Fact Sheet

The Kyriba and BlackLine Partnership

Greater Integration, Connectivity and Reporting with Kyriba and BlackLine Partnership

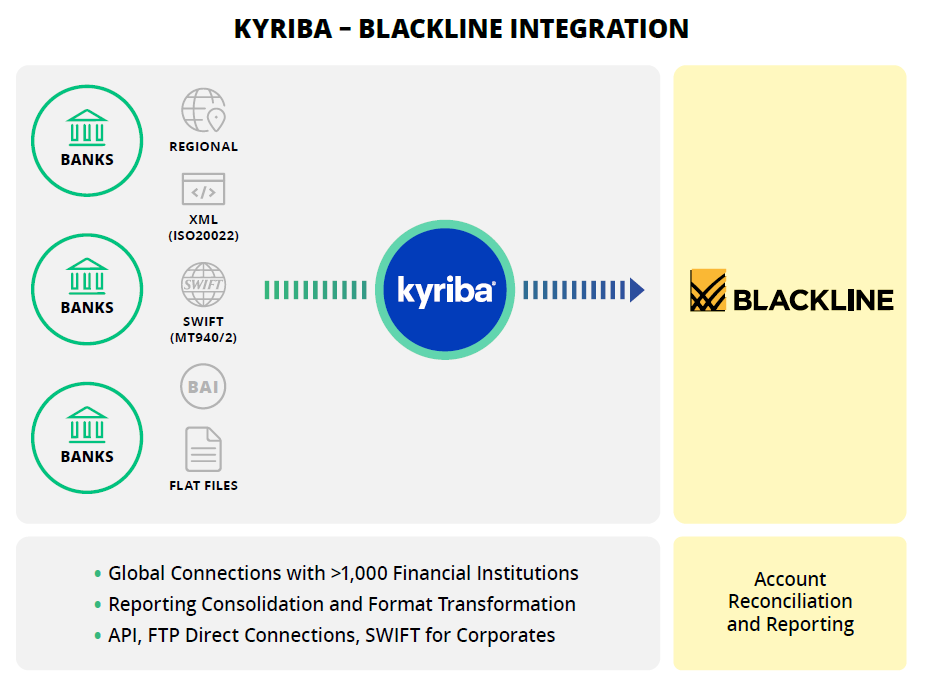

The Kyriba and BlackLine partnership delivers customers greater cash visibility and reporting capabilities from the bank all the way to the general ledger. Our customers benefit from this partnership through enhanced, automated bank and treasury reporting delivering access to better information.

Kyriba connects BlackLine customers directly to over 1,000 banks via leading technology to include an award-winning Open API platform. Visibility to connectivity, bank reporting and status reports are all easy to access via our dashboards and widely used Bank Connectivity Cockpit.

Regardless of industry, size or geographic scale, Kyriba and BlackLine integrations help organizations of all sizes streamline and speed projects for cash visibility, bank reporting and ERP upgrades or ERP migrations.

The Kyriba and BlackLine partnership and collaboration helps our customers adapt and respond to the changing bank landscape through the latest technology and integrations for cash and liquidity reporting.

Cost Reductions, Value for Your Organization

The traditional treasury environment is very IT dependent with highly customized code bases which are not only costly, but also difficult to scale.

Kyriba’s multi-bank, connectivity-as-a-service offers extensive bank connectivity as a managed service (Connectivity as a Service) with great reductions in implementation and ongoing IT costs. In fact, Kyriba’s capabilities around payments has, on average, saved customers over 120 hours per month.

About BlackLine

Since its founding in 2001, BlackLine has become a leading provider of cloud software that automates and controls financial close and accounting processes. Companies come to BlackLine because their traditional manual accounting processes are not sustainable. We help them move to modern accounting by unifying their data and processes, automating repetitive work, and driving accountability through visibility.