Treasury is at an inflection point.

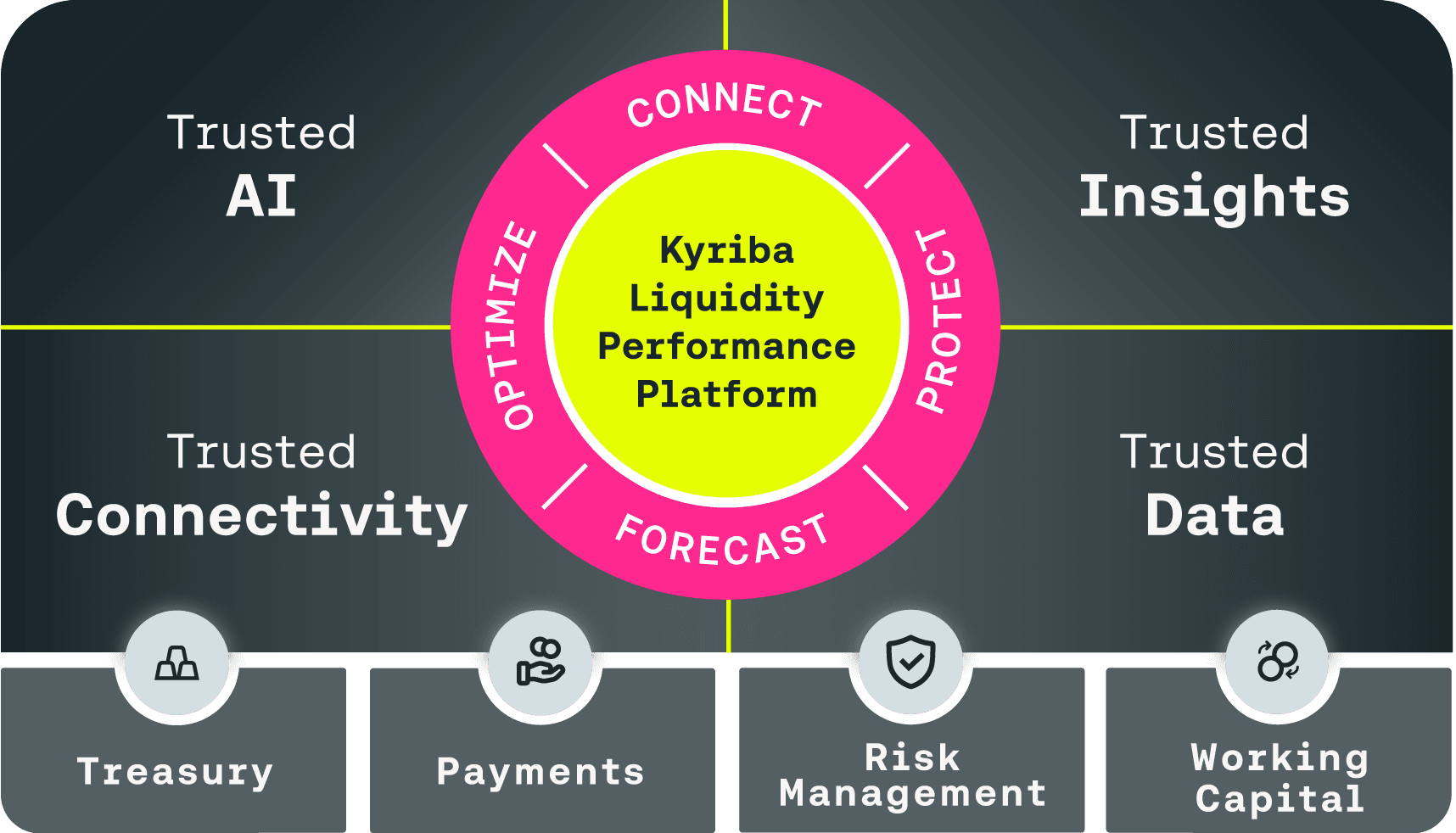

Kyriba transforms how you connect, protect, forecast, and optimize your liquidity.

Yesterday's treasury playbook is failing.

Markets move faster. Payment rails multiply. CFOs expect treasury to drive growth. Instead treasurers are drowning in spreadsheets.

The result? Liquidity Gridlock.

Cash trapped in silos. Forecasts built on guesswork. Fraud slipping through. Risk discovered too late.

It's costing millions in idle cash, preventable fraud, and missed opportunities.

The answer?

Kyriba’s Liquidity Performance Platform.

Kyriba breaks Liquidity Gridlock.

One unified platform connects, protects, forecasts, and optimizes your liquidity—powered by trusted AI and enterprise-grade security.

Unlike fragmented point solutions, Kyriba delivers end-to-end liquidity performance. Real-time visibility. Intelligent controls. Predictive insights. All working seamlessly to turn liquidity from cost center to strategic advantage.

Every AI insight is explainable and auditable. No black boxes. Full transparency into every prediction, driver, and recommendation.

Our vision

Connect — See and act on your liquidity, everywhere

Unify banking data, ERP systems, and analytics. Achieve real-time visibility across 9,900+ banks: every account, entity, and currency.

Stop waiting for data. Start acting on intelligence.

Protect — Keep every payment safe, compliant, and traceable

End-to-end fraud prevention with real-time anomaly detection. Complete audit trails. Built-in compliance.

Block fraud in real time, before payments leave your account.

Forecast — Plan ahead with AI you can trust

AI-powered forecasting that's accurate, explainable, and continuously learning. Model scenarios, stress-test plans, see the future with clarity.

Turn your expertise into foresight.

Optimize — Free up cash and manage risk

Free up idle cash, lower financing costs, manage risk. Intelligent recommendations tied to your liquidity position and policies.

Every optimization unlocks more liquidity.

The future of treasury is already here.

- Get a demo

Real-time payments. Blockchain. Stablecoins.

Treasury teams become liquidity strategists, not transaction processors.

Winners orchestrate with trusted AI that monitors 24/7, forecasts continuously, and executes within governed policies.

Build this future with Kyriba today.

Experience Liquidity Performance, tailored to your org.

Enterprise

Deliver a holistic, enterprise-ready solution to connect, protect, forecast, and optimize liquidity—globally, and at scale.

Midsize

Experience an easy-to-use, flexible, and scalable solution for cash, banking, payments, and liquidity management.

Public Sector

Kyiba is trusted by Federal, State, and Local governmental agencies to safeguard and manage cash and optimize treasury and finance planning.

Banks

Employ the pre-built connectivity needed to accelerate the delivery of liquidity, payments, and risk capabilities to your corporate clients.