Fact Sheet

Kyriba’s Enterprise Liquidity Management Platform: Optimize Liquidity, Reduce Risk, Unlock Growth

Kyriba’s winning Liquidity Performance platform is the most connected liquidity network with banks, ERPs, trading portals, data tools, suppliers, and more. With close to 3,000 clients and 80,000 users worldwide, Kyriba manages more than 3 billion bank transactions and $15 trillion in payments annually. Our platform is built to enable financial leaders to connect, protect, forecast, and optimize liquidity for sustainable growth.

Products

- Treasury Management

- Payments

- Working Capital

- Risk Management

Solutions Coverage

- Enterprise Organizations

- Mid-Sized Companies

- Industry Verticals

- Banks and Financial Institutions

Open Cloud

- Connectivity-as-a-Service

- Data Analytics and Visualization

- Artificial Intelligence

- API-first Developer Portal

Analytics

- Integrated Visual Dashboards

- On-demand Drill-down Capabilities

- Presentation-ready for Sharing

Platform

- 24/7 Cyber Security Center

- Global Software-as-a-Service

- Disaster Recovery

- Supports 14 Languages

Compliance

- SOC 1 and SOC 2 Type 2 Reporting

- ISO 27001 Standards

- CSA CAIQ Compliance Criteria

- Data Privacy Framework (DPF) Certification

Table of Contents

Treasury Management

Kyriba provides CFOs and treasurers with the visibility and reporting they need to make confident, analytical, and data-driven liquidity decisions to manage complex cash structures, investments, borrowings, and hedging to optimize enterprise liquidity.

Cash Management and Forecasting

Complete cash visibility with flexible cash position dashboards and full reconciliation capabilities makes it easy to view prior-day and intraday postings. Clients can use extensive options for modeling and measuring the effectiveness of forecasts to improve the accuracy and extend the horizon of cash forecasting.

Liquidity Planning

Kyriba offers clients more advanced forecasting capabilities with Kyriba Liquidity Planning including constructing multiple forecasts, modeling forecast scenarios, and generating new forecasts with AI, all within a single, flexible platform with spreadsheet operability.

Cash Pooling and In-house Banking

Clients can manage notional and physical cash pools to offer real-time inter-company positions, interest calculations, and automated reporting.

Multilateral Netting

Multilateral netting calculates net payables and receivables positions by participant, optimizing exposure management and in-house bank integration.

Bank Relationship Management

Bank account management (BAM), signatory tracking, FBAR reporting and bank fee analysis provide improved control of bank accounts and more transparency into bank fees.

GL Reconciliation

Complete bank-to-book reconciliations within Kyriba by matching bank transactions within the Kyriba platform, originated from daily bank reporting through the month, against booked transactions imported from the general ledger.

Financial Transactions

Fully track treasury financial transactions for your investments, debt, and risk instruments with complete integration to the payments, accounting and cash forecasting modules.

Accounting and Compliance

Journal entries can be generated for all cash and liquidity models. With automated ERP integration with the general ledger, Kyriba delivers bank-to-book reconciliation for monthly matching of bank actuals with uploaded accounting balances.

Payments

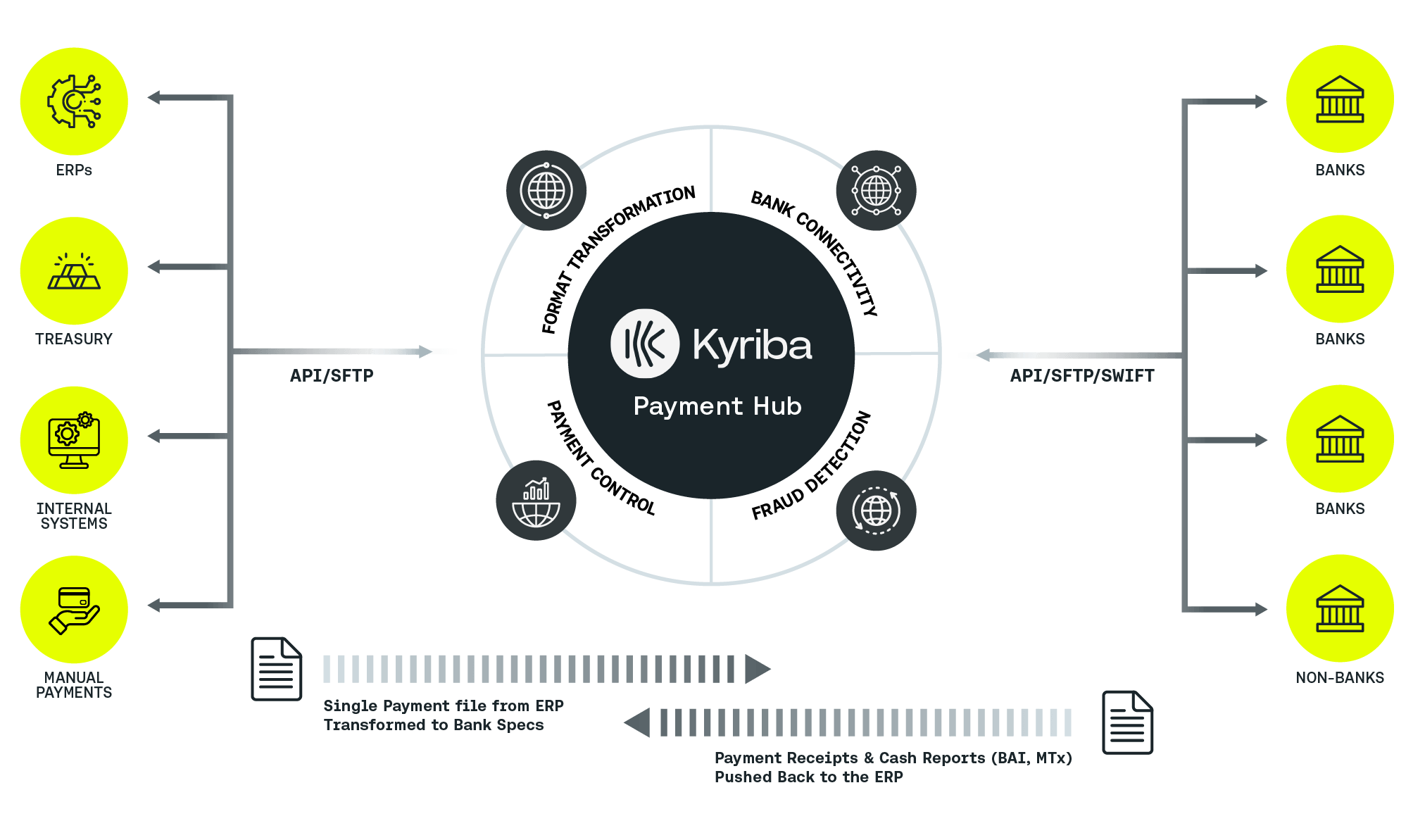

Kyriba offers a pre-connected, multi-bank and secure global payment network to centralize and standardize company-wide payment workflows, enhancing task automation, error management, fraud detection and payment status visibility, all integrated in one payment hub.

Format Transformation

With 50,000+ payments format scenarios Kyriba offers the most extensive format library in the industry, incl. ISO 20022 XML, SWIFT MT/MX, and various local formats, eliminating the need for clients to manage bank protocols and format transformation in house.

Kyriba also offers a complete set of self-service format customization tools in Kyriba Open Formats Studio for clients and partners to quickly implement, test, and deploy payment formats within the Kyriba Payment Hub, including using ChatGPT to create scripts.

Payment Controls

Clients can standardize payment controls in compliance with their organization’s payment policy. Kyriba supports up to 9 levels of rule-based approval, personal digital signature, and full audit trails with activity logs.

Payment Acknowledgment

The Kyriba Payment Hub supports end-to-end payments tracking with one payment status reporting dashboard. Clients can also review and approve payments on-the-go with Kyriba Mobile App (iOS and Android).

Bank Connectivity

Kyriba supports multi-bank connectivity including SWIFT, Bank APIs, host-to-host, and other country networks, so clients can maximize automation, ensure payments security, and minimize total costs.

Payments Fraud Detection

Kyriba’s fraud detection module offers scenario-based, AI-powered, real-time detection of suspicious and sanction-prone payment activities to ensure that digitized payments policies and procedures are enforced. Kyriba also supports confirmation of payee with bank account validation through global partners (SisID, TrustPair and GIACT).

Working Capital

As a bank-independent solution Kyriba provides clients the option to leverage leading technology and services to access working capital in the most efficient and flexible ways, enabling CFOs to generate free cash flow and improve financial results with a full spectrum of working capital solutions.

Control and ownership – Clients are the owners of their programs. Our model puts the partners in control.

Bank Relationship – Clients can select and reward multiple key relationship banks.

Risk – Eliminate single bank risk and diversify funding sources.

Kyriba is not a funder – Kyriba does not use its balance sheet, make credit risk process or policy based decisions on behalf of partners.

Payables Finance

Kyriba Payables Finance provides suppliers with a complete reverse factoring solution where suppliers can accelerate collection of their receivables due from their buyers, with full integration among the buyer, the supplier, and the financing partner.

Dynamic Discounting

Dynamic discounting programs are best suited for organizations that have excess liquidity, and are looking for an alternative to low-yield, short-term investments to earn risk-free returns on excess cash. The control of this program fully sits with the buyer and their suppliers; they can negotiate the financial benefits and Kyriba’s platform will support them to achieve it.

Hybrid Payables Finance and Dynamic Discounting

The Hybrid model brings the Payables Finance and Dynamic Discounting programs together, and allows the funding source to be switched between internal and external. Most businesses with sales seasonality have periods where cash is scarce or in abundance. Depending on the cash position of the buyer, the program structure can alternate between the buyer using their funds to early pay their suppliers’ invoices or the financial institution comes into play and funds them.

Receivables Finance

Kyriba Receivables Finance accelerates payment on the receivables to get cash into the business quickly, giving CFOs a new solution suite to optimize working capital and strengthen the balance sheet. Seamless integration across the entire platform means easier liquidity management and working capital stability.

Risk Management

Kyriba provides CFOs and treasurers with complete, end-to-end workflows for FX, Interest Rate, and Commodity risk management programs to protect balance sheets, income statements, and cash flows.

FX Exposure Management

In-depth analytics drive visibility into currency exposures and enable better assessment, mitigation, and reporting of currency impacts on earnings and financial statements.

Mark-to-Market Valuations

Kyriba supports full valuation capabilities, including credit risk and CVA/DVA support, leveraging Kyriba’s integrated market data.

Derivative and Hedge Accounting

Derivative and hedge accounting capabilities for FX and interest rate hedging programs offer full support for FASB, IFRS and local GAAP requirements.

Lease Accounting

Intuitive workflows support IFRS16 lease accounting standards, including lease management, calculations, and general ledger integration.

Cash Flow Hedging

Kyriba’s FX Cash Flow Exposure management enables clients to analyze and manage currency impact on future cash flows. It protects the value of cash flow forecasts and improve EBITDA predictability.

Balance Sheet Hedging

Kyriba’s FX Balance Sheet Exposure management enables clients to measure, monitor, and manage currency exposure and protect balance sheet. It protects earnings and reduces program costs.

Connectivity-as-a-Service

Kyriba offers a single liquidity network with API-first integration to banks, ERPs, trading portals, data tools, suppliers, and more, improving business continuity and minimizing IT time and related costs. Kyriba also provides 24/7 monitoring of connectivity performance.

Host-to-host and Bank API Connectivity

Kyriba offers host-to-host direct-to-bank connections via secure FTP to hundreds of banks for clients with high volume bank transactions. Kyriba is also the leader in bank API connectivity, supporting bank reporting, and payments with Bank of America, J.P. Morgan, U.S. Bank, CITI, HSBC, Deutsche Bank, and many more. Instant payments usually requires bank API connectivity, e.g., TCH RTP, FedNow, and SCT Inst.

Regional and Country Protocolsy

Many countries require using regional networks to connect to local banks. Kyriba supports these country-specific networks, including:

- Zengin and ANSER in Japan

- EBICS in France, Germany and Switzerland

- BACS and Faster Payments (including the Direct Corporate Access option) in the UK

- CBI in Italy

- EDITRAN in Spain

SWIFT Connectivity

Kyriba offers multiple options to leverage the SWIFT Network for bank reporting and payments. Options include Kyriba Bank Statement Concentrator, where customers use the Kyriba BIC11. For clients who prefer their own BIC, options include SWIFT Alliance Lite2 and SWIFT Service Bureau. Kyriba integrates over 600 corporate BICs on our platform, representing more than 20% of SWIFT’s total corporate BIC membership.

ERP Connectivity

The Kyriba platform connects to over 10,000 ERP instances. It offers pre-developed API connectors for major ERPs including SAP ECC and S/4HANA, Oracle Cloud, NetSuite, Microsoft Dynamics 365 and Workday. It can also connect to any other ERP via different connectivity protocols. Kyriba ERP connectivity supports payments, bank statements export, cash management, GL export and reconciliation, FX balance sheet and working capital workflows. Kyriba can accelerate ERP-to- bank connectivity projects by months or years.

Artificial Intelligence

Kyriba’s AI strategy includes fully supporting embedded AI models within the platform’s workflows and securely opening the platform via APIs to engage with GenAI tools such as ChatGPT.

Example Use Cases

Forecasting

Kyriba utilizes AI to forecast cash flows based on historical transactions, patterns, and seasonality. AI projections are compared against other forecast sources to assess forecast accuracy and the ideal role for AI in cash forecasting. In addition, AI is used to calculate excess cash balances at desired confidence intervals, minimizing idle cash and maximizing returns.

Payment Fraud

Kyriba’s fraud detection engine uses AI to detect payment anomalies and isolate suspicious payments, utilizing an adversarial model trained on the organization’s payment history. Implemented with other payment controls and scenario analysis, AI provides a powerful real-time detection mechanism against payment fraud.

Payment Formats

With Kyriba’s Open Formats Studio, users can enable ChatGPT to generate new or update existing payment format scripts, including testing and validating the new formats before incorporating them into their payment workflows for immediate integration to the bank, greatly decreasing the time and effort required for on-demand implementation and adjustment of payment formats.

Reporting

Kyriba’s Open Reports Studio enables users to securely query data directly in Microsoft Excel, enabling users to securely engage AI tools such as ChatGPT and Microsoft Copilot with their Kyriba data to integrate external insights, build new queries, and dynamically generate new reports.