Fact Sheet

Kyriba Payments

Centralize Your Enterprise-Wide Payments to Control and Automate Your Payment Workflows

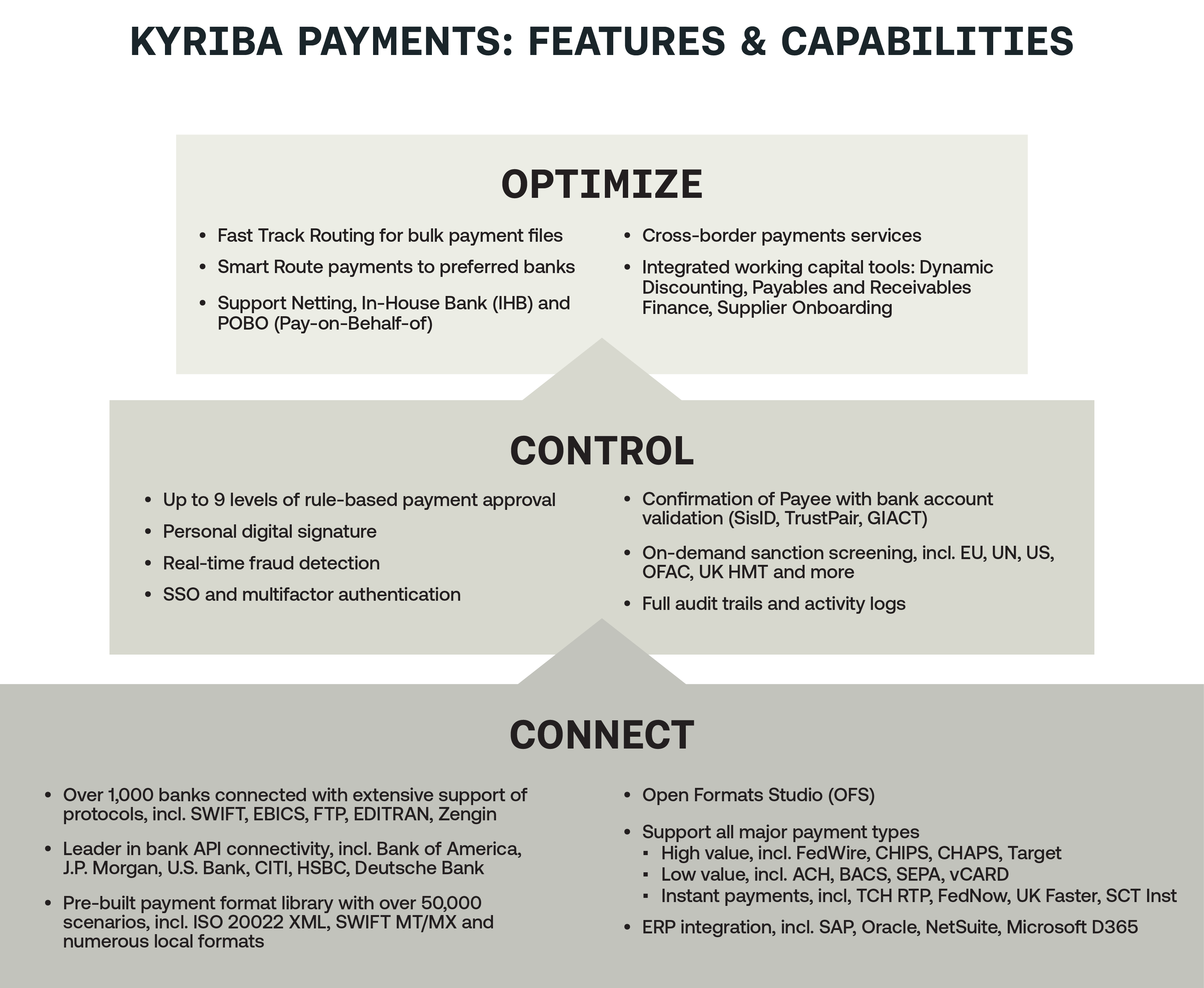

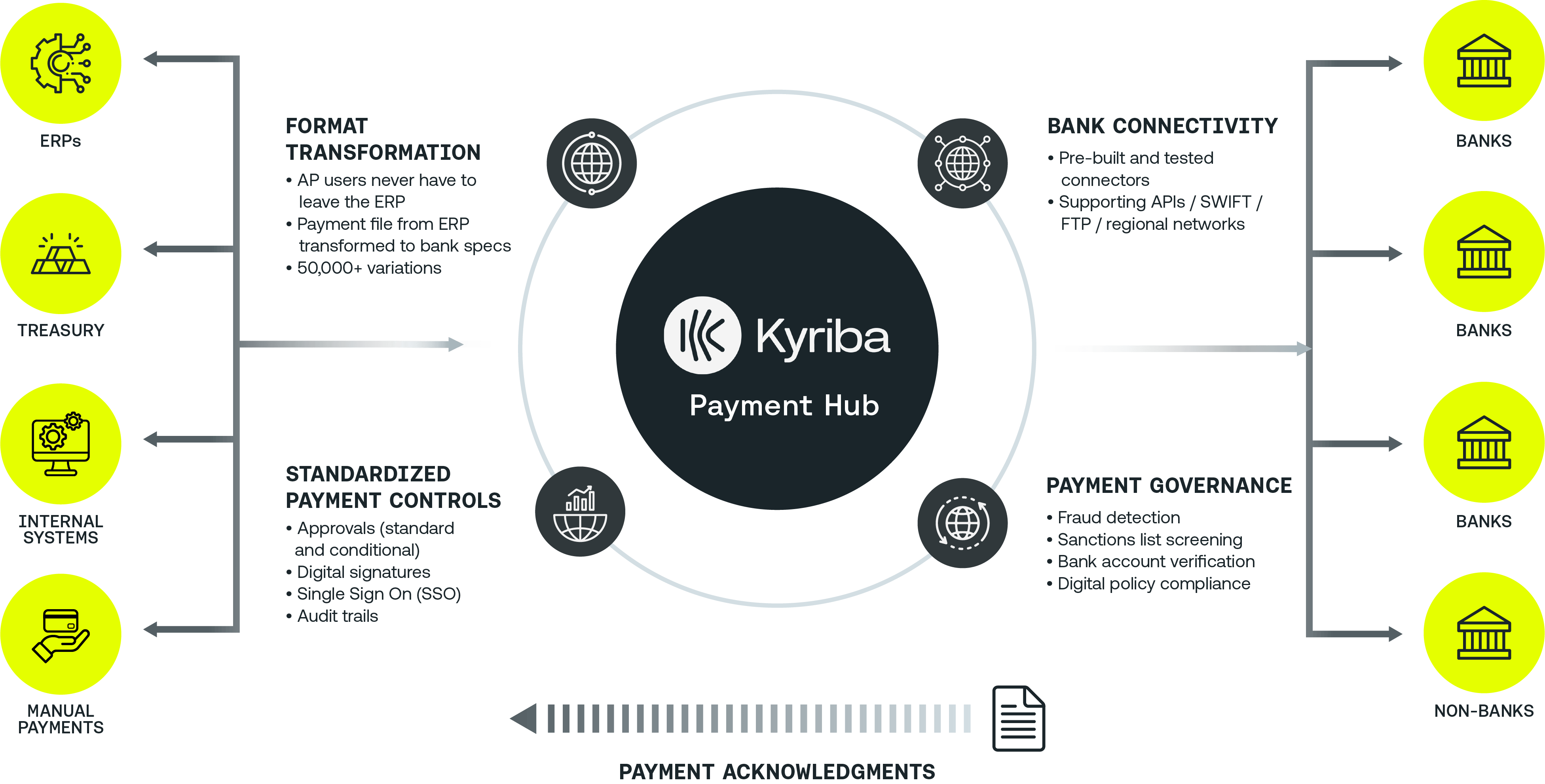

Kyriba offers a pre-connected, multi-bank and secure global payment network for organizations of all sizes. The Kyriba Payments solution centralizes and standardizes company-wide payment workflows to enhance both controls and efficiencies with task automation, error management, fraud detection and full status visibility, all integrated in one payment hub.

Kyriba Payments is an integrated part of Kyriba’s Liquidity Performance Platform, delivering leading practices in centralizing payments workflows, enhancing payments controls, reducing fraud risks and optimizing liquidity management.

Table of Contents

Harness Connectivity-as-a-Service

- Eliminate the costs of multiple bank portals

- 24/7 monitoring of connectivity performance

- Improve bank relationship management, bank fee analysis and governance

- Out-of-the-box ERP to bank connectivity

- SWIFT certified and SWIFT gpi compliant

Enhanced Payments Security

- Enforce workflow to initiate exceptional payments in Kyriba instead of in different uncontrolled banking portals

- Automatic quarantining of suspicious and non-compliant payments with AI or customizable rules

- Flexibility to modify or stop any payments in large payment files (supporting up to 1 million payments in one batch)

- Synchronized account signatory management

- Error analysis and recovery with transparent monitoring and reporting

- Secure disaster recovery

Accelerated Payments

- Automatic transformation of payment formats based on bank channel, payment type or location

- Open Formats Studio (OFS) for quick formats translation and adaptation

Large Account Support

- API-powered extensions, advanced data exchange transformation and NACHA support

- Custom fields to meet specific requirements

Visibility and Intelligence

- End-to-end payments tracking

- One payment status reporting dashboard with real-time data visualization and analytics

- Kyriba Mobile App (iOS and Android) for review and approval on-the-go