eBook

Perfecting the Cash Flow Forecast in an Uncertain Market

Cash forecasting is an art that is difficult to perfect. Every organization talks about forecasting more effectively, but few allocate sufficient people, time, and technology to build an effective program. Understanding the importance of an accurate cash forecast that can be relied upon for key financial decisions is critical to making the right investments in forecasting.

While there are many reasons to forecast, such as protecting against currency volatility and the need to mobilize cash globally, there are a few key areas that should be addressed to help CFOs and treasurers further make the connection between accurate cash forecasting and bottom-line financial performance.

In this new reference guide, we will outline why organizations should forecast, and discuss best practice methods for perfecting the cash forecast.

Key Stat

CFOs and boards are prioritizing better forecasting. Fully 84% of respondents to the Strategic Treasurer 2021 Technology Survey indicated that forecasting is very important for treasury.

What is Cash Forecasting?

Cash forecasting is a key component of corporate cash management. When performed accurately, forecasting enables:

- Greater certainty of projected cash balances

- Longer term investing

- Reduced borrowing costs

- More effective hedging programs

- Better mobility of global cash

Key Vocabulary

Cash positioning is concerned with today and often the next five business days. The purpose is to manage daily liquidity to ensure shortfalls are covered and surpluses are concentrated to earn some yield on excess cash.

Cash budgeting is performed by finance teams such as FP&A and is more focused beyond one year – although with increased emphasis on free cash flow guidance, the reconciliation of indirect budget-based forecasts with direct cash flow forecasts is increasingly managed quarterly.

Cash forecasting typically extends cash positioning with horizons anywhere from one week to one year. Forecasting leverages multiple data sources to increase confidence in the projected cash balances so that better cash decisions can be made. The value of forecasting is based upon the value of those better decisions.

Why Forecast?

Cash forecasting drives financial performance.

It is critical for CFOs and treasurers to understand the link between effective cash forecasting and bottom line financial performance. Excuses such as “we’re cash rich” or “interest rates are too low” no longer satisfy hungry investors who demand that cash be deployed or returned to them. Without adequate visibility of forecast cash and where cash needs to be deployed to meet growth targets, CEOs and CFOs risk looking foolish in front of shareholders and analysts.

Fixing Cash Balance Issues

Post Basel III, banks must hold collateral to offset the potential runoff of a corporate’s deposits, meaning that it now costs them more to hold corporate cash. The higher the possibility of withdrawal, the more collateral banks must maintain. Effective cash forecasting allows companies to segregate operational and non-operational cash into time buckets, as well as deliver the needed accuracy to allocate cash to longer duration investment strategies. This will help preserve previously realized investment returns or help to find an alternative for cash balances that are no longer wanted by your bank.

A poorly executed cash forecasting program drives a number of negative consequences, including:

- Earnings per share losses from unexpected and unhedged currency impacts

- Difficulty in maintaining (let alone increasing) return on cash in a post-Basel III environment

- Challenges in securing adequate and / or cost-effective borrowing to fund operations – increasing operating costs

- The frequent need for expensive emergency borrowing (e.g. via bank overdraft) to cover an unexpected cash shortfall – also increasing operating costs

- Inability to efficiently fund strategic projects and programs

- Difficulty in providing accurate earnings and free cash flow guidance, affecting credibility with the investment community

Forecasting FX to Avoid Unnecessary Losses

The volatility in global currencies shows no signs of abating, meaning that the pressure on CFOs to maintain the value of foreign cash inflows and outflows persists.

USD-based Companies

The relative strength of the USD vs. all other foreign currencies challenges CFOs because a strong USD means that foreign revenues will be lower, and unless foreign markets are cash flow negative, earnings will suffer. If projected cash inflows can be accurately predicted, treasury teams can hedge, protecting the value of incoming cash flows.

UK-based Companies

British enterprises have faced significant currency volatility arising from Brexit and other macroeconomic conditions. While currency rates are not easy to predict, CFOs simplify their job and minimize exposure if their teams can more accurately project foreign cash flows. This allows treasurers to hedge exposures and maintain value of incoming and outgoing cash.

EMEA and Markets with Depreciating Currencies

For those CFOs that count USD, GBP or other appreciating currencies as foreign cash flows, then they will have seen a roller coaster of exchange rates, making the task of forecasting certainty near impossible. Stakeholders demand earnings predictability, which can only be achieved by first perfecting the forecast and then hedging the foreign components.

Forecasting is the Key

Cash forecasting is required in order to make effective hedging decisions to protect the value of projected foreign cash balances. Understanding the gross inflows and outflows will help determine net cash flows by currency.

To be effective, it is critical to know the amount and timing of cash flows so that treasury teams can maximize protection of net cash flows.

Health Care Service Corporation (HCSC) improved its forecasting capabilities and was able to reduce working capital holdings by nearly $4 billion. The health insurance company was then able to make more strategic investment decisions earlier in the day, resulting in a 5% increase in investment returns. Short-term returns grew by $40 million, while long-term returns have seen an increase of $140 million.

Effective Liquidity Forecasting for Strategic Enablement

Certainty in projected cash balances drives the CFO’s ability to anticipate and prepare for corporate actions and strategic investments.

Without Confidence in Cash Forecasts, One of Two Things Happen:

- CFO and treasurer are not relied upon to contribute to key organizational decisions

- The CFO ends up being volunteered for commitments that treasury has to react to – often times inefficiently and without maximizing business value

With an effective forecasting program, the CFO, supported by the treasurer, can be an effective strategic partner.

Future Acquisitions

If the board is considering mergers and acquisitions, the CFO is asked to provide guidance on the components of cash/debt/equity to calculate a total acquisition cost. With an effective cash forecast, CFOs can be confident in delivering this insight – and perhaps do so proactively.

When cash is held globally, share buybacks or dividend hikes are a challenge. Often CFOs find it cheaper to borrow cash domestically than repatriate funds – yet this analysis requires certainty into projected cash balances. Confidence in the cash forecast is critical to optimize business value.

Reinvestment of Cash into the Business

CFOs need an effective cash forecast in order to make commitments on how to reinvest cash to meet organic growth targets. Lack of confidence will lead to unnecessary borrowing or equity financing.

Treasury Opportunities in Strategic Cash Forecasting

CFOs are placing a higher priority on strategic cash forecasting in recent years. But they’ve mostly been relying on FP&A departments for this task, while treasury is typically left to handle short-term cash forecasts. However, there are some key ways that treasury can get involved and ensure that it is a significant contributor to company strategy.

Working with FP&A

CFOs turned to FP&A largely due to the upheaval at many organizations in the early days of the COVID-19 pandemic. CFOs generally needed more forecasts, scenario planning and stress-testing information and relied broadly on FP&A because investors and shareholders were demanding answers.

To become involved in the strategic forecasting process, treasury departments need to be proactive. They should reach out to the CFO and to FP&A to see how they can help, and they should feel emboldened by the fact that they have been consistently reliable.

Treasury has an overall proven track record of creating accurate forecasts—sometimes more so than FP&A in many respects. FP&A typically makes longer-term projections that hinge on different data sources, such as assumption-based, top-down projections. Treasury should pursue opportunities to work cross-functionally with FP&A and contribute to these 12-18-month forecasts, thereby cementing the department’s status as a strategic contributor.

Treasury is well-suited for strategic cash forecasting because the function understands overall financing plans and the associated costs. FP&A, in contrast, needs to get that info from treasury to model it.

In terms of setting up new subsidiaries in different countries, we head the cash needs and requirements. FP&A typically looks at historical scenarios to predict future needs and treasury typically forecasts the needs for future state.”

— Lee-Ann Perkins, CTP, FCT, Assistant Treasurer for Specialized Bicycle Components

Perfecting the Cash Forecasting

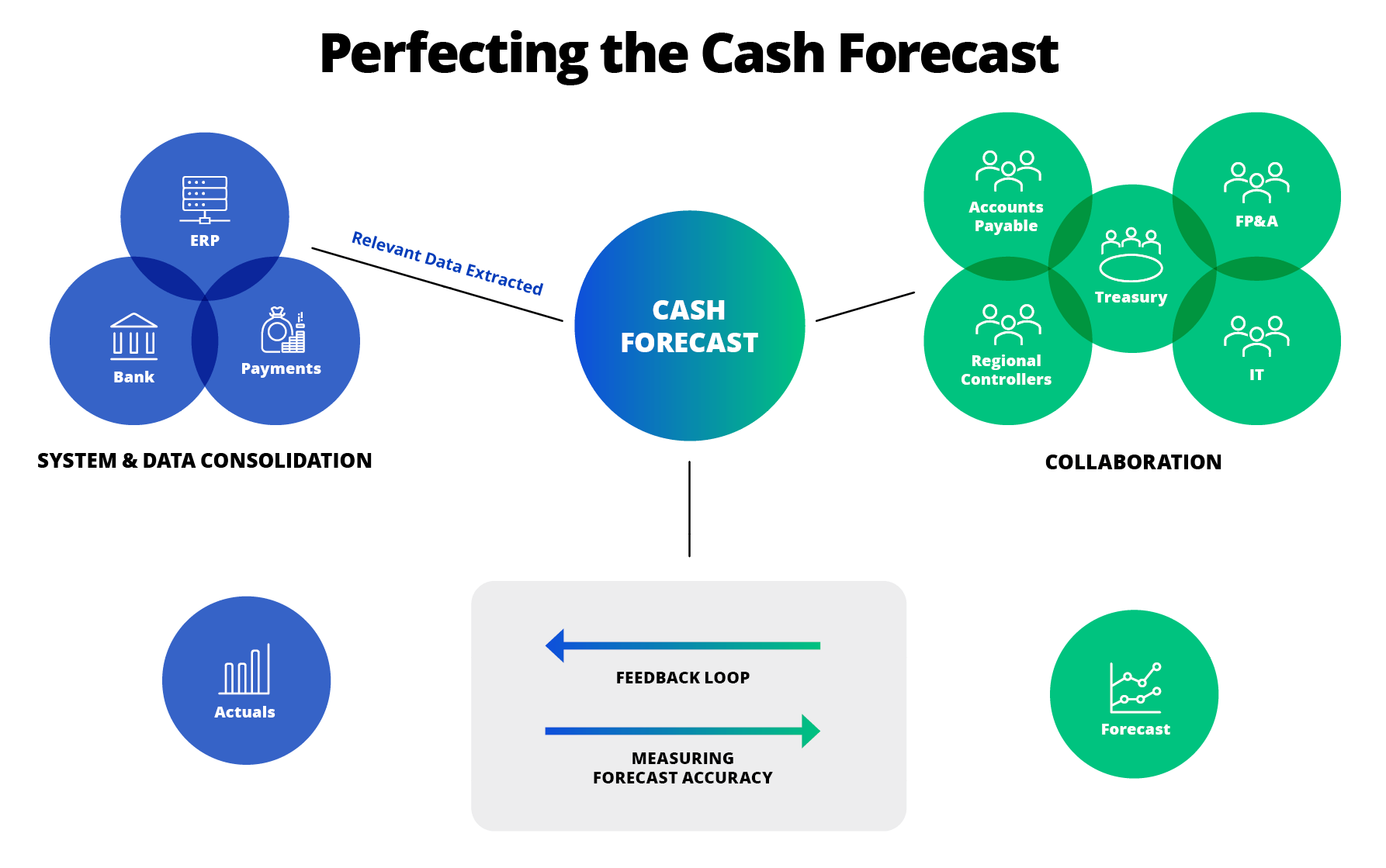

Consolidation

Consolidating data is about finding the right information and determining the most efficient (i.e. automated) way to integrate it into a consolidated forecast system. While automation is important, data quality is also paramount to success.

When building the forecast, each line item may be sourced in different ways. The source of the information will determine the best way to build the forecast for each line item. For example, many treasury teams prefer to import accounts payable data directly from the ERP while for receivables information they may wish to extrapolate historical data and model using a linear regression.

For treasury teams to be effective, it is important that all methods be fully automated and secure so that initial setup, maintenance, and daily execution to build the forecast are easy and can be maintained by the user (and not require reprogramming).

Collaboration

Making decisions on the best data to build the forecast also requires determining who to collaborate with to smoothly access that key information. In many cases, treasury does not have direct authority over the people that own systems and/or business responsibilities that offer that data. Yet, treasury relies upon this outside information to build a comprehensive forecast – so good internal communication skills are often critical to receiving quality information in a timely way.

Examples of teams to collaborate with include:

- Accounts Payable – for payables trends or supply chain finance updates

- FP&A – for budget and free cash flow projections

- IT – automated imports from the ERP

- Regional Controllers – forecast projections for decentralized organizations

Many treasury teams plan, with their CFOs, a top-down collaboration model that builds effective cash forecasting into the team’s objectives and compensation. This draws attention to the forecasting objectives and motivates each team to fulfill their roles.

Measurement

The most important – and often overlooked – step is the measurement of forecast accuracy. Implementing a process to measure forecast accuracy at a detailed level to identify the source of variances is critical to improving quality and ultimately reducing forecast variances.

Equally important is implementing a feedback loop – to systems and to people – that ensure that forecast data is improved based on variances that were identified. And people need to be held accountable; the entire organization needs to be committed to accuracy. A high variance should perhaps be reflected in the bonus payout for the employee that is responsible.

The feedback loop is especially important when non-treasury resources are contributing to the forecast to ensure that the right behaviors and cash forecast numbers are positively reinforced while opportunities for improvement are well communicated. This is especially effective when feedback is aligned to KPIs and quarterly objectives of those outside of the treasury team.

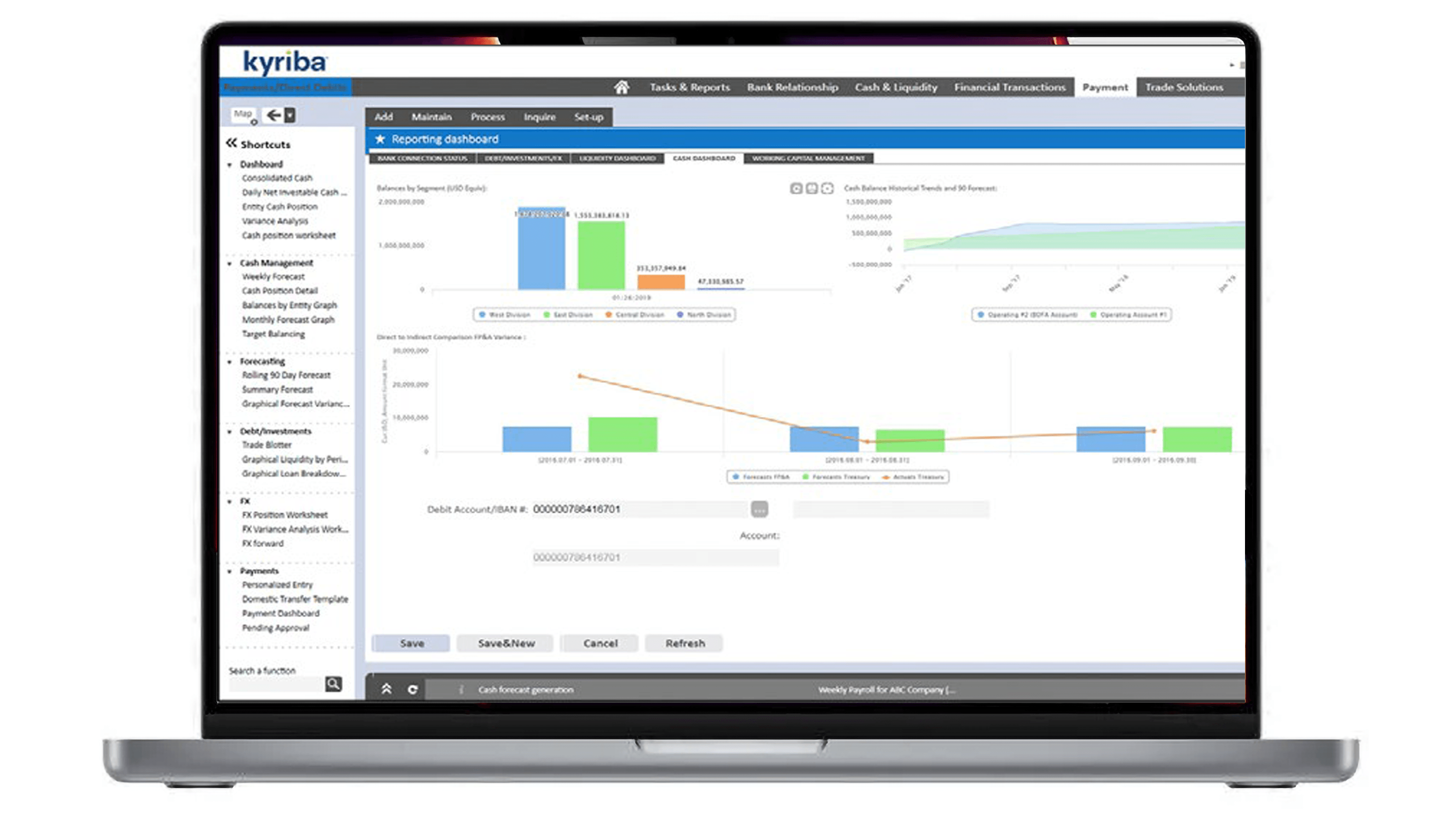

A forecast variance analysis should be detailed with multiple ‘snapshots’ taken. If only a summary picture is reviewed (e.g. how effective was forecasting over a three-month period) then a lot of the variability is hidden within that timeframe. Measuring daily, weekly, or bi-weekly will help uncover the ups and downs between forecast and actuals that might otherwise go unnoticed. Fortunately, the business intelligence features of a TMS offer the data visualization and analytics required to provide this level of detail.

The key to forecasting is flexibility so that you have many options to model the different streams of forecast data. The accuracy of your data will determine if importing, regressing, extrapolating, or other methods of calculations are needed to build your forecast effectively.

Without measuring forecast accuracy, it is impossible to know how well you are forecasting. Data visualization helps focus on important variances – whether by category, time bucket, or geography – and isolate what data needs to be improved for future forecasting. ROI of cash forecasting is very high.

Key to Success

A forecast variance analysis should be detailed with multiple ‘snapshots’ taken. If only a summary picture is reviewed (e.g. how effective was forecasting over a 3-month period) then a lot of the variability is hidden within that timeframe. Measuring daily, weekly, or biweekly will help uncover the ups and downs between forecast and actuals that might otherwise go unnoticed. Fortunately the business intelligence features of a TMS offer the data visualization and analytics required to offer this level of detail.

The Role of Technology

Taking on strategic cash forecasting may require treasury to adopt new tools, including APIs and artificial intelligence. These tools can rapidly gather copious amounts of data, enabling treasury teams to quickly build global cash forecasts and extend the accuracy and horizon of those forecasts.

APIs

While many organizations view APIs as connectors that allow companies to access their banks and real-time payments, they have much greater potential. They can unify data, bringing information together into one, composable system. They can take a company’s system of record (the ERP), merge it with a treasury management system, and also bring in data sets from other internal and external sources, such as purchase requisitions, purchase orders, invoices, sales forecasts, etc.

With such expansive capabilities, it’s easy to see why APIs are the perfect tools for cash forecasting. A survey of over 800 finance executives by IDC and commissioned by Kyriba revealed that 88% of them are prioritizing APIs this year. That’s because CFOs understand that APIs can unify forecast data across their organizations so that they can make better decisions. They are demanding more precise cash forecasting and liquidity planning.

And they are right to demand it, because at the moment, they don’t have the insights they need. The IDC survey also revealed that currently only 15% of finance leaders leverage real-time data to drive insights, and only 25% of finance teams reliably forecast cash and liquidity beyond one month.

AI

Artificial intelligence and machine learning (AI/ML) can greatly enhance cash forecasting. AI-based tools can evaluate variables and errors found in historical data, allowing them to better estimate cash inflows and outflows in the near future.

In the near future, as these tools accumulate more data, they will be able to make predictions on mid- and long-term horizons. Of course, with predictions, there’s always a question of accuracy. Fortunately, some tools allow users to track the accuracy of their projections by comparing estimations with historical actuals.

If you don’t have access to that real-time data, then you’re not utilizing the most up-to-date information. Then how could you be as accurate as you could be going out further than four weeks?”

— Lisa Husken, Value Engineer, Kyriba

Advance Your Cash Forecasting

Many Reasons to Forecast

Cash forecasting is important whether your company is cash rich or debt-laden. If you have a high percentage of non-operational cash deposits, you need to know whether you can eventually release some of those holdings. Conversely, organizations with large amounts of debt need to know when they can afford to make payments. And multinationals with significant foreign revenues must forecast better, so they can hedge effectively and deliver cash predictability to their stakeholders.

Creating the Cash Forecast

The key to forecasting is flexibility so that you have many options to model the different streams of forecast data. The accuracy of your data will determine if importing, regressing, extrapolating, or other methods of calculations are needed to build your forecast effectively.

Measuring the Forecast

Measurement is the most important part of forecasting. Without measuring forecast accuracy, it is impossible to know if you are good at forecasting. Data visualization helps zero in on important variances – whether by category, time bucket, or geography – and isolate what data needs to be improved for future forecasting.

ROI of Cash Forecasting is Very High

The value of forecasting is driven by what your organization can do with additional cash. The value of cash can be measured by investing longer with higher returns on cash, repaying debt, earning yield from early supplier payments, or investing in new organizational projects. Perfecting the cash forecast means freeing up cash from working capital and directing towards these higher value uses.

Collaboration is Key

Treasury and FP&A should be working closely together on strategic cash forecasting. Rather than one department taking it on in its entirety, both functions should take on aspects that play to their strengths.

Technology Makes the Difference

Organizations have more data than ever before, and they need realtime access to it to make strategic decisions. And the only way to facilitate that is through technology like APIs.