eBook

Get Strategic about Liquidity Management with a Supplemental Treasury Management System

Advanced treasury management and data-delivery capabilities enable finance organizations to see their global cash, liquidity, and risk exposures and create value for the business.

Recent disruptions, such as the pandemic and current inflationary conditions, have thrust treasury management into the spotlight. With rising interest rates and a strengthening US dollar, many finance organizations are turning to their treasury departments to proactively mitigate currency impacts upon foreign earnings and to enhance the use of internal liquidity over capital markets. Some are also looking to reduce costs in response to inflation. These factors are putting pressure on treasury departments to elevate their operating models and to digitally transform their capabilities around financial risk, balance sheets, working capital, and payments while simultaneously reducing costs. Some organizations are responding to these pressures by accelerating their digital transformation agendas and moving core capabilities into the cloud. They are also seeking to use internal and external data more extensively by enhancing their analytical capabilities. One way to accomplish these objectives is to combine a leading, cloud-based financial system, such as Workday Financial Management, with the enhanced treasury management capabilities of a cloud-based, supplemental system, such as Kyriba.

Eight potential ways to achieve ROI

- Greater process efficiency via treasury automation and standardized reports.

- Timely and accurate cash visibility.

- Reduced banking fees and transaction costs.

- More effective hedging programs to manage FX and IR risk.

- Enhanced liquidity management and funding opportunities.

- Decreased IT support and required maintenance.

- Improved operations and fraud detection.

- Greater agility and enhanced business continuity via global SaaS platforms.

Table of Contents

Treasury as a value lever: Leveraging a Supplemental Treasury Management System

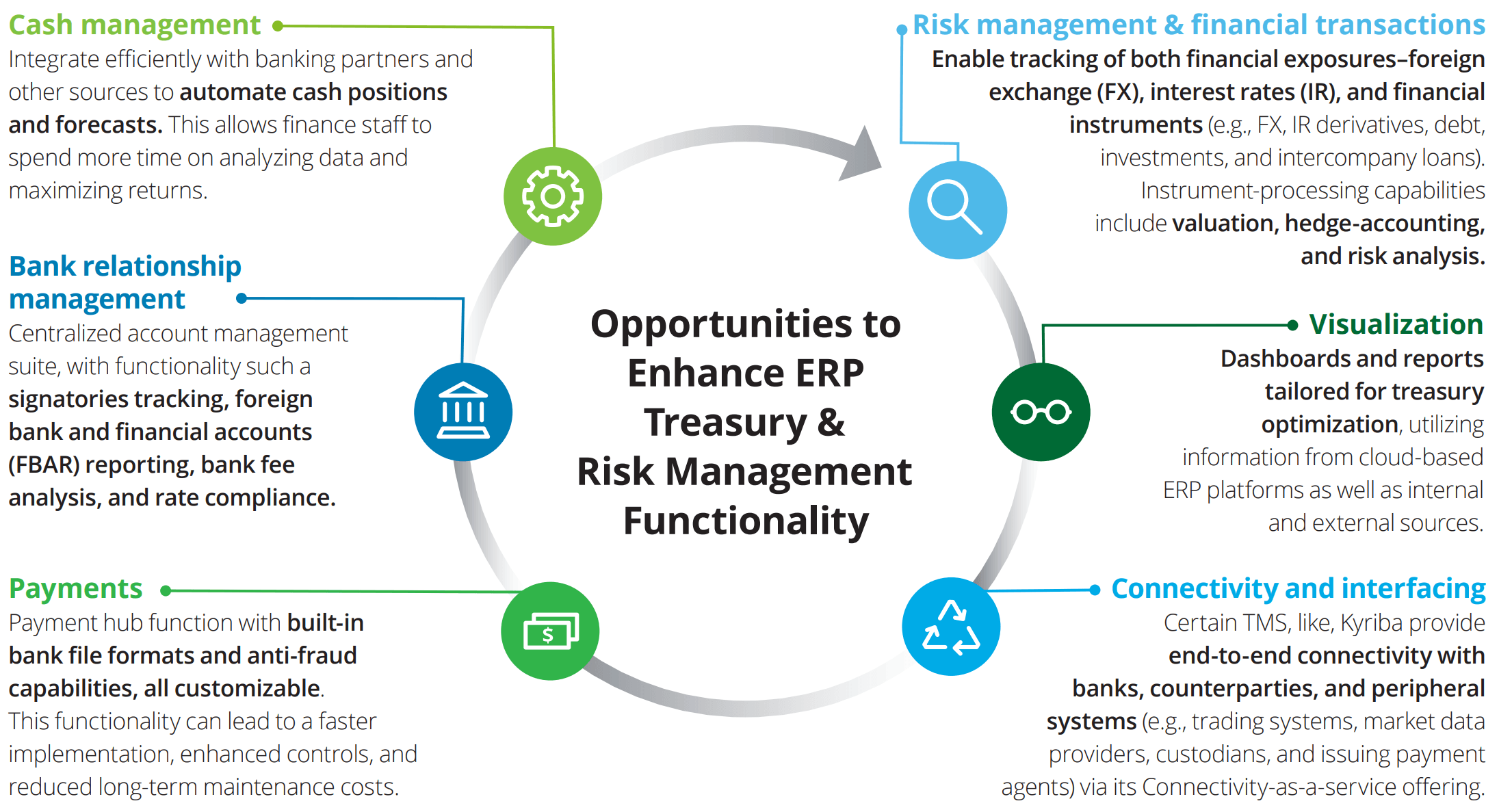

Supplemental treasury management systems (TMS) generally offer in-depth functionality across treasury management and accounting, bank connectivity and payments, control and compliance, risk management, and supply chain finance. Accordingly, the business case for implementing a supplemental TMS can be compelling, especially for companies that need to perform complex intercompany lending, hedging, risk valuation, foreign exchange, and other intricate financial operations.

However, modernizing the treasury management function requires a combination of capabilities, including industry-specific knowledge of leading practices; functional specialties such as strategy and operations, risk management, financial advisory, tax, and cyber security; and highly experienced professionals with technical skills across the various ERP ecosystems such as Workday and Kyriba. Deloitte not only offers these diverse capabilities but also integrates them efficiently. Deloitte is also a recognized market leader in finance transformation; it has achieved the highest quality rating on Workday implementation scorecards and it is Kyriba’s only enterprise-certified alliance relationship, having received implementerof-the-year awards for the last three consecutive years.

With these qualifications, Deloitte is well-positioned to help you combine a cloud-based financial management system with a supplemental TMS. This can open up many opportunities for cashmanagement cost savings and improved treasury function performance.

Cloud-based solutions to enhance visibility and management of cash, liquidity, and risk exposures

Leverage Deloitte’s extensive finance transformation experience, knowledge of leading practices, and familiarity with the financial management and treasury management capabilities found in leading platforms such as Kyriba and Workday.

Tailored for treasury optimization

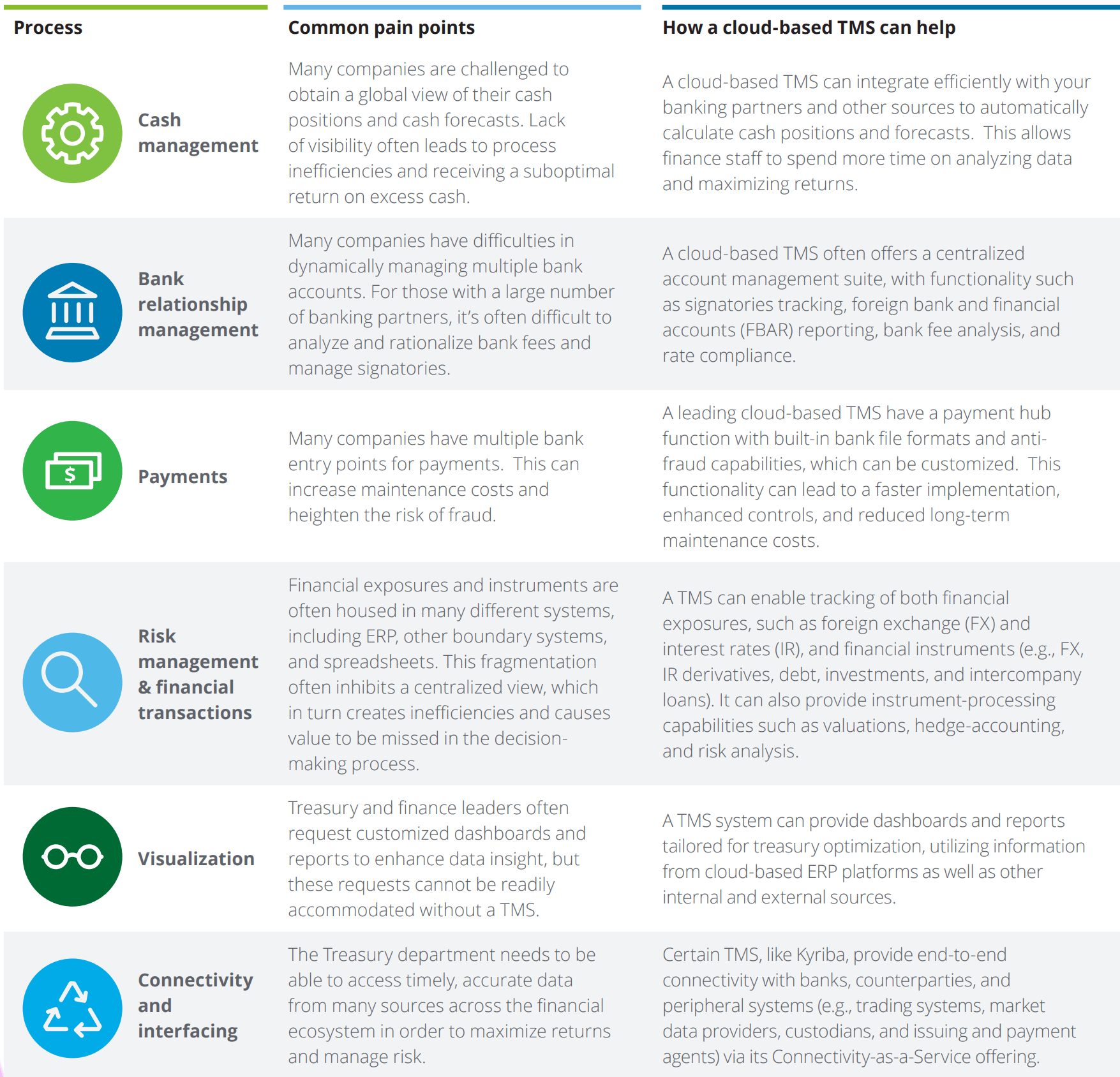

As detailed in Table 1, finance leaders have the ability to alleviate many common ERP treasury-management pain points by tapping Deloitte’s extensive finance transformation experience, knowledge of leading practices, and familiarity with the financial management and treasury management capabilities found in leading platforms such as Kyriba and Workday.

How can we help

Deloitte can assist you in taking the next steps to modernize your treasury management capabilities by guiding you through an initial scoping session to determine a personalized path forward. During this session, we can apply our technical acumen, treasury knowledge, and finance transformation experience to help you:

- Assess the current state.

- Develop a digital finance strategy based on combining leading cloud-based systems.

- Identify finance transformation opportunities and create a roadmap for realizing them.

- Design the solution and develop an implementation plan according to leading practices.

- System integration and implementation support for your selected solution.

Ultimately, through proprietary accelerators and pre-defined data integrations, we can help you streamline your TMS implementation, delivering it simultaneously with a cloud-based financial management implementation, or after it is complete.

Time to get strategic?

Treasury management trends triggered by digital disruption several years ago have only intensified under recent economic conditions. The role of the treasury function continues to grow as a value-add partner of the CFO and a strategic advisor to the business—all while core treasury goals and mandates, such as liquidity risk management and being a steward for financial risk management, have become even more important in a world of volatile markets, tight supply chains, and rising interest rates.

Could it be time for your organization to get strategic about liquidity management with a cloud-based financial management system and a supplemental treasury management system? To find out, contact us.

This document contains general information only and Deloitte is not, by means of this document, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This document is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor. Deloitte shall not be responsible for any loss sustained by any person who relies on this document. Product names mentioned in this document are the trademarks or registered trademarks of their respective owners and are mentioned for identification purposes only. Deloitte is not responsible for the functionality or technology related to the vendors or other systems or technologies as defined in this document. As used in this document, ‘Deloitte’ means Deloitte & Touche LLP, which provides audit, assurance, and risk and financial advisory services and Deloitte Consulting LLP, which provides strategy, operations, technology, systems, outsourcing and human capital consulting services. These entities are separate subsidiaries of Deloitte LLP. Please see www.deloitte.com/us/about for a detailed description of our legal structure. Certain services may not be available to attest clients under the rules and regulations of public accounting. Copyright © 2023 Deloitte Development LLC. All rights reserved.

Want to learn more about how to gain with a supplemental treasury management system?

Check out this webinar to hear how Deloitte helped Exelon and Constellation Energy modernize their Treasury organization through a Kyriba implementation.