Fact Sheet

Treasury Requirements in the Oil and Gas Industries

Kyriba’s clients in the oil and natural gas industries range from production equipment manufacturing, exploration, and extraction to pipeline transportation. We help these companies through our industry expertise and leading solutions.

While no two companies are the same, many of our clients in the sector share many common treasury and finance requirements. Kyriba provides the capabilities to effectively manage liquidity, debt, investment, cash, payments, and FX risk, enabling executives to make more informed decisions.

Table of Contents

Enterprise Liquidity

Oil and gas companies need comprehensive views of their liquidity. Kyriba enables clients to achieve 100% cash visibility and reduce reliance on borrowing, transforming liquidity into a strategic asset.

Managing Multiple Entities

Kyriba’s oil and gas clients commonly have multiple subsidiaries and business lines across the globe, often in emerging markets with limited banking infrastructure. This drives cash pooling, netting, in-house banking, and intercompany requirements. Kyriba fully supports multi-entity businesses, offering a host of services for parent and subsidiary treasury management. Our clients seamlessly connect automatically to their relationship banks, ERPs, and other systems, eliminating file uploads and manually-generated reporting and reconciliations.

Cash Flow Forecasting

Increasing cash forecasting horizons and improving accuracy is a key requirement in the oil and gas sector. With typically tight profit margins and volatility across many areas, minimizing idle cash and getting the surplus invested or available has become increasingly important. Kyriba consolidates forecast data and measures forecast accuracy to increase confidence in your cash projections.

FX Risk Management

Operating in many different countries means handling many currencies. Kyriba’s FX Risk Management, creates confidence in expanding identification and aggregation of FX exposures and risk mitigation capabilities to manage impacts to earnings. Kyriba gives support to a full end-to-end solution for exposures, trading and post-trade activities.

Global Payments

Commanding so many operations also places a heavy burden on oil and gas treasury departments in terms of payments. Kyriba’s Payments Hub manages AP and AR payments, while maintaining robust format transformation for communication with banks and other institutions.

Debt and Interest Rate Hedging

Higher debt loads are common in the industry. With interest rates on the rise, treasury teams must enable effective interest rate hedging programs. Kyriba supports debt and interest rate derivative position keeping, automates mark to market, and delivers regulatory compliance including hedge accounting support.

Efficiency and Productivity

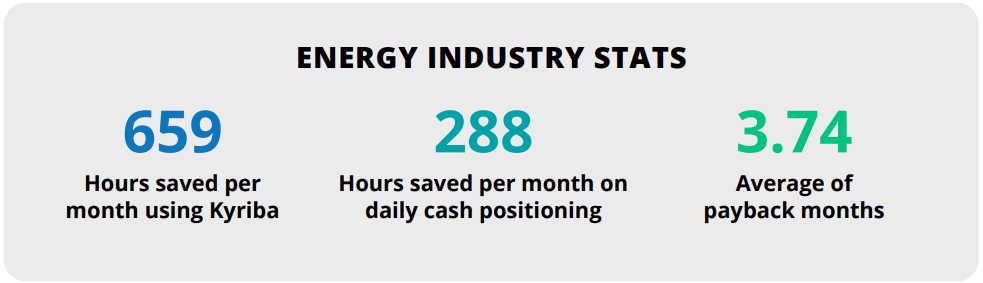

As with other industries, CFOs and treasurers in oil and gas are focused on improving the efficiency and productivity of the treasury function. From optimizing bank accounts, to bank relationship management, and through automation of manual tasks to improve operational controls, Kyriba delivers productivity to the financial team, enabling less time spent on treasury and more time allocated to business intelligence and strategic insight.