FAQ

What are Real-time Payments?

Real-time payments are a payment type where the transmission of the payment message and the availability of “final” funds to the payee occur in real time or near-real time and on as near to a 24-hour and seven-day (24/7) basis as possible.

Real-time payments are designed to be as close to 24/7 as possible, meaning that payments can be made and received at any time of the day or night, seven days a week. This is a significant departure from traditional payment systems, which may have limited hours of operation and require several business days to process payments.

The terms “real-time payments,” “faster payments,” and “instant payments” are often used interchangeably to describe this type of modern payment infrastructures. While there may be subtle differences in the way these terms are used, they are generally used to describe the same type of modern payment infrastructure.

These payment systems are typically domestic or regional in nature, meaning that they are designed to facilitate payments within a specific country or region. However, there are efforts underway to develop cross-border real-time payment systems that would allow for the seamless transfer of funds between different countries and currencies.

Table of Contents

- What Are the Typical Use Cases for Real-time Payments?

- What Are the Benefits of Adopting Real-time Payments?

- How to Enable Real-time Payments

- What Is a Typical Payment Flow of Instant Payments?

- Examples of Real-time Payments Adoption

- Why Are Cross-Border Real-time Payments More Complex?

- What are Immediate Cross-border Payments (IXB)?

What Are the Typical Use Cases for Real-time Payments?

With the world moving to a new level of instancy, every organization should understand both the value impact and the use cases for real-time payments when it comes to its own business context.

There are many great examples of how companies are using instant payments, especially with large volume low value payments, to save costs and increase speed.

Below are some of the use cases Kyriba clients are benefiting from:

- Time-sensitive payments are perfect for real-time payments, for example emergency payroll, disaster relief, and AP exception payments from industries such as distribution and logistics.

- Intercompany transfers are low risk and a common use case. With real-time payments, companies can efficiently deploy working capital across their subsidiaries.

- Instant insurance claims disbursement is a typical example of improving customer experience with real-time payments. The same also applies in the gig economy where business or service transactions can be settled immediately on the spot.

- Request-to-pay is also becoming more common, where suppliers embed real-time payment instructions within an email to simplify the invoicing process, either to encourage early payment or to accelerate late payments.

What Are the Benefits of Adopting Real-time Payments?

There are many good reasons to add real-time payments to your payment mix, mainly because of the unprecedented visibility and transparency this new payment type brings to both the payer and the payee.

Some of the most outstanding benefits of using instant payments are:

- Improved supplier relationships: making early or on-time payments is an easy way to improve rapport between vendors and clients. With instant payments, invoices can be paid immediately and some vendors will offer discounts for early payments.

- Control over working capital: faster payments mean more accurate cash visibility that allows companies to unlock working capital, releasing funds for debt repayment and/or reinvestment

- Increased security: with full visibility of payment details including end-to-end tracking and confirmation of credit, risk of fraud decreases

- Improved ROI: lower bank wire fees and reduced time spent researching, correcting, and resending failed payments translate to significant cost savings for businesses

- Immediate settlements: with the ability to transfer payments and pay bills 24/7, payment delays are eliminated, transaction history is current, and account balances stay up-to-date

- Non-repudiation: because instant payments carry a digital footprint specifying the time, date, origin, and destination of each transaction, no one can dispute that a payment was sent, received, and processed.

How to Enable Real-time Payments

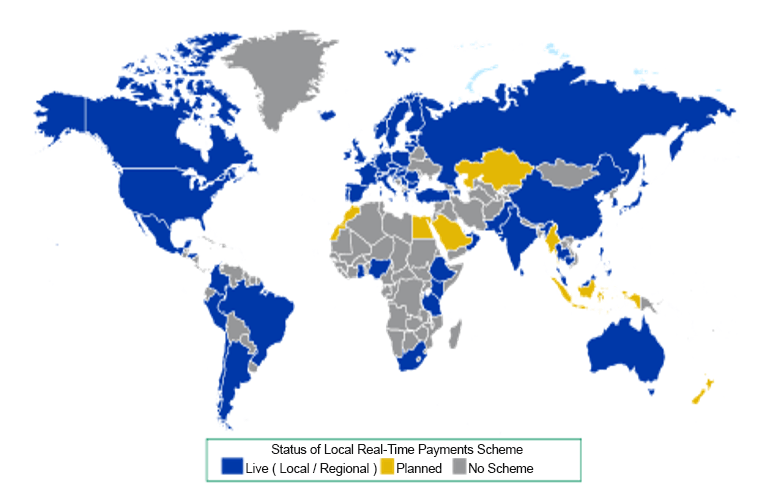

Globally there are more than 70 countries where domestic or regional instant payments are available. For example, you can find real-time payment systems in:

- Americas (USA, Canada, Brazil, Mexico)

- SEPA countries (over 25 countries supported)

- Asia (Singapore, Japan, Thailand, Australia, Hong Kong)

In different countries and regions, instant payments might have different names too. For example:

- USA: RTP® by The Clearing House, FedNowSM Service by The Federal Reserve

- UK: Faster Payment System

- SEPA countries: SEPA Instant Credit Transfer (SCT Inst)

Singapore: PayNow - India: Immediate Payment Service (IMPS)

Corporates can access real-time payments via FTP or Bank API (e.g., CashPro by BoA, CITI, JPMC), depending on which is supported by your partner banks.

On top of the bank connectivity, the following payment formats all support instant payments:

- JSON: a lightweight data interchange format that is commonly used in web applications, and it is often used for real-time data exchange due to its simplicity and flexibility

- ISO 20022 XML: a messaging standard that allows for the exchange of structured financial messages between different parties, and it is used by a growing number of financial institutions and payment systems around the world.

- Fixed formats: standardized formats for financial messages that are used by various financial institutions and payment systems. These formats provide a consistent structure for financial messages to ensure that they are processed correctly and efficiently.

- CSV formats: simple text-based formats that are commonly used for storing and exchanging tabular data, such as financial transactions. They are easy to use and can be opened and edited using a wide range of software applications, making them a popular choice for organizations.

What Is a Typical Payment Flow of Instant Payments?

The payment flow of instant payments can vary depending on the specific payment system or infrastructure used, but there are some common elements that are typically involved. Here is a general overview of the payment flow of instant payments:

- Initiation: The payment process begins when the payer initiates an instant payment request, typically through an online banking portal or mobile app. The payer may need to provide information such as the recipient’s name, account number, and the amount of the payment.

- Authorization: Once the payment request is received, the payer’s bank verifies that there are sufficient funds available and authorizes the instant payment.

- Transmission: The payment message is then transmitted to the recipient’s bank in real-time or near-real-time. This transmission may occur through a variety of channels, such as a secure messaging network or an instant payment platform.

- Clearing: The recipient’s bank processes the payment message and ensures that the funds are available to the recipient. This may involve verifying the recipient’s account details, checking for any fraud or errors, and updating account balances.

- Settlement: The final step in the payment flow is settlement, which involves the transfer of funds from the payer’s bank to the recipient’s bank. This settlement typically occurs in real-time or near-real-time, and the recipient’s account is credited with the payment amount.

Overall, the payment flow of instant payments is designed to be fast, efficient, and secure, with minimal delays or processing times. This makes instant payments an attractive option for businesses and individuals who need to make and receive payments quickly and reliably.

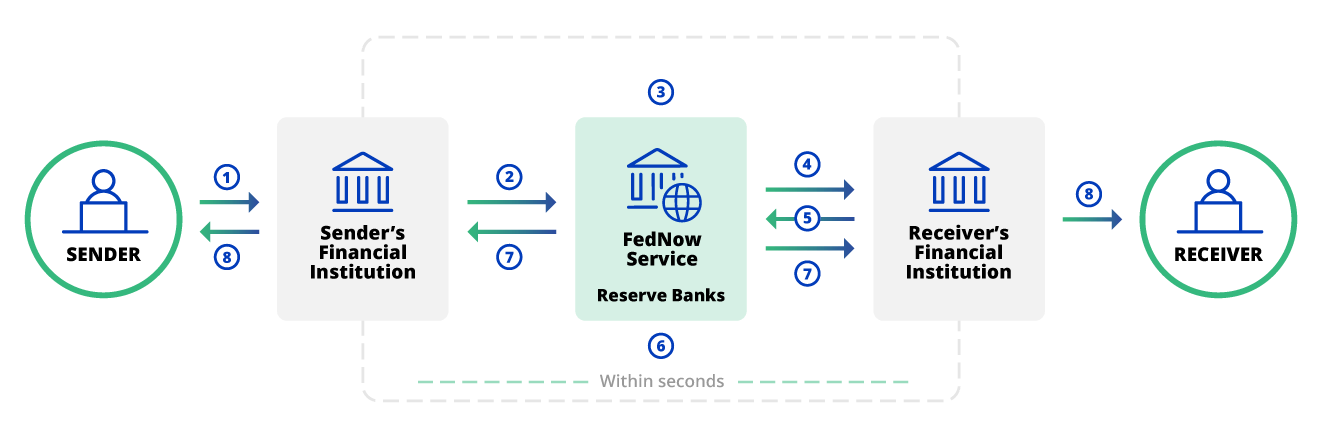

The Federal Reserve explains on its website how instant payment flow works among its network participants. It represents well how instant payments work in general, with everything taking place in as quickly as just seconds.

Source: FedNow “About The FedNowSM Service”

- In step 1, a sender (i.e., an individual or business) initiates a payment by sending a payment message to its financial institution through an end-user interface outside the FedNow Service. The sender’s financial institution is responsible for screening the payment according to its internal processes and requirements.

- In step 2, the sender’s financial institution submits a payment message to the FedNow Service.

- In step 3, the FedNow Service validates the payment message, for example, by verifying that the message meets message format specifications.

- In step 4, the FedNow Service sends the contents of the payment message to the receiver’s financial institution to seek confirmation that the receiver’s financial institution intends to accept the payment message. At this point, the receiver’s financial institution will have the opportunity to confirm or deny that it maintains the specified account.

- In step 5, the receiver’s financial institution sends a positive response to the FedNow Service, confirming that it intends to accept the payment message. Steps 4 and 5 are intended to reduce the number of misdirected payments and resulting exception cases that can occur in high-volume systems.

- In step 6, the FedNow Service debits and credits the designated master accounts of the sender’s and receiver’s financial institutions (or their correspondent financial institutions), respectively.

- In step 7, the FedNow Service sends a payment message forward to the receiver’s financial institution with an advice of credit and in parallel sends an acknowledgement to the sender’s financial institution, notifying it that settlement is complete.

- In step 8, the receiver’s financial institution credits the receiver’s account. As a term of the FedNow Service, the Federal Reserve Banks anticipate requiring the receiver’s financial institution to make funds available to the receiver almost immediately after step 7. This crediting to the receiver’s account as well as the debiting of the sender’s account by their respective financial institutions happens outside the FedNow Service.

Source: FedNow “About The FedNowSM Service”

Examples of Real-time Payments Adoption

Kyriba client Hunt Companies was among the early adopters for real-time payments in the US and is a great example to demonstrate the associated benefits. The main challenges Hunt Companies faced before the use of instant payments were as follows:

- Significant bank fees resulting from the huge volume of payments

- Lack of visibility into payment status, especially the rejected payments

- Significant time spent by the team to research and resend failed payments

With RTP® Hunt Companies has seen the following business outcome:

- A reduction of bank fees from $6 on average for a wire transfer to less than $1 for RTP®

- An impactful number of productivity hours gained per month by Hunt’s finance team

- In just three months, the client has seen a 375% increase in the number of payments using RTP® month-over-month

Why Are Cross-Border Real-time Payments More Complex?

Cross-country real-time payments are more complex and challenging than domestic real-time payments due to several factors:

- Regulatory Frameworks: Each country has its own regulatory framework, which can vary widely in terms of security requirements, data privacy laws, and customer protection regulations. This makes it difficult to ensure compliance with all relevant regulations when transferring funds across different countries.

- Interoperability: Different countries use different instant payment systems that are not always interoperable with each other. This can make it difficult to transfer funds seamlessly between different countries, with payments formats and messaging standards differences.

- Settlement Systems: Settlement systems can vary widely between countries, and cross-border instant payments require a settlement system that can handle multiple currencies. It requires coordination between different payment systems and financial institutions, which usually takes time.

- Fraud and Cybersecurity: when real-time payments are sent across different countries, they can be more vulnerable to fraud and cybersecurity threats. There is increased risk of payments fraud due to the delays in currency conversion and settlement.

What are Immediate Cross-border Payments (IXB)?

There are ongoing efforts to make cross-border real-time payments a reality. SWIFT gpi and the ISO 20022 XML V9 messaging standard are both good examples of efforts to standardize payment messaging and improve interoperability between different payment settlement systems.

A great advancement in this direction is the new payment initiative of Immediate Cross-border Payments (IXB). EBA Clearing, SWIFT and The Clearing House have announced that they are working together to deliver pilot service for IXB for real-time USD-Euro payments in 2023.