Fact Sheet

Kyriba API Integration for Microsoft Dynamics 365

Unleash the Power of Enterprise Liquidity Management with Microsoft Dynamics 365 and Kyriba

Table of Contents

- A Secure and Scalable Connectivity Solution

- Major Benefits of Using Kyriba D365 Integration Solution for Payments Workflow

- The Kyriba D365 API Integrated Payments Workflow Explained

- Kyriba D365 API Integration for Cash Management Workflow

- Kyriba D365 API Integration for GL Export Workflow

- Kyriba D365 API Integration for Bank Statement Export Workflow

- Kyriba D365 API Integration for GL Reconciliation Workflow

- Kyriba D365 API Integration for FX Balance Sheet Workflow

- FAQs on the Kyriba D365 API Integration

A Secure and Scalable Connectivity Solution

Kyriba’s API integration for Microsoft Dynamics 365 (D365) accelerates payments and bank connectivity projects, eliminates project risk and drastically reduces connectivity costs. The Kyriba D365 integration centralizes payment activity, fully manages bank connectivity and delivers superior fraud detection and visibility. It also provides a full suite of out-of-the-box ERP workflows for cash management, GL reconciliation, GL export, FX balance sheet and bank statement export.

With one API gateway, clients can connect via Kyriba to over 1,000 global banks, supported by an extensive format library of 50,000 pre-developed and pre-tested payment scenarios. Kyriba’s connectivity solution relieves IT development and maintenance burdens by managing future connectivity and format changes while monitoring connectivity performance 24/7.

Major Benefits of Using Kyriba D365 Integration Solution for Payments Workflow

| With Kyriba D365 Integration | Without Kyriba D365 Integration | |

| Configuration and Installation |

|

|

| Payment Processing |

|

Connected via SFTP:

Direct to Kyriba API:

|

| Payment Monitoring |

|

|

The integration between D365 and Kyriba allows clients to submit and monitor payments and direct debits using D365 with automated workflow into the Kyriba Platform.

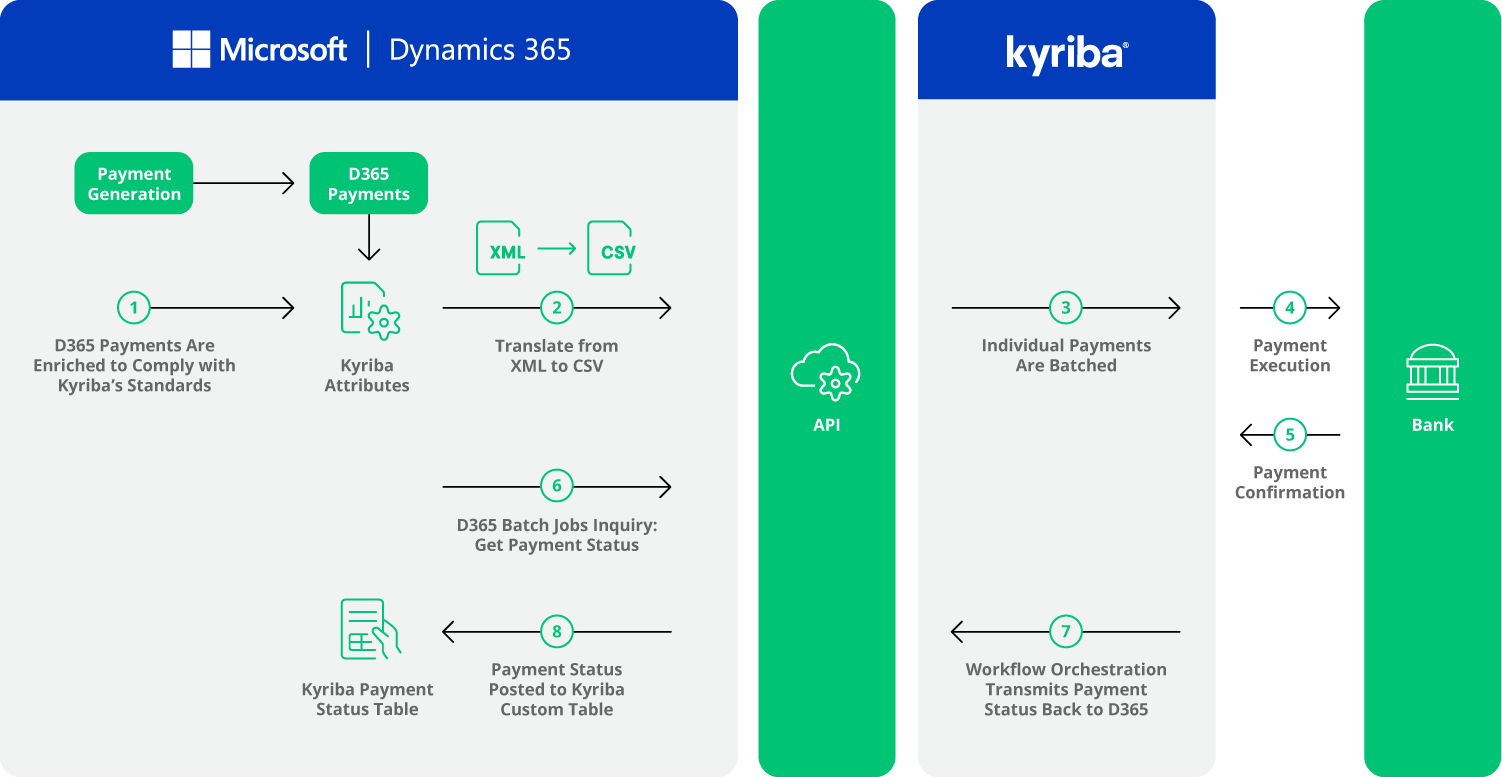

The Kyriba D365 API Integrated Payments Workflow Explained

- D365 payments are translated to comply with Kyriba’s standard payment information. Kyriba’s custom table provides mapping of relevant information.

- D365 payments are translated from XML to CSV and sent to Kyriba as individual payment requests.

- Payment requests are batched in Kyriba.

- Batched payment orders are sent to associated banks to be executed.

- Payment confirmation is sent by the banks to the Kyriba application.

- Inquiries are scheduled in D365 ERP to retrieve payment acknowledgments from the Kyriba application.

- Payment status updates are transmitted to D365 ERP through API integration.

- Payment status is posted to Kyriba’s custom table.

Kyriba D365 API integration also supports cash management, GL reconciliation, GL export, FX balance sheet and bank statement export workflows.

Kyriba D365 API Integration for Cash Management Workflow

Supporting cash flow forecasting and positive pay.

The automated workflow facilitates:

- Open customer and vendor invoices

- Non-Kyriba payments, such as checks

- Other GL entries to support cash forecasting

Kyriba D365 API Integration for GL Export Workflow

Providing a cash accounting solution, sending GL entries created in Kyriba to the ERP.

Main features include:

- Export of GL entries from Kyriba

- Export of GL entries not otherwise reported to the ERP

Kyriba D365 API Integration for Bank Statement Export Workflow

Exporting bank statements to ERPs.

The automated workflow features:

- Extract of bank statements in a format accepted by ERPs

- Export contains prior day/intra-day data, depending on the ERP

Kyriba D365 API Integration for GL Reconciliation Workflow

Facilitating reconciliation of bank transactions to accounting.

It eliminates error-prone manual entry with:

- Import of bank account entries from the ERP

- Posting of GL adjustments back to the ERP

Kyriba D365 API Integration for FX Balance Sheet Workflow

Extracting balances for FX analysis (previously as FireApps).

Main features include:

- Extract of life-to-date balances for assets and liabilities

- Balances aggregated by entity, currency and GL account in document, local and reporting currencies

For more details, check out the Kyriba Developer Portal.

FAQs on the Kyriba D365 API Integration

Do different D365 platforms require different installations?

No, the same Kyriba D365 build package is available for all installations.

What are the D365 releases Kyriba supports?

Kyriba follows the D365 release updates. Kyriba always communicates with the latest build package along with the oldest supported D365 version. For instance, currently (2023), the oldest D365 version supported is 10.0.32. See the Kyriba Developer Portal for more information.

Can customers use their own middleware to call the API?

Yes, customers can use their own middleware to call the API.

What authentication schemes does the integration use?

The integration uses REST API with Basic Authentication or OAuth2.

Can clients connect to multiple ERP systems?

Yes, Kyriba ERP Connectors support the integration of multiple ERPs, including NetSuite, Oracle Cloud, SAP S/4HANA and ECC.

Are payment transfers batched?

All payment transfers are batched in Kyriba. Technically, clients could send a single payment request to Kyriba.

What payment types are supported?

The integration supports payment request imports and payment status updates for vendor payments, treasury, direct debits and checks.

How long does it take to connect my ERP to Kyriba?

Historically, installation and API connectivity take 2-5 days, depending on the complexity of a client’s configuration and modules in scope. Kyriba D365 API integration reduces the cost, risk, time and effort required to connect D365 ERP to Kyriba.