suppliers. Here are few issues that enterprise businesses feel more acutely than smaller businesses, including:

- Centralized liquidity/cash data: The centralization of liquidity data streamlines financial operation, allowing for better control for financial leaders. Centralization provides financial leaders with the opportunity to standardize cash management across all legal entities, reduce the number of bank accounts in use, and provide a more holistic view of bank or foreign exchange (FX) exposures.

- Deep liquidity analytics: Having access to deep analytics provides users with the ability to better predict future liquidity. More importantly, it allows them the chance to find patterns or overlooked items that have business significance (e.g., identifying cash as a revenue-generating asset, monitoring bank fees, and deposit rates).

- Real-time massive data: Finance leaders need real-time information to optimize decision making but often must wait to the end of day/period/quarter to get an accurate and holistic view of the current state of the enterprise liquidity. Today’s liquidity manager needs real-time data to build accurate forecasts and market simulations. Real time is also essential in effective communication of the business cash position between stakeholders.

IDC Marketscape Vendor Inclusion Criteria

The vendor inclusion list for this document seeks to accurately depict the vendors that are most representative of any given treasury functional buyer’s selection list. Vendors were further investigated to ensure that their offerings qualified as “software as a service (SaaS) or cloud enabled” and the vendor had won recent deals. Further, participant companies indicated which other vendors they most often compete against in deals. Also, the treasury software must be able to be purchased and implemented separately from other associated financial/enterprise resource planning (ERP) software. Preference was given to companies with revenue of more than $10 million and/or that were on our watch list of companies within this market.

The vendor inclusion list for this document seeks to accurately depict the vendors that are most representative of any given software application on a buyer’s selection list based on the following items:

- Vendors must have a SaaS or cloud offering — on-premises-only applications are out of scope.

- Software applications can be purchased separately (not just functionality built into a larger system) and are available off-the-shelf without required customization.

- Software application has capabilities for treasury management features including bank relationships management, corporate payment management, financial risks management, cash and liquidity management, debt and credit ratings, debt and investments, and hedge accounting.

- The vendor had 2023 revenue in at least two countries.

- The vendor had at least $5 million in 2023 treasury management software revenue.

- The vendor had minimum of one treasury product in market for at least three years.

- The vendor must have a significant footprint with business with more than 1,000 employees.

Advice for Technology Buyers

The process of transitioning treasury management from a manual model to an intelligent model can be a challenging one. It is important to structure your treasury department to be more efficient and agile to cope with the ever-changing compliance/regulatory/liquidity demands. Here are key steps in the journey toward optimizing your treasury management department through the addition of an advanced software package like the ones listed in this document:

- Begin by looking inward: Before you choose your treasury management software vendor or even whether a dedicated TMS is a sound investment for your organization, first you should take the opportunity to do some self-reflection. Here are key questions to ask regarding the internal resources and processes:

- What are the issues I would like to resolve with this new system?

- Are the issues technology related?

- What are my internal support resources and capabilities?

- How should we define success for this implementation?

- Which internal stakeholders should we include in the evaluations processes?

- Select the right partners (internal and external): The first step in the journey to TMS is developing a strategy and plan for the implementation. This includes doing due diligence in finding the right TMS vendor. Here are key questions to ask regarding the TMS vendor:

- Does the vendor have experience with my type of product, service, and company size?

- Can the vendor show you a live demo with your organization’s “live/real” data to show the benefit to the business?

- Does the vendor understand the regulations that will impact my business? How are these regulations reflected in my current product, and how will they change in the future?

- What is the vendor’s strategic investment outlook for the next three to five years? Why? How will that change and enhance my business?

- Take ownership of the implementation: For optimal results, organizations must take an active role in the actual implementation of the software. Treasury management software touches upon other back-office systems (ERP, finance, accounts receivable, supply chain, inventory, etc.). As a result, extreme attention must be given to how the TMS system is set up and how it interacts with other systems within your organization. Here are key questions to ask regarding the TMS implementations:

- What levels of support are available, and are they geographically available for my business?

- How should I set up the service-level agreement (SLA) before signing any contracts?

- Can TMS integrate with my company’s other IT systems and those of my partners?

- Which IT systems need to integrate and to what degree?

- How are we set up to deal with frequent product updates?

- Note that post-implementation is critical: The success of any SaaS implementation hinges on what happens after the implementation is up and running. This is where change management takes center stage, and the people side of treasury management becomes essential. Here are a few key questions to ask regarding the post-go-live phase of TMS implementations:

- Do we have a strategy to encourage rapid adoption among treasury employees?

- Do we have the right amount of training for employees to master the new features within the TMS system?

- Are we communicating the purpose and benefits of the system change to the treasury employees?

- Have we aligned existing policies and procedures to enable the adoption of the new workflows?

This IDC MarketScape vendor assessment assists in answering these questions, among others. The goal of this document is to provide potential software customers with a list of treasury software companies that have taken great strides to incorporate the previously listed capabilities. We have profiled and assessed their capabilities to support the complicated area of treasury management software.

Kyriba

After a thorough evaluation of Kyriba’s strategies and capabilities, IDC has positioned the company in the Leaders category in this 2023 IDC MarketScape for the worldwide SaaS and cloud-enabled enterprise treasury and risk management applications market.

Kyriba is a secure, scalable SaaS platform that leverages artificial intelligence, automates payments workflows, and enables multinational corporations and banks to maximize growth, protect against loss from fraud and financial risk, and reduce operational costs.

Kyriba’s platform offers a range of solutions, including cash and liquidity management, forecasting and budgeting, risk management, payments and bank connectivity, and financial accounting. The platform is designed to help companies of all sizes, from small businesses to large enterprises, and manage their financial operations more efficiently and effectively.

Quick facts about Kyriba are:

- Employees: 1,000

- Total number of clients: 2,500+

- Globalization: 100+

- Industry focus: Chemicals, consumer goods, energy, financial services, healthcare, higher education, insurance, manufacturing, nonprofit, real estate, retail, technology, transportation, hospitality, and utilities

- SaaS: Multitenant SaaS platform

- Pricing model: Combination of annual subscriptions and consumption based

- Partner ecosystem: 100+

Strengths

- Data and connectivity: Kyriba’s platform uses APIs to unify data across the enterprise, AI to predict and enrich new data, and embedded Analytics to visualize and present data patterns and reporting. Kyriba offers out-of-the-box, certified connectivity to ERP vendors including SAP ECC and S4/Hana, Oracle, NetSuite, and Microsoft Dynamics and includes prebuilt connectors to over 1,000 global banks for bank reporting and payments. Kyriba offers a SWIFT service bureau alongside APIs and other direct to bank connectivity.

- More than treasury: Kyriba’s platform offers treasury alongside risk management, payments, working capital, and connectivity products. Each can operate standalone or as a single solution. Kyriba was originally built as a cash management solution and has developed into a comprehensive TMS with products that are designed for IT and other branches within the office of the CFO.

Challenges

- Client’s short-term goals: Focus by clients on immediate functional requirements to replicate their current business practices without fully strategizing future requirements and involving their IT teams soon enough to leverage available transformation capabilities can be a challenge when implementing a new TMS.

- Client internal alignment: As Kyriba offers more than TMS capabilities (payment factory, payables finance, and receivables finance), there are challenges in obtaining an internal alignment of many teams in the client organization (CFO, treasury, accounting, procurement, IT, etc.) to leverage all Kyriba’s capabilities.

Consider Kyriba When

Consider Kyriba if you are looking for a comprehensive TMS that features a robust cash and liquidity management system from a company that also offers many additional finance department capabilities.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications and consumer technology markets. IDC helps IT professionals, business executives, and the investment community make fact-based decisions on technology purchases and business strategy. More than 1,100 IDC analysts provide global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries worldwide. For 50 years, IDC has provided strategic insights to help our clients achieve their key business objectives. IDC is a subsidiary of IDG, the world’s leading technology media, research, and events company.

Copyright and Trademark Notice

This IDC research document was published as part of an IDC continuous intelligence service, providing written research, analyst interactions, telebriefings, and conferences. Visit www.idc.com to learn more about IDC subscription and consulting services. To view a list of IDC offices worldwide, visit www.idc.com/offices. Please contact the IDC Hotline at 800.343.4952, ext. 7988 (or +1.508.988.7988) or [email protected] for information on applying the price of this document toward the purchase of an IDC service or for information on additional copies or web rights. IDC and IDC MarketScape are trademarks of International Data Group, Inc.

Copyright 2023 IDC. Reproduction is forbidden unless authorized. All rights reserved.