What is Liquidity Planning?

Liquidity planning is an evolution of traditional cash forecasting surrounding the cash forecast with data which supports better-informed liquidity decisions. Liquidity planning makes the forecast actionable by connecting the outcome of cash forecasting—how much cash the organization expects to have—with information about the levers the CFO and treasurer can pull to meet cash flow targets and mobilize cash.

Treasury and the CFOs are often under immense pressure to provide the entire organization with the right level of operating capital (working capital), to meet the critical wide range of financial obligations in the most cost-effective way.

Liquidity Planning expands beyond cash and liquidity management, delivering the ability to manage available funds from different sources across varying timelines to fund current operations and future obligations.

Typical levers may include investment, borrowing, credit facilities, and aspects of the cash conversion cycle. Liquidity planning data tells finance teams where sources of cash are so that they can execute decisions rapidly, enterprise wide.

Challenges of Liquidity Planning for CFOs

CFOs and finance teams are severely constrained when it comes to liquidity and tight management of available cash flows at any time, particularly in volatile environments when inflation is high and the borrowing rates are increasing rapidly. Today’s CFO needs to move beyond inconsistent visibility into longer-term flows and be capable of making accurate strategic decisions.

The following are some of the key challenges that CFOs face in liquidity planning:

- Managing volatility: One of the biggest challenges for CFOs is managing the volatility of the markets, which can have a significant impact on liquidity planning. For instance, a sudden market downturn or interruption (such as the recent SVB crisis) or an unexpected geopolitical event can result in a significant decrease in cash flow, forcing the CFO to quickly adjust their liquidity plan.

- Rising interest rates: Another challenge for CFOs is the increasing borrowing rates, which can impact liquidity planning. As interest rates rise, the cost of borrowing increases, making it more difficult for companies to access the funds they need to maintain adequate liquidity. This can be particularly challenging for companies that are highly leveraged or have a large amount of debt.

- Inflation: CFOs must also navigate the effects of inflation, which can impact both the cost of goods and services and the value of assets. This can make it more difficult to accurately forecast cash flows and plan for the future.

- Regulatory compliance: CFOs must ensure that they are in compliance with all relevant regulations, including those related to liquidity planning. This can include requirements for maintaining adequate reserves or complying with specific reporting requirements.

- Uncertainty in the global economy: With ongoing geopolitical tensions and economic uncertainty in many parts of the world, CFOs must be prepared to quickly adjust their liquidity planning strategies in response to changing market conditions.

- Technological disruption: The rise of new technologies and digital platforms is also changing the landscape for liquidity planning. CFOs must be able to navigate the complexity of these new tools and platforms, while also ensuring that their company's financial data is secure.

For example, the recent trend towards sustainability and ESG (environmental, social, and governance) investing, which has led to increased scrutiny of companies' financial practices and may impact their access to capital in the future.

How to Measure the Impact of Liquidity Planning

Most impacts to, and from, working capital are measured through metrics that include weighted average cost of capital (WACC), cash conversion cycle (CCC) and various debt metrics like interest expense, return on debt, etc.

- Weighted average cost of capital (WACC) represents a firm’s average after-tax cost of capital from all sources. WACC is calculated by multiplying the cost of each capital source (debt and equity) by its relevant weight by market value, then adding the products together to determine the total.

- The cash conversion cycle (CCC) is a metric that expresses the time (measured in days) that it takes for a company to convert its investments in inventory and other resources into cash flows from sales.

- The average interest rate can be hedged against interest rate volatility with fixed rate loans and interest rate derivatives

- The average borrowing spread can be secured with long-term debt and reduced with buyer invoices and inventory guarantees

- The average treasury spread can be enhanced by reducing opportunity cost on cash and maximizing return on short-term investments

What Impacts the Timeline of Liquidity Management

When cash forecasting timelines extend beyond 90 or 120 days, the visibility and accuracy of forecasts begin to diminish significantly, and companies are often required to invest for shorter tenors or commit to more debt capacity than really needed. These pressures begin to increase when strategic decisions are limited or rely on debt or the sale of assets to supply the funds required for expansion or M&A activity, for example.

More and more, companies are relying upon technology to increase the available sources of liquidity information and make the task of aggregating and analyzing information from those sources more granular, accurate and meaningful. Another attribute of a leading system is the ability to continuously improve your forecasting processes through benchmarking and comparing plan to actuals or budget to actuals.

Key Features of a Liquidity Planning Solution

Effective liquidity planning is critical for any business, as it helps to ensure that there is enough cash available to meet financial obligations and invest in growth opportunities. To support this, there are several key features available in modern Software-as-a-Service (SaaS) solutions that can help CFOs and finance teams make more informed decisions.

One of the most important features is the ability to extend forecasting horizons. In the past, liquidity planning was often limited to short-term forecasting, which made it difficult for CFOs to make strategic decisions that would impact the company's financial health in the long run.

However, with modern SaaS solutions, it is now possible to create more accurate forecasts that extend weeks, months, and even years into the future. This extended visibility allows CFOs and finance teams to plan for a variety of scenarios and make more informed decisions about how to allocate resources.

Another important feature of modern SaaS solutions is their ability to aggregate and process huge amount of data sets, including cash flow projections, accounts payable and receivable, and historical performance, and provide data-driven insights into the company's financial health to help identify areas where liquidity may be at risk.

This allows CFOs and finance teams to take proactive measures to address these risks, such as securing additional financing or optimizing cash management practices.

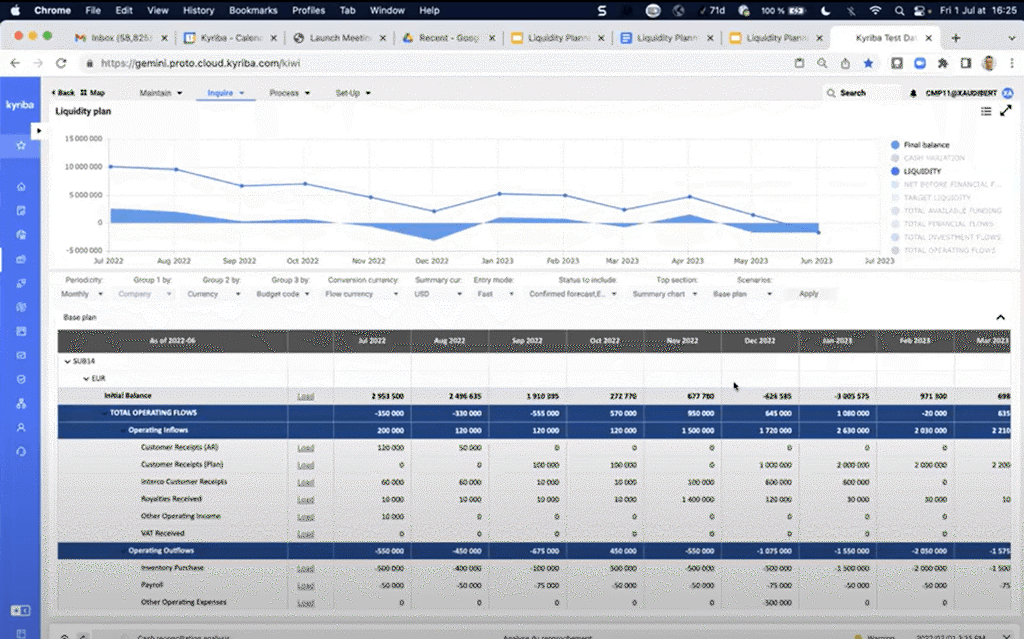

Finally, modern SaaS solutions usually offer dashboards with real-time liquidity analytics to provide comprehensive view of the company's liquidity position, taking into account both current and projected cash flows, as well as existing debt and other financial obligations. By analyzing this data, CFOs and finance teams can identify areas where liquidity may be at risk and take proactive measures to address these risks.

A more detailed list of key features of a liquidity planning solution includes:

- Flexibility and Configurability

Model forecasts the way you want with as many iterations as you like, including top down or bottom-up presentations to support different types of forecasting in your organization. - Formula-based Construction

Include or exclude the data you want in each line item and summary total. - Multiple, Parallel Forecasts

Run multiple cash forecast cycles at once, designed with different data and assumptions. - What-if Scenarios

Model forecasts against various liquidity and risk scenarios. - Excel-like Entry

On-demand single click editing and copy/paste directly into the forecast. - Submission and Review Workflow

Collaborate with other users including notifications and comments. - Variance Analysis

Combine with Cash Analytics for detailed and drill-down on forecast variances. - Load Data from anywhere

Unify forecast data from ERP, spreadsheets, data lakes and other sources via API or file interface. - AI-Enhanced Cash Flows

Combine with Cash Management AI or other AI apps to include data-driven forecasts as part of your cash flow planning.

What is Included in Kyriba’s Liquidity Planning Solution

Kyriba’s Liquidity Planning Solution is the result of the focus on continuous innovation and product development across treasury and finance functional areas impacting liquidity management. Kyriba’s solutions help finance organizations of all sizes and industries deliver improved liquidity performance.

The latest innovation is the Liquidity Planning and Analytics product suite, which creates a liquidity management system and solution for better working capital management and cash flow forecasting over longer horizons. Liquidity decisions are more focused and accurate with the right mix of technology and reporting, ultimately reducing the cost of liquidity availability.

Kyriba’s Liquidity Solution helps treasurers find the right balance and optimal mix across varied sources of liquidity to meet obligations while keeping costs at the right level. The new user experience is easy to use, and includes features to make scenario analysis, plan comparisons and collaboration across the finance organization more actionable and insightful.

With this solution Kyriba creates more confidence for the CFO and treasurer with expanded forecasting information, as well as with investment and borrowing data to make more informed liquidity decisions, making the cash forecast actionable, demonstrating the impact of investing, and borrowing decisions with real-time data and analytical insights.

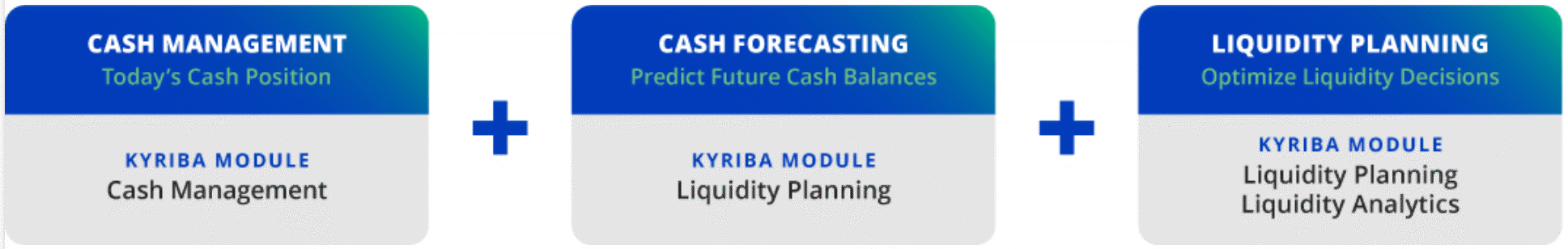

Kyriba’s Cash Management, Liquidity Planning and Liquidity Analytics modules give treasury teams and finance leaders in treasury, FP&A, finance, procurement and accounting the tools and interactive reporting they need to proactively manage cash and liquidity lifecycles end-to-end.