Fact Sheet

Kyriba Payments Fraud Detection Solution

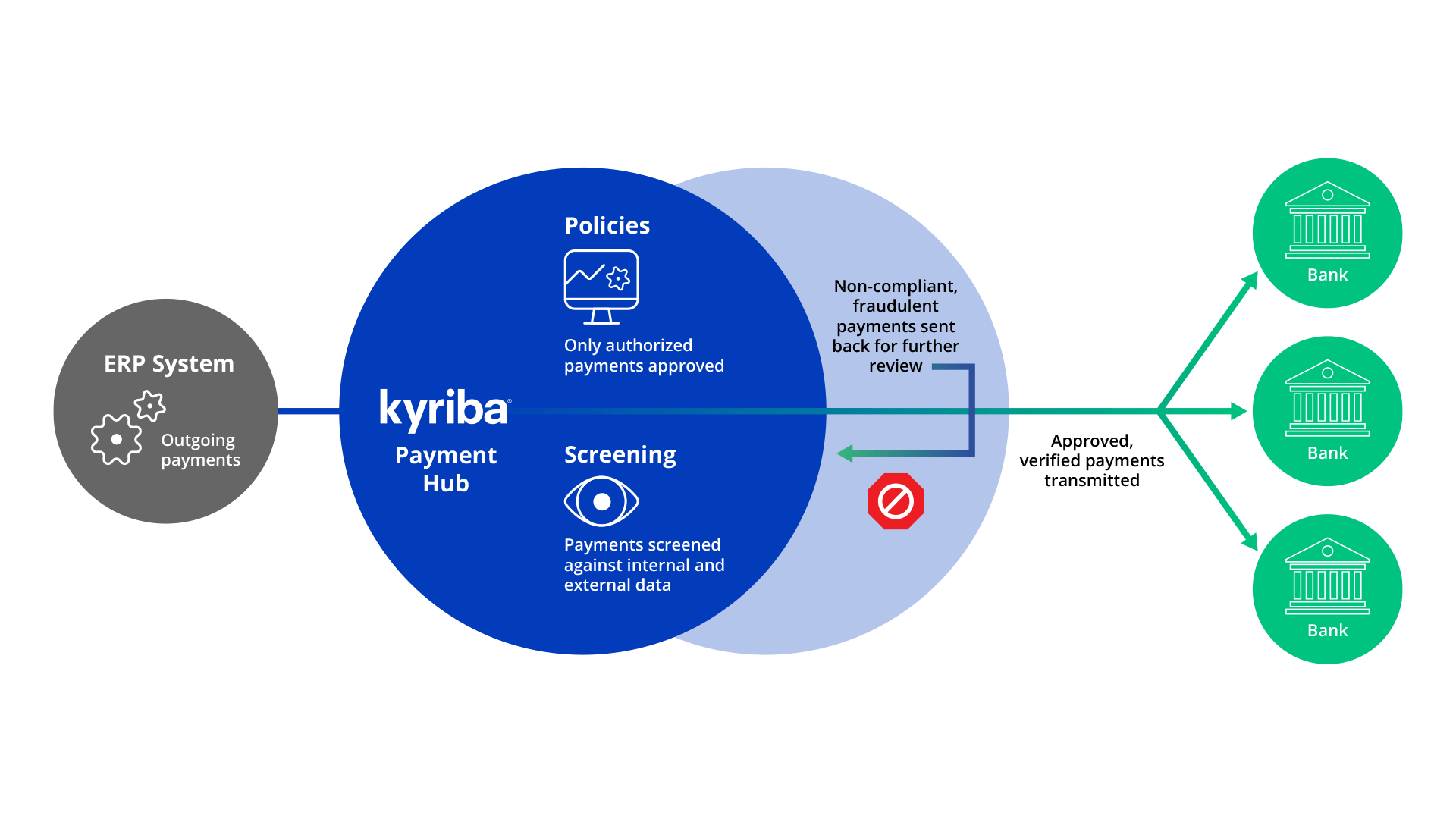

Payments fraud continues to be a top concern for organizations. According to a recent US companies and B2B payment fraud survey report published by Trustpair and Giact, 56% of US companies were targeted by B2B payment fraud in 2022 and 82% of senior leaders consider fraud prevention to be a top priority for 2023. CFOs and treasurers clearly require a more complete set of payments controls to stop fraud altogether.

Kyriba’s Payments Fraud Detection module extends the effectiveness of standard payments controls to include real-time detection to stop suspicious payments in their tracks. The module, the first of its kind in the industry, includes customized scoring, centralized alerts, complete resolution workflow management, and data visualization through a drilldown KPI dashboard.

Table of Contents

Payments Fraud Detection Scenarios

Kyriba’s Payments Fraud Detection capabilities allow users to set predefined detection rules to screen for suspicious payments requiring further attention, such as:

- Transfer to a beneficiary’s bank account located in a blacklisted country or a country not on the whitelist

- International payment made to a country where the company has no known supplier or operations

- Multiple payments that, in combination, exceed a soft or hard payment limit

- Changes to a payment that was imported from an ERP

- The first payment to a bank account for an existing vendor

- Payments inconsistent with the amounts or dates of the payment history

- Payments to one bank account used by several vendors

During setup, authorized users will determine which detection scenarios should be employed to prevent transmission to the bank until fully resolved.

Real-Time Alerts and Notifications

Kyriba users can customize the Payments Fraud Detection dashboard to display all suspicious payments and prioritize their resolution, based on KPIs such as detection rule, risk exposure, incident counts, and a fraud detection scorecard. Dashboards feature the ability to drill down so authorized users have complete transparency in all payment screening and can resolve outstanding actions efficiently.

Payments Fraud Prevention Workflow

The module also supports an end-to-end workflow for the resolution of outstanding suspicious payments. In addition to customizing alerts within the KPI dashboard, users can also determine how each detected payment should be managed. For example, payments to countries within Asia are tracked but not prevented from transmitting to the bank. A payment to North Korea, on the other hand, may be stopped instantly until further investigation.

The Resolution Workflow

- Separation of duties between the payment initiator, the payment approver and the reviewer of a detected payment

- Designation of reviewer(s) by payment rule and specific payment scenario (e.g., payments over $1M are sent to the treasurer for review)

- Ability to assign non-treasury personnel to review certain detected payments

- Option to hide alerts from initiators/approvers of the detected payment

- Scenario-based determination for stopping payments until resolved by designated users

Use of Artificial Intelligence

Machine learning algorithms are used within the Fraud Detection module to identify suspicious payments. Based on user tolerances, outgoing payments are compared against historical payment patterns, with suspect payments quarantined for further review.

Bank Account Validation

Kyriba is interfaced with partners that perform onetime and recurring validation of account ownership to confirm recipient bank account information and add an additional layer of fraud detection and payment validation. Checks can be performed within the ERP and for outgoing payments.

Reporting and Audit Trails

Kyriba’s Payment Fraud Detection module offers complete KPI reporting so that detected payments are permanently tracked in the system for daily, monthly, or annual reporting. History is maintained indefinitely and all details of the suspicious transaction—including the audit trail of detected and resolved actions—are retained for internal and external audit reporting.