Blog

Could Stablecoins Drive Payment Innovation?

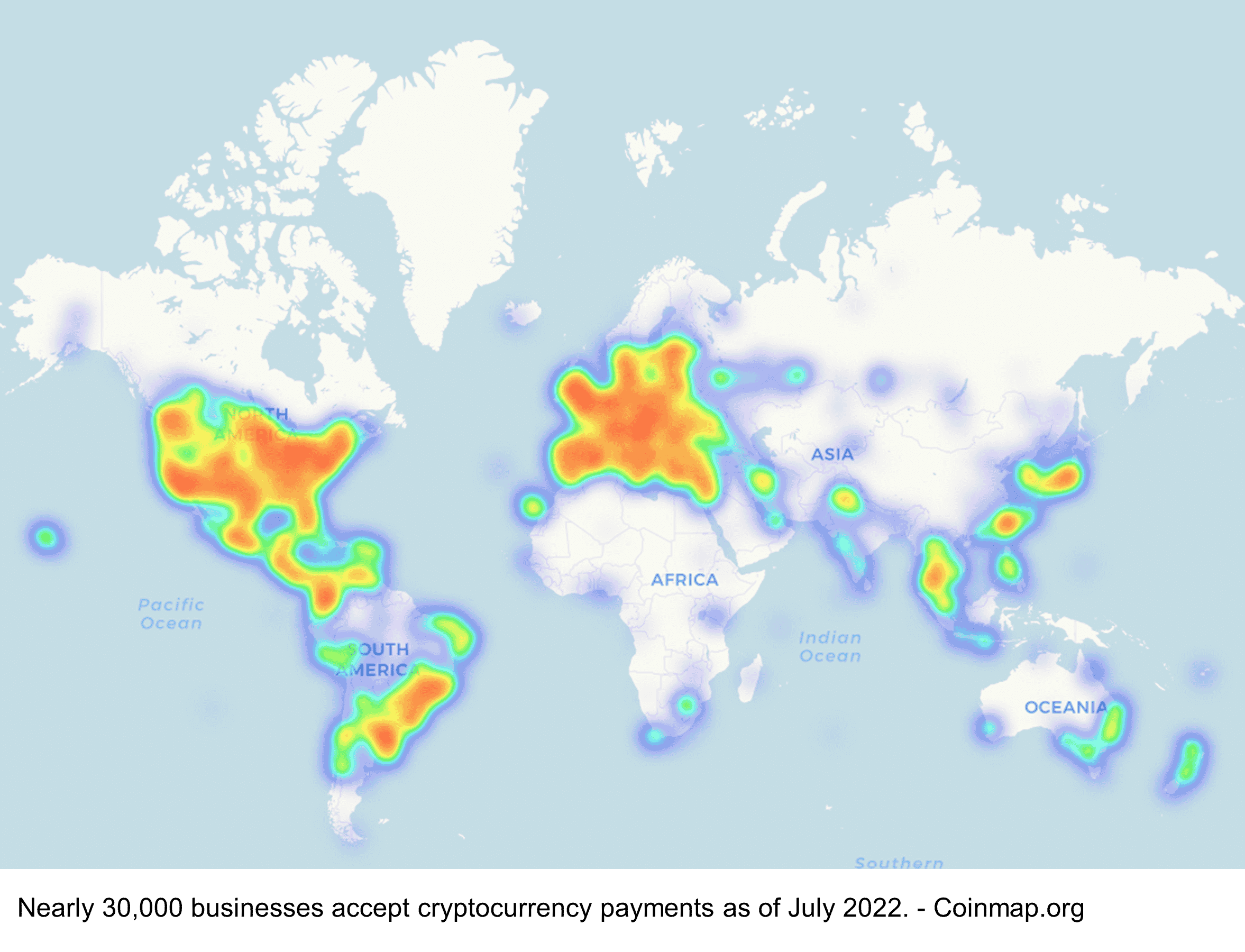

Despite the current market volatility, cryptocurrencies(1) are slowly seeping into everyday transactions,(2) driven largely by small businesses. There are an estimated tens of thousands of businesses that are accepting cryptocurrencies as payments roughly representing about 0.01% of businesses worldwide.

Large corporations have stayed away from cryptocurrencies with a few exceptions(3) where the use is limited to holding cryptocurrencies in treasury. The treatment of cryptocurrencies as an “indefinite-lived intangible asset”(4) poses an accounting risk, forcing companies to write down(5) the value of these assets when their value plummets.

The level of adoption is by no means impressive. Meanwhile, challenges with high-fees, scalability and volatility will continue to limit broad adoption of cryptocurrencies as a form of payment. Such limitations pose an important question for CFOs and treasurers: Are cryptocurrencies worth paying attention to?

Stablecoins and the Future of Payments

The answer is yes, given the potential for innovations that can shape the future of payments for corporates and merchants alike. This is especially true for Stablecoins(6), as they present an opportunity to lower fees, reduce barriers and drive better services like instant cross-border payments. The promise hinges on a stablecoin’s ability to maintain its peg to a specified asset (typically U.S. dollars), or a pool or basket of assets, and provide perceived stability when compared to the high volatility of unbacked crypto-assets.

Since the launch of BitUSD in 2014 on the BitShare(7) blockchain, stablecoins have evolved into public and private stablecoins. Public stablecoins exist in two forms. Reserve-backed or custodial stablecoins are backed by cash-equivalent reserves such as deposits, Treasury bills and commercial paper. These are issued by intermediaries who serve as the custodians of the cash equivalent assets and offer a 1-for-1 redemption of their stablecoin liabilities for the asset it is pegged against.

Algorithmic stablecoins (e.g.,UST) rely on mechanisms other than cash-equivalent reserves to stabilize their price. The peg to a specified asset is achieved by overcollateralized crypto and/or smart contracts that defend the peg by automatically buying or selling the stablecoin. These public stablecoins provide liquidity across the thousands of cryptocurrencies currently in the market. The private institutional stablecoins use tokenized deposits held by the bank for efficiently providing internal liquidity or liquidity for the bank’s wholesale clients between accounts held at the same bank. These coins (e.g., JP Coin) form a closed loop payment network similar to the ones offered by wallet providers like PayPal.

Stablecoin Guidance

Stablecoins have had their share of troubles(8) and collapses(9) in their short history. These risks were well understood by regulatory agencies. However, the explosive growth in cryptocurrencies has made it difficult if not impossible for regulators(10) to keep up. Outside of the ad-hoc enforcement actions against crypto firms by the SEC(11), the industry continues to operate largely outside of regulations. Given the complexity of the crypto ecosystem, it is pragmatic for regulators to start with Stablecoins as they are relatively simpler and have real applications. It is therefore not a surprise, that despite the market turmoil, New York became the first U.S. state to issue guidance for Stablecoin issuers.

The Virtual Currency Guidance(12) provided by the New York Department of Financial Services (DFS) outlines redeemability, reserve and attestation requirements for entities issuing U.S. dollar-backed stablecoins. The industry has been waiting for long-overdue commonsense regulations for reducing systemic risk and providing a fertile ground for stablecoin issuers and other fintechs to drive broad innovation in financial services and payments.

Table 1: Key points from The Virtual Currency Guidance provided by the New York DFS

| Backing and Redeemability |

|

| Reserve |

|

| Attestation |

|

Kyriba has taken a forward looking posture in this space, for example via partnership with Copper to offer corporate treasury direct access to Copper’s award winning digital asset investment platform, and the ability to manage liquidity across fiat, crypto and money market funds.

While the specific time-horizon on when a trend would become meaningful is not easy to predict, CFOs and treasurers can preserve optionality by partnering with providers that stay at the forefront of payment market trends.

More to Read:

- API: Copper Integration

- Blog: The Top 5 Trends for CFOs in 2022

- Blog: Digital Currencies: Not Ready for Corporate Treasury

References

(1) FSB defines all private sector digital assets that depend primarily on cryptography and distributed ledger or similar technology as crypto-assets and not currencies; for this article the two terms are being used interchangeably.

(2) Map of Cryptocurrency ATMs and Merchants, Coinmap.org

(3) Public companies holding bitcoin, Coingecko.com

(4) Accounting for and auditing of digital assets

(5) MicroStrategy Posts a Loss After Taking Bitcoin Impairment, Bloomberg 2/22

(6) Financial Stability Board, Crypto-assets and Global “Stablecoins”

(7) Whitepaper: BitShares – A peer-to-peer polymorphic Digital Asset Exchange

(8) Terra Luna timeline; TerraLuna UST collapse – What Happened?

(9) CFTC fines Tether and Bitfinex for misleading claims; Panics and Death Spirals: A history of- failed stablecoins

(10) Stablecoin risks and potential regulations, BIS Working Paper 11/2020

(11) Crypto Assets and Cyber Enforcement Actions, notes seven enforcement action for the period Jan – April 2022

(12) Guidance on issuance of US Dollar backed stablecoins, New York Department of Financial Services, Jun 2022