We need a bold new path for liquidity.

CFOs and Treasurers are facing a huge problem.

It’s called Liquidity Gridlock.

Today’s high-performing financial leaders require full visibility and control over liquidity. Problem is, they haven’t been given the tools they need to succeed. Instead, financial data is siloed across overlapping and disconnected systems. The result? Compromised insights, forecasting and risk management. We call this sad state of affairs Liquidity Gridlock. And we believe financial leaders deserve better.

The Solution? Liquidity Performance.

Kyriba’s Liquidity Performance platform was built to end Liquidity Gridlock by connecting businesses to a single, fluid network of liquidity—integrating banks, ERPs, trading portals, data tools, suppliers, and more.

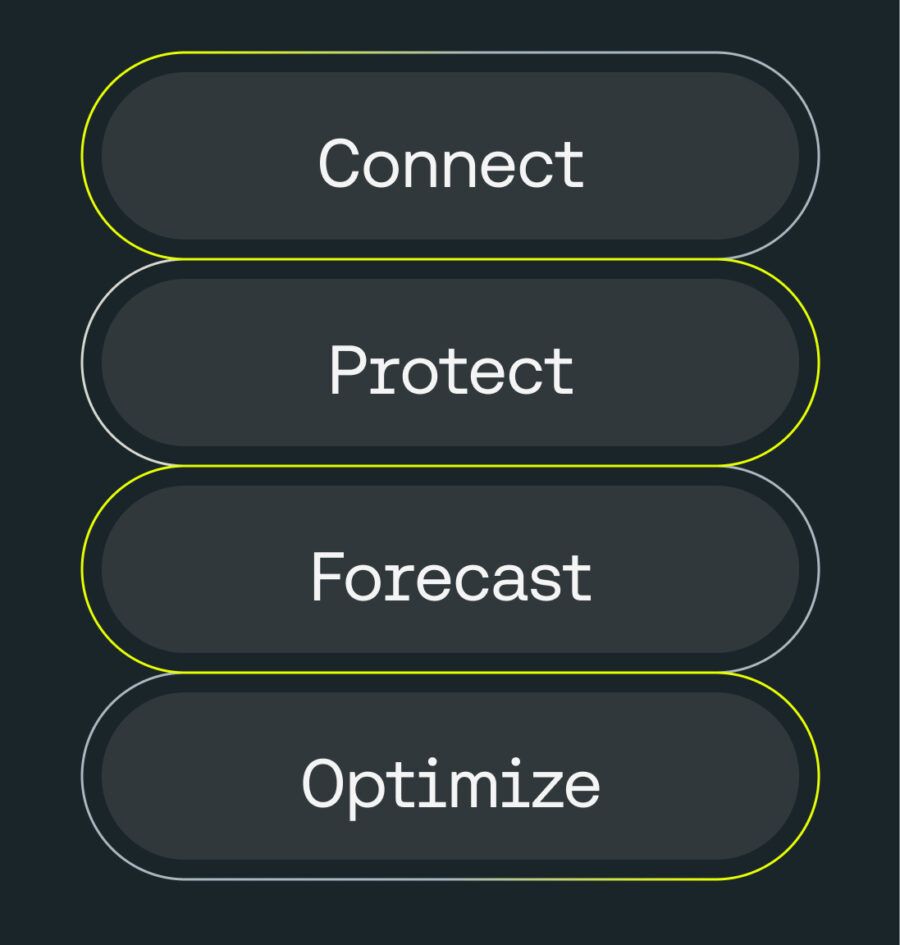

Once connected, financial leaders are empowered to protect, forecast, and optimize liquidity to continuously improve their position.

Connect your

network.

Protect liquidity.

Forecast with

confidence.

Optimize for

growth.

Kyriba by the numbers.