Blog

Considerations for a Treasury-led Commodity Hedge Program

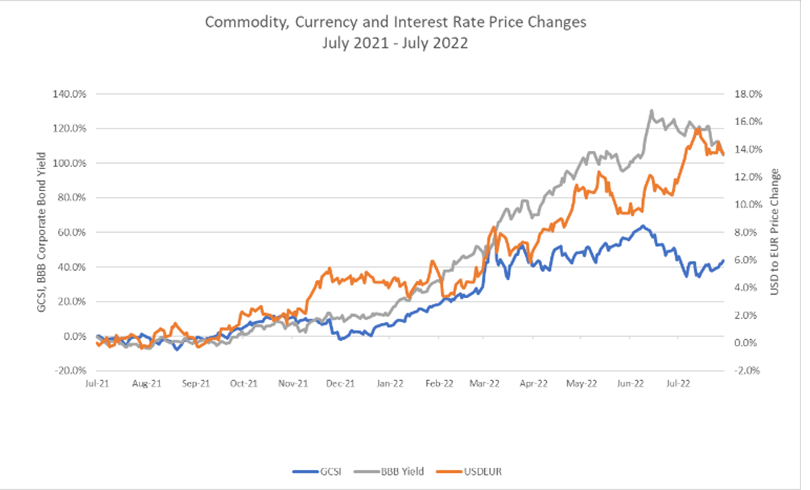

In 2022, we are experiencing what some might call a perfect storm of financial risk. Over the past 12 months, we have seen sharp movements in currencies, interest rates and commodities, with a corresponding spike in price volatility. If a treasurer is already managing FX and interest rate risk, arguments can be made for adding commodity price exposure to the fold.

Why Treasury?

Treasury is increasingly becoming responsible for managing commodity exposures. Reasons for this are many but the following are often key considerations.

Counterparty Relationships

Many of the same financial institutions that offer hedge products to manage interest rate risk and FX risk, also offer commodity hedge instruments. Because treasury may already be executing hedge instruments in FX or interest rates, the decision of what counterparties to engage with can fit nicely into the treasury bank relationship management. Often corporate treasurers look to build strong relationships with the banks that provide credit and other capital market support and allocating commodity hedging to relationship banks can increase their wallet share of business with the company. If the existing ISDA agreement in place does not already include language specific to commodities it can be easily amended.

Risk Exposure and Visibility

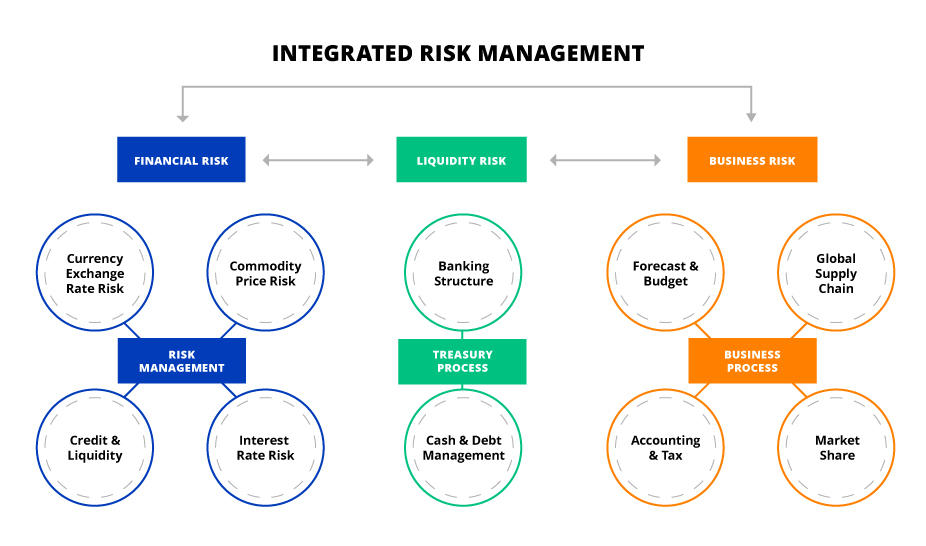

Monitoring counterparty risk exposure is another consideration when selecting financial institutions for commodity instruments. The credit exposure from outstanding derivative instruments can be combined with other exposures (bank deposits, FX derivatives, etc.) to ensure the total exposure by institution does not exceed corporate policy. A company may take an integrated approach to financial risk management, noting the interplay between financial, liquidity and business risk.

The visibility to hedge contracts is another argument for having treasury manage commodity exposures. Treasury could monitor the change in the settlement value of hedge contracts and integrate those changes into the cash forecast. Allowing treasury to centralize the process reduces the risk of overlooking changes in the outstanding value of the derivative portfolio and the impact on future flows.

Vendor Streamlining

The number of treasury management systems (TMS) that can handle commodity hedging continues to grow. Rather than having a separate software platform to manage commodity hedging, a company may be able to use its existing TMS. This will depend in part on the types of commodities the company needs to hedge, as some exchange-traded commodities may not be covered under the TMS risk management platform.

Risk Management Objectives

A more sophisticated risk management strategy may look to incorporate commodities, interest rates and foreign exchange exposures to manage earnings or revenue at risk. Targets such as VAR and EAR can be achieved at lower cost and greater accuracy with the more risk exposures that are included. The ability to incorporate all these risks into the analysis may favor a single system that encompasses all the exposures to achieve target variance at maximum efficiency.

How Commodity Price Exposure Differs from Others

While treasury is a good fit for a commodity hedge program, treasury risk managers who have not previously handled commodity hedging will need to educate themselves on certain areas. First, they need to understand which commodity derivative will best match the underlying risk being hedged. An education on the different reference prices for commodities and why they vary is also critical.

Location Basis Risk

Unlike currency, which can be transferred and stored electronically, commodities must be physically transported and safely held in a storage facility. This introduces the issue of location basis risk when hedging commodities. It is important to understand what price index best matches the price of the commodity in the location where it will be used. For example, the price of natural gas to be used in a product in Chicago is likely to be based on the NGI Chicago Citygate natural gas price rather than the NYMEX Henry Hub price. While both price indices will normally closely correlate over time, a local disruption in one market can result in a large spike in price with very little movement in the other market. These locational variances are not observed in currency prices.

Inventory

A grasp of the inventory cycle and accounting treatment is important for understanding the correct exposure to hedge and avoiding a timing mismatch between the settlement of the hedge contracts and the impact of the price when the commodity is consumed or sold. Understanding the time from purchase of the raw material to the sale price will impact the product margin, especially where there is price flexibility, and the sale price can be increased to reflect the rising cost of the commodity.

Supply-Demand

Market fundamentals are an important influence on commodity price. Disruptions to the supply of a commodity will result in upward pressure on the price until availability of the commodity exceeds demand and a surplus occurs sufficient to stabilize the market price. If the supply is far outstripping demand, suppliers looking to sell the commodity will lower the price, exerting downward pressure of the market price.

In addition, the commodity markets attract a large proportion of speculators relative to the currency and interest rate markets. Speculators are not trying to hedge their exposure to minimize volatility but are adding exposure to benefit from a perceived positive or negative movement in the commodity price.

Volatility

Another difference between currency and commodity markets is market volatility. Some markets such as gas and electricity need to be supplied in real-time. Electricity storage is difficult, resulting in considerable volatility compared to currencies. While annual volatility of major currency pairs when high is about 10%, spot natural gas prices can often fluctuate more than 100% on an annualized basis. Spot power prices can jump 1000% or more on an annualized basis, as seen in 2021 when the Texas power grid suffered weather-related power failures.

Currency

In addition to the commodity itself, the currency in which a reference commodity contract is quoted is important. For example, let’s say a company is hedging with an over-the-counter future or forward contract that is priced in U.S. dollars but the company’s functional currency is not USD. The company’s exposure to that commodity will change even if the quoted commodity price does not change but the USD strengthens or weakens against the company’s functional currency. It is important to understand this, because hedging against the commodity exposure using a USD-denominated forward or future will not eliminate the exposure to the hedged USD due or received at delivery.

One approach is to enter an FX swap for the nominal contract amount of USD and link the FX hedge to the commodity hedge. If the commodity exposure changes and the company moves to unwind the commodity hedge, it will also need to unwind the FX contract as well.

Keeping Sales/Procurement in the Loop

Placing the oversight of commodity hedging within treasury requires strong communication with operations. Changes in production, contract terms, reference price, etc. can have an impact on commodity exposures. Contract term changes is an area that is often not communicated in a timely manner to the risk management group.

Technology Can Help

Treasury departments are increasingly being asked to manage commodity hedge programs. Many already hedge interest rate risk, FX risk and counterparty exposure, and it is seen as a natural extension of the financial risk management oversight mandate.

To efficiently manage a commodity hedge program, treasury departments should consider the advantages of utilizing a solution that seamlessly integrates with the rest of its technology stack. Treasury teams who take on this responsibility and are still relying on Excel will find themselves overwhelmed. Now is the time to ensure that you have the capabilities to manage these complex programs.