Executive Insights: Managing FX Risk Under Daily vs. Single Rate

The approach an accounting organization implements for booking non-functional foreign currency (FX) transactions has a major impact on the processes and tools that finance teams require to effectively manage FX risk. CFOs and senior finance managers need to understand the key attributes of their rate methodology environment to ensure their teams have the necessary resources in place to be successful and deliver the best results for the company.

To run a successful FX risk management program, regardless of rate methodology, a company requires: the ability to collect accurate data, strong policies and procedures and competent personnel. This Executive Insights ebook covers the key differentiators between Daily and Single rate companies in terms of 1) the challenges each rate methodology presents to all stakeholders involved in managing FX balance sheet risk, and 2) the resources those stakeholders need to effectively mitigate that risk.

Rate Methodology Overview

The two rate methodologies predominantly used by global corporations are:

- Daily Rate. ERPs/financial systems have a daily market rate loaded which is used for booking FX transactions on that value date

- Single Rate. Typically using the prior month-end balance sheet rate for booking FX transactions throughout the entire month

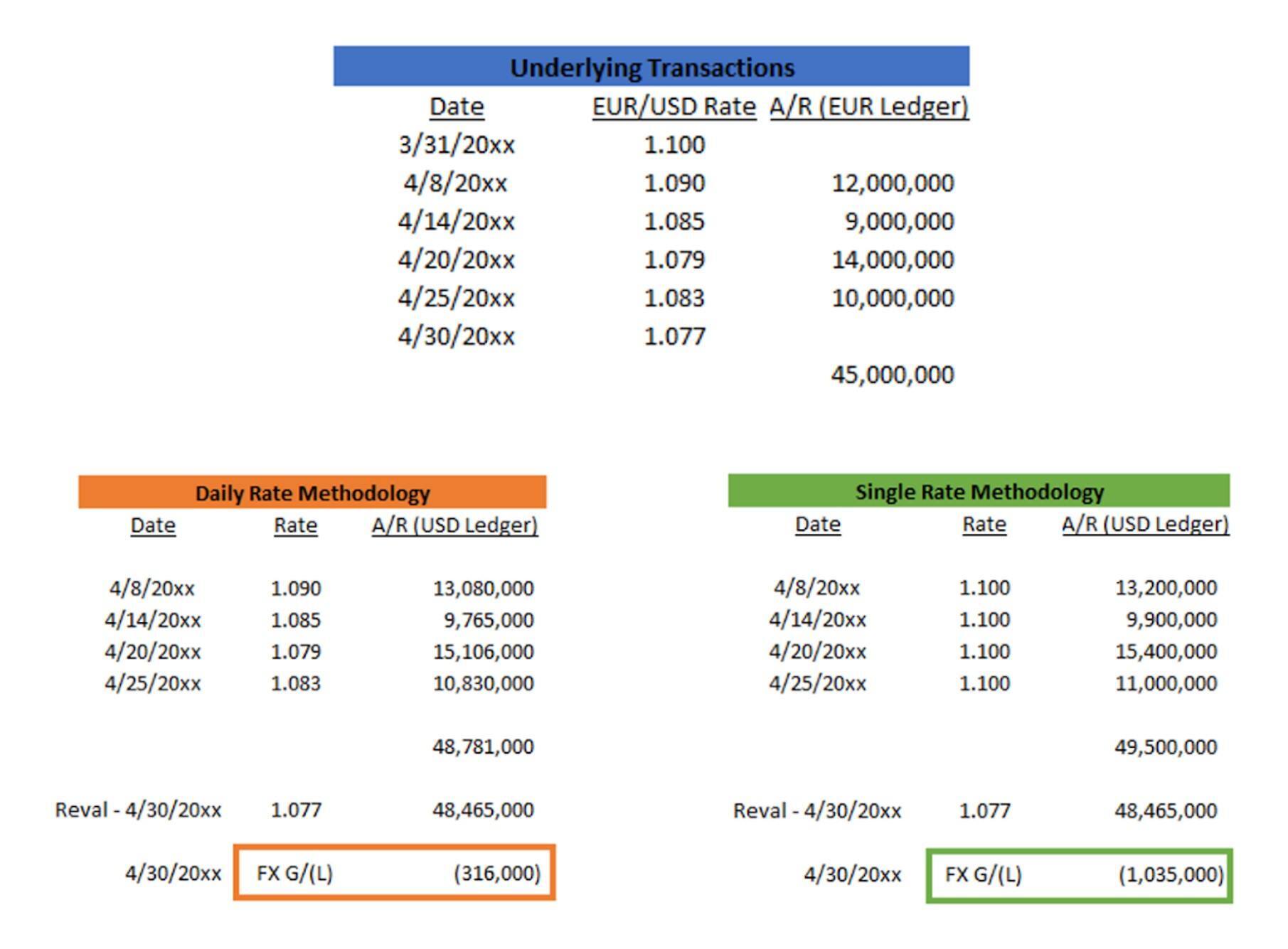

In this example, we have an identical set of EUR denominated Accounts Receivable transactions being booked in a USD functional entity, showcasing how these FX transactions would be booked and revalued into functional currency at month end if the transactions were still outstanding:

Table 1: Daily Rate vs. Single Rate Example

In the Daily Rate Methodology books, the EUR transactions were initially valued in USD terms at the current/market (or daily system rate) on each transaction date. Then the underlying EUR values were remeasured/revalued at the current month end rate of 1.077.

In the Single Rate Methodology books, the EUR transactions were initially valued in USD terms at the prior month end rate of 1.100. Then the underlying EUR values were remeasured/revalued at the current month end rate of 1.077.

As shown above, the difference in methodologies is all in the rates used to book the initial transaction. The process of remeasurement/revaluation at month end works the same. The single rate methodology happened to have larger FX losses than the daily rate. Every month will be different depending on the direction of the exposure and FX markets. The purpose of the example is to demonstrate the differences and how each method works, not to suggest one method is better, or yields better results, than the other.

The Kyriba FX team believes that there is no universally superior rate methodology. Both the Single and Daily approaches have trade-offs, and certain industries or business models may find one approach a better fit than the other. Additionally, changing a company’s current methodology can be difficult. Therefore, the focus of this eBook is to provide insights on how to navigate whichever rate methodology you are faced with at your organization.

Daily Rate Methodology

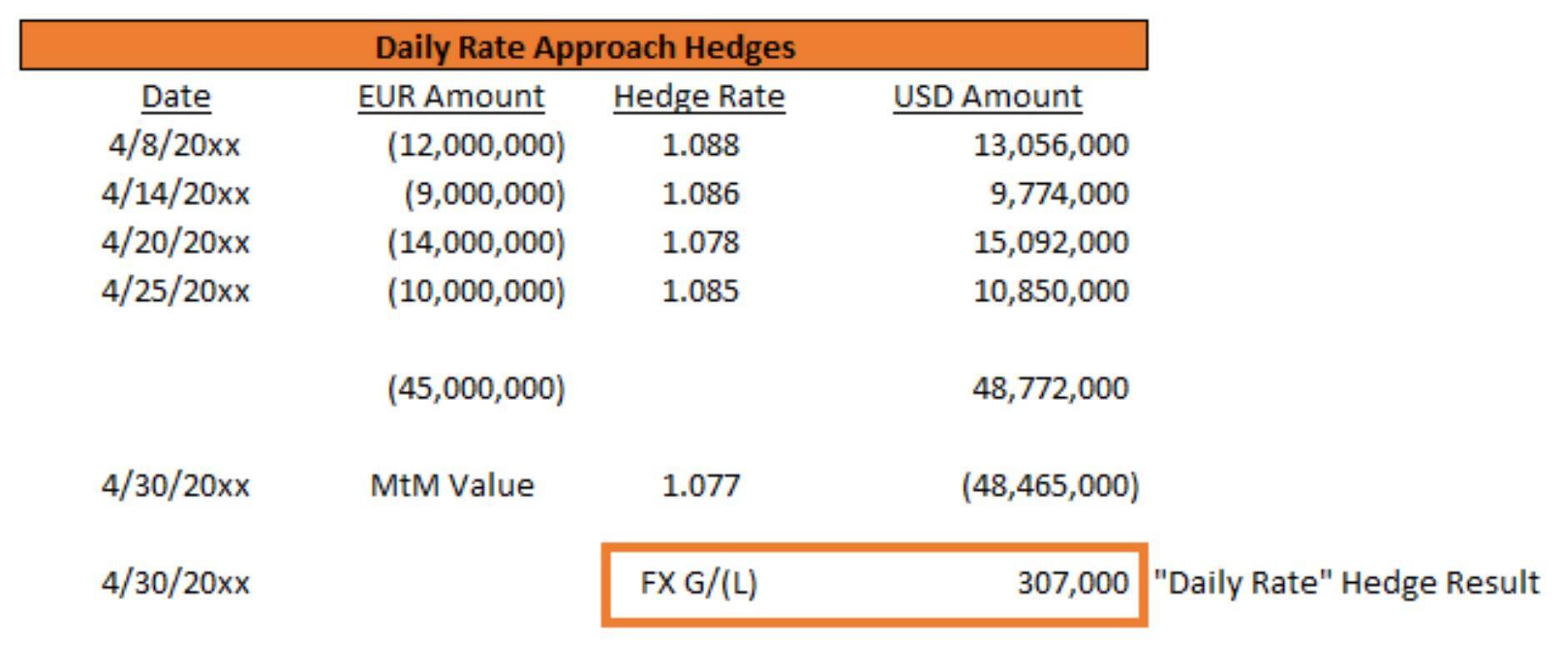

In Table 1’s Daily Rate example, the A/R transactions are booked at a different system rate on each booking date. This establishes the starting value of the transaction in functional currency. A perfect balance sheet hedge program would need to hedge each A/R transaction on the booking date to capture an offsetting position as close to the system’s daily rate as possible. At April month end, the A/R transactions would revalue in the ERP, and the hedges would either have an offsetting valuation (if still open) or realized settlement (if closed out), effectively mitigating the revaluation risk on the P&L. Table 2 shows a simulation of hedges with hedge results.

Table 2: Daily Rate Hedges

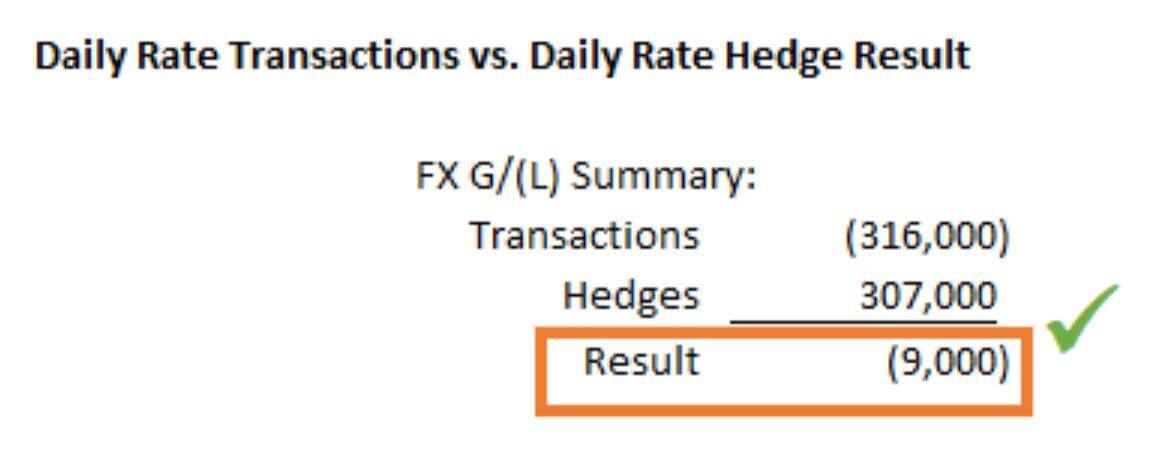

The hedge result was simulated by doing a basic mark-to-market valuation on each trade; which captures the difference between the hedge rate and the month end rate of 1.077. Comparing the results of both the A/R transactions and hedges, we have:

Table 3: Daily Rate Results

In theory, this looks simple. In reality, with potentially thousands of transactions, multiple currencies transacted in each entity and numerous entities; how is a company going to practically monitor this activity and execute the required offsetting hedges?

Daily Rate Challenges and Resources Required

| Challenges | Resources REquired | |

| Exposure Collection | Without the proper tools, companies often have exposure collection routines that require manual intervention due to 1) ERP reporting not being comprehensive or accurate, and/or 2) collecting data from multiple ERPs or sources. When in a daily rate environment, balance sheet exposures should be captured every day. Manual processes will take up valuable time and risk the common pitfalls associated with any manual process. Additionally, if entities are adding new monetary GL accounts, this can be hard to catch timely with home-built exposure collection routines. |

|

| Exposure Analysis | Similarly, without proper tools, companies would require manual intervention to take the collected exposures, aggregate the data, incorporate outstanding hedge positions and run various analysis views on aggregated data. Another heavy lift for something that warrants a daily frequency. |

|

| Data Integrity | Completing a high-level monthly FX Gain/Loss analysis check is difficult, if not impossible in a daily rate environment. A more detailed approach which, even if not reviewed daily, requires the visibility to look back at daily GL Account changes with rate details is necessary to identify potential issues with the underlying transactional FX accounting. To effectively manage risk, it’s critical to perform ongoing reviews to ensure clean transactional accounting. Resources from accounting are ultimately required if balances need to be cleaned up. |

|

| Hedge Decisions & Execution | For effective risk management with daily rates, a company needs to monitor and adjust hedge positions as frequently as possible. Whether a company can adjust hedge positions daily or settle for a weekly routine, the bottom line is that they should be adjusting more frequently than a single rate company. This means more time spent running a full end-to-end FX routine including trade execution, confirmations and capturing final trade details (including internal back-to-back trading if applicable). |

|

| Hedge Performance | Most variances between exposure revaluation results and hedge results will be driven by forward point and trading costs, timing slippage between ERP rates and hedge rates and any data integrity issues (causing incorrect hedge decisions, or mismatches from FX accounting results that don’t add up). |

|

Single Rate Methodology

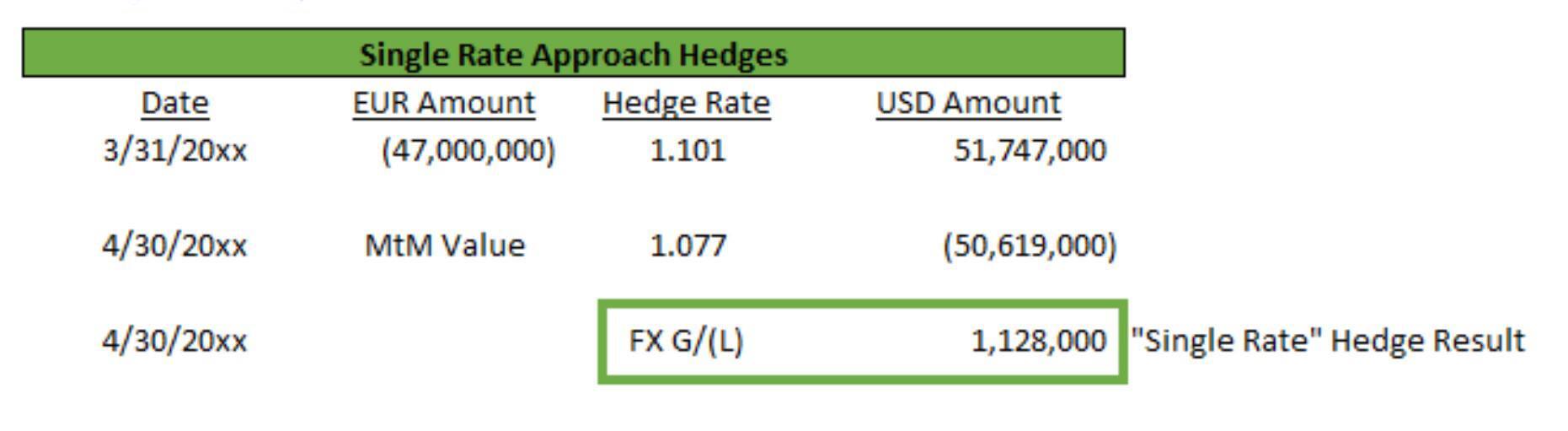

In Table 1’s Single Rate example, all A/R transactions are booked at the March month end system rate, regardless of the specific April booking date. A perfect balance sheet hedge program would need to hedge each A/R transaction by anticipating April’s activity at the end of March and placing a hedge to capture an offsetting position as close to the March month end rate as possible. At April month end, the A/R transactions would revalue in the ERP, and the hedges would either have an offsetting valuation (if still open) or realized settlement (if closed out), effectively mitigating the revaluation risk on the P&L. Table 4 shows an example simulation of hedges with hedge results. Note: In the example the hedge amount does not line up perfectly with A/R, simulating that there is generally exposure forecast variance associated with single rate hedging.

Table 4: Single Rate Hedges

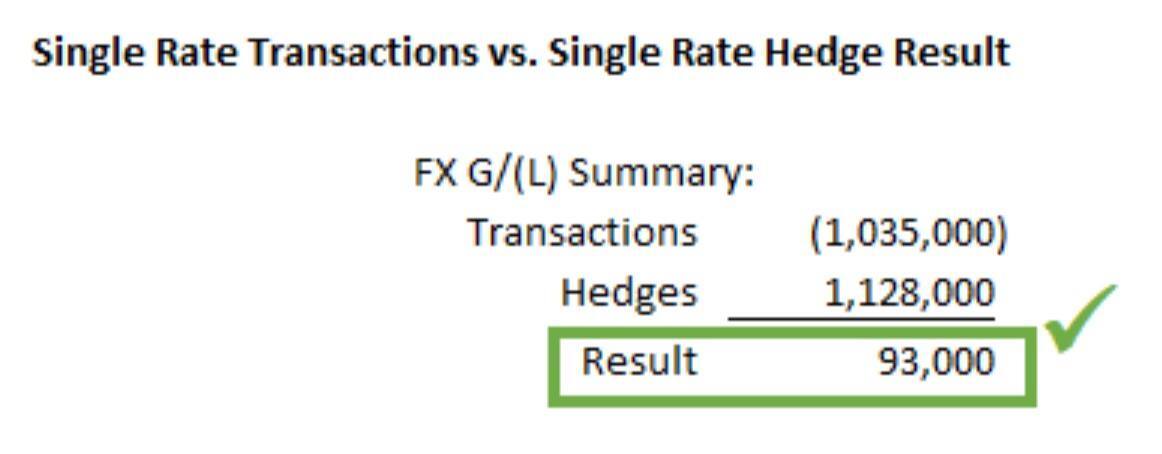

The hedge result was simulated by doing a basic mark-to-market valuation on each trade; which captures the difference between the hedge rate and the month end rate of 1.077. Comparing the results of both the A/R transactions and hedges, we have:

Table 5: Single Rate Results

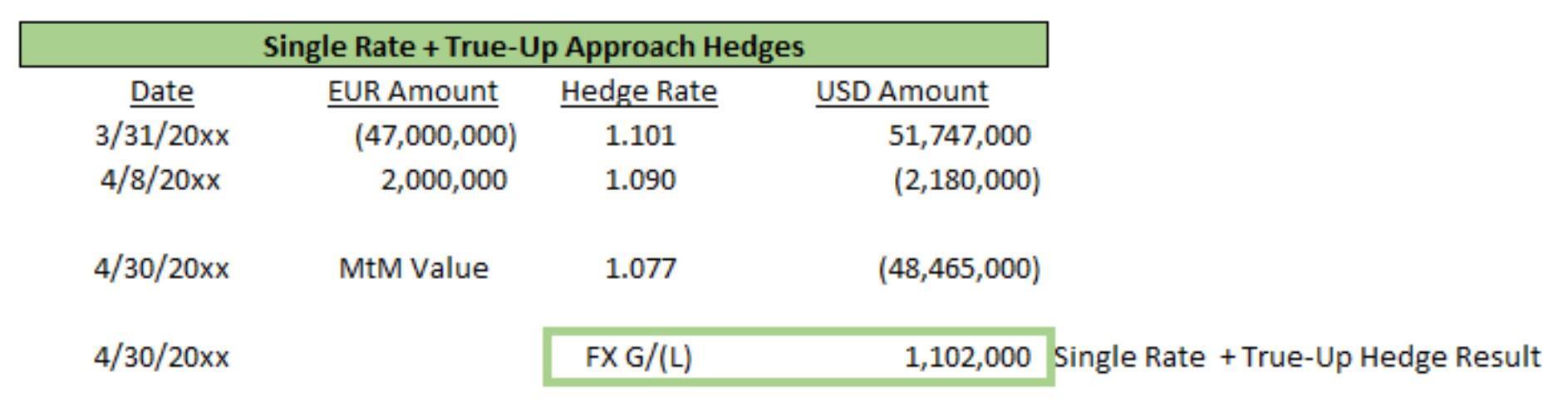

A common process implemented for single rate hedge programs is to adjust (true-up) hedge positions after the prior month's books close. At this time the company has more up-to-date data and should have better insight into April’s expected ending exposure position. Closing this gap can reduce the ineffectiveness that results from initial exposure forecasting variances. Table 6 shows an example of the initial single rate hedge with a later adjusting hedge to align with April’s actual ending exposure position.

Table 6: Single Rate Hedges + True-Up Hedge

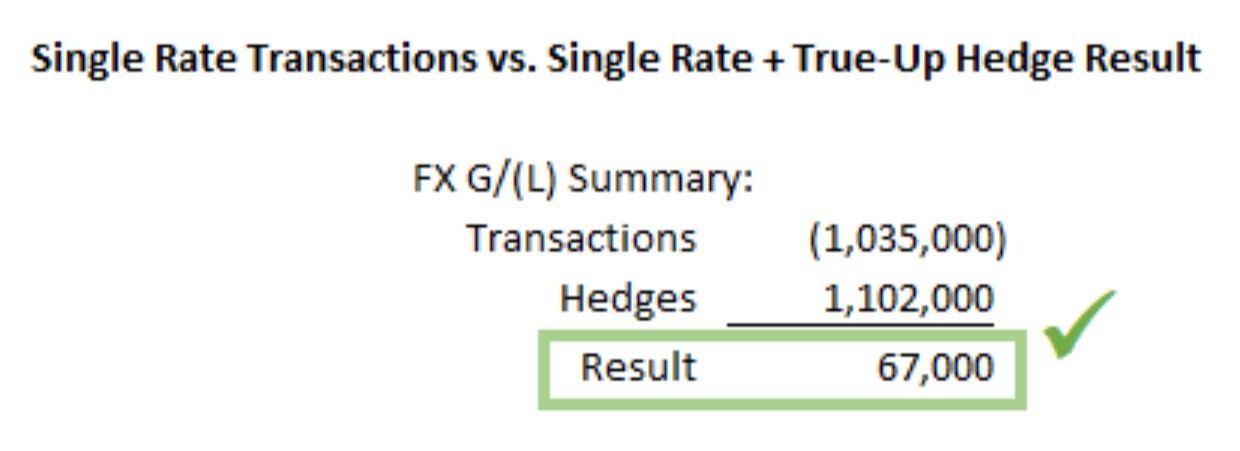

Comparing the results of both the A/R transactions and hedges, we have:

Table 7: Single Rate + True-Up Results

In this example, the hedge results without an adjustment were $92,000; while with the adjustment hedge were $67,000. The adjustment helps deliver on the hedge objective to reduce the FX Gain/Loss volatility on the P&L.

Looking at the hedging activity alone leaves the impression that hedging with a single rate methodology is simpler. However, the necessity to incorporate exposure forecasts to achieve effective results adds complexities in other areas.

Single Rate Challenges and Resources Required

| Challenges | Resources Required | |

| Exposure Collection | Same as with Daily rates, companies often have exposure collection routines that require manual intervention due to 1) ERP reporting not being comprehensive or accurate, and/or 2) collecting data from multiple ERPs or sources. Single rate companies also face the same concern of being able to catch accounting changes such as new GL accounts.

The major additional challenge is implementing an exposure forecast process. Not only do forecasts need to be as accurate as possible, but the company also needs to administratively manage the process of creating or collecting forecast adjustments and consolidating with the core exposure data. |

|

| Exposure Analysis | Similarly, without proper tools, companies would require manual intervention to take the collected exposures, aggregate the data, incorporate outstanding hedge positions and run various analysis views on aggregated data.

Forecast vs. Actual variance analysis is critical to track the quality of forecast data and evaluate adjusting inputs or taking other forecasting approaches. |

|

| Data Integrity | Completing a high-level monthly FX Gain/Loss analysis check is generally straightforward. However, these types of analysis often only pinpoint issues to an entity level. Additionally, single rate companies run into plenty of FX transactional issues in subledgers, and items such as foreign accruals, which require attention.

Chasing down potential FX accounting issues has dependencies with the accounting organization, and it is challenging to get them to prioritize FX questions. |

|

| Hedge Decisions & Execution | Hedge adjustments are typically made less frequently than daily rate hedging companies. However, effective hedge programs still require the true-up adjustment concept, adjusting to material un-forecasted mid-month exposure changes, and adjustments caused by spot conversions. Therefore, having efficient end-to-end processes that support making mid-month changes is critical. Each adjustment requires re-evaluating exposure positions, determining hedge decisions, trade execution, confirmations and capturing final trade details (including internal back-to-back trading if applicable). |

|

| Hedge Performance | The same key daily rate hedge performance ineffectiveness drivers apply to monthly rate companies (forward point and trading costs, timing slippage between ERP rates and hedge rates and any data integrity issues).

However, a new major driver emerges: forecast to actual variance. Forecast variance can disrupt hedge performance results and needs to be monitored closely. Forecast contributors outside of treasury need to be educated/trained, and need to be held accountable for their role in the risk management process. |

|

Note on a Mixed Rate Methodology Environment

Many companies will have a standard rate methodology that they aim for globally, but will have some legal entities that have a different rate methodology. We often refer to these entities as “outliers” to the standard rate methodology.

Outliers can be a result of acquisitions, where the acquired company had a different methodology and it is difficult to change within the acquired ERP system. This also commonly happens with Single Rate methodology companies who have subsidiaries in countries that have local laws/regulations that mandate a Daily Rate methodology for their statutory books. Example: Global company standard is a Single Rate methodology, Brazil’s statutory requirements mandate that companies use a daily rate published by Brazil’s Central Bank for completing local books. Some companies who have the functionality available in their ERP can keep US GAAP books for that entity using a Single Rate methodology, while keeping local books with a Daily Rate methodology.

Companies should take inventory of all outliers to their standard rate methodology. If the risk of a Daily Rate outlier entity is being managed with the same global standard processes implemented to address risk at Single Rate entities, the results will not be effective. Using the insights provided in this eBook, companies can carve out separate risk management processes for the different circumstances faced at these outlier entities. This situation may require additional resources or tools to manage risk effectively.

Conclusion

When comparing the included Daily and Single rate examples (spend a minute to compare the different rate methodology transaction results with the different rate methodology hedge results in above tables), you can observe that if a company was on daily rates and managing risk with a single rate mindset, the results would be atrocious; and likewise if a company was on single rates managing risk with a daily rate mindset. Some challenges and requirements are common across both hedging approaches, but there are several major differences. Therefore, it’s critical for senior leadership to understand these differences and support their finance organization with the appropriate tools and resources for the applicable task at hand. P&L and EPS volatility in Other Income and Expense (FX Gain/Loss) depends on it.

Join our latest

demo session

to learn about

FX automation

Related Resources