Fact Sheet

Le programme API de Kyriba

Les banques utilisent de plus en plus les interfaces de programmation d’application (API) pour offrir de meilleures expériences à leurs clients. Mais les API offrent des potentiels bien supérieur aux simples connexions bancaires.

En tant que leader de la connectivité dans le domaine de la trésorerie et de la finance, Kyriba exploite au mieux la puissance des API pour accompagner les responsables financiers dans leurs projets de transformation digitale.

Table of Contents

Qu’est-ce qu’une API ?

Les API permettent à différents logiciels d’échanger des données entre eux. Elles rendent possible le développement de connecteurs préconçus pour transférer plus rapidement les données entre les systèmes. L’utilisation d’API permet de raccourcir les délais de mise en oeuvre, de simplifier l’intégration et la sécurité, et de fournir aux utilisateurs un accès instantané aux données des systèmes internes et externes.

Pour la trésorerie et la gestion financière des entreprises, les API présentent un potentiel quasi illimité. Elles facilitent la mise en place d’un écosystème ouvert qui permet aux développeurs tiers de créer des applications sur la plateforme du fournisseur d’API. Elles permettent d’accélérer le flux de données bancaires, offrant ainsi aux services de trésorerie et de gestion financière des entreprises de nombreux avantages, notamment :

- Paiements en temps réel

- Notification immédiate du règlement des transactions

- Détection de la fraude

- Informations complémentaires relatives aux paiements

- Moins de dépendance à l’égard des lignes de crédit

- Réduction du risque de découverts

- Élimination des traitements par batch

- Confirmation instantanée des opérations de change Les API représentent le catalyseur de la

trésorerie et de la gestion financière en temps réel, permettant aux directeurs financiers et aux trésoriers de prendre des décisions plus judicieuses et plus éclairées.

API Bancaires

Kyriba se connecte chaque jour à plus de 1 000 banques internationales pour le compte de ses 2 500 clients en utilisant de nombreux protocoles de connexion, dont les API. La plupart des banques n’ont pas encore publié et n’utilisent pas encore d’API dans la production en direct. Cependant, Kyriba se connecte aux banques qui prennent déjà en charge les API, mais aussi d’autres méthodes de connexion comme FTP et SWIFT.

Les services bancaires disponibles via l’API sont différents selon les banques, mais peuvent inclure les paiements instantanés, les paiements effectués au niveau national, les paiements transfrontaliers,

l’établissement de rapports sur les soldes et les transactions bancaires, et le suivi des paiements via SWIFT gpi. La connexion aux API est transparente pour l’utilisateur. Elle présente aussi des avantages importants par rapport à l’approche basée sur les fichiers, tels que la réponse immédiate des banques et la possibilité de recevoir de nouvelles données et notifications en temps réel.

Le hub Open API de Kyriba permet aux équipes trésorerie, finance et informatique de transformer la façon dont elles accèdent aux informations et les utilisent.

API dans un système ERP

Kyriba a développé des connecteurs d’API standard pour les principaux ERP du marché dont SAP, Oracle, Microsoft Dynamics et d’autres grands encore. Mais il existe aussi d’autres API compatibles avec de nombreuses solutions qui ne sont pas nécessairement des ERP. Les connecteurs d’API de Kyriba pour les ERP fournissent des données en temps réel, notamment des notifications basées sur des événements. Kyriba peut également transmettre des mises à jour instantanées à votre ERP, telles que des changements de statut de paiement.

L’API de Kyriba pour les ERP offre les avantages suivants :

- Des intégrations ERP prêtes à l’emploi avec Kyriba : Il s’agit notamment des prévisions de trésorerie, de l’initiation de paiement, des confirmations de paiement, de la comptabilisation des instruments financiers, et du rapprochement comptabilité et rapprochement comptable

- Assistant de paramétrage d’un connecteur ERP : Expérience contextuelle en libre-service permettant la configuration de connexions ERP à Kyriba et le provisionnement pour les partenaires et les clients via le portail de développement

- Téléchargements de paquets ERP : Accès en libreservice aux composants d’intégration du côté ERP et aux documents

- API ouverte pour les ERP : Prise en charge de points de terminaison d’API à connexion directe pour de nouvelles intégrations ERP

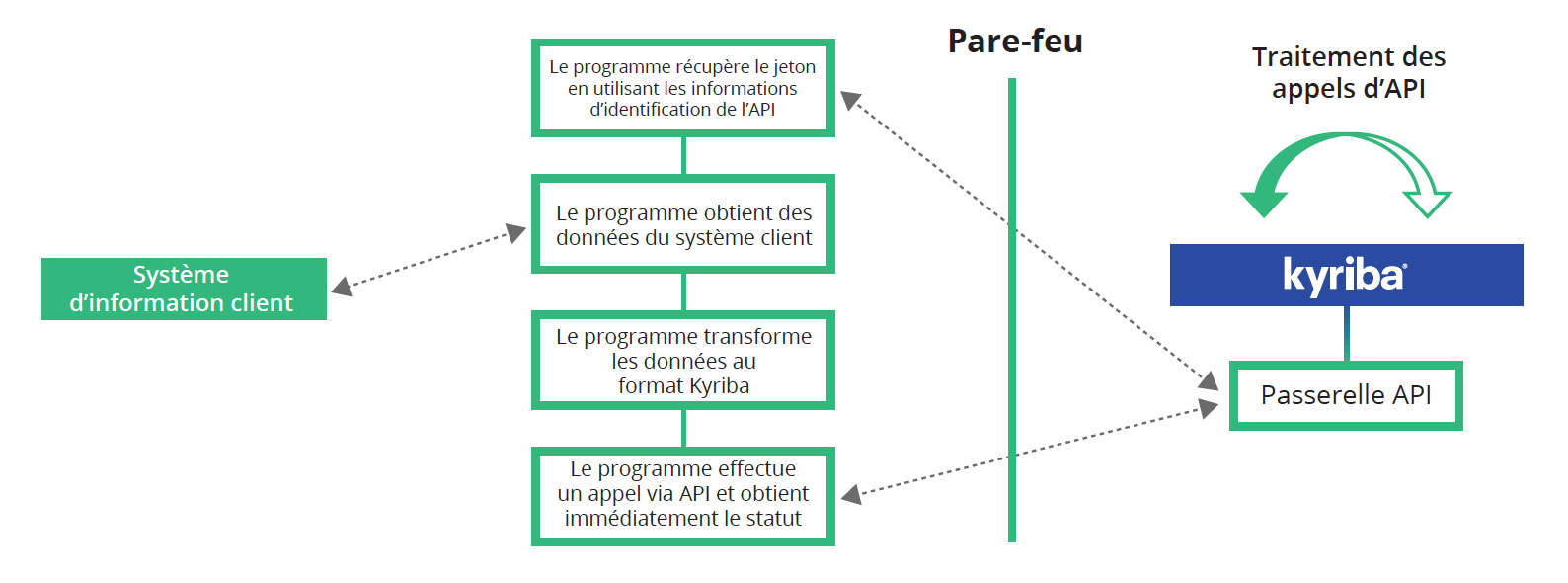

Fonctionnement

Portail Développeurs

Le portail développeurs de Kyriba représente une ressource pour les développeurs de technologies afin de créer de nouvelles applications pour la place de marché Kyriba et un référentiel consultable regroupant les partenaires et les applications pour les utilisateurs actuels de Kyriba. Les développeurs peuvent s’inscrire gratuitement et bénéficier de :

- Notre catalogue d’API

- Nos documents relatifs aux API

- Nos exemples d’API

- Notre assistance via notre communauté et nos tickets

- Nos journaux de modifications

- Notre environnement de test

- Notre App Store pour publier leurs applications

Les API de Kyriba respectent le standard d’API REST et peuvent exporter, créer, modifier et supprimer des données. Elles sont entièrement documentées en ligne ; les clients, les partenaires et les équipes de Kyriba peuvent facilement accéder à des documents détaillés sur les API, à des échantillons JSON (JavaScript Object Notation) et effectuer des appels d’API en ligne à des fins de formation ou pour évaluer la mise en place de tests.

L’avantage des API

Les API sont plus que de simples connecteurs aux banques et aux ERP. Les API permettent l’interconnexion de plusieurs applications financières, et l’échange de données en temps réel pour que les systèmes financiers composables deviennent une réalité. L’API ouverte et le portail développeur de Kyriba permettent à nos clients d’accéder immédiatement à un réseau de banques, d’ERP, de plateformes de négociation, d’agrégateurs de données et à une communauté FinTech internationale qui exploitent tout le potentiel de la liquidité et de la finance en temps réel.