FAQ

What is FX Risk?

FX risk, also known as foreign exchange risk, refers to the potential losses that an international financial transaction may incur due to fluctuations in currency exchange rates. It occurs when a firm denominates a portion of its equities, assets, liabilities, or income in a foreign currency, and any changes in the exchange rate of that currency will affect the firm’s financial position.

If a volatile movement occurs in one of the transactional currencies and the company has not managed the exposure to that currency (either via organic exposure elimination or hedging), then they are susceptible to negative impacts to their earnings per share (EPS) and earnings before interest, tax, depreciation and amortization (EBITDA).

Table of Contents

What Are the Different Types of FX Risks?

FX risks include transaction risk, translation risk, economic risk, and liquidity risk.

- Transaction risk happens when the value of a company’s future cash flows change due to changes in exchange rates from the time the transaction occurs to the settlement of the transaction. This risk is particularly of concern for companies that conduct business across international borders and have significant international receivables and payables.

- Translation risk occurs when a firm’s equities, assets, liabilities, or income are denominated in a foreign currency and any fluctuation in the exchange rate will cause a change in the reported financial statement. Translation risk can arise when a company reports its financial statements in a currency other than its functional currency, or when a company reports its financial statements in a different currency than the currency of the subsidiary.

- Economic risk refers to the effect of exchange rate changes on the present value of future cash flows of a firm. It is the risk associated with changes in the economic environment that can have an adverse impact on a company’s operations. This risk can arise from changes in exchange rates, interest rates, inflation, and other macroeconomic variables. Economic risk is particularly relevant for companies with significant international operations.

- Liquidity risk indicates the ability of an organization to absorb FX volatility in its cash flow. Companies who cannot absorb FX unpredictability will face issues paying bills, repaying loans, making payments to suppliers, and running their businesses effectively.

What Is FX Cash?

FX cash refers to the holdings of a corporation or entity in foreign currency. It is the amount of foreign currency held by an entity at a given time, which can be affected by changes in the currency exchange rate.

What Is FX Exposure?

FX exposure refers to the potential loss a company could suffer due to changes in currency exchange rates. It can also be understood as the sensitivity of a company’s financial situation to changes in exchange rates. Businesses with extensive international operations often have significant FX exposure, making careful management essential.

What Is Hedging Currency Risk?

Hedging currency risk involves making investments with the aim to reduce the risk of adverse price movements in an asset by taking an offsetting position in a related security. It often involves the use of financial instruments such as futures contracts, forwards, options, and swaps.

- Futures contracts: a futures contract is a standardized contract between a buyer and seller to buy or sell an asset at a predetermined price at a specified time in the future. Futures contracts are used to hedge against price fluctuations in commodities, currencies, and other financial instruments. Currency contracts allow for exposure to changes in exchange rates and interest rates of different currencies.

- Risk: Futures contracts are risky because agreed upon transactions must take place by the predetermined date and at the predetermined price, regardless of the current market price.

- Benefit: Futures contracts hedge against price fluctuations and can also be used to speculate on price movements. Futures contracts also provide greater liquidity than other financial instruments, as they are traded on exchanges that are closely monitored by regulatory authorities.

- Forward contracts: a forward contract is a customized (non-standardized) contract between two parties to buy or sell an asset at a specific price on a future date.

- Risk: forward contracts are high-risk contracts, since they are traded over-the-counter (OTC) instead of on centralized exchanges that are regulated and show transparent pricing and contract data. As well, they carry risk similar to futures contracts, where the forward rate specified in the contract may differ widely from the spot rate on the agreed to settlement date.

- Benefit: since businesses can lock in a price for the asset in advance, they know the exact cost of the asset, which can help them better manage their budget and cash flow. In addition, forward contracts are completely customizable and can be tailored to meet the needs of both parties.

- Options: an option is a financial contract that grants the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a certain date. Options come in two varieties, calls and puts. A call option will give the holder the right to buy the underlying asset, while a put option will give the holder the right to sell the underlying asset.

- Risk: when buying options, the downside potential is the premium spent on the option. When selling calls, the downside potential is unlimited. When selling puts, the downside potential is limited to the value of the stock.

- Benefit: buying and selling options offers investors a way to gain exposure to potential market volatility without having to commit to the full purchase price of the underlying asset. Options differ from futures in that options are contracts that give the owner the right to buy or sell the underlying asset, while futures are contracts that obligate the owner to buy or sell the underlying asset. In addition, options can be bought or sold at any time before the expiration date, while a futures contract must be bought or sold on or before its expiration date.

- Swaps: a currency swap is a financial instrument involving exchanging interest payments in one currency for equivalent payments in another currency.

- Risk: currency swap risks include exchange rate fluctuations, interest rate changes, and counterparty risk, which can lead to financial losses if not managed effectively. Parties involved should be aware of potential liquidity challenges and legal documentation issues, as well as regulatory changes that can impact the terms of the swap.

- Benefit: currency swaps offer the ability to manage and reduce foreign exchange risk, facilitating access to foreign currencies for financing or investment, and the potential for lower borrowing costs in specific currencies. They offer flexibility to customize terms, making them suitable for a wide range of financial and operational needs. Currency swaps can also enhance cash flow management by aligning revenues and expenses in different currencies.

What Is FX Risk Management?

FX risk management is a strategy used by companies to avoid or minimize potential losses that could result from fluctuations in exchange rates. It involves assessing the type and level of risk, measuring it, and deciding on appropriate methods to manage the risk. To avoid FX impacts on earnings, organizations must manage their forex exposure and risk by arranging financial hedging facilities with banks, buying or selling foreign currencies at spot rates or forward rates, and creating risk management policies to guide the firm’s foreign exchange operation.

Organizations can reduce FX risk by organically eliminating exposures internally or by hedging exposures through balance sheet exposure management and cash flow exposure forecasting.

- Balance sheet exposure management: entails treasury professionals measuring, monitoring, and managing currency exposure and the associated risk from their balance sheet. The benefits of balance sheet exposure management include:

- The ability to manage EPS at risk to the industry MBO of less than $0.01

- Increased exposure identification

- Increased visibility to exposures

- Reduced program costs

- Reduced FX risk

- Improved hedge program

- Cash flow exposure forecasting: consists of the creation, analysis, and management of currency exposure from forecasted transactions and cash flows. The benefits of cash flow exposure forecasting include:

- Improved predictability of EBITDA

- Increased forecast accuracy

- Increased participation in the cash flow process

- Reduced cost of hedging

What Is Currency Risk Management?

Currency risk management involves identifying the risk exposure to changes in currency exchange rates and using strategies and financial instruments to mitigate the impact of these changes. It is an integral part of international financial management for multinational corporations. The term “currency risk management” is often used interchangeably with “FX risk management.”

How Kyriba Helps Organizations Manage FX Risk

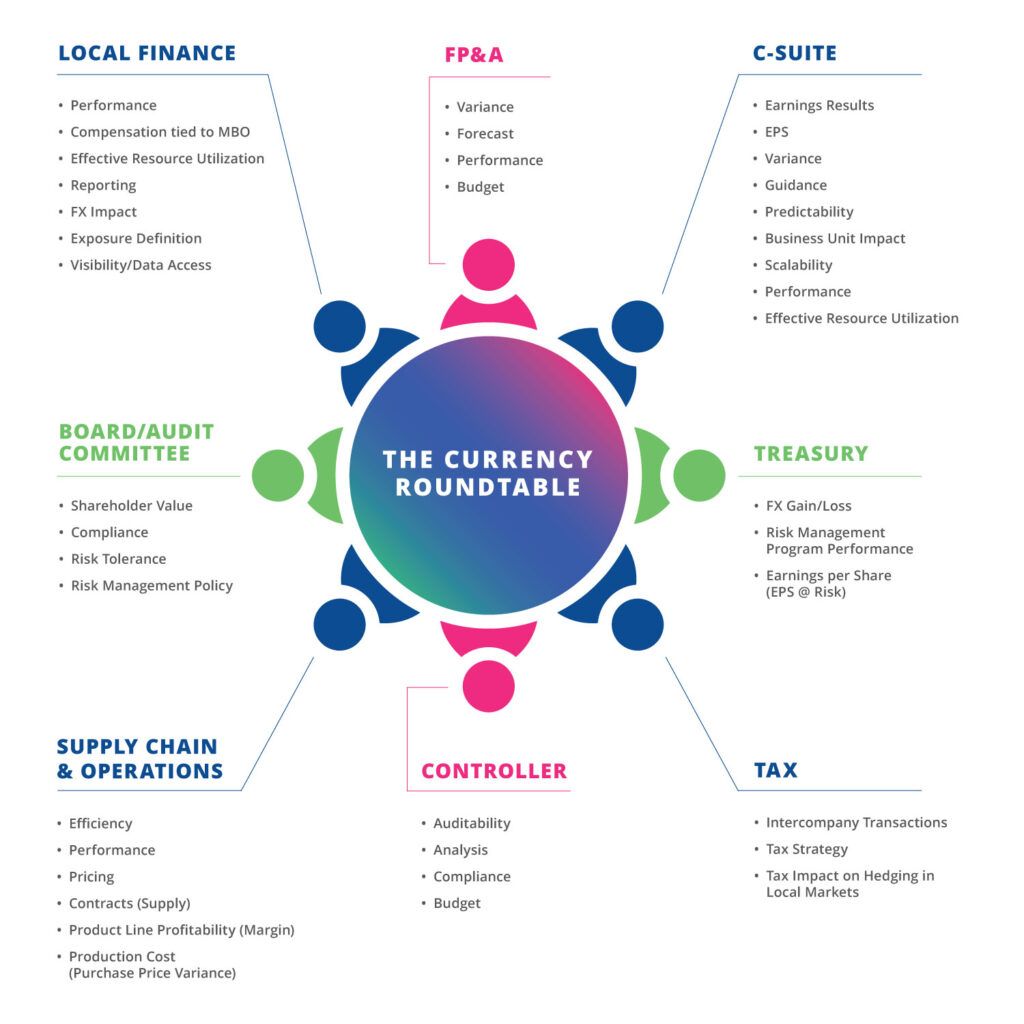

By understanding FX risk and planning for it, companies can reduce their exposure and protect their bottom-line from any unexpected changes in exchange rate values. Kyriba has the tools and features to help companies identify and manage their FX risk, allowing them to confidently expand their operations into new markets.

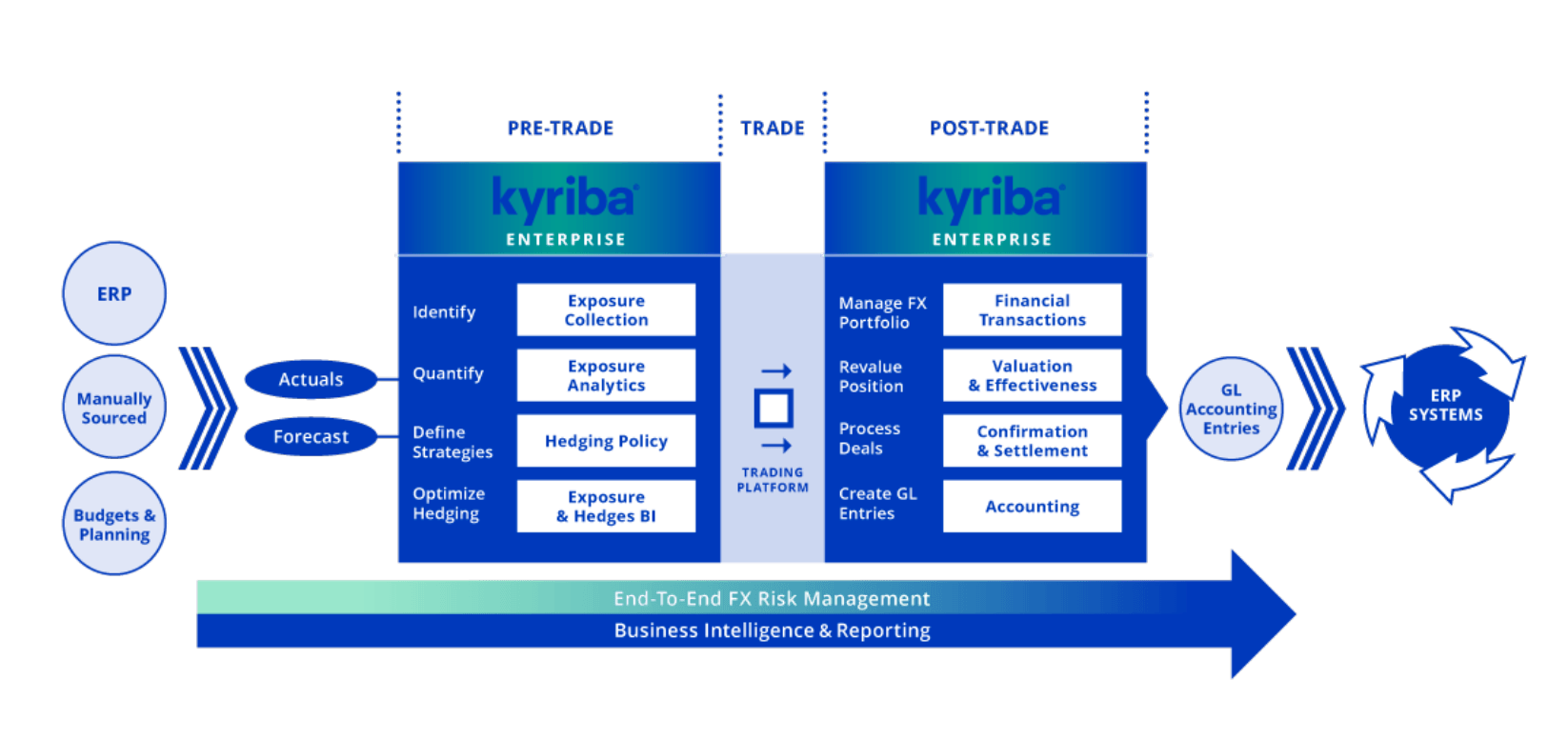

Kyriba’s Risk Management delivers pre-trade, trade, and post-trade capabilities that introduce analytics to your FX programs, helping businesses protect balance sheets and income statements from currency fluctuations.