Fact Sheet

FX Exposure Management for Oracle

Delivering on-demand interactivity with Oracle applications, Kyriba for Oracle is a cloud-based solution that reduces the risk of foreign currency volatility to earnings per share and corporate value.

Table of Contents

The Cloud-based Business Model Advantage: Quick ROI and Low TCO

By leveraging the Cloud-based business model, Kyriba creates two advantages: speed and low cost, without sacrificing the safety and security of your data. Kyriba is committed to keeping your confidential data safe and secure, and our processes and controls are audited annually.

The Cloud-based model frees your IT personnel from the need to manage and maintain the product and updates typically associated with installed and licensed software products, and enables Kyriba to rapidly and continually add product innovations to the market.

Kyriba customers experience quick returns on their investment. Up and running quickly, Kyriba provides almost immediate visibility to exposure and risk data, and access to analytics and decision support capability. Confidence in your decisions allows you to take actions to manage risk, reduce costs and gain operational efficiency.

Kyriba’ Cloud-based application also provides low Total Cost of Ownership. Because Kyriba is hosted, it requires little or no redeployment during upgrades, and no IT development. You know the subscription-based outlay at the time of purchase; you also know that the cost of ownership will not spike due to upgrades, redeployment, or support during the subscription term.

The Kyriba Oracle Extract Toolkit: Facilitating Set-up and Ongoing Data Aggregation

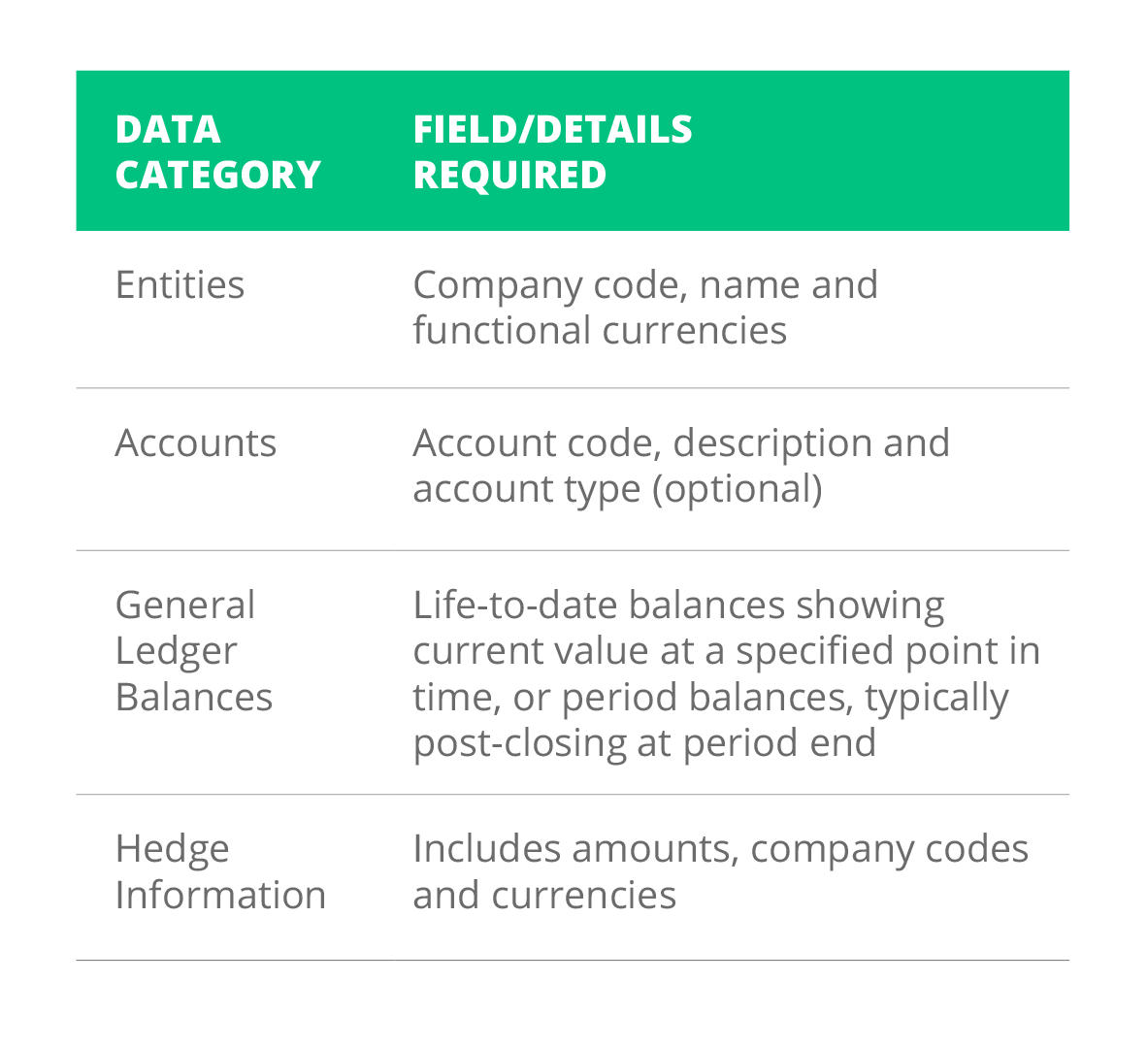

Using proprietary technologies, Kyriba aggregates raw G/L data from Oracle, as well as other ERP systems, databases and spreadsheet data sources.

To facilitate the process of data collection for initial enrollment and ongoing exposure management, Kyriba has created an Oracle Extract Toolkit. The Kyriba Oracle Extract Toolkit consists of software queries that capture Oracle account/entity configuration and revaluation rules and generate FX exposure data. The Kyriba Oracle Extract Toolkit gathers information about the account definitions and company information. On an on-going basis, the Kyriba Oracle Extract Toolkit provides a query used to extract summary monetary asset and liability or revenue and expense balance data from your Oracle general ledger.

The Kyriba queries for Oracle are reports written in SQL*Plus, designed to be run from either the SQL*Plus command line or installed to the Oracle Applications Suite and run as concurrent programs. The programs do not create any database objects nor do they write or update any database tables or objects. The programs require read-only access to several tables and objects located in the APPS schema.

If one does not already exist, Kyriba can provide scripts to create a read-only schema to access these objects. From the SQL*Plus command line, output is generated using DBMS_OUTPUT and spooled to a local pipe-delimited file.

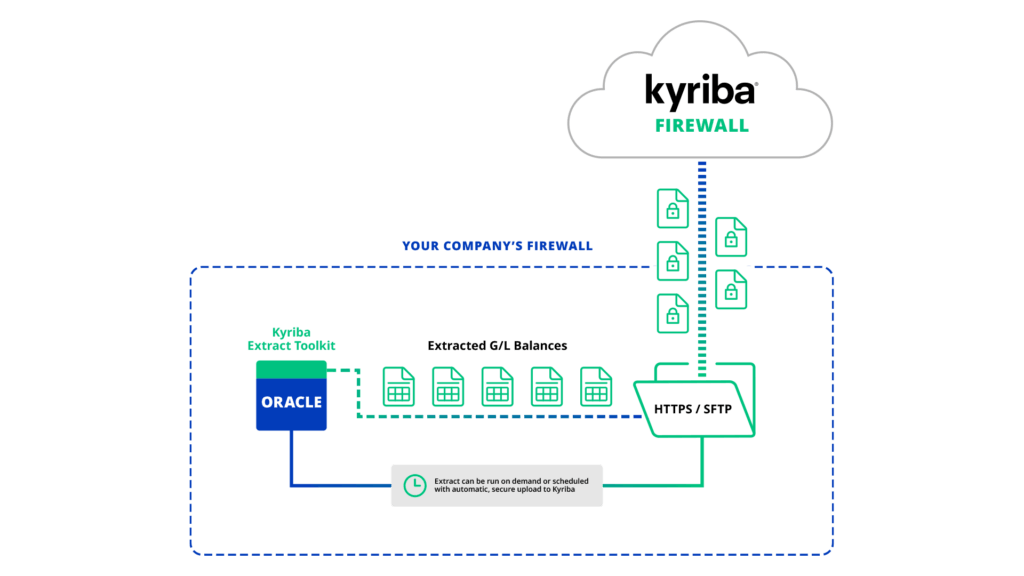

The extracted files can be manually and securely uploaded to Kyriba by any authorized user. To further maximize efficiency, frequency, time savings, error reduction, and security, while minimizing support required from IT, the extract process (both the execution of the extract query and the encryption and upload of the resulting files) can be automated. For a fully automated solution, queries can be set up within the Oracle Applications Concurrent Manager and executed ad-hoc as needed, or scheduled to run periodically.

Subsequent scripts can encrypt and transport the file directly to Kyriba. An automated extraction, encryption and upload process is particularly beneficial if you have multiple data source instances or systems.

For each instance of Oracle, your IT team will deploy and maintain the Kyriba Oracle Extract Toolkit queries. The query programs are the only software deployed and maintained in your environment.

Kyriba Application Security

Kyriba understands and appreciates the importance of keeping your highly-confidential financial data safe and secure, and simultaneously available to your authorized users on demand. We have passed the scrutiny of our discriminating customers and ensure that our standards for security and confidentiality are the maximum possible.

Here are some of the elements that built confidence for our customers:

- Strong encryption to protect sensitive G/L data both in motion and at rest

- Annual SSAE 18 Type 2 audits for the Kyriba application and company processes and controls

- ISO 27001 certification

- Internet firewalls and an additional level of access protection around the production databases

- Application layer separation from data with application-only access

- Role-level access and idle disconnect

- IP Whitelisting, guaranteeing client access from only specific Internet addresses

- Continual monitoring through port scans and network intrusion detection systems

- Complete audit trail in application and data back-up

- Application hosting with AWS and Microsoft Azure

- Full redundancy in daily operations for Internet connectivity, failover, and load balancing

- Disaster recovery plan & capabilities provide for full redundancy & a production system recovery objective of 6 hours

- Annual third-party penetration testing and security audits

- Employee, contractor and data center personnel background checks

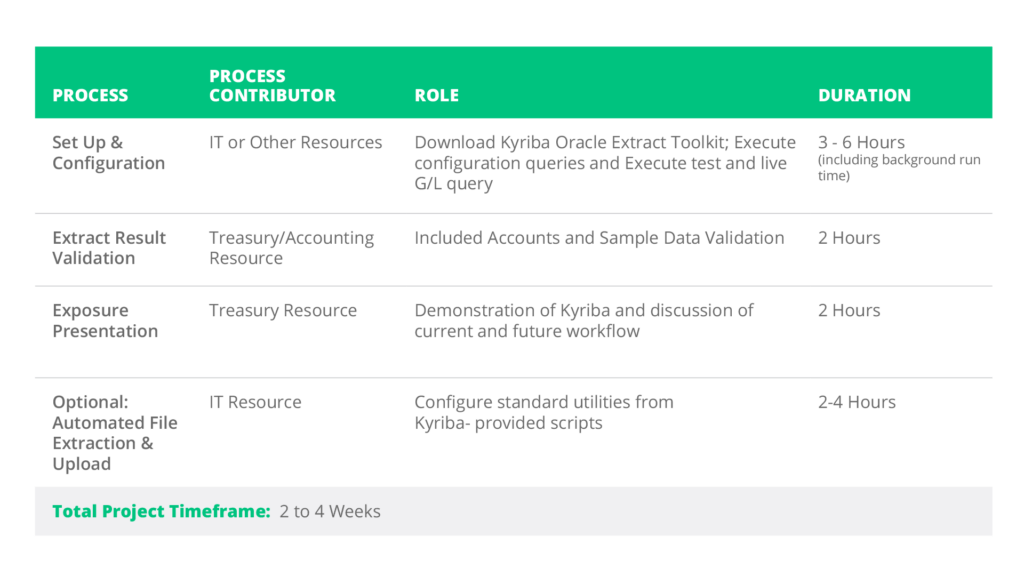

Enrollment: A Simple Process

The Kyriba Professional Services team will lead your IT and Treasury staff through three simple, well-defined steps including query set-up, resulting data validation, and an exposure presentation, to achieve ongoing, on-demand Oracle data aggregation and Kyriba FX exposure management. A final step automates the file extraction, encryption and upload process. On average, it takes 8-10 hours of an IT generalist’s time per ERP system enrolled in the Kyriba service.

Typical enrollment resources include:

- A developer or resource with APPS schema access or access to a read-only schema to execute the programs to retrieve the setup information and the general ledger balances

- A developer or functional person (usually Treasury) who can verify Kyriba balances using native Oracle general ledger reports

- (Optional) A DBA or Systems Administrator, if installing the program to the Oracle Applications Suite as a concurrent program. Kyriba provides instructions for concurrent program installation

During Enrollment, your IT personnel will install and execute the Kyriba Oracle Extract Toolkit. The toolkit installs in minutes and provides two components: configuration queries and a general ledger (G/L)extract query.

The configuration queries derive a chart of accounts table, revaluation rules and entity structure. Next, IT, or other personnel with access rights, execute the Kyriba G/L extract query to produce a test exposure data set. Once the data is validated, you may be asked to re-run the G/L query to produce a final data set. Your IT team will spend three to six hours on this step, including runtime.

During Query Result Validation, your treasury and/or accounting team members will use the sample data generated by the Kyriba G/L extract to verify monetary asset and liability or revenue and expense account information. The Kyriba Professional Services team will produce a sample data set for your review to ensure a complete data set consistent with G/L balances in Oracle. You may also provide data on outstanding hedges, and the validated balance and hedge data is uploaded to Kyriba to calculate FX exposure and support timely, data- driven risk mitigation and cost reduction decisions. This step requires approximately two hours of time/effort.

During Exposure Presentation, Treasury and Kyriba Professional Services review your current workflow and systems landscape, progress to date, the future vision for the end state of rollout, and workflow and process improvements.

A demonstration of the Kyriba software with your live exposure data and a discussion of how exposure visibility can help you optimize your risk management decisions complete the review. This process requires at least two hours of treasury time/effort.

Automated File Extraction, Encryption and Upload

Automated File Extraction, Encryption & Upload is supported through standard protocols HTTPS (e.g. via cURL) and SFTP (Secure FTP) for automating the transfer of files to a secure staging area within the Kyriba application.

Kyriba has customized these protocols with syntax to enable users to transfer files to, and trigger processing within, the Kyriba application. You can deploy scripts (samples provided by Kyriba) based on the needs of your environment, which retrieve the output generated by the Kyriba G/L Extract Program, and encrypt the file(s), before transferring them over 128-bit HTTPS or SFTP to Kyriba.

During your Kyriba enrollment, our Professional Services team will supply scripts as part of the toolkit and work with you to configure them for your environment. The level of effort required to automate the file transfer is subject to the complexities of your environment but is typically measured in hours, not days. The process requires a Systems Administrator, Developer and/or DBA with privileges to create or modify shell scripts to automate the process or integrate with existing processes.

Benefits of Automated File Encryption and Transmission

- Data encrypted at rest and in motion

- Creation of a straight-through process from business systems/ERP to Kyriba

- Automates transfer of the extracted data files directly to Kyriba increasing efficiency and time savings, and reducing errors

- Enables more frequent processing and analysis cycles

- Allows coordinated transfer of files from multiple business systems

- Additional security through PGP encryption and IP Whitelisting

- Uses industry standard utilities and protocols: HTTPS file transfer and SFTP

- Less operational and IT overhead

Supported Versions

- Oracle 11i

- Oracle R12

Oracle and Oracle E-Business are the trademarks or registered trademarks of Oracle Corporation and/or its affiliates.