Fact Sheet

Connectivité « as a Service » – Kyriba

La connectivité entre les divers systèmes de gestion est primordial pour les entreprises. Elles continuent d’investir massivement dans des solutions ERP (Enterprise Resource Planning), et elles en font la solution centrale de leur système de gestion. Dès lors, l’intégration de ces solutions avec l’ensemble de l’écosystème, dont font partie intégrante les banques, est devenu un enjeu majeur. Malheureusement, ce processus d’intégration est généralement très complexe et long, tant pour les banques que pour les entreprises : ces projets durent souvent plus de 6 à 12 mois… Mais il existe une alternative plus efficace.

Voici la solution Bank Connectivity as a Service (BCaaS) de Kyriba pour les institutions financières. Kyriba propose désormais sa solution de communication – une solution éprouvée et leader sur le marché – directement à ses partenaires bancaires.

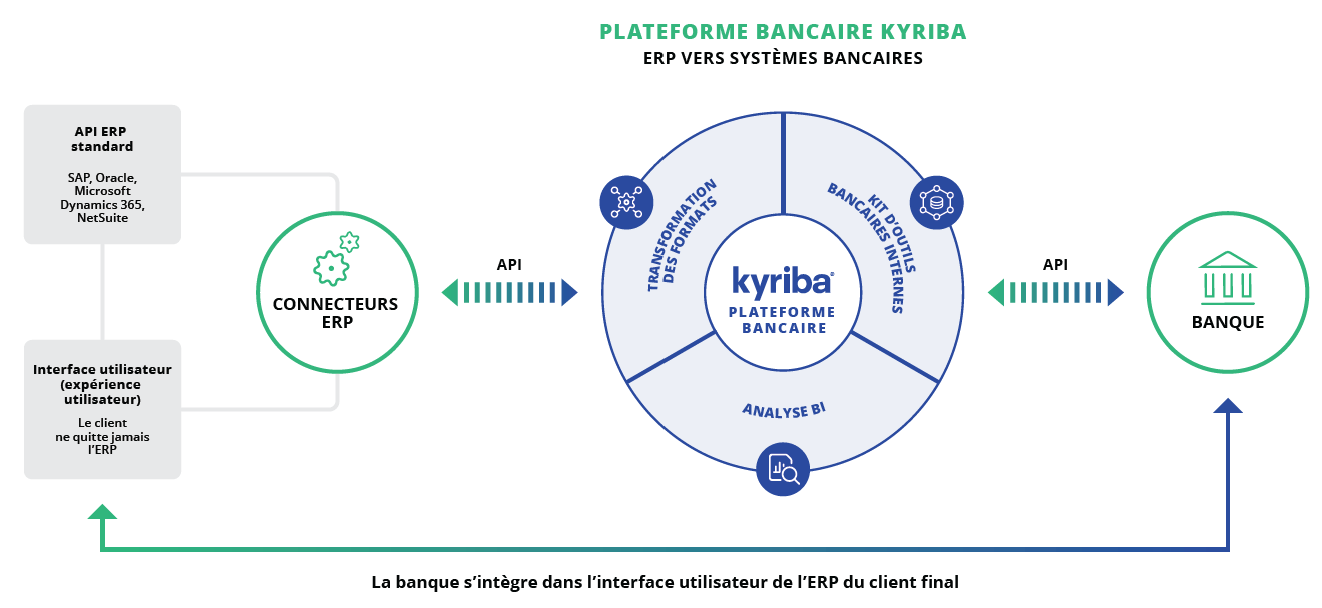

Le service BCaaS de Kyriba accélère et simplifie l’intégration des systèmes ERP des clients de la banque, dans l’infrastructure de paiement interne de la banque. Connecter facilement la banque dans l’ERP des entreprises offre un accès instantané aux relevés de comptes et aux fichiers de paiement. Les clients de la banque n’auront jamais à se connecter à Kyriba et ne seront même pas conscients de la transformation gérée par notre plateforme. Un nouveau service bancaire est à leur disposition. Cette solution unique et révolutionnaire réduira les coûts de mise en œuvre, tout en apportant de la valeur à vos clients entreprises.

Table of Contents

AVANTAGES POUR LA BANQUE

La solution BCaaS de Kyriba offre un service de connectivité entreprise-banque de classe mondiale au sein d’une plateforme 100 % Cloud et de connexions préconfigurées avec les principaux fournisseurs d’ERP du marché, notamment SAP, Oracle, NetSuite et Microsoft Dynamics 365. La connectivité par interface de programmation d’applications (API) permet un accès automatique aux données en temps réel, évitant au service informatique de devoir générer des fichiers. Kyriba possède également une expérience éprouvée avec d’autres systèmes sources axés sur le reporting des relevés de compte bancaire, les paiements, les portails d’opérations de change et les plateformes Cloud.

Renforcer la relation client

BCaaS propose aux clients, plus d’opportunités pour développer ses activités de gestion de flux ou de financement/placement avec son partenaire bancaire.

Formatage et transmission des fichiers bancaires

Nous proposons des formats prédéfinis pour les paiements, les rapports d’état des paiements et les relevés de compte, ainsi qu’un accès à de nouvelles plateformes de paiement. En outre, Kyriba vous libère, vous et vos clients, en proposant une gestion personnalisée de la fraude aux paiements, grâce à des règles de détection couplées au Machine Learning. Et nous surveillons la connectivité grâce à des centres d’assistance disponibles 24 h/24 et 7 j/7.

Depuis 20 ans, Kyriba construit et maintient une bibliothèque mutualisée de formats de fichiers de paiement à travers le monde, ce qui évite à nos clients de devoir développer et tester leurs propres formats dans leurs ERP existants. Pour ce qui est de la connectivité, Kyriba a créé des API pour les principaux ERP du marché, en diffusant les interfaces pour l’import rapide des fichiers dans notre plateforme. Vos propres ressources techniques et responsables des projets auront accès à notre solution pour configurer les clients sous une base de données unique afin de gérer toutes les intégrations de fichiers de paiement, quel que soit le système source (ERP ou autre).

AVANTAGES POUR LE CLIENT

Obtenir plus de visibilité sur sa liquidité pour optimiser ses positions. Les décisions d’emprunt et d’investissement doivent être prises rapidement, efficacement et le plus tôt possible. Parallèlement à la connectivité, le traitement des paiements tiers (fournisseurs et autres contreparties) constituent une étape cruciale pour rationaliser et réduire les coûts liés ces processus. En exploitant les solutions innovantes de Kyriba, vous pouvez consolider les connexions de vos clients et leur permettre d’effectuer des paiements sécurisés en temps réel.

De plus, il faut parfois six mois ou plus aux services informatiques des entreprises pour développer et tester des fichiers de paiements personnalisés en sortie des ERP ou des systèmes d’achat. Grâce à la combinaison des API ERP et de la bibliothèque de formats de paiement de Kyriba, qui compte plus de 45 000 formats de paiement internationaux préétablis et testés, vos clients peuvent acheminer des fichiers de paiement directement de leur ERP vers votre plateforme bancaire en quelques semaines seulement.

Grâce la connectivité de Kyriba, vos clients bénéficieront de délais de mise en œuvre plus courts, avec moins de modification nécessaires, et au final d’une plus grande confiance dans les capacités de votre banque, ce qui se traduira par un meilleur niveau de service et une meilleure fidélisation.

UNE SOLUTION GAGNANT-GAGNANT

Avec la solution BCaaS de Kyriba, vous n’aurez plus jamais à vous soucier de refaire ou de modifier vos propres systèmes pour les adapter aux besoins de vos clients. Et vos clients n’auront pas non plus à faire d’ajustements. Vous disposerez d’une seule et unique version, Kyriba assurant la maintenance des formats pour se conformer aux normes ISO et aux modifications des systèmes de compensation. La connectivité bancaire intégrée de Kyriba est une solution gagnant-gagnant pour les institutions financières et leurs entreprises clientes, offrant de meilleures expériences de mise en œuvre, une interface utilisateur supérieure et une plateforme qui renforce les relations entre les banques et les clients.