Fact Sheet

Utilities: Managing Liquidity in an Evolving Industry

Utilities in North America are undergoing a period of rapid change that is presenting new challenges and opportunities. As utilities’ needs evolve, so too must traditionally labor-intensive treasury and cash management processes.

With advancements in technology and growing investment in decarbonization, electrification, and green energy, utilities are reimagining their approaches to providing services. At the same time, utilities also need to contend with strict regulations, changing customer demands, outside risks, and complex ownership structures that can make treasury and finance operations challenging.

With Kyriba, utilities can keep ahead of finance technology demands during these challenging times.

Kyriba automates many routine tasks, allowing treasury and finance to focus on important strategic activities.

Table of Contents

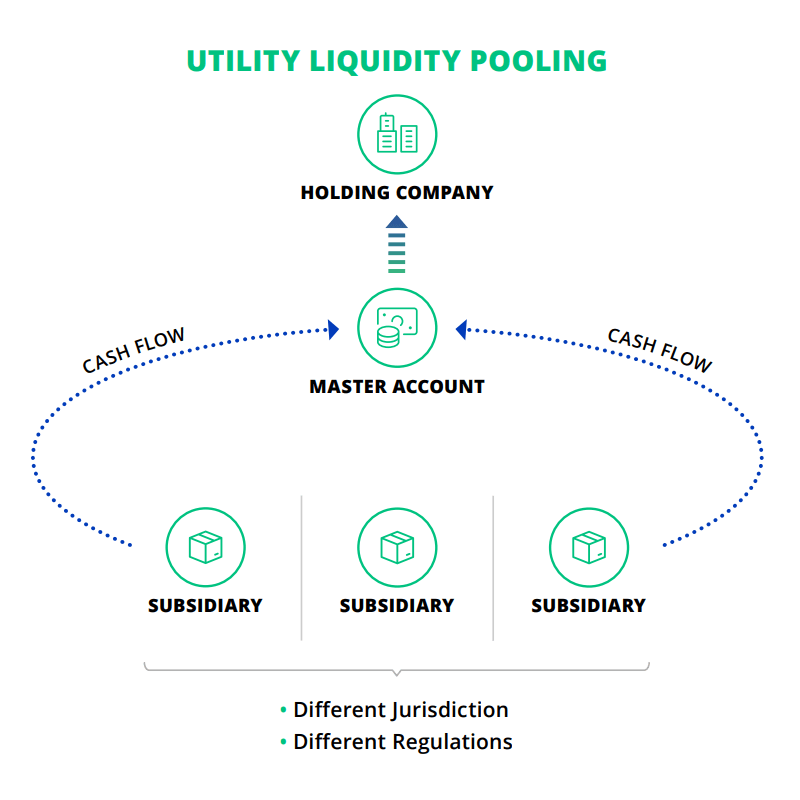

Intracompany Lending and Liquidity Pooling

Larger regulated utilities nearly always operate across multiple jurisdictions with their own sets of regulations, making liquidity pooling and intracompany lending extremely complex. Kyriba manages the complexities of working across differing jurisdictions, maintaining the regulatory firewall between the holding company and the operating companies. Kyriba’s dashboard and pooling capabilities allow you to track and report intercompany transactions to internally pool and lend cash safely and efficiently.

Automation of Treasury and Cash Management

Regulated utilities are required to manage key ratios for statutory compliance. If ratios are off when treasury reports financials to Public Utilities Commissions, utilities can incur hefty fines. With Kyriba’s advanced prediction and analytics capabilities, you can now safely and confidently manage debt and equity ratios to guarantee statutory compliance while simultaneously delivering the KPIs needed to manage your complex business.

Bank and ERP Connectivity

As utilities move away from in-house systems and into the cloud, you will require robust connections between your banks and your ERP systems. Kyriba offers connectivity to Oracle, SAP and Microsoft Dynamics 365, the most prevalent ERPs used by utilities. Kyriba’s APIs can easily connect to your ERP, and beyond.

Cybersecurity (NERC-CIP)

Protecting your critical infrastructure is vitally important. Moreover, it is mandated. Kyriba’s NERC-CIP compliant SaaS software and secure solution infrastructure provides the framework for your utility to meet its obligations.

Advanced Cash Forecasting

One challenge that utility treasury groups routinely report is their difficulty in creating meaningful cash forecasts. That worry can be behind you. Routinely named one of the world’s best cash forecasting solutions, Kyriba adds flexibility, visibility and power to your cash positions, organized by bank, entity, cash flow category, transaction status, etc.

Bank Account Management and Bank Fee Analysis

Kyriba’s Bank Account and Bank Fee Management modules offer workflows to track all details of your bank accounts and banking fees. You’ll have complete review and approval workflows to manage signature authorities while being assured that you are only paying those fees that have been contracted.