eBook

The Biggest FX Problem (That No One Talks About)

In this ebook, we reveal the most common types of accounting errors, breakdowns in accounting controls, system configuration issues, and process deficiencies leading to unnecessary FX risks.

Table of Contents

- Hidden Accounting Impacts

- Background and Purpose

- The FX Exposure Management Process Owner: Starting Where the Buck Stops

- The Data Dilemma: Getting to the Source of FX Related Accounting Volatility

- Recording the Transaction

- Intercompany Mismatches

- ERP and Systems Configuration

- Oracle

- SAP

- System Configuration & Maintenance Issues: Revaluation Under ASC 830 / IAS 21 Framwork

- SCENARIO #1

- SCENARIO #2

- Initial Revaluation and Process Design

- Maintenance of Revaluation Process

- The Assessment of FX Risks

- Assessing Your Organization’s Foreign Currency Exposure Management Situation

- Foreign Currency Exposure Management: An Enterprise Issue

- Currency surprises impact in obvious (and not-so-obvious ways).

- Recommended Next Steps

- About Kyriba FX Risk Management

Hidden Accounting Impacts

We hear time and time again that CFOs and Treasurers alike “don’t know what they don’t know” about their foreign currency exposure data.

All too often, the first symptom of a problem shows up as a material misstatement of FX gain/loss. Usually, this is a result of what Kyriba has coined as “accounting volatility.”

We use this term to describe the phenomenon of systematic, recurring inaccuracies that exist in most multi-currency ERP systems, that obscure the true magnitude of a company’s foreign currency exposure in ways that make the problem difficult to detect.

In many cases, accounting volatility is reflected in the delta between hedging actions and actual FX gain/loss resulting from the underlying exposure.

Background and Purpose

In this ebook, Kyriba will highlight critical issues facing treasury and accounting teams and cover shortcomings in the way companies today account for multi-currency transactions and manage the resulting foreign currency exposures.

Time and again, our analysis of foreign currency exposure management processes within organizations uncovers a ticking time bomb that could (and eventually does) have material impact on a company’s financial performance and its ability to accurately reflect FX gain/loss within financial statements. Frequently, this time bomb is an undetected exposure hidden within the ERP that is masked by a variety of data integrity issues. Without adequate visibility into the source data, Treasury can only cope with/or try to manage around the problem. As a result, their decisions (even when based on sound strategies) are ineffective and even potentially counterproductive.

All too often, this time bomb is detected once it’s too late. The problem ultimately surfaces in the FX gain/loss line of the income statement and the CFO is faced with foreign currency exposures that have serious economic and compliance consequences.

In every case we have witnessed, the question isn’t if companies are misstating FX gains/losses, but whether how large the material impact is.

Getting to the heart of the matter and preventing a disaster begins with a close examination of the ERP system(s), controls and related processes that undermine the accuracy and completeness of foreign currency exposure data. The first section of this ebook will deal specifically with the issue of accounting volatility — a result of pervasive, self-reinforcing inaccuracies that exist in most ERP systems with regards to foreign currency — that obscures the true magnitude of a company’s exposure in ways that make the problem difficult to detect.

An examination of the processes that contribute to foreign currency exposure identification often reveals uncoordinated activities and the lack of a true process owner who has the oversight to adequately manage and drive actions throughout the entire process. In the second part of this ebook, we’ll discuss why foreign currency exposure management goes beyond Treasury and is ultimately an enterprise-wide issue.

Companies that approach foreign currency exposure management from an enterprise perspective (assigning the proper ownership, authority and resources to the process) can focus their attention and energies on strategic, value-based decision making that will protect and strengthen the value of the organization. The third part of this ebook will discuss how companies can begin to transform their foreign currency management practices into enterprise-level, standard processes.

The FX Exposure Management Process Owner: Starting Where the Buck Stops

In almost every conversation we conduct with CFOs, Treasurers, and Accounting, a common theme emerges: an overall lack of crossfunctional coordination and collaboration within organizations with regard to activities that impact FX exposure quantification and measurement.

While Treasury may be regarded as the process owner, in reality they maintain control of, and have authority over, only one piece of the puzzle. Different functional groups within an organization contribute to foreign currency exposures and their management process. The FX gain/loss line on the corporate income statement is the ultimate product for these efforts. Responsibility and accountability for that number resides with the CFO. As such, it is the CFO who assumes responsibility and accountability for the process and must ensure coordination among the contributing functional groups to ensure that this result is both accurate and acceptable within company policies. The only way to ensure the kind of cross-functional coordination required to properly manage the foreign currency exposure management process is to elevate awareness and priority of the issues throughout the enterprise.

Acknowledging foreign currency exposure as an enterprise risk means assigning the proper level of oversight, accountability, and resources to the entire management process. At a strategic level, the FX business process owner must have the strategic responsibility for addressing and maintaining currency risk management decisions, processes, and policies. The FX business process owner must be able to coordinate tactical activities across multiple disciplines, and communicate effectively with Finance, Accounting, Tax, and Operations representatives from around the globe. Ultimately, they’re the stakeholder with visibility into the foreign currency exposures and management process, from data to exposure, across the enterprise.

The Data Dilemma: Getting to the Source of FX Related Accounting Volatility

The Challenge of Defining Exposures

In most organizations, the Treasury department is accountable for managing foreign currency exposure and the related FX gain/loss.

While Treasury often maintains control over the process to select hedging instruments and dictate internal risk management tactics, their ability to mitigate the effects of FX volatility depends on accurate and complete exposure data. If the data is inaccurate or incomplete, companies may execute risk mitigating actions within policy but still sustain significant FX gain/loss volatility.

The real problem with foreign currency exposure data integrity issues is that they are extremely difficult to detect until a major problem has surfaced.

In our experience, we frequently find off-setting errors and omissions that distort foreign currency data, falsely masking the true exposure in ways that make it difficult to isolate an anomaly and determine the source of an error. We’ve come to refer to this phenomenon as accounting volatility – a pervasive, self-reinforcing sequence of data integrity issues that become increasingly complex and intractable over time.

Treasury is a customer of the accounting organization when it comes to foreign currency exposure data. Assuming that a multi-currency accounting system is in place for the enterprise, valid foreign currency exposure data is dependent upon two key premises:

- Multi-currency transactions have been properly recorded in the transaction currency.

- Accounts that are required to be revalued in accordance with ASC 830 / IAS 21 are being revalued on a periodic basis.

Accounting volatility can result if multi-currency accounting entries have not been recorded appropriately, or if the revaluation process is not properly identifying accounts that should be revalued. The result in either case is a misstatement of the foreign currency gain/loss in the income statement for the organization.

Either foreign currency gain/loss remains embedded within the monetary asset and liability accounts in the balance sheet, or it has been improperly recognized prematurely in the income statement.

In the following section of this ebook, we will discuss these issues and provide questions that CFOs and Treasurers can ask to determine the future likelihood, and historical magnitude, of accounting volatility within their organization.

Recording the Transaction

One difficult-to-detect issue that has serious impact on foreign currency exposure management is the entry of the foreign currency transaction in the functional currency instead of the transaction currency. As a result, the exposure is not detectable and cannot be managed by Treasury. In addition, the foreign currency gain/loss associated with this transaction exposure is not realized incrementally with the process of account revaluation. Rather, it is realized all at once, when the transaction is cleared or settled.

Another prevalent issue is the clearing and reconciliation of multi-currency account balances in functional currency instead of transaction currency. This results in invalid transaction currency balances and mismatched relationships between the transaction currency and functional currency within the ERP system. Because revaluation processes are based upon transaction currency balances, invalid balances can lead to unrealized FX gain/loss calculations and inaccurate, posted results during period-end processing. These accounting issues are evidence of a process breakdown usually attributed to employee training in the area of transaction entry. Detecting these issues requires a disciplined analytic review of the monthly foreign currency FX gain/loss for entities within the enterprise, given the foreign currency exposure relationships within each entity and changes in foreign currency rates.

Intercompany Mismatches

Intercompany mismatches have a significant impact on the nature, level, and complexity of a company’s foreign currency exposure. Generally, intercompany transactions are recorded in one of the functional currencies of the entities that comprise the intercompany relationship.

As a rule, the intercompany account balances recorded within two entities of an intercompany relationship should net to zero on a currency-bycurrency basis.

Despite this, one common source of accounting volatility is mismatched intercompany balances in which one entity has recorded an intercompany payable or receivable, while the other has either neglected to record the corresponding transaction or has recorded it inaccurately. This too is a symptom of a multi-faceted process breakdown – one in the recording of the transaction and another associated with the reconciliation process.

Intercompany transactions that take place in a currency other than the functional currency of either entity creates additional exposure for the enterprise and further complicates the FX exposure management process. As described in the table at the bottom, when a third currency enters this relationship, each entity has an exposure to the transaction. There are two ways to resolve this issue and eliminate the exposure.

One way is to execute two currency conversions: one entity purchases the currency, and the other entity sells the currency. Alternatively, a process must be developed to convert the third currency balance into one of the entity’s functional currencies based upon a pre-determined rate convention, followed by a single currency conversion to settle the balance.

In many cases, creating an intercompany transaction in a third currency is not an acceptable business practice. Unfortunately, due to the complexity around intercompany balances, lack of visibility in transaction currency across multiple systems, multi-department responsibilities, and inadequate reporting infrastructure, it’s often unknown that this is an unacceptable business practice.

ERP and Systems Configuration

ERP Configuration of FX Postings

Specific FX-related configuration, administration and maintenance issues in most major ERP systems add to the complexity and potential for problems with multi-currency accounting.

Oracle

- Oracle does not define a functional currency at the company level. It is defined for a set of books.

- The ability to support multiple functional currencies for a company is often overlooked or misconfigured.

- Revaluation rules apply only in the context of a company in a set of books. If a company transacts in multiple sets of books, multiple rules may be required for the same accounts and/or currencies — this is often overlooked or misunderstood.

- Revaluation processing looks at functional currency of the set of books, not the company. A non-functional transaction in a set of books with the same currency will be ignored for revaluation.

SAP

- SAP does not define a functional currency but rather a local currency. Often times, the revaluation processes is run multiple times whenever the functional currency is different from the local currency, effectively reapplying FX adjustments.

- Revaluation criteria are usually managed through the use of variants (i.e. predefined parameter definitions) that are static, requiring constant manual updates to reflect current accounts and entity relationships; these updates are often overlooked.

- Institutions where the Controller organization is decentralized, account setup and changes in entity relationships contribute to uncoordinated revaluation criteria and the potential to either:a. Revalue some accounts

b. Revalue accounts multiple times

c. Revalue accounts that should not be revalued

System Configuration & Maintenance Issues: Revaluation Under ASC 830 / IAS 21 Framwork

As detailed previously, accounting and process issues related to transaction data quality may not be the only source of accounting volatility. In many cases, problems related to monetary asset and liability account revaluation in accordance with ASC 830 / IAS 21 guidelines contribute to unreliable FX gain/loss statements.

In working with clients to set up end-to-end processes for identifying foreign currency exposure, we routinely uncover and help to resolve issues related to revaluation validity that hamper customers’ ability to properly reflect the impact of currency revaluation on their financial statements. We commonly encounter inaccurate results from improper revaluation of accounts across the enterprise, typically finding a combination of accounts that are being revalued properly, as well as accounts that are being revalued, but shouldn’t be. In most cases, companies are unaware of the problem.

In either scenario, the underlying root causes of these inconsistencies can be grounded in the following factors:

1. Maintenance of the systems and processes comprising revaluation processes become inaccurate over time.

SCENARIO #1

An account that should be revalued is not being revalued

1. Treasury has no visibility into this account for their exposure management process

- Thus, they cannot mitigate risk with regards to the underlying currency exposure

2. There is no unrealized FX gain/loss being recorded on a monthly basis

- The total FX gain/loss that exists within the account is sitting in the balance sheet, waiting to be realized all at once when transaction(s) making up the account balances are cleared and/or adjusted

**You may encounter compliance issues as a result of this scenario

2. Initial setup of the revaluation environment within a multi-national company is complicated.

SCENARIO #2

Accounts that should not be remeasured are identified for remeasurement

1. Treasury takes risks mitigating actions for these inaccurate balances (in the accounts) as part of the exposure management process

- An associated FX gain/loss in addition to currency conversions, hedge valuations/settlements, and the inherent cost (bank fees, forward points, and/or option premiums) associated with currency hedge transactions are recorded for the account

2. The effects of the risk mitigating currency actions have been realized with no off-setting amount that would have resulted from an underlying exposure

- The company will eventually discover that the account should not have been revalued and records the adjustment to reverse the recorded unrealized FX gain/loss

Initial Revaluation and Process Design

Setup of the revaluation environment within a multi-national organization is complicated. Initial setup requires:

- An understanding of the requirement to revalue monetary asset and liability accounts as prescribed by ASC 830 / IAS 21.

- Configuring a combination of systematic and manual processes across the accounting enterprise to accomplish the requirement.

The initial configuration can be very complex, as is evident in the many different variables which must be assessed when configuration is done:

- Multi-system accounting environment

- Revaluation processes provided within each of the accounting systems that comprise the enterprise accounting framework. Each system can approach revaluation differently

- Revaluation dependencies on specific account setup parameters

- Manual processes to address accounting system deficiencies or desired business practices

- Centralized vs. de-centralized processes

- Period-end close processes

Our analysis and work with companies has shown that finding the one person in the organization that understands every revaluation parameter, setting, and process is nearly impossible.

The fragmentation of responsibility around this area will continue to complicate the overall revaluation framework, leading to a consistent misstatement of the FX gain/loss and an inherent ability of Treasury to successfully manage the foreign currency exposure.

Maintenance of Revaluation Process

Maintenance of the systems and processes comprising revaluation can often become inaccurate. Does your process include any of the following common reasons?

- Rapid merger and acquisition activity with lagging system integration

- Growth in the chart of accounts with no process for determining if accounts should be added to the revaluation list

- Complicated revaluation rule maintenance environment within accounting systems

- No common oversight, responsibility or ownership of the process – fragmentation of responsibility

- No periodic account review process to test effectiveness of systematic and manual revaluation processes

- Consistent turnover within the accounting staff, who has revaluation responsibility as part of the close process

- Lack of ongoing education and training

- Lack of consistent visibility to revaluation results and context to interpret the results

- Inconsistent review of FX gain/loss and not establishing a process for resolution of results outside of tolerance

The Assessment of FX Risks

Diagnosing Accounting Volatility: Symptoms, Questions and the Self-Assessment

So far, we have discussed common foreign currency exposure data integrity issues, the role of the ERP and accounting systems administered by IT and/or Accounting, and accounting and organizational issues that contribute to the problem of accounting volatility.

Next, we’ll consider the symptoms of these problems in the form of key questions that CFOs or Treasurers can pose to indicate the degree of accounting volatility within their organization.

- How confident is Accounting that multi-currency transactions are being recorded properly, including initial entry and clearing of the transactions?

- If multi-currency transactions are not being recorded or cleared properly, they can create unexpected FX gain/loss volatility. As discussed previously, if a Regional Accounting Manager records a multi-currency invoice in the local currency of the entity instead of the transaction currency, the Treasurer will have no visibility to the exposure. When the payment is cleared, the gain/loss on the transaction will unexpectedly impact the income statement.

- When was the last time Accounting reviewed enterprise-wide revaluation to determine if the system(s) configuration and related processes produced a result that compiled with ASC 830 / IAS 21?

- In the vast majority of companies that we have worked with, we have uncovered multiple ERP/accounting system setup/configuration problems and process issues which not only raise compliance concerns, but also create embedded FX gain/loss volatility that is very difficult to detect and manage.

- How confident is Accounting that intercompany transactions are being reconciled on a timely basis and are in balance?

- We commonly witness intercompany transactions that demonstrate the significant balance discrepancies discussed previously. Intercompany issues we often encounter that can cloud foreign currency exposures include:

- Intercompany transactions where only one side of the transaction is recorded in the GL

- Intercompany transactions that do not have matching balances

- Intercompany transactions that are not posted in the same transaction currency

- Intercompany transactions that are recorded in a third currency (functional currency of entity)

- We commonly witness intercompany transactions that demonstrate the significant balance discrepancies discussed previously. Intercompany issues we often encounter that can cloud foreign currency exposures include:

- Does Accounting perform foreign currency gain/loss analysis on a regular, monthly basis and maintain a proactive process for the resolution of exceptions?

- If yes, how often do they encounter unexpected results, and what is the process for investigation and resolution? If not, do they verify that the gain/loss on currency exposures is as expected and within corporate tolerance?

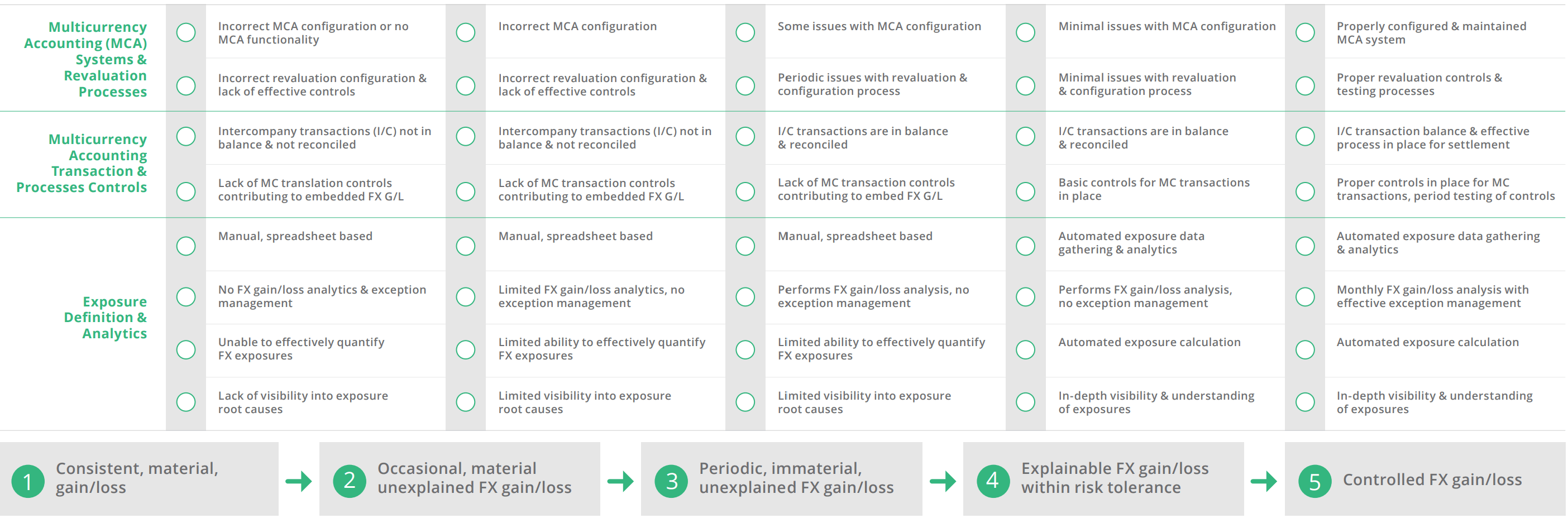

Assessing Your Organization’s Foreign Currency Exposure Management Situation

Upon addressing these key questions, you should be able to assess your company’s ability to quantify and manage foreign currency exposures.

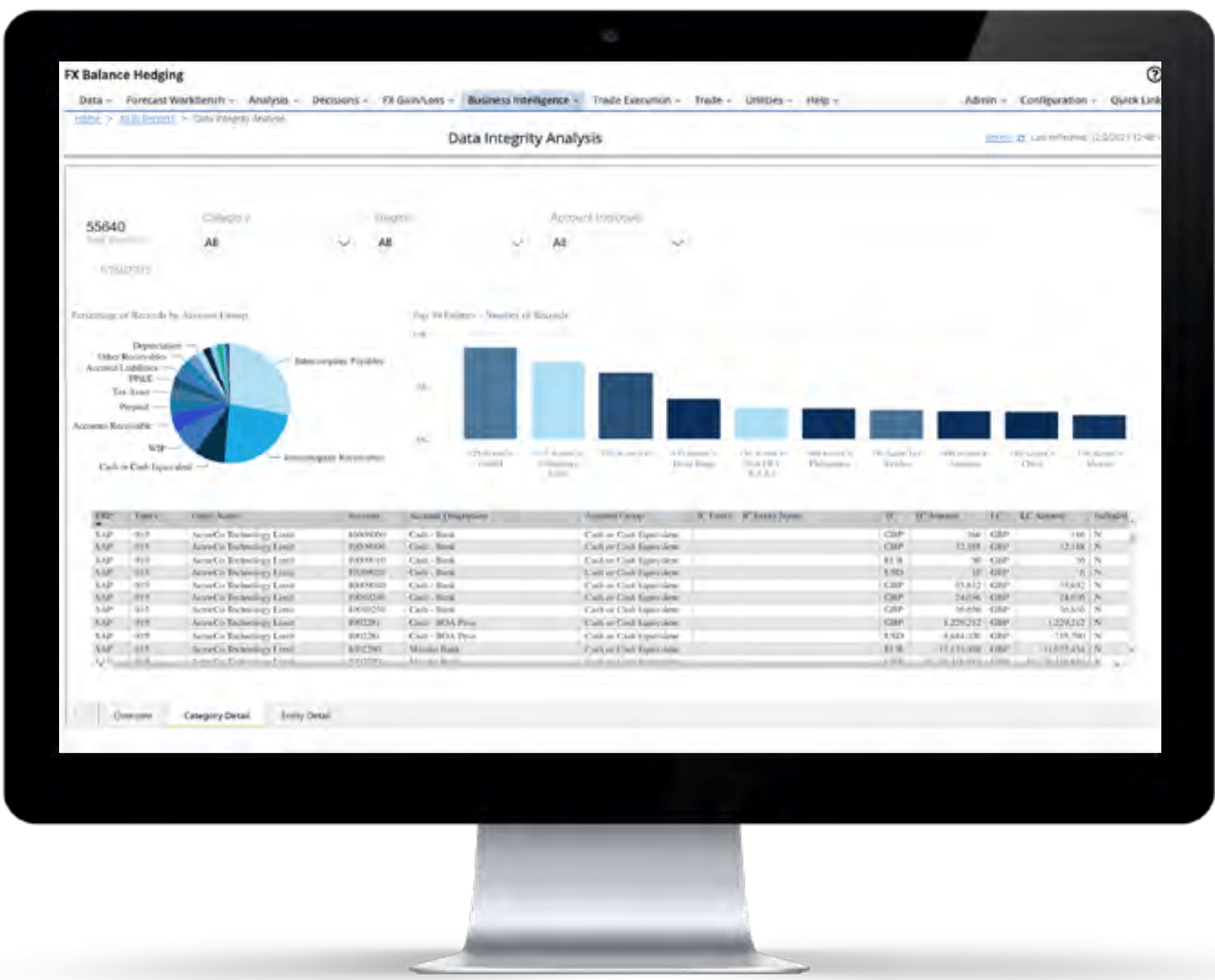

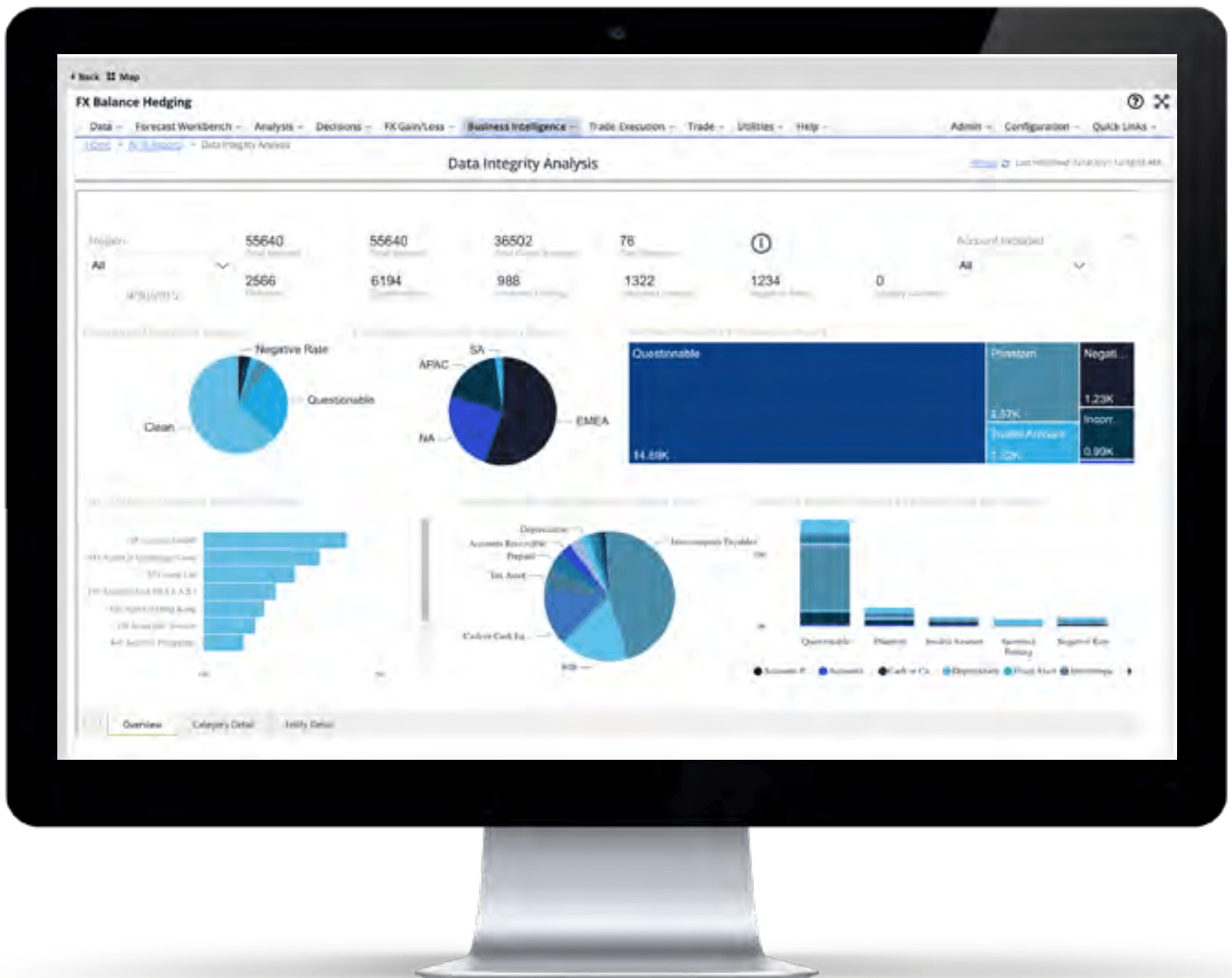

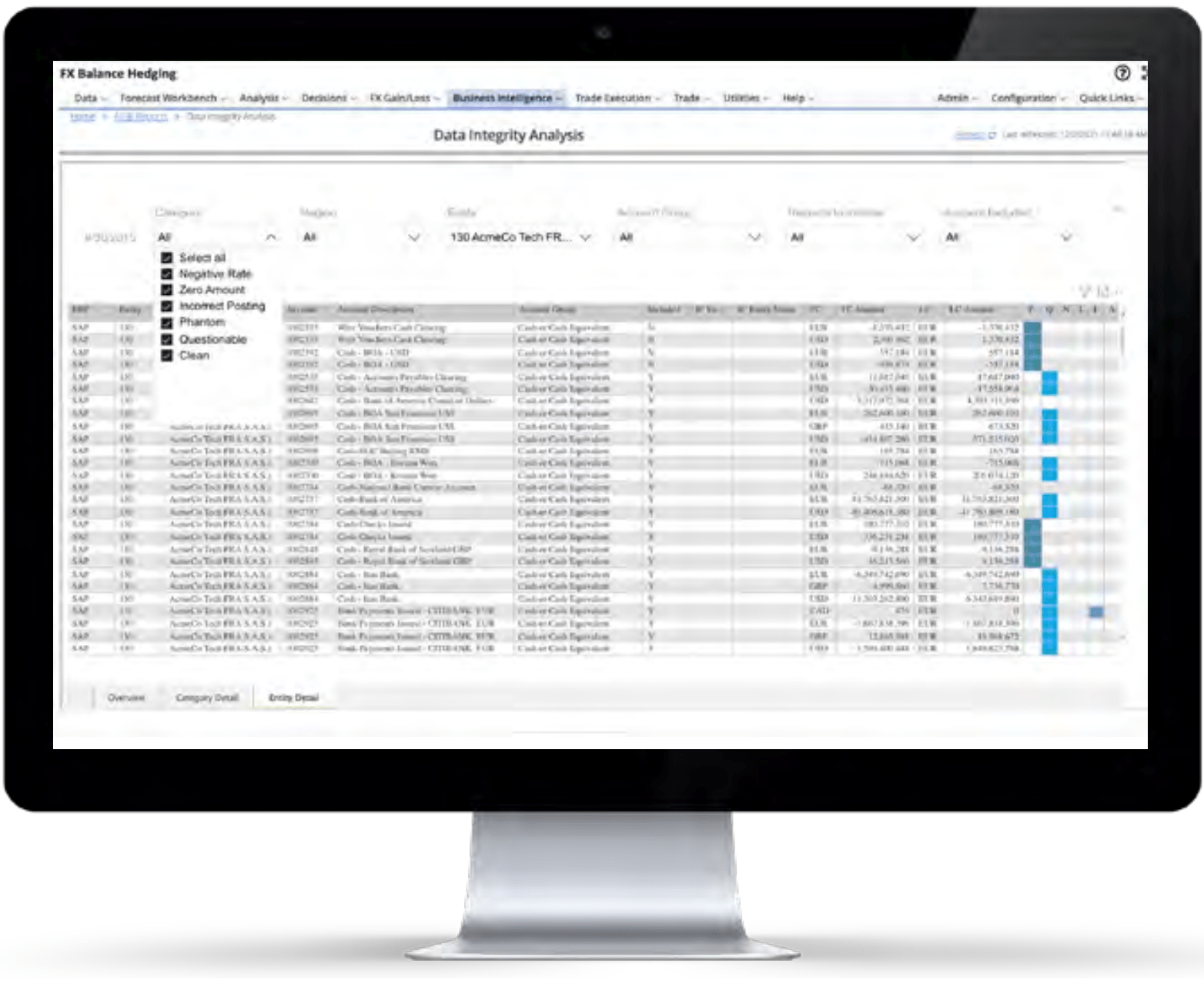

The FX Exposure Management Capability Model represented by the excerpt below, can help you determine your company’s current capabilities and define concrete goals to improve your ability to quantify and manage foreign currency exposure. We’ve developed this assessment with selections to help you identify the most applicable attributes of your FX Exposure identification and management. Once you take the assessment, the category with the most items checked will be an indicator of your company’s ability to manage foreign currency exposure.

Representative extract from the Kyriba FX Exposure Assessment

Foreign Currency Exposure Management: An Enterprise Issue

Additional Resources

Savvy corporates are adopting a roundtable approach to currency risk management.

Currency has become an issue outside the halls of treasury. Modern currency aware organizations understand that currency impacts many areas of the business and that all of those areas are represented at the company’s currency roundtable. Everyone at the currency roundtable has access to accurate, complete, and timely exposure data, as well as the analytics to understand how those exposures impact their functional area — and conversely, how decisions they make affect foreign currency exposures and the company’s overall financial performance.

Currency surprises impact in obvious (and not-so-obvious ways).

When a company’s revenue is regularly eroded by currency surprises it has less cash available for productive activity. That loss has ripple effects, including credit rating downgrades that raise the firm’s cost of capital and debt covenant breaches that limit its access to liquidity. Both reduce available cash and limit the organization’s ability to deliver maximum profit to shareholders.

For more detail on the deeper impacts of currency surprises, check out the latest Currency Impact Report from Kyriba:

Recommended Next Steps

CFOs, Treasurers, and Accounting can turn to Kyriba FX to provide an unparalleled ability to access accurate and complete exposure data, on demand. Our platform is backed by a team of experts who continually support the currency risk management process at some of the largest organizations in the world. Put simply, teams that have identified FX related accounting to exposure management issues can rely on Kyriba to provide a solution to remediate any sources of accounting volatility and inaccuracy.

In many cases, organizations choose to leverage Kyriba’s industry leading software platform to measure, monitor, and manage their currency risk management programs on an ongoing basis.

About Kyriba FX Risk Management

Kyriba FX Advisory Services helps treasury and finance professionals understand and manage currency impact to financial results. Organizations ranging from Amazon to Google use Kyriba FX analytics to monitor and manage the impact of currency on their business. Kyriba FX was developed as the first solution to automate foreign exchange exposure management for multinational companies, delivering unparalleled expertise and driving measurable results.

To this day, Kyriba FX is focused on helping organizations quantify their foreign exchange exposure and cost-effectively insulate their company from the uncertainty of currency volatility. Whether we’re working with a Fortune 50 organization or a growing U.S. company poised to go global, we take the same approach to understanding our customer’s foreign exchange policies, processes, and objectives. Kyriba FX is a cloud based software suite that customers can deploy to cost-effectively manage their own foreign exchange exposure management process.