Video

What Is a Dynamic Discounting Solution? Kyriba Explains It in This Video

What Is a Dynamic Discounting Solution? Kyriba Explains It in This Video

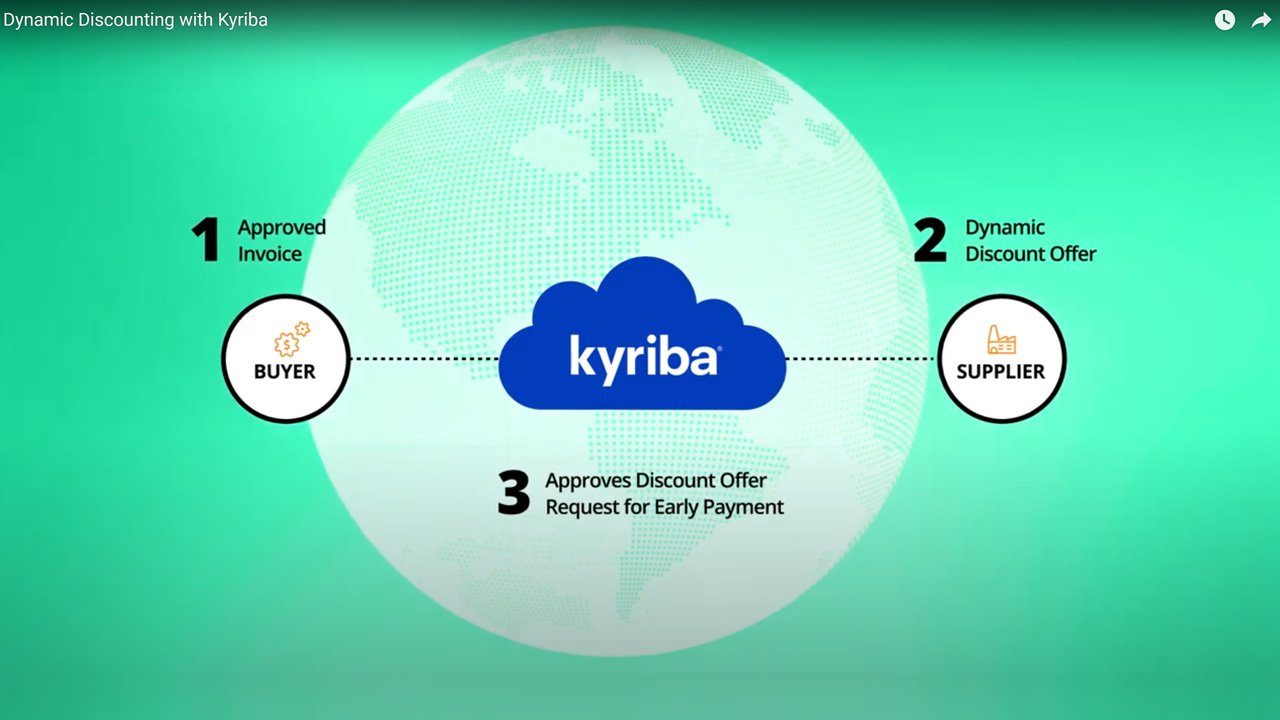

Dynamic discounting is an innovative business strategy that can enable organizations to save money, while at the same time providing their suppliers with an incentive to be paid earlier. This buyer-led program allows buyers to pay their suppliers early, in exchange for a discount on the invoice value. It is a more flexible alternative to traditional discounting programs, as it provides a sliding scale discount structure that decreases as the payment date nears. This sliding scale discount allows the buyer to select a payment option that provides the most savings. This is a great advantage for buyers because it provides them with flexibility but with both their payment processing capabilities and their liquidity levels being taken into consideration.

Dynamic discounting programs offer a greater opportunity to benefit from discounts and provide added flexibility for both sellers and buyers. Sellers can select which invoices they want to enter into the dynamic discounting platform, while buyers have the option to pay at a time that best meets the needs of their organization. This arrangement is beneficial for both parties, as sellers are able to receive payments more quickly, while buyers can take advantage of more advantageous payment terms. Furthermore, dynamic discounting programs allow for a closer collaboration between the two parties.

Having a thorough understanding of one’s current and potential future free cash flow is essential for any successful working capital solution program including dynamic discounting. This is because it allows the buyers to make informed decisions about which type of supplier financing program is most beneficial for them at any given moment. By having a clear view of enterprise-wide liquidity, these organizations are better equipped to choose the program that best meets their needs, allowing them to make the most of their working capital solution program. Furthermore, this insight can also help them to plan ahead, especially when the market is experience a high level of volatility.

Kyriba’s working capital solutions are unrivalled in their capabilities to enable businesses to access real-time, comprehensive information across different systems. Furthermore, Kyriba facilitates cooperation between treasury and procurement departments in order to utilise surplus cash in a secure and profitable manner. This can help organisations to improve profitability, reduce financial risk, and optimise cash flow.

Watch this video to find out more.