Blog

Liquidity Risk Management and Governance for Advancing Treasury

When Deloitte asks treasurers the CFO mandate they receive to do their jobs, liquidity risk management is the top response. In fact, about 96% of all the treasurers or treasury organizations polled say that the most critical mandate they receive from their CFO is ensuring the company is safeguarded against liquidity events. The other top response is optimizing working capital, with 88% of polled treasurers indicating this is becoming a top priority for their CFOs.

At KyribaLive 2023, Matthew Hollander, Principal at Deloitte and Erik Smolders, Managing Director at Deloitte, discussed why the pressure is so high and how to use the right combination of technologies to enhance liquidity risk management effectively.

The Pressures to Deliver

Hollander explained that corporate treasurers are taking on more responsibilities, expanding their roles as they relate to the liquidity management process. But, as Smolders pointed out, Rome was not built in a day.

With challenges, such as rising interest rates, economic volatility, recurring bank failures and pandemics, it has become critical for treasurers to drive an enterprise liquidity risk management framework to better respond to the CFOs, the board and the shareholders. As free cash flow guidance becomes more prevalent for the CFO’s quarterly earnings calls, so does the heightened pressure on treasurers to deliver results.

“The treasurers that we polled have listened to their CFOs,” Smolders said, indicating that the top three priorities of their CFOs are: risk liquidity, cash forecasting and working capital enhancements.

“For your organization to be more focused on the working capital piece,” Hollander said as an example, “the first question becomes, how well are you doing on the day-to-day? It’s a crawl, walk, run. If you don’t have the line of sight into your cash, if you don’t have line of sight to your risk, the other components aren’t going to come along with it,” he said.

How Can Treasury Better Manage Liquidity Risk??

As treasurers analyze balance sheet risk factors such liquidity forecasts and add working capital optimization to the mix, they have increasingly become trusted business advisors to the CFOs. Through the evolution, treasurers now also analyze accounts receivable and accounts payables from a strategic perspective. For example, they are utilizing accounts receivables financing or optimizing payables terms with suppliers to drive more free cash flow. The term adjustments help treasurers drive the organization to understand their implications on an overall return on invested capital level and elevates the conversation within the organization.

Enhancing Data Management

To analyze working capital to manage liquidity risk effectively, treasury will need an element of technology and data management.

The emergence of new technology is a significant opportunity for the treasurer to advise the CFO. The first method is obtaining the data from different systems, such as ERPs. Through modern connectivity options of APIs, data integration has become a reality. The second method is leveraging a centralized system of record to make the integrated data both visible and accessible.

Using modern API technology allows treasurers to import liquidity data from systems – like ERPs – in real-time and with minimal implementation time. Kyriba’s flexible scenario analysis can quickly create multiple business scenarios for the organization and formulate the agile way to optimize working capital and meet the free-cash-flow goals of the CFO and board, without any external borrowing.

Without an integrated treasury management system in place and the policy and standard formats being set around it, it is challenging to put data analysis in place. And technology is just the tip of the iceberg. “You can implement a great treasury system, but if your treasury and finance teams are not harmonized around the system, it can impact how you elevate your organization’s game,” Hollander said.

Advances in technology have made liquidity and working capital management possible in one 360-degree view. For example, Kyriba’s artificial intelligence (AI) prediction models based on seasonality, can significantly increase the liquidity forecast accuracy from about 50% to 95% for certain categories. This is a game changer for seasonality-based forecasting.

Collaborating with FP&A

An emerging trend in corporate finance sees treasurers forming closer alliances with FP&A teams, offering insightful free cash flow forecasting to company boards and investors.

FP&A teams typically adopt a macro perspective towards cash flow forecasting, starting with Net Income and incorporating alterations in balance sheet accrual accounts to formulate an operational or free cash flow forecast. Treasurers, tasked with executing capital allocation strategies, have an encompassing view of global collection patterns, new subsidiary funding, and global disbursement habits. Therefore, they become indispensable assets to FP&A teams when establishing a precise cash budgeting process.

Traditionally, treasurers encountered obstacles in consolidating and categorizing bank activities, and juxtaposing them with previously determined free cash flow forecasts. Today, technology empowers treasurers to surmount these challenges, providing real-time insights into global bank balances, a step ahead of their corporate accounting and finance colleagues.

In many corporations, the treasurer’s role expands beyond managing funds, bridging the FP&A’s indirect forecasting with the treasury’s direct method. Although both methods differ, their shared objective is predicting fluctuations in cash flow. By applying their direct method and updating the forecast as actual bank data is reported across their global banking group, treasurers can offer valuable strategic advice to the CFO on potential upsides to free cash flow, as well as potential risks to the initially committed FP&A indirect cash flow plan.

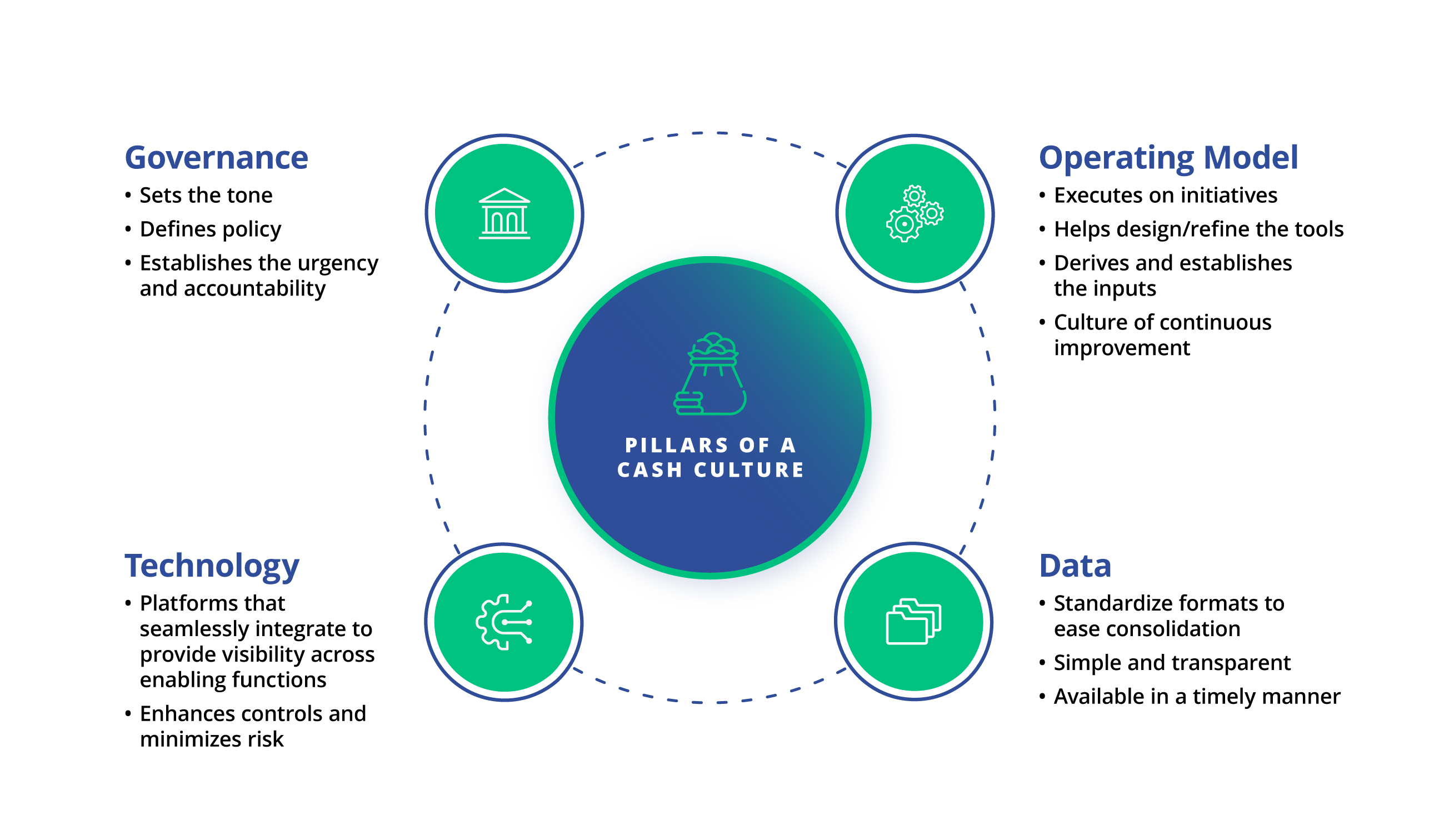

Building a Cash Culture

Essentially, treasurers need to get a mandate from their executive team to oversee working capital strategically. Treasurers are in a position to do this because they commit to the rating agencies and to the bank counterparties.

Today, many leading-edge organizations are developing a Cash Council composed of a mix of team members from treasury, finance, supply chain, sales, procurement and taxes. Every organization is different. But having all those people involved in working capital decisions, in return on invested capital decisions, is crucial to drive the new cash culture. “From a treasury point of view, you usually need to know where the cash sits tomorrow,” said Smolders, “the Cash Council helps drive where the cash is going to be tomorrow. Why are the numbers not what they’re supposed to be? Why are we not hitting targets? What can be done to move the targets around?”

Key Learnings

The role of treasurers in managing liquidity risk and optimizing working capital has become increasingly vital in today’s volatile landscape. With the majority of treasurers recognizing the CFO’s mandate for safeguarding against liquidity events, the pressure on treasurers to deliver results has intensified.

Embracing technology, building an achievable liquidity risk management framework, collaborating with FP&A and fostering a cash culture will allow treasurers to fulfill their mandate of managing liquidity risk and optimizing working capital effectively.

“Those kinds of achievements are slow, and need to take their time to get there,” Smolders said. Setting targets – such as preventing it from becoming worse year over year – can be beneficial and help create momentum in building the framework. “It’s about being empowered and making sure that the organization is ready,” Smolders said. Understanding the various components and leveraging technology can help organizations to achieve those incremental wins.

Watch the on-demand session to learn more about liquidity management and governance for advancing treasury.