FAQ

What is Receivables Finance?

Receivables finance, also known as invoice finance, is a type of working capital facility that enables businesses to borrow against unpaid invoices. Receivables finance helps businesses to improve their cash flow by unlocking the value of invoices they’ve already issued, allowing them to access funds immediately instead of waiting for their customers to pay.

With receivables finance, businesses can secure the capital they need to fund operations, growth, or expansion projects.

Table of Contents

- Why is Receivables Finance Important?

- What is the Difference between Receivables Finance and Accounts Receivables?

- How to Turn Accounts Receivables into Cash Flow

- What are the Benefits of Receivables Finance?

- What are Some Different Types of Receivables Finance?

- What Are the Key Features of Kyriba’s Receivables Finance Solution?

- Seamless Integration with Other Kyriba Modules

Why is Receivables Finance Important?

Accounts receivable measures the money that their customers owe to a business for goods or services already provided. Analyzing a company’s accounts receivable will help investors gain a better sense of a company’s overall financial stability and liquidity. If clients’ late payments or unexpected expenses occur, the company’s financial health could be put at risk. In extreme cases, receivables finance problems could cause damages that are very hard to recover from.

This potential risk is why accounts receivable financing allows corporates to convert invoices or credit sales into cash right away, without having to hound their clients for immediate payment. Receivables finance requires a funder or factor that will be willing to finance those client invoices in advance against a fee.

What is the Difference between Receivables Finance and Accounts Receivables?

Receivables finance is a financing agreement where a company receives financing capital related to a portion of its accounts receivable. Accounts receivables (AR) are legally enforceable claims for payment held by a business for goods supplied or services rendered that customers have ordered but not paid for.

Accounts receivables financing is the selling of outstanding invoices for funding–outstanding invoices or receivables are sold to a finance company. Receivables finance solutions enable sellers to access early payment on outstanding receivables, while remaining in control of obtaining the most efficient funding sources for its receivables.

How to Turn Accounts Receivables into Cash Flow

Receivables finance works by advancing a business a percentage of the value of its unpaid invoices. The business will then receive the full value of the invoice, minus any finance charges, when the customer pays. This process helps businesses to secure the funds they need to finance operations, growth, or expansion projects without taking on additional debt or equity.

What are the Benefits of Receivables Finance?

Receivables finance programs provide the following benefits for suppliers:

- Instant cash access: companies have immediate access to cash because they do not have to wait for loans to be approved

- Reduced credit risk position: the finance company who purchased the receivables assumes the risk on the outstanding amounts

- Improved organizational cash position: the funding derived from receivables finance helps unlock working capital that organizations can use to take advantage of business growth opportunities

In short, receivables finance offers a number of advantages to businesses that need to access working capital quickly and easily.

What are Some Different Types of Receivables Finance?

There are many different types of Receivables Finance, depending on the agreements between sellers, factors, and creditors. Two of the most common types are of receivables finance are:

- Purchasing receivables: the process of buying goods or services on credit and then receiving payments in the future. A purchasing receivable is an amount of money that a company owes to another company after goods or services have been purchased.

- Asset-based lending: financing that is secured by collateral such as inventory, accounts receivable, or equipment. Asset-based lending typically works by using a business’s assets as collateral for the loan. The lender will assess the value of the assets and loan up to a certain percentage of the assets’ value. The loan proceeds are then used to finance the borrower’s working capital needs, such as purchasing inventory, paying off debt, or covering operational expenses.

In addition, there are types of Receivables Finance within the above categories. The three most common are:

- Factoring: a type of financing service used by businesses to access cash quickly. Through factoring, businesses are able to sell their accounts receivable (invoices) to a third-party financial institution, called a factor. The factor then advances the business a portion of the face value of the invoice and collects payments from the customer.

- Invoice discounting: Invoice financing is a type of business funding that helps companies to access the cash tied up in their outstanding invoices. This short term funding option offers businesses a way to get the money they are owed by their customers faster, while still allowing the customer to pay at their own pace.

- Securitization: Securitization is the process of pooling together various types of debt, such as mortgages and corporate loans, and packaging them into a financial instrument known as a ‘security’. These securities can then be traded on the open market, allowing lenders to diversify their portfolios and access capital more quickly and cost-effectively.

These types of receivables finance allow businesses to access short-term capital quickly to address cash flow needs.

What Are the Key Features of Kyriba’s Receivables Finance Solution?

Kyriba’s Receivables Finance solution helps businesses to streamline their receivables finance process and maximize their working capital. With Kyriba’s platform, businesses can manage, monitor, and forecast their receivables finance easily and efficiently, while also reducing the risk of fraud and increasing visibility into their finances. Kyriba’s Receivables Finance solution can help businesses to unlock the value of their unpaid invoices and access the funds they need to grow their business.

Key features of Kyriba Receivables Finance solution include:

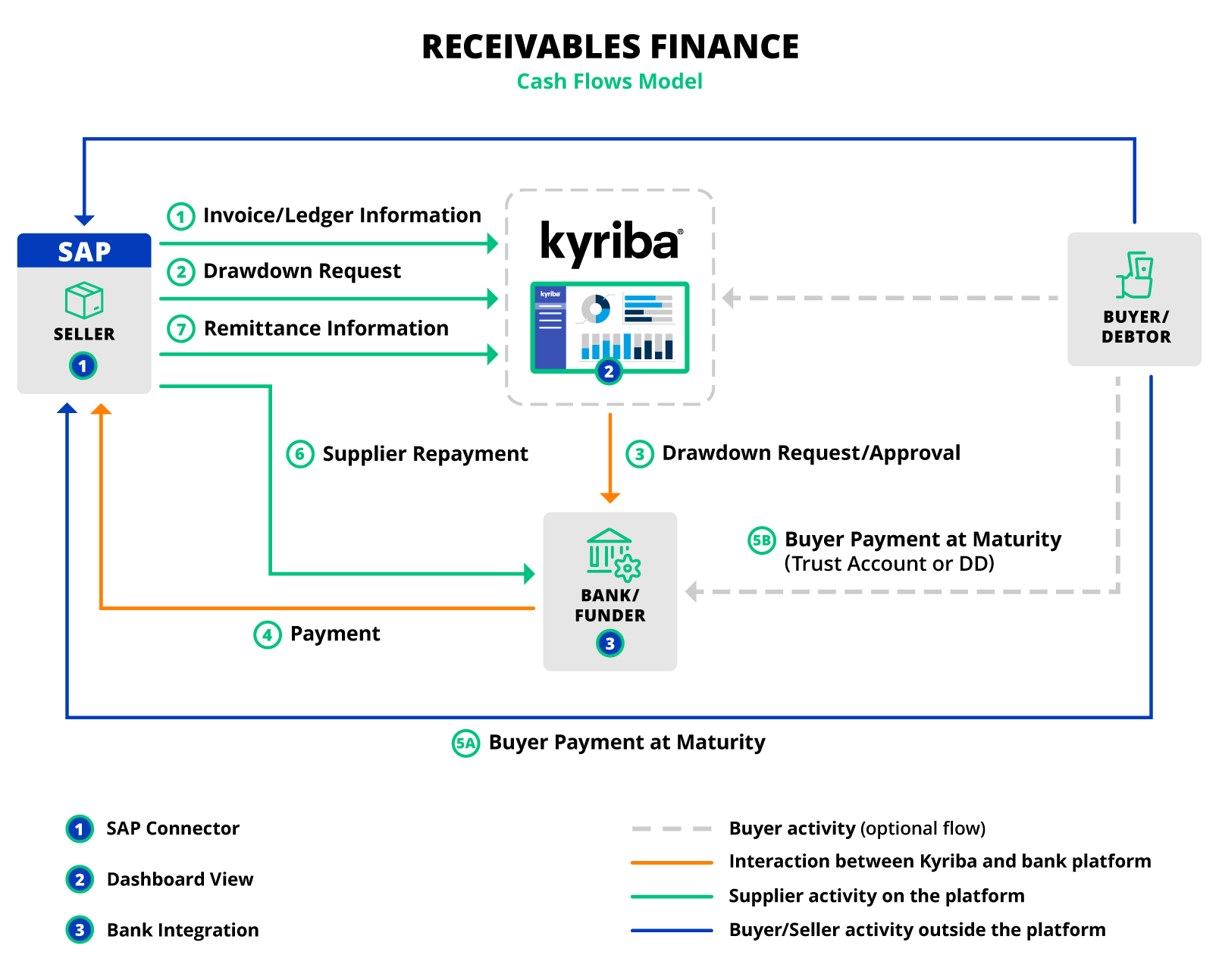

- Fast and efficient implementation: using application programmable interfaces (APIs), Kyriba Receivables Finance seamlessly connects to the seller’s enterprise resource planning (ERP), allowing for real-time status updates

- Advance payment processing: Kyriba Receivables Finance enables eligibility and limit checks before processing documents or receivable sales to banks. Then, the platform completes the workflow by connecting to funders and retrieving the status of drawdown requests

- Payment and reconciliation: Once collection reconciliation is complete, Kyriba Receivables Finance automatically settles re-payments of financed and collected invoices to the funder on the due date

- Dashboards, reports, and tips: Kyriba Receivables Finance offers a homepage widget that makes prepayment status, collections, limits, DSO, and other KPIs readily available

- Seamless integration: Kyriba Receivables Finance is natively integrated with the other modules of Kyriba’s Liquidity Management platform. It provides real-time visibility into other discounting or payables finance programs if any (such as Dynamic Discounting, Supply Chain Finance, and Confirming). This integration provides better business intelligence and reporting, providing a quick, easy, and in-depth analysis of global funding programs.

Kyriba’s Receivables Finance module is available for corporates, large and medium companies, as well as to financial institutions as a white-label solution.

Seamless Integration with Other Kyriba Modules

Kyriba’s Receivables Finance solution is natively integrated with all other Kyriba Working Capital modules, as well as Kyriba Treasury, Payments, Risk Management and Connectivity. Kyriba’s Working Capital solutions provide you with access to business intelligence and reporting dashboards to drive quick and easy deep analysis of your overall financing programs.